Key Factors

- Graduate PLUS loans will now not be accessible to new debtors beginning July 1, 2026.

- Dad and mom and graduate college students will face new federal borrowing caps that will go away bigger funding gaps.

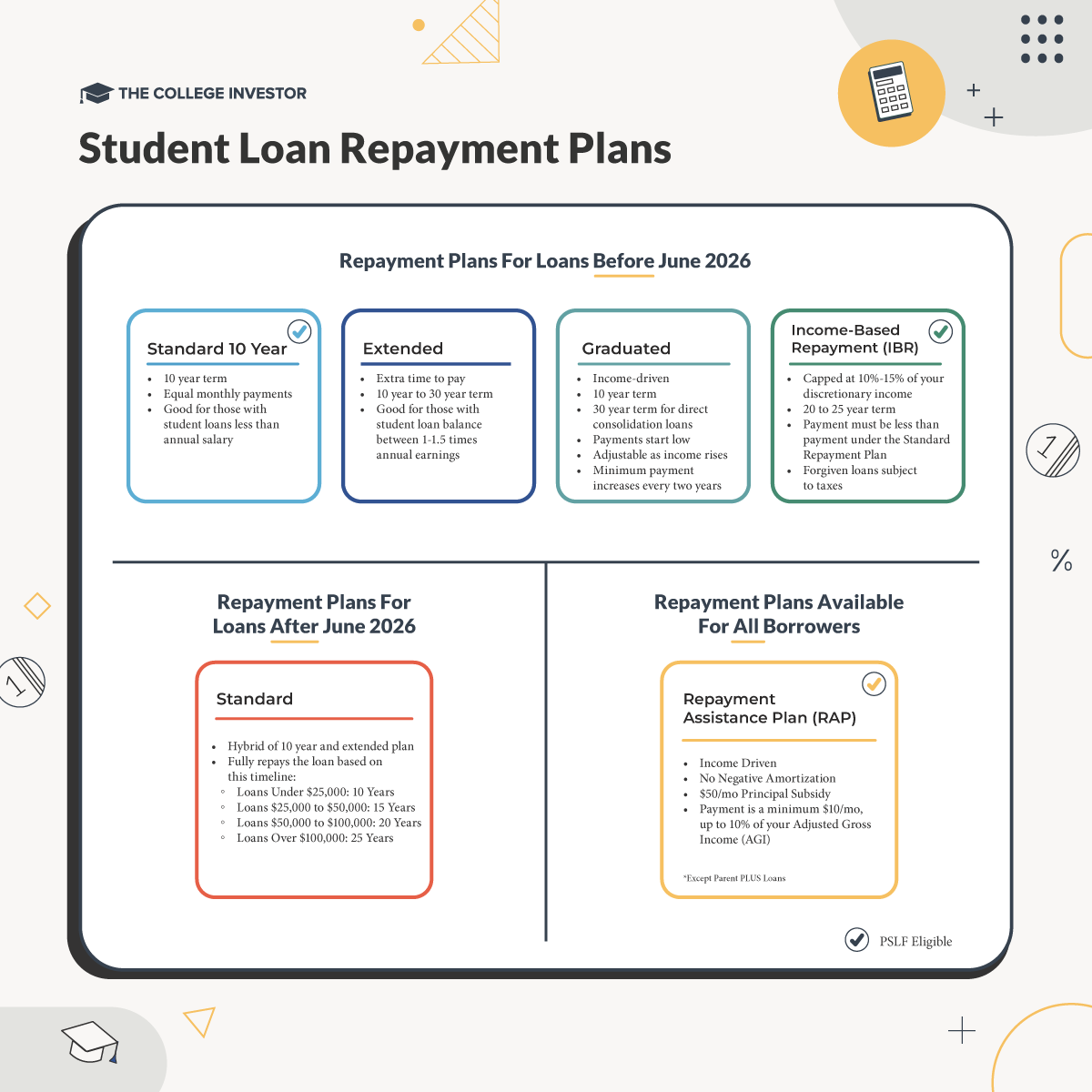

- The Reimbursement Help Plan (RAP) will substitute at this time’s income-driven choices for future loans, whereas the SAVE plan is ending.

