- 1040.com – Is It Free?

- What’s New In 2026?

- Does 1040.com Make Tax Submitting Simple?

- 1040.com Options

- Flat Worth For Federal And State Tax Submitting

- Guided Navigation or Select Your Personal Journey

- Audit Help

- 1040.com Drawbacks

- 1040.com Pricing And Plans

- How Does 1040.com Examine?

- Contact

- Is It Protected And Safe?

- Is 1040.com Price It?

- Widespread Questions

Professionals

Cons

1040.com is a contender within the mid-tier tax software program class. With a flat $34.99 worth for all filers, 1040.com looks like a breath of recent air when in comparison with different tax software program with infinite add-ons and upgrades. It additionally has an easy-to-use interface.

Nonetheless, there’s no improve choice to work with a professional or to import your tax knowledge, which may very well be a deal-breaker for some filers.

It’s additionally not as straightforward to make use of as {industry} leaders TurboTax and H&R Block, which do cost extra for a premium expertise. 1040.com gives a good service at an affordable worth, however it’s not probably the most compelling software program in the marketplace.

Right here’s what it’s essential know concerning the 1040.com tax software program this yr. Additionally, learn how it stacks up in our annual listing of the best tax software programs.

1040.com – Is It Free?

Tip: 1040.com is $29.99 together with all federal and state tax varieties and wishes

Not like some opponents, 1040.com doesn’t supply a free model. All customers pay the identical $34.99 price no matter their tax-filing wants. The $34.99 value consists of federal taxes and as many states as you want. That’s a lot lower than you’d pay with premium opponents, who usually cost greater than $34.99 per state, not to mention federal taxes.

The 2 add-ons are for companies offered by third-party companions. A further $29.95 value means that you can pay your $34.99 price together with your refund, which is unquestionably not value the fee, because it doubles what you pay with no actual advantages. You can too pay $34.95 for audit help ought to the IRS come again with questions.

What’s New In 2026?

For the 2026 tax submitting season, 1040.com supplies the same feel and look to earlier years. Should you’ve performed taxes on-line earlier than, you’ll discover the format and interface acquainted and simple to navigate. And for those who’ve used 1040.com, it will likely be largely the identical.

Pricing is identical as 2025. Probably the most important updates this yr are normal updates to maintain up with IRS modifications. 1040.com calls its tax-filing expertise a “Walkthrough,” the place you reply questions or choose the varieties you need to enter. You’ll doubtless discover some large modifications from final yr because of Trump’s tax invoice.

Choice to decide on between steerage and type choice

Does 1040.com Make Tax Submitting Simple?

Be aware: 1040.com is much from the simplest tax submitting possibility. Think about FreeTaxUSA and TurboTax for simpler submitting.

1040.com makes use of a “hybrid” navigation mannequin. Customers can resolve whether or not to permit 1040.com to ask questions on their taxes utilizing a left-hand navigation bar or soar round and select the part to work on.

