- Nation-state threats drive file volumes: North Korea steals greater than ever, and Russia’s A7A5 token facilitates large-scale sanctions evasion

- Chinese language cash laundering networks dominate the panorama

- Full-stack illicit infrastructure suppliers facilitate malicious cyber exercise

- The rising intersection of crypto and violent crime

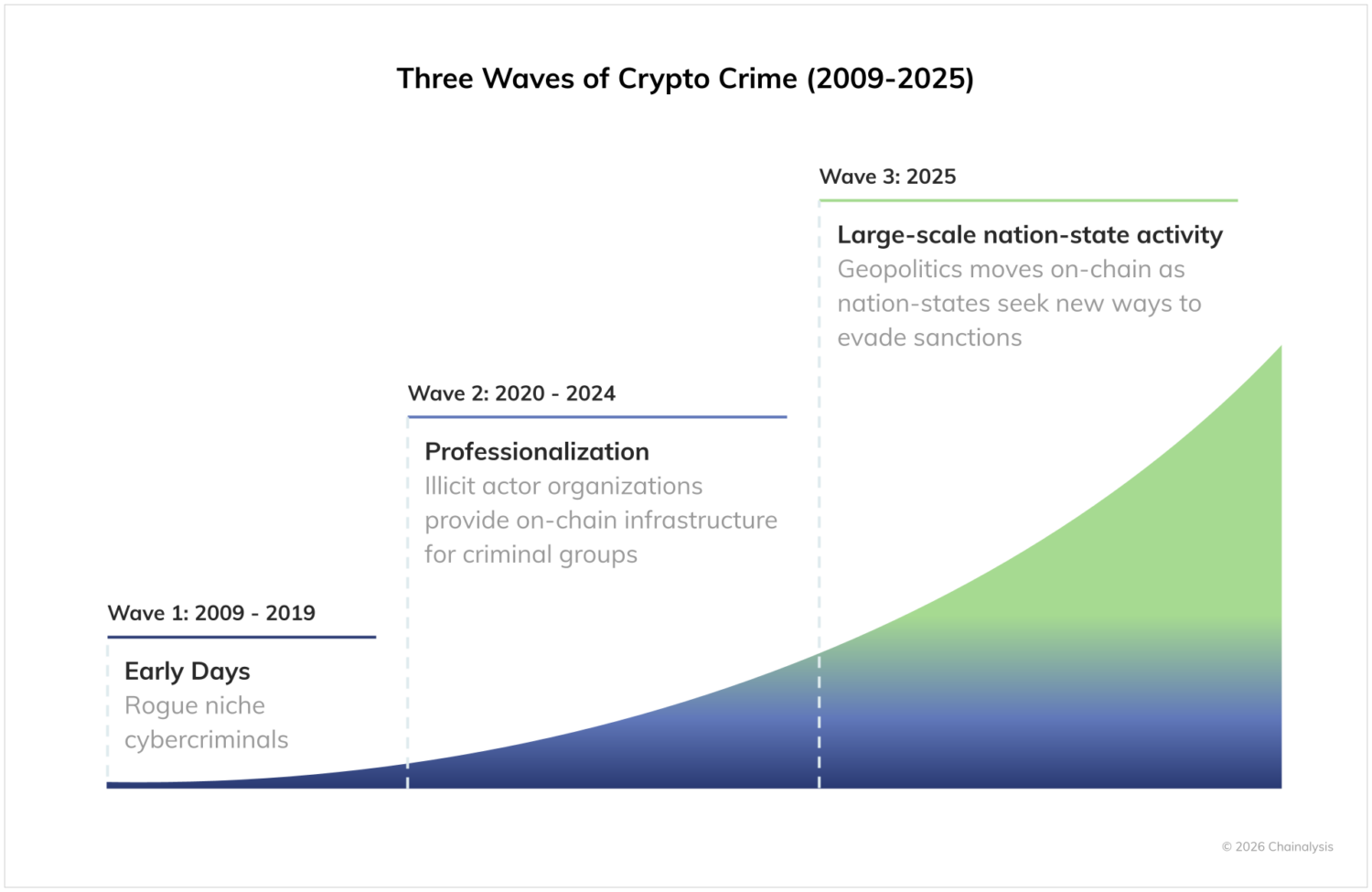

In 2025, we tracked a notable rise in nation-state exercise in crypto, marking the newest section within the maturation of the illicit on-chain ecosystem. Over the previous few years, the crypto crime panorama has turn out to be more and more professionalized; illicit organizations now function large-scale on-chain infrastructure to assist transnational prison networks procure items and companies and launder their ill-gotten crypto. Towards that backdrop, we’ve got seen nation-states transferring into this house, each by tapping into these similar professionalized service suppliers and by standing up their very own bespoke infrastructure to evade sanctions at scale. As nation-states plug into the illicit crypto provide chains initially constructed for cybercriminals and arranged crime teams, authorities companies and compliance and security teams now face considerably increased stakes on each the patron safety and nationwide safety fronts.

How are these and different developments manifesting on-chain? Let’s look at the info and high-level developments.