Federal student loans are a essential part in how households pay for faculty.

Starting in 2026, new legal guidelines will change how a lot college students and fogeys can borrow and the way these pupil loans are repaid. The adjustments are important, particularly for graduate college students, skilled packages, and households that depend on Guardian PLUS loans to shut faculty funding gaps.

Student loan repayment additionally faces one of many largest shifts in historical past.

For households planning for faculty or graduate college, or these already in compensation on pupil loans, the following yr shall be one other wild one with updates and adjustments.

Would you want to save lots of this?

1. Grad PLUS Loans Are Ending

For years, Graduate PLUS loans have allowed graduate {and professional} college students to borrow as much as the full cost of attendance, masking tuition, charges, housing, and residing bills after different support is utilized.

That choice ends for brand spanking new debtors after July 1, 2026.

What’s altering

Graduate PLUS loans will no longer be issued to college students who take out their first federal mortgage for graduate college on or after that date. College students who have already got Grad PLUS loans for his or her program of examine could also be allowed to proceed borrowing underneath current limits for as much as three years, however new college students to graduate packages is not going to have entry.

Why it’s taking place

The One Big Beautiful Bill Act ended the Grad PLUS mortgage program, as lawmakers have expressed concern about limitless borrowing. Graduate college students, whereas being a decrease variety of debtors, have a significantly higher average balance.

Ending Grad PLUS borrowing locations a tough restrict on how a lot graduate students can finance by way of federal pupil loans.

The way it impacts you

College students getting into legislation college, medical college, MBA programs, and different high-cost graduate packages might now not have the ability to borrow sufficient by way of federal loans alone to cowl complete prices.

That shortfall might should be stuffed by way of:

- Scholarships or fellowships

- Employer tuition benefits

- Private financial savings

- Private student loans

What to plan now

Potential graduate college students ought to evaluation the complete price of packages they’re contemplating and examine it to the brand new federal student loan limits.

2. Guardian PLUS Loans Will Have New Limits

Parent PLUS loans have lengthy been the backstop of school financing, permitting dad and mom to borrow as much as the full cost of attendance for their child’s education.

That, too, is altering.

What’s altering

New Guardian PLUS loans issued after July 1, 2026 shall be capped at:

- $20,000 per yr per pupil

- $65,000 complete per pupil

Beforehand, dad and mom may borrow the complete quantity of the price of attendance, minus different financial aid acquired.

Why it’s taking place

Guardian PLUS borrowing has grown steadily, and policymakers have expressed concern about dad and mom taking over massive balances near retirement, typically with restricted skill to repay.

The brand new caps have been handed as a part of the One Huge Stunning Invoice Act, which additionally changed the repayment option for future parent PLUS loans as properly.

The way it impacts households

Households that rely closely on Guardian PLUS loans to afford personal schools, out-of-state public universities, or high-cost packages might face significant funding gaps.

The change might affect:

- College selection decisions

- Whether or not students live on or off campus

- How prices are cut up between dad and mom and college students

What to plan now

Dad and mom of middle- and high-school college students ought to revisit faculty financial savings plans and anticipated borrowing methods. Households might have to:

- Improve financial savings the place doable

- Evaluate in-state and lower-cost choices extra fastidiously

- Ask schools about institutional grants and tuition payment plans

- Run The College Investor’s How Much Student Loan Debt Can I Afford Calculator

Dad and mom with current PLUS loans must also monitor consolidation and compensation timelines, as entry to income-based compensation choices depend upon when loans are consolidated.

3. New Borrowing Limits For Graduate And Skilled College students

With the tip of Grad PLUS loans comes a brand new construction of mortgage caps for graduate {and professional} schooling.

There’ll now be new borrowing limits for each graduate school and professional school programs – the primary time the federal government has ever made the excellence in borrowing limits per program.

What’s altering

Federal Direct Unsubsidized Loans will stay accessible, however with stricter limits:

- $20,500 per yr and $100,000 lifetime for graduate programs

- $50,000 per yr and $200,000 lifetime for professional programs

Why it’s taking place

This alteration is designed to switch open-ended borrowing with strict limits, just like how undergraduate loans function.