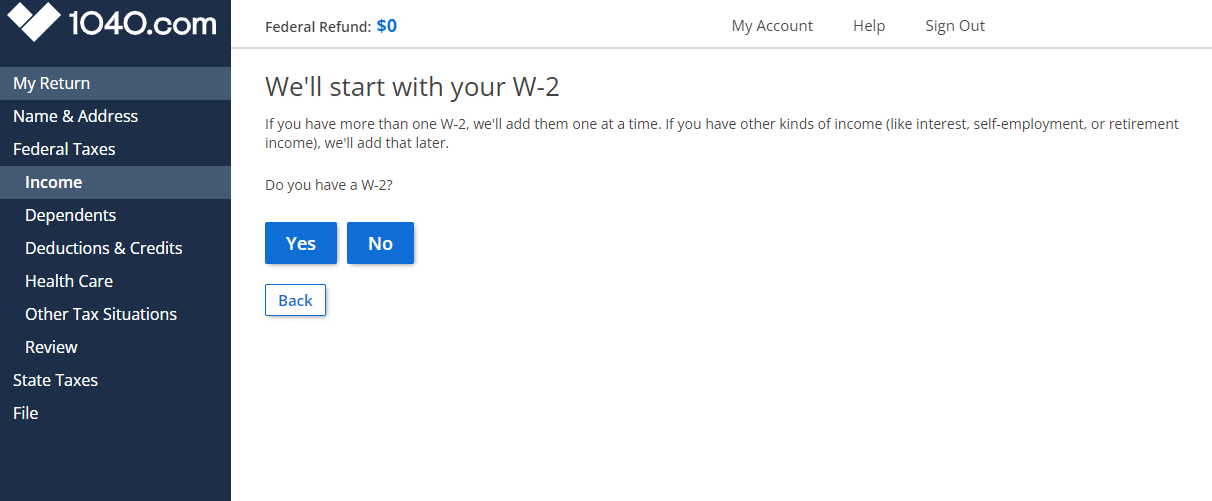

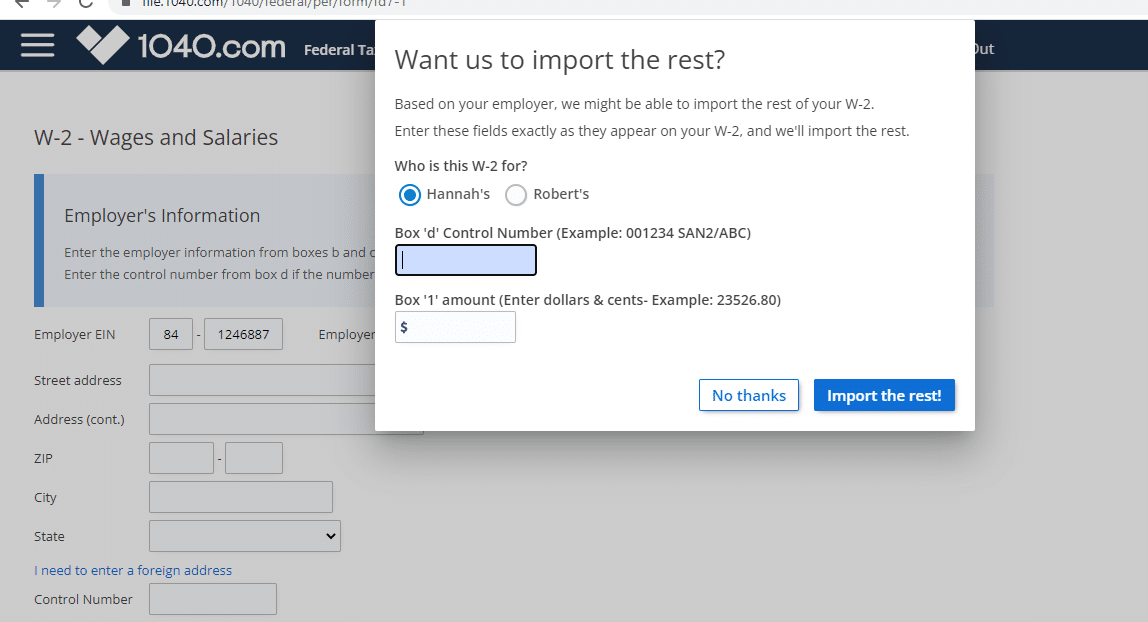

The interview-style navigation is usually a bit tedious. One standout function from mid-tier and low-cost opponents is the choice to import your W-2 knowledge in case your employer is supported. All it’s a must to do is enter your employer ID, and 1040.com will discover and import your knowledge in case your employer participates.

W-2 Import

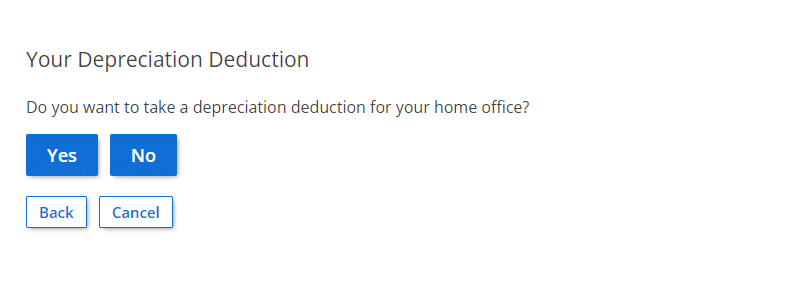

The software program gives a good expertise for individuals who don’t have investments or for many who are coping with self-employed business expenses. Filers who need to deduct depreciation for his or her rental properties should add a depreciation worksheet. This course of might be complicated and unintuitive.

