- Coming into The Trough Of The Happiness Curve

- Public Investments – Grade A

- Personal Investments – Grade A Minus

- Bodily Actual Property – Means Too A lot Effort

- Property #1: Most Latest Main Residence Turned Rental

- Property #2: Summer time Transform Job

- Property #3: Partial Rental Turned Full Rental

- Property #4: The Largest Rental That Was Hardest To Lease Out

- Strong Complete Rental Revenue Progress

- Household Dynamics – Grade B Minus

- Artistic Endeavors – Grade A Plus

- Cash Is Good, A Pleased Household Is Far Higher

- Glad 2025 Is Over, However Additionally Miss The Time We No Longer Have

- Subscribe To Monetary Samurai

Pleased New Yr 2026 everybody! With one other yr wrapped up, I believed I’d do a 2025 yr in overview so I can at some point look again fondly as an previous man. Total, I give the yr an A for effort, which is all I can actually management. Sadly, the outcome didn’t match the hassle, as I give it a B minus, perhaps even a C plus.

The principle motive for the B minus is ongoing household points that negatively affected my spirits. I’m naturally a cheerful and joyful individual – a steady-state 8 out of 10. However for a lot of the complete yr, I felt numerous grey clouds and wet days hanging overhead.

The factor is, even in case you are joyful, when somebody in your loved ones is underneath duress, your happiness will inevitably decline. From the whole lot from growing older to caring for youngsters and sick dad and mom, the happiness dip for the sandwich era is actual.