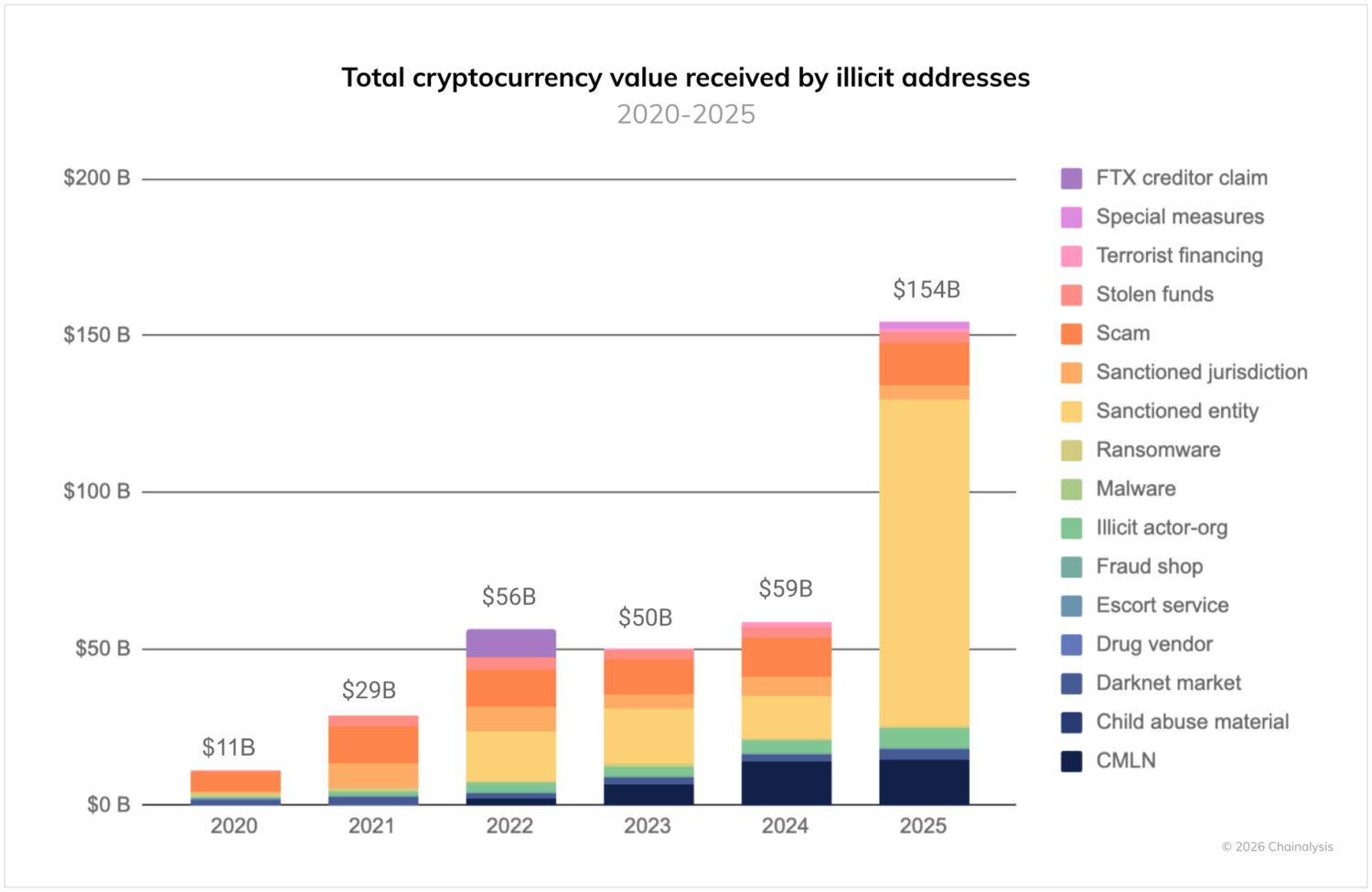

In response to our knowledge, illicit cryptocurrency addresses obtained not less than $154 billion in 2025. This represents a 162% improve year-over-year (YoY), primarily pushed by a dramatic 694% improve within the worth obtained by sanctioned entities. However even when the worth obtained by sanctioned entities had been flat YoY, 2025 would nonetheless mark a file 12 months for crypto crime, as exercise elevated throughout most illicit classes. As at all times, we should caveat that this determine represents a lower-bound estimate primarily based on illicit addresses we’ve recognized thus far. [1]

These illicit volumes are nonetheless dwarfed by the broader crypto financial system, which largely consists of legit transaction volumes. Our estimate for the illicit share of all attributed crypto transaction quantity elevated barely from 2024 however stays beneath 1%. [2]

