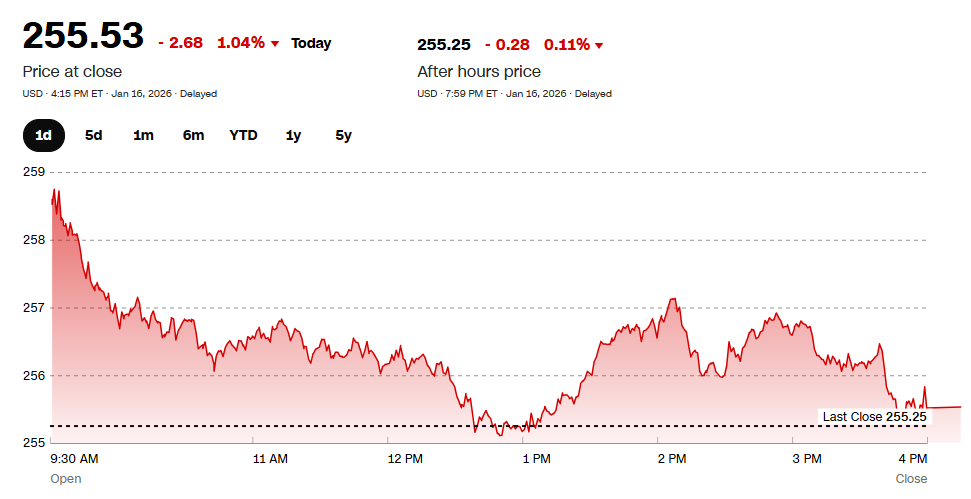

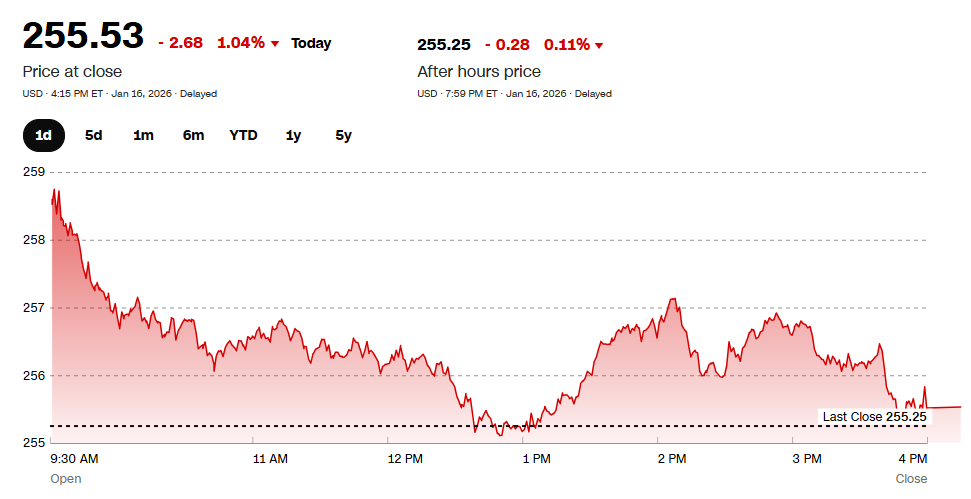

Apple inventory at $300 stays out of attain proper now as shares are buying and selling round $260 in mid-January 2026, which really represents a decline of roughly 4.1% for the month. The Apple inventory value opened the yr at $271.01 however has been trending decrease all through January, and this raises some questions on whether or not Apple inventory reaching $300 is even achievable this month regardless of what some bullish analysts are forecasting. The 52-week excessive of $288.62 was reached again in December 2025, and that degree represents the Apple inventory ATH 2026 that the corporate might want to surpass.

Additionally Learn: Alphabet (GOOGL): Analyst Forecasts $5T Market Cap in 2027

Apple Inventory 2026 Outlook Highlights ATH, Worth Forecast, And $300 Surge

Analyst Targets Level To Upside Potential

Apple inventory at $300 doesn’t look achievable for what stays of January based mostly on how buying and selling has unfolded. The closing value hit $259.96 on January 14, placing shares $40 in need of the goal with solely half a month to go. Apple inventory 2026 started on a excessive observe however misplaced traction quickly, whereas institutional cash hasn’t moved. Thirty-seven analysts collectively charge Apple inventory as a “Reasonable Purchase,” with the one-year Apple inventory forecast averaging $284.07 based on MarketBeat.

Worth goals from Robert W. Baird and Wells Fargo & Company each stand at $300.00, and Morgan Stanley pushed its estimate to $315 throughout late December 2025. Wedbush analyst Dan Ives instructions consideration with the best goal of $350 on Wall Avenue. Ives acknowledged: “2026 goes to lastly be the yr that Apple really enters the AI Revolution. The elephant within the room stays the invisible AI technique, with the largest shopper put in base on the earth of two.4 billion iOS gadgets and 1.5 billion iPhones, the time is now for Apple to speed up its AI efforts.”

Ives’ $350 forecast for Apple inventory in 2026 implies roughly 35% appreciation from current costs and would elevate the market cap to one thing close to $5.17 trillion. He famous that monetizing AI options may add between $75 and $100 per share to the Apple inventory value within the years forward, which represents substantial worth.

Strategic Strikes Strengthen Income Outlook

Institutional buyers have warmed to the Apple inventory value because of key strategic bulletins that analysts say will strengthen Companies income going ahead. Apple formally partnered with Google to combine Gemini into Siri and different AI capabilities, a collaboration anticipated to drive sooner machine alternative cycles and higher Companies monetization. Moreover, Apple launched Creator Studio at $12.99 per 30 days, bundling inventive software program with new AI options to diversify income streams away from pure {hardware} gross sales.

Wedbush and J.P. Morgan reaffirmed their bullish positions after the Gemini partnership went public, and Evercore ISI continues to undertaking a $300 value goal with an “outperform” score. The newest earnings launch confirmed Apple delivered $1.85 per share, beating the Avenue’s $1.74 estimate by $0.11. Income totaled $102.47 billion for the quarter, surpassing forecasts and reflecting an 8.7% year-over-year achieve.

Close to-Time period Challenges May Delay $300 Goal

Present Apple inventory forecast fashions weave on this latest momentum along with expectations for a considerable Siri improve arriving in spring 2026, which could function a catalyst for shares. But Apple inventory at $300 encounters near-term challenges which have fueled January’s downturn. Business reviews flag a shortage of high-grade glass fabric, a vital chipboard materials that might squeeze machine availability or escalate part bills if the availability hole continues.

Additionally Learn: Apple Stock ATH in 2026: Bullish Momentum After December Peak

Activist teams press Apple to drop X and Grok from its app platforms as a consequence of AI-generated content material points, introducing regulatory and notion dangers. Analysts have tied the inventory’s latest drop to forecasts of diminished international smartphone urge for food and skepticism that the Apple inventory ATH in 2026 could be reached quickly. Institutional holders management 67.73% of excellent shares, whereas the corporate’s market worth sits near $3.82 trillion with a P/E a number of of 34.80.

Attaining Apple inventory value ranges at $300 earlier than January closes relies upon closely on provide chain decision and investor confidence within the forthcoming AI rollout. At this level, the February-March interval looks as if a extra possible goal for testing these three-figure marks, given the Apple inventory forecast consensus ranges from $284 to $315 over twelve months. For Apple inventory reaching $300 and past will seemingly demand alignment throughout a number of elements, from fixing provide points to profitable AI deployment and sustained efficiency in key territories like China.