Coming into The Trough Of The Happiness Curve

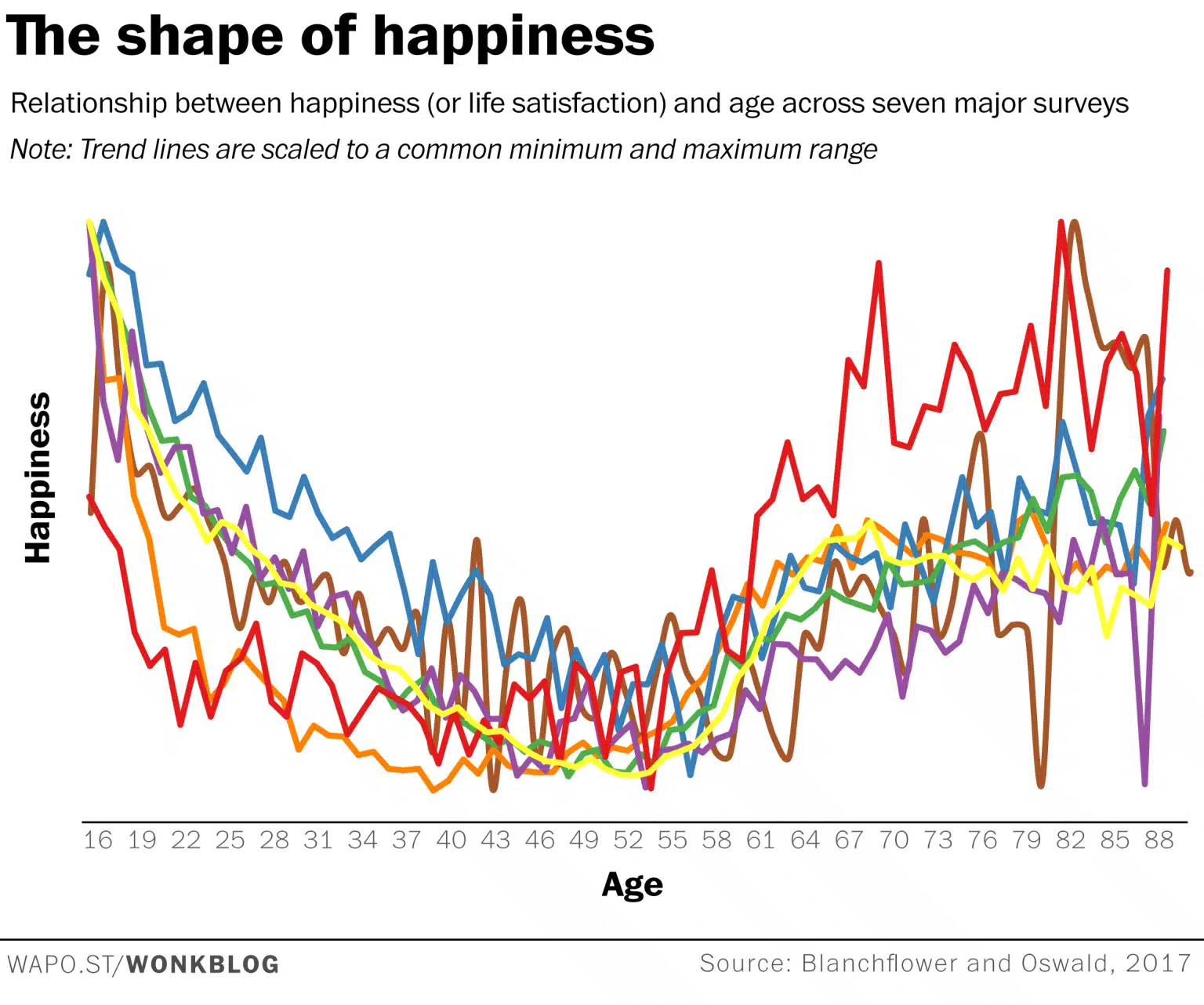

Simply have a look at this nice chart summarizing seven main surveys of 1.3 million randomly sampled folks throughout 51 nations. Between ages 45 and 55 is the place happiness is lowest – and my spouse and I are 45 and 48.

I wrote this submit first earlier than on the lookout for happiness curves to see the place we stand. It’s comforting that we’re not alone.

However gosh, I believed I’d have the ability to keep away from this trough by retiring earlier. In truth, I wrote a submit stating the best reason to retire early is greater happiness sooner and for longer. That part lasted about 11-12 years, however it has now pale.

2025 actually made me respect, as soon as once more, how cash can’t purchase happiness after your primary wants are met. I used to be annoyed this yr that, irrespective of how exhausting I attempted, the melancholy nonetheless lingered.

It’s unhappy to comprehend that even in the event you stay in a pleasant home, have minimal debt, have your well being, don’t really feel caught at work, and have joyful youngsters, you may nonetheless really feel down typically. This disconnect additionally feels embarrassing, particularly in the event you’ve grown up in a creating nation with an incredible quantity of poverty and inequality.

Everyone knows the options: apply gratitude each day, take steps to eliminate regrets, stroll and train each day, cut back need, and decrease expectations Nevertheless, apart from continually displaying up, there’s typically nothing you are able to do when uncontrollable circumstances happen.

Now on to my 2025 overview, categorized by Investments, Household, and Artistic Endeavors.

Public Investments – Grade A

Total, 2025 was a stable yr financially thanks to a different bull market. My mixed public fairness portfolio rose by about 23%. The explanation for its 6% outperformance in comparison with the S&P 500 was as a result of my obese positioning in Google, Tesla, and Nvidia. On the draw back, my shares in Apple, Amazon, and Nike underperformed the S&P 500.

That is now three years in a row of 20%+ returns, which appears like a lottery win after a tough 2022 (-24% for my tech-heavy equities). The after-tax positive aspects alone are in a position to pay for about 4 years of regular dwelling bills for a household of 4 right here in San Francisco.

The issue with a 23% return is that it took numerous effort to get there as an active investor. And albeit, I believed I had returned much more earlier than I crunched the numbers.

If I had simply invested all my cash in an S&P 500 index and performed nothing, I’d have made about 16.5%. I’m unsure if the hassle to make an additional 6% is price it, particularly since I may have simply underperformed. However I keep energetic as a result of some huge cash is at stake as DUPs with no regular energetic revenue.

Going via the whipsaw of the April tariff tantrums, adopted by attempting to continually determine whether or not the financial system would actually be OK amid stagflation fears, took a toll on my psychological vitality. However I want to acknowledge {that a} ~6% outperformance has purchased us just a little over one yr of dwelling bills. I simply must be cautious not dropping an excessive amount of this yr.

Personal Investments – Grade A Minus

As for my non-public investments in enterprise debt and enterprise capital, it’s more durable to gauge returns since a lot is illiquid. I do know one 2018 classic enterprise fund holds Rippling, which is doing nice. However the remainder of the closed-end funds stay unclear as many investments are nonetheless within the early stage.

Fundrise Venture was a standout performer. It rose over 45%, making it my top-performing fund funding of the yr. I had about $140,000 invested initially of 2025, and invested $100,000 on June 20.