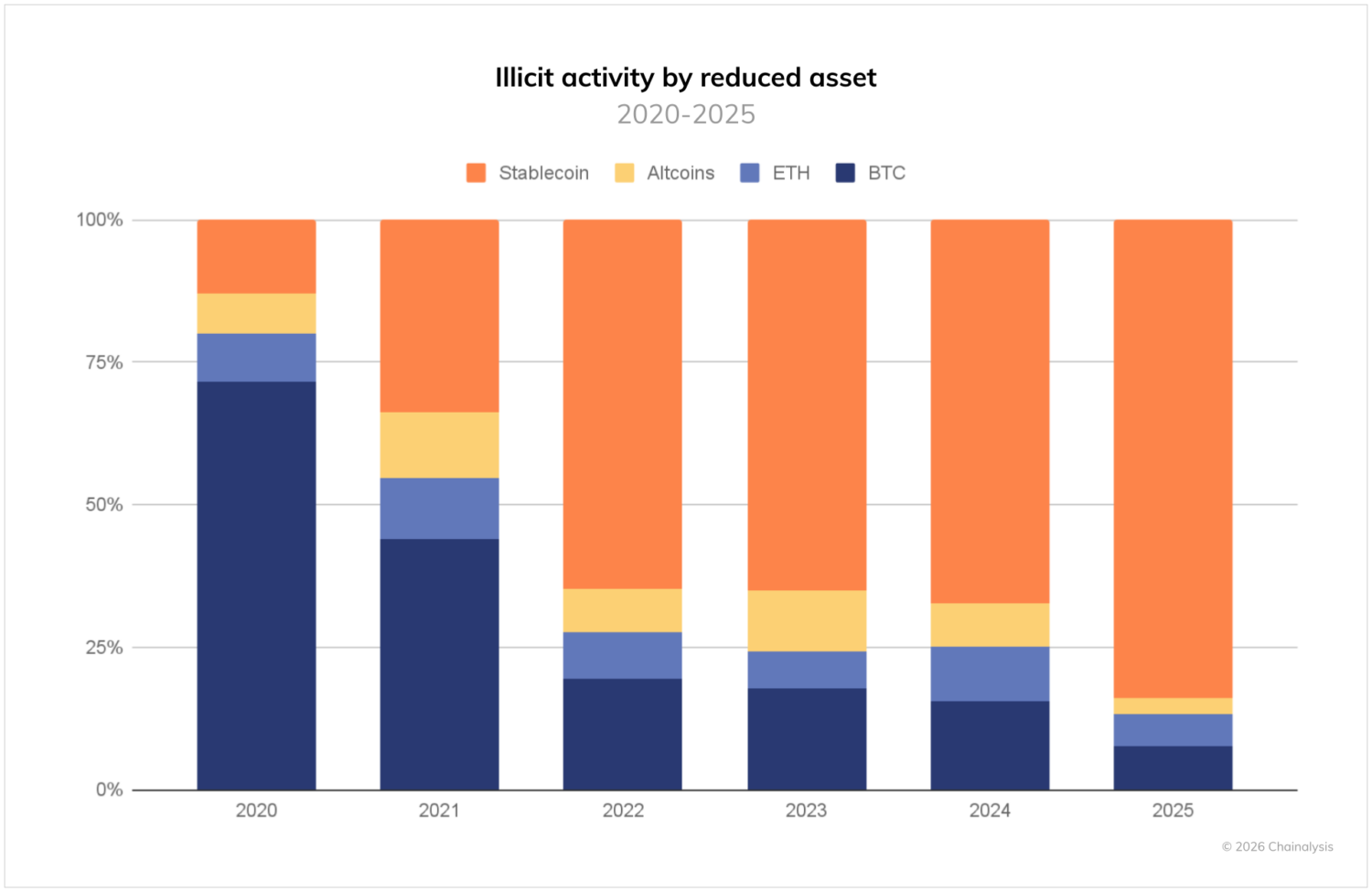

We’re additionally observing a continued shift within the kinds of property concerned in crypto crime, as proven within the chart beneath.

For the previous few years, stablecoins have come to dominate the panorama of illicit transactions, and now account for 84% of all illicit transaction quantity. This mirrors broader ecosystem developments the place stablecoins occupy a large and rising share of all crypto exercise resulting from their sensible advantages: simple cross-border transferability, decrease volatility, and broader utility.

Beneath, we’ll take a more in-depth take a look at 4 key developments that outlined crypto crime in 2025 and might be necessary to look at going ahead.

Nation-state threats drive file volumes: North Korea steals greater than ever, and Russia’s A7A5 token facilitates large-scale sanctions evasion

Stolen funds remained a serious risk to the ecosystem in 2025, with DPRK‑linked hackers alone stealing $2 billion. Devastating mega-hacks drive that complete, most notably the February Bybit exploit, the most important digital heist in crypto historical past, at almost $1.5 billion. Though North Korean hackers have lengthy been a fixture of the risk panorama, the previous 12 months has been their most harmful but, each in worth stolen and within the sophistication of their intrusion and laundering techniques.

Maybe most importantly, 2025 noticed unprecedented volumes related to nation-states’ on-chain conduct. Whereas Russia introduced legislation in 2024 to facilitate sanctions evasion through crypto, these efforts got here to fruition in February 2025, when the nation launched its ruble-backed A7A5 token, transacting over $93.3 billion in lower than one 12 months.

In the meantime, over the previous a number of years Iran‘s proxy networks have continued to facilitate cash laundering, illicit oil gross sales, and procurement of arms and commodities on-chain to the tune of $2+ billion via confirmed wallets recognized in sanctions designations. Iran-aligned terrorist organizations, together with Lebanese Hezbollah, Hamas, and the Houthis, are utilizing cryptocurrency at scales by no means earlier than noticed, regardless of numerous army setbacks.