Interview for depreciation

To summarize, the software program works nicely for individuals who have easy tax submitting conditions. Should you’re an investor or a small-business proprietor with greater than a easy aspect hustle, it may very well be value paying extra elsewhere.

1040.com Options

1040.com does the job of serving to you file your taxes simply positive, however it’s not the quickest or most intuitive expertise. Listed here are some standout execs and cons to think about.

Flat Worth For Federal And State Tax Submitting

1040.com costs a single worth for federal and state tax submitting. The $29.99 price ticket permits filers to file in a number of states and consists of all supported tax conditions. While you’re prepared to take a look at, there are not any tiers or upgrades to cope with. One worth suits all.

Guided Navigation or Select Your Personal Journey

The 1040.com software program gives a guided navigation possibility to assist filers work via their returns. Customers who go for the question-and-answer interface can discover most of what they want in a single go via the software program.

The draw back is that the guided navigation solely covers easy submitting conditions. Customers with extra advanced revenue sources (akin to investments, actual property, or self-employment) should choose their revenue sort from the menu earlier than receiving steerage from the software program.

Should you don’t need to use the navigation, you’ll be able to soar between sections and varieties whenever you need to enter one thing particular.

Request to finish tax varieties

Audit Help

1040.com customers pays for added audit help from ProtectionPlus, a 1040.com associate. The improve prices $34.95, and together with the bottom value of $34.99, it’s dearer than different mid-tier software program. By comparability, you’ll be able to add audit help for $7.99 with TaxHawk and FreeTaxUSA.

1040.com Drawbacks

Let’s take a better have a look at a number of areas the place 1040.com left us underwhelmed.

Restricted Import Choices

1040.com helps W-2 imports whenever you work with a taking part employer, which is nice. Nonetheless, it doesn’t permit customers to import 1099 varieties or spreadsheets. Customers should manually copy data from their tax varieties to finish tax submitting. For individuals with inventory or crypto trades, this could add a whole lot of cumbersome overhead to tax submitting.

More durable To Use For Non-W2 Earnings Sources

Coming into rental data and capital gains from investments is arduous. Customers should know what they’re doing to finish the submitting if they’ve advanced tax submitting wants. It’s additionally pretty difficult if it’s essential depreciate a enterprise expense.

No Part Summaries

1040.com doesn’t have part summaries displaying revenue, deductions, and different key particulars. This may make it tough to find out whether or not you entered the knowledge accurately and leaves you doing a whole lot of searching for those who suspect an error. 1040.com retains a rolling abstract of the refund you’re due, however that is inadequate for looking the main points.

1040.com Pricing And Plans

1040.com makes use of a simplified pricing plan. All customers pay $34.99. It is value noting that the worth tag even applies to customers who must file a number of state returns.

This places the software program solidly within the middle-tier pricing class for tax software program. It might make sense for some filers, together with those that might “unexpectedly” get ran into larger pricing tiers elsewhere. For instance, these with tuition bills, little one care deductions, playing winnings, health savings accounts (HSAs), and different frequent varieties might get monetary savings utilizing 1040.com.

Plus, the truth that your flat $34.99 consists of limitless states might be very compelling. With many free tax software companies, you continue to must pay for state submitting, which regularly exceeds $34.99 every. Should you moved final yr or must file in a number of states, that’s a discount.

How Does 1040.com Examine?

1040.com is extra inexpensive than the premium tax software program platforms. We’ve in contrast it to different discount software program, together with Cash App Taxes (free) and TaxHawk.

We usually want opponents consumer expertise to 1040.com. Nonetheless, multi-state filers might recognize that 1040.com consists of limitless state returns within the base worth.