In July/August, I additionally determined to reinvest $200,000 price of expiring Treasury payments and open a brand new private account earmarked for my youngsters’s future. I figured, if I am prepared to speculate over $200,000 in a 529 plan, then I would as nicely spend money on the very expertise which may make their school educations out of date.

My fundamental remorse shouldn’t be investing extra initially of the yr once I had a windfall from promoting a property. However out of self-discipline, I maintain non-public funding allocation to at most 20% of my investable capital.

The explanation I don’t give my non-public investments an A is that one enterprise debt fund (out of three) closed out at a 12% IRR, underperforming the S&P 500. In the meantime, my private commercial real estate investments noticed one other flat yr, though there are constructive indicators of life.

Bodily Actual Property – Means Too A lot Effort

2025 was the most tough yr I’ve ever had as an actual property investor.

The principle motive is that I had three tenant turnovers out of 4 properties, which required my spouse and me to arrange every property both on the market or for lease. Then I did one other reworking job. The time, coordination, and emotional vitality concerned have been important.

Property #1: Most Latest Main Residence Turned Rental

The primary property required about two months of preparation and in the end offered by way of a preemptive offer. I hit my reasonable goal gross sales worth and felt terribly relieved that we offered it, particularly after the devastating January fires in Southern California. It was an ideal property with ocean views, however the rental yield was low as a result of excessive worth level and the necessity to handle 4 tenants annually was annoying.

After this sale, which solely had a 13-day shut, I believed the remainder of the yr could be simple avenue with regard to property administration. Oh, how flawed I used to be!

Property #2: Summer time Transform Job

Given we determined to go to Hawaii for 5 weeks for summer season college and see my dad and mom, I figured it was time to remodel the neglected two-bedroom in-law unit related to my dad and mom’ home. It was my aunt’s previous dwelling house, and it hadn’t been inhabited for over 13 years. The place was piled with stuff, crawling with bugs, and had damaged taps and defective wiring in all places.

I believed the rework would take two or three weeks and value perhaps $25,000. But it surely ended up taking 4 weeks whereas I used to be there and one other week after I returned to make the place absolutely livable, with furnishings, a fridge, and home equipment.

After gut-remodeling a property from 2019–2022, I swore I’d by no means rework one other property once more. It’s a horrible course of, and I’d fortunately pay a premium for a fully remodeled home. Nevertheless, I felt my summer season in Hawaii was a now-or-never second to get to work as a result of no one else would after my aunt handed a number of years in the past.

The silver lining is that I acquired the place performed and absolutely furnished, offering my spouse and kids with a extra snug dwelling association throughout our 10-day winter vacation journey. That mentioned, I did virtually burn down my parents’ house twice in a single week as a result of defective wiring for the dryer. Ah, extra stress.

Property #3: Partial Rental Turned Full Rental

After coming back from Hawaii in July, I wanted to relaxation as a result of the journey was additionally exhausting on my spouse. I additionally felt unsettled for the reason that eating room furnishings, fridge, and washer and dryer weren’t going to reach till early September, after which have been pushed again till the top of November.

Sadly, throughout our time away, our long-time tenants since 2019 at one other property discovered one other place to stay. They have been stable renters who occupied the upstairs portion of a home with two bedrooms and one lavatory. They wished a complete single-family house as a result of having a child.

To accommodate, earlier than we went to Hawaii, I provided to lease them the downstairs portion as nicely, giving them three bedrooms, two loos, and an workplace. Maintain df, Even after providing a reduction to comparable market rents, they determined to lease a smaller home farther south for much less. No downside, however not splendid for me.

The method took about 5 weeks to search out new tenants. As soon as once more, we needed to clear, paint, backyard, and repair some random issues in preparation for brand spanking new tenants. I additionally hosted a number of non-public showings for events. Happily, we discovered an ideal household who’s respectful and had beforehand owned property within the space. They relocated again to San Francisco as a result of better enterprise demand after transferring away throughout COVID.

The constructive of our tenants transferring out was our semi-passive income elevated by $3,500 a month. This was because of charging market lease after a number of years of undercharging by ~$1,000/month and renting the complete home as a substitute of simply the upstairs for an additional ~$2,500 / month.