Chinese language cash laundering networks dominate the panorama

2025 has seen the emergence of Chinese language cash laundering networks (CMLNs) as a dominant drive within the illicit on-chain ecosystem. These subtle operations have dramatically expanded the pattern of crypto crime’s diversification and professionalization, providing all kinds of specialised companies together with laundering-as-a-service and different prison infrastructure. Constructing on the framework established by operations like Huione Guarantee, these networks have created full-service criminal enterprises that assist every little thing from fraud and scams to North Korean hack proceeds, sanctions evasion, and terrorist financing.

Full-stack illicit infrastructure suppliers facilitate malicious cyber exercise

Whereas nation‑state use of crypto is rising, extra “conventional” cybercrime stays very a lot alive: ransomware operators, CSAM platforms, malware distributors, scammers, and illicit marketplaces nonetheless rely on a dense layer of enablers to remain efficient. Illicit actors and nation‑states alike are more and more reliant on infrastructure suppliers that supply a full stack of companies and are themselves seen on‑chain, together with area registrars, bulletproof internet hosting companies, and different technical infrastructure that may be leveraged for malicious cyber exercise.

These infrastructure suppliers have developed from area of interest internet hosting resellers into built-in infrastructure platforms designed to face up to takedowns, abuse complaints, and sanctions enforcement. As these choices proceed to scale, they’re prone to play a key position in supporting financially motivated criminals and state-aligned actors alike to amplify the attain of malicious cyber exercise.

The rising intersection of crypto and violent crime

Many individuals nonetheless image crypto crime as one thing purely digital — faceless unhealthy actors behind keyboards relatively than threats that manifest within the bodily world. In actuality, we’re seeing rising connections between on-chain exercise and violent crime. Human trafficking operations have more and more leveraged cryptocurrency, whereas there has additionally been a very disturbing rise in bodily coercion assaults, wherein criminals use violence to drive victims to switch property, usually timing these assaults to coincide with cryptocurrency worth peaks.

As we transfer ahead, cooperation amongst regulation enforcement, regulatory our bodies, and crypto companies might be essential in combating these evolving and converging threats. Whereas the general share of illicit exercise stays small relative to legit crypto utilization, the stakes have by no means been increased for sustaining the integrity and safety of the cryptocurrency ecosystem.

[1] A 12 months from now, these totals might be increased as we proceed to establish extra illicit addresses and incorporate their historic exercise into our estimates. For perspective, after we printed last year’s Crypto Crime Report, we reported $40.9 billion for 2024. One 12 months later, our up to date estimate for 2024 is considerably increased at $57.2 billion, with a lot of that progress coming from numerous kinds of illicit actor organizations offering on-chain infrastructure and laundering companies for high-risk and illicit actors. Usually, our totals exclude income from non-crypto-native crime, akin to conventional drug trafficking and different crimes wherein crypto could also be used as a way of cost or laundering. Such transactions are just about indistinguishable from licit transactions in on-chain knowledge, though regulation enforcement with off-chain info can nonetheless examine these crimes utilizing Chainalysis solutions. In instances the place we’re in a position to affirm such info, we rely the transactions as illicit in our knowledge.

[2] To calculate the illicit share of attributed transaction volumes, we decide the denominator by calculating all inflows to identified companies throughout all of the property that we monitor, excluding inside transfers inside companies. We then divide the illicit worth obtained by the whole worth obtained by all companies.

This web site comprises hyperlinks to third-party websites that aren’t below the management of Chainalysis, Inc. or its associates (collectively “Chainalysis”). Entry to such info doesn’t suggest affiliation with, endorsement of, approval of, or advice by Chainalysis of the positioning or its operators, and Chainalysis just isn’t answerable for the merchandise, companies, or different content material hosted therein.

This materials is for informational functions solely, and isn’t meant to supply authorized, tax, monetary, or funding recommendation. Recipients ought to seek the advice of their very own advisors earlier than making most of these choices. Chainalysis has no duty or legal responsibility for any resolution made or some other acts or omissions in reference to Recipient’s use of this materials.

Chainalysis doesn’t assure or warrant the accuracy, completeness, timeliness, suitability or validity of the data on this report and won’t be answerable for any declare attributable to errors, omissions, or different inaccuracies of any a part of such materials.