Nonetheless, Money App Taxes is free for those who qualify, and TaxHawk is simply $15.99 per state – so at one state you are saving cash versus 1040.com.

|

Header

|

|

|

|

|---|---|---|---|

|

Score |

|||

|

Unemployment Earnings (1099-G) |

Included |

Free |

Free |

|

Scholar Mortgage Curiosity |

Included |

Free |

Free |

|

Import Final 12 months’s Taxes |

Included |

Free |

Free |

|

Import W-2 |

Included |

Not Supported |

Not Supported |

|

A number of States |

Included |

Not Supported |

$15.99 Per State |

|

A number of W2s |

Included |

Free |

Free |

|

Earned Earnings Tax Credit score |

Included |

Free |

Free |

|

Youngster Tax Credit score |

Included |

Free |

Free |

|

HSAs |

Included |

Free |

Free |

|

Retirement Contributions |

Included |

Free |

Free |

|

Retirement Earnings (SS, Pension, and so on.) |

Included |

Free |

Free |

|

Curiosity Earnings |

Included |

Free |

Free |

|

Itemize |

Included |

Free |

Free |

|

Dividend Earnings |

Included |

Free |

Free |

|

Capital Good points |

Included |

Free |

Free |

|

Rental Earnings |

Included |

Free |

Free |

|

Self-Employment Earnings |

Included |

Free |

Free |

|

Small Enterprise Proprietor (Over $5k In Bills) |

Included |

Free |

Free |

|

Audit Help |

$34.95 Add-On |

Free |

Deluxe ($7.99) |

|

Recommendation From |

Not obtainable |

Not obtainable |

Professional Help ($44.99) |

|

Pricing |

$34.99 |

$0 Fed & $0 State |

$0 Fed & |

|

Cell

|

Contact

You will not discover a cellphone quantity revealed wherever on 1040.com. If you wish to get in contact with a reside help consultant, you will must create an account to entry the corporate’s chat help. Or you’ll be able to submit normal questions utilizing the e-mail contact form here.

Is It Protected And Safe?

1040.com employs a powerful privateness coverage and makes use of industry-standard encryption and multi-factor authentication to maintain consumer data secure and safe. These precautions are normal for all tax submitting corporations.

Customers can really feel assured that 1040.com is as secure to make use of as most different tax software program. In fact, utilizing a powerful, distinctive password and following different cybersecurity greatest practices is vital to make sure the dangerous guys don’t get into your knowledge.

Is 1040.com Price It?

1040.com gives a reasonably good consumer interface for individuals with simple submitting conditions. Should you moved within the final yr and it’s essential file taxes in a number of states, work throughout state traces, or earn revenue in a number of states for every other cause, it may very well be a sensible choice for you.

Nonetheless, we don’t advocate 1040.com as a best choice for the everyday tax filer. The software program is simply too cumbersome to make use of for a $34.99 worth level. Cash App Taxes and TaxHawk supply superior consumer experiences at lower cost factors.

If you wish to dig into different choices, we’re prepared that can assist you discover the best tax software for your situation.

Why You Ought to Belief Us

On the School Investor, we don’t play favorites. We’ve got over a decade of expertise reviewing tax filing programs, and we’ve used most of them ourselves over the previous few years. Our aim is that can assist you discover the fitting tax app on the proper worth. There’s no good solution to file taxes for everybody, however there’s doubtless a best choice for you. We need to enable you discover the fitting match on your distinctive wants.

Widespread Questions

Listed here are the solutions to a couple of the most typical questions that individuals ask about 1040.com:

Can 1040.com assist me file my crypto investments?

Coming into crypto trades into 1040.com is feasible, however cumbersome. Customers must enter every transaction into the 1099-B/8949 type part manually. Should you had a whole lot of trades, that would take hours.

Can 1040.com assist me with state submitting in a number of states?

Sure, this is likely one of the greatest causes to select 1040.com. The $34.99 worth consists of federal and limitless state returns.

Does 1040.com supply refund advance loans?

1040.com doesn’t supply refund advance loans. You’re in a position to pay on your 1040.com prices together with your refund for an additional $29.95, however we don’t recommend this.

The publish 1040.com Tax Software Review 2026: Pros And Cons appeared first on The College Investor.