Property #4: The Largest Rental That Was Hardest To Lease Out

Lastly, I believed I used to be performed after three property turnovers! However no, the actual property gods had extra work for me to do. Solely a month after discovering new tenants, I obtained one other electronic mail from one other set of tenants giving their 45-day discover. Apparently, they’d already relocated to Colorado and have been solely returning sometimes. This was a shock, particularly since their youngsters attended a faculty simply blocks away and so they had moved in solely 15 months earlier.

As soon as once more, I spent about six weeks coordinating cleansing, repairs, and the tenant search. This time it was more durable. The lease was a 35% increased worth level than my different rental, which lowered the rental pool. Additional, I used to be looking in the course of the off-peak months of October and November, a part of the worst time of the year to find renters.

Happily, 5 weeks after I revealed my first advert on Craigslist, a lady reached out saying she and her husband have been relocating to San Francisco for work. One labored at a Collection C non-public tech startup, and the opposite at one of the crucial in style AI LLM firms in the present day, which I’m a shareholder in via the Fundrise.

To my shock, the couple was prepared to pay $10,000 a month for a five-bedroom, four-bathroom house. Given their salaries and fairness compensation, the lease was truly fairly reasonably priced. They wished two house places of work and house for a house health club.

Resulting from these new tenants, lease for this reworked house went from $9,000 a month for 12 months in 2024-2025, to $9,200 a month for 3 months in 2025, and now $10,000 a month from November 2025 onwards.

Strong Complete Rental Revenue Progress

Total, I boosted my semi-passive revenue by about $4,300 a month, offered there are not any unexpected bills. I offered a property bought in 2020 for roughly a 20% internet revenue after taxes and costs and reinvested a lot of the proceeds into private and non-private fairness. Then I made made a two-bedroom in-law unit very nice for all members of the family to remain.

Because of this, I give the actual property returns an A, however the effort required an F. I really feel like I did 4 years price of normal actual property administration in a single yr.

Because of this, I’m decided to promote one other property after 2027 once I can benefit from the tax-free exclusion rule. Within the meantime, I hope my tenants benefit from the properties and stay self-sufficient. Actual property was my biggest supply of economic stress in 2025.

The industrial actual property market additionally appears to be waking up from its lengthy slumber. It’s been a tricky slog since inflation surged and the Fed started climbing rates of interest aggressively in 2022. However valuations are actually extraordinarily compelling in comparison with the inventory market, and I’m beginning to invest more in private real estate again.

Household Dynamics – Grade B Minus

Resulting from some advanced points affecting one beloved member of the family particularly exhausting, a grey cloud hung over my spouse and me all year long. I attempted to be a rock by retaining our funds stable, operating Daddy Day Camp each weekend, dropping off and choosing up the children 95% of the time, and at all times being round within the evenings.

My days would typically run from about 5:15 a.m. till 11:30 p.m. as a result of I wished to jot down earlier than the household wakened and after the household had gone to mattress. Sadly, my effort to be a full-time dad didn’t appear to be sufficient. My spouse has rather a lot on her plate, is doing the very best she will, and is genuinely adored by our kids. I’m additionally studying the way to be extra empathetic to issues and organic adjustments outdoors our management.

The excellent news is that we’ve got the monetary sources to supply the very best therapy and care attainable. One other vivid spot is that our kids proceed to develop and thrive. They love their college, have pals, and obtain an infinite quantity of high quality time from each dad and mom.

In notably, I spent numerous time instructing each youngsters tennis and swimming. They now have decent-looking forehands and backhands, together with improved freestyle strokes. In whole, I gave every youngster at the least 35 one-on-one classes, every lasting one to one-and-a-half hours.

Instructing your individual youngsters requires endurance, inside prayers for endurance, and sheer dedication. However seeing seen progress has been extremely rewarding.

It’s deeply satisfying to have the ability to help my household and allow my spouse to be 10 years free from full-time work after helping her negotiate a severance package again in 2015. Nevertheless, the load is getting heavier because of persistent elevated inflation, pointless wishes, and hedonic adaptation. I have to make changes as a way to final.

Artistic Endeavors – Grade A Plus

As soon as you permit your day job, you’ll most certainly want to search out one thing inventive or purposeful to do. I extremely doubt you’d be joyful solely watching eight hours of TV a day and taking part in pickleball. Personally, I’ve a have to really feel helpful. It additionally feels nice to assist folks really feel higher and achieve confidence of their funds.