The way it impacts college students

Graduate college students in lower-cost packages may even see little distinction. These in costly skilled tracks may have to seek out tens of hundreds of {dollars} elsewhere.

Packages with excessive tuition however modest post-graduation earnings might change into more durable to justify financially underneath the brand new guidelines. Private lenders may also NOT replace federal student loans for some degrees.

What to plan now

Candidates ought to examine anticipated debt to real looking earnings outcomes of their area. Graduate college selections will should be extraordinarily Return on Investment (ROI) focused.

4. The Reimbursement Help Plan (RAP) Launches

Borrowing guidelines are solely half the story. Repayment plans are altering too.

What’s altering

For loans disbursed on or after July 1, 2026, most current income-driven repayment plans shall be changed by a brand new Repayment Assistance Plan, or RAP.

Debtors will typically select between:

- A standard fixed repayment plan

- The brand new RAP choice

It is vital to notice that debtors with new Guardian PLUS loans after July 1, 2026 will solely have entry to the usual plan.

Why it’s taking place

The federal compensation system has grown complicated, with a number of income-driven plans overlapping. RAP is meant to simplify repayment — although not essentially make it cheaper.

The way it impacts debtors

Funds underneath RAP shall be tied to revenue, however forgiveness timelines are longer than underneath current plans. Month-to-month funds for some debtors might rise over time, notably as revenue will increase.

RAP is compelling, although, as a result of it presents curiosity subsidies and principal discount help.

What to plan now

College students who anticipate to depend on income-driven compensation ought to pay shut consideration to when their loans are disbursed. Loans disbursed earlier than June 30, 2026 will nonetheless preserve entry to Income Based Repayment (IBR).

5. The SAVE Plan Is Ending

The Saving on a Precious Training, or SAVE plan, was a Biden-era initiative that has left over 7 million debtors in limbo. Whereas the court system and OBBBA both have killed the SAVE Plan, the final SAVE Timelines are nonetheless unsure.

What is for certain is that debtors within the SAVE plan should be making selections and planning to vary compensation plans this yr.

What’s altering

SAVE is closed to new debtors and people within the SAVE plan have to resolve on either IBR today, or wait for RAP in July. It is doable the Division of Training will drive debtors into a brand new plan on their very own timeline – which is probably not useful for these ready in limbo.

Why it’s taking place

SAVE was created underneath earlier government authority and has confronted authorized and legislative challenges. This was challenged in court, and likewise eliminated by law.

The way it impacts debtors

Debtors at present on SAVE ought to run their numbers utilizing The College Investor’s RAP Calculator or Student Loan Calculator to find out:

- Potential fee underneath IBR

- Potential fee underneath RAP

- Potential customary plan fee

Based mostly on these numbers, debtors can resolve which compensation plan would work finest for them. Debtors pursuing Public Service Loan Forgiveness ought to doubtless change sooner, somewhat than later, to proceed making ahead progress.

What to plan now

Debtors ought to login to their mortgage servicer and guarantee their contact data is up to date. This can guarantee they do not miss any vital timelines or deadlines.

What Debtors And Households Can Do Now

An important step is early planning. The foundations that apply to your loans will rely closely on while you borrow, and what sort of pupil mortgage you’ve got.

Households wish to:

- Evaluate faculty and graduate college timelines fastidiously

- Evaluate complete program prices in opposition to new mortgage limits

- Improve financial savings or seek scholarships earlier

- Ask financial aid offices how funding packages might change

Current debtors have to run the numbers on their compensation plans and perceive the adjustments.

The federal pupil mortgage system in 2026 shall be extra restricted, extra structured, and fewer forgiving for future debtors. Households who perceive these shifts now shall be higher positioned to keep away from surprises later and to make schooling selections that align with long-term monetary stability.

Do not Miss These Different Tales:

Editor: Colin Graves

The put up 5 Major Student Loan Changes Coming in 2026 appeared first on The College Investor.