In 2025, I revealed one other 156 articles, 52 newsletters, and roughly 30 podcast episodes. Right here’s a recap of the best articles on Financial Samurai for 2025. What made this notably gratifying have been two issues.

First was the success of my second nationwide bestseller, Millionaire Milestones: Simple Steps to Seven Figures. It took two years to jot down and numerous hours to market. One of many highlights was narrating the audiobook myself. It was one of the crucial difficult skilled experiences I’ve had.

The problem of the method made me understand how a disability or health issue could take away your ability to earn, so please take nothing without any consideration. In case you are wholesome, benefit from your means to provide earlier than it is gone.

Second was sustaining my publishing streak regardless of Google and AI negatively impacting website site visitors. As natural site visitors declined, so did income. However as a result of I genuinely love writing, I stored going anyway. I’ve been anticipating today for 5 years, and now the existential crisis from AI is right here. I do not assume I am going to ever absolutely stop.

Shock Video Interview

Lastly, Enterprise Insider released a fun video interview that includes my household and two others discussing cash classes for elevating youngsters. The inquiry got here out of the blue and felt like an ideal approach to shut out the yr.

As an alternative of paying to take footage and ship out vacation playing cards, I had an Emmy-winning producer attain out and produce a video for us as a substitute.It was an effective way to complete the yr and commemorate my dad and mom and grandparents.

Cash Is Good, A Pleased Household Is Far Higher

2025 strengthened a fact I’ve identified for many years: the window to live your best life doesn’t keep open perpetually. That is the principle motive I stop the desire to make maximum money at age 34 and left my finance job behind. As soon as your primary wants are met, cash not brings incremental happiness.

Household and pals matter much more. They’re additionally the individuals who can harm us or assist us probably the most. To today, I’m nonetheless attempting to higher perceive my dad and mom’ personalities. Particularly, I’m attempting to distinguish how a lot of the way in which they’re is because of their personalities versus their ages. They function so in a different way than I try this I discover myself looking for clues once I’m with them.

I’m additionally dwelling life for the primary time and am fascinated to see how our views change over time. You’d assume we’d at all times have the ability to steadily improve our pleasure the extra we obtain, however I’m not seeing this correlation after age 45. As an alternative, the extra we’ve got, the heavier we are likely to really feel and the extra we endure. Having ever-higher expectations is a recipe for unhappiness.

Genetically, we’re all constructed in a different way. Based mostly on twin research, roughly half of our happiness is influenced by genetics, setting a “set level,” whereas the opposite half comes from our intentional actions and life circumstances. So I want to stay conscious that we’re all distinctive in our personal methods.

Glad 2025 Is Over, However Additionally Miss The Time We No Longer Have

I’m happy with my effort and my angle this yr. I referred to as my dad and mom repeatedly and made time to see them greater than I’ve since I used to be 19. The spotlight was shocking my dad for his eightieth birthday on November 17 by merely showing within the kitchen one afternoon as he got here downstairs.

Well being-wise, I continued to play tennis and pickleball 3 times per week and even began going to Sunday night time basketball at my youngsters’s college. I simply must be cautious to not overdo it to keep away from accidents.

Ultimately, I grew our family funds, spent great high quality time with our kids, helped many individuals with their funds, and survived a yr of persistent grey clouds. On the flip facet, the time spent actively managing our funds throughout a risky inventory market, discovering new tenants and consumers, and dealing with significant car problems on the finish of the yr actually beat me up.

A B minus grade feels about proper. However I hope the rays of sunshine will burn off the clouds extra repeatedly once more. Subsequent up are my New Yr’s resolutions for 2026.

How was your 2025? What have been a few of your hits and misses?

Subscribe To Monetary Samurai

Hear and subscribe to The Monetary Samurai podcast on Apple or Spotify. I interview specialists of their respective fields and focus on a number of the most attention-grabbing matters on this website. Your shares, scores, and opinions are appreciated.

To expedite your journey to monetary freedom, be part of over 60,000 others and subscribe to the free Financial Samurai newsletter. You can even get my posts in your e-mail inbox as quickly as they arrive out by signing up here. Monetary Samurai is among the many largest independently-owned private finance web sites, established in 2009. The whole lot is written based mostly on firsthand expertise and experience.