Bitcoin merchants started 2026 on a optimistic word, snapping up choices bets that concentrate on a value rally into six digits.

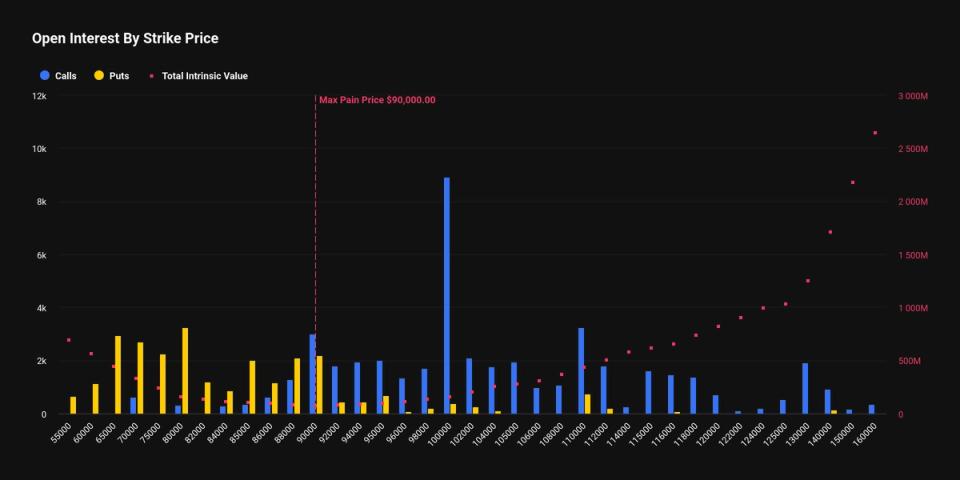

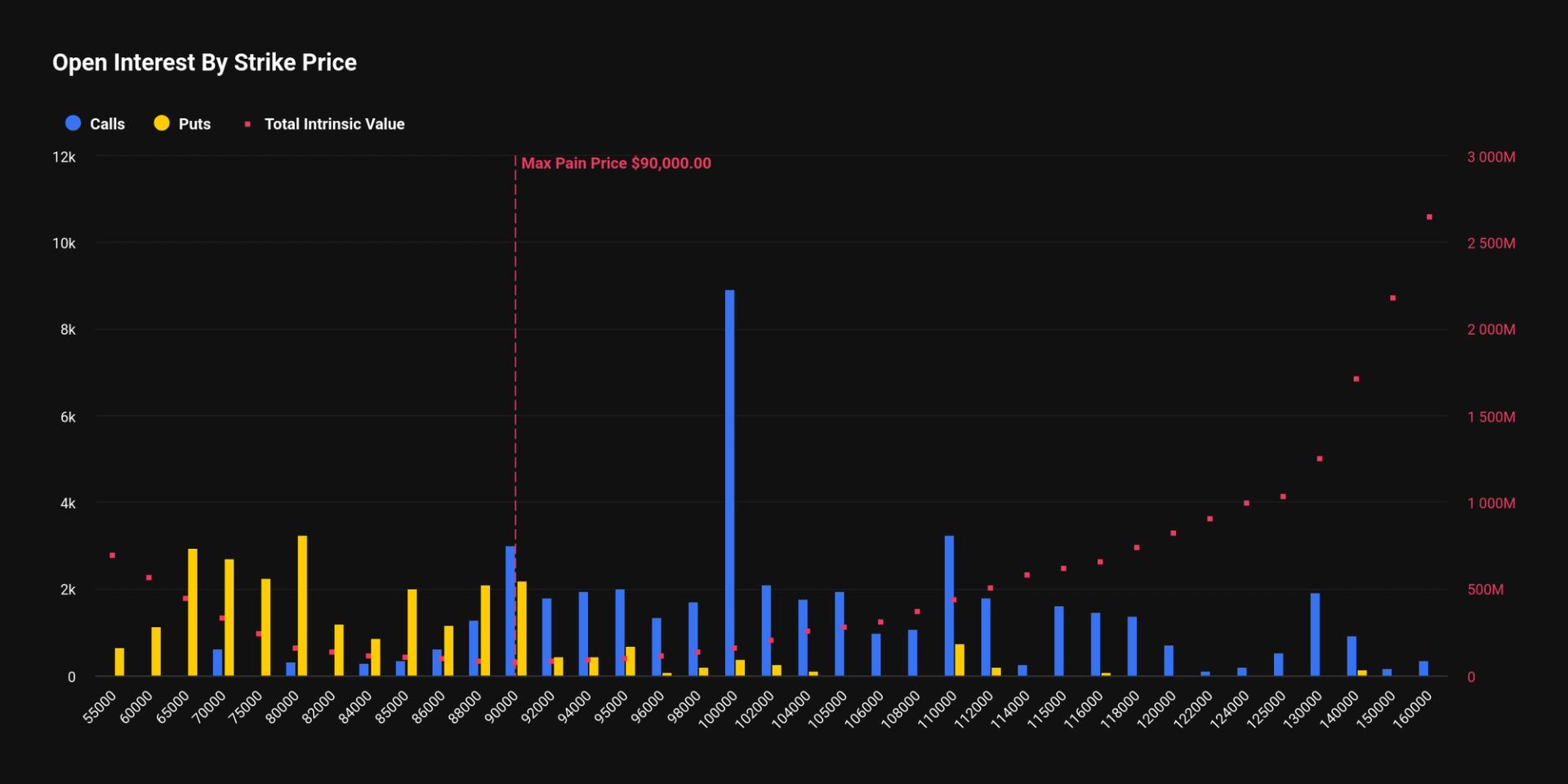

Since a minimum of Friday, there was a notable enhance in investor curiosity within the $100,000 strike January expiry name possibility listed on Deribit, the world’s largest crypto choices alternate by quantity and open curiosity.

A name possibility provides the purchaser the appropriate, however not the duty, to buy the underlying asset at a predetermined value at a later date. The $100,000 name possibility represents a wager that bitcoin’s value will rally above that stage on or earlier than the expiry of the contract.

“Stream stays dominated by rolls, with a notable uptick in curiosity across the 30 Jan 100k calls,” Jasper De Maere, desk strategist at Wintermute.

Previously 24 hours alone, the variety of energetic or open contracts in that exact possibility has elevated by 420 BTC, in line with information supply Amberdata. That equates to a notional open curiosity progress of $38.80 million, essentially the most amongst all January calls and throughout all platform-wide expiries on Deribit, the place one choices contract represents one BTC.

The possibility lately boasted a complete notional open curiosity of $1.45 billion, with January expiry accounting for $828 million alone, in line with information supply Deribit Metrics.

The upside positioning aligns with the bullish sentiment that dominated most of 2025, when merchants chased name choices at strikes from $100,000 to $140,000.

Demand for these bullish possibility performs might surge additional if BTC’s value rally extends past $94,000, in line with QCP Capital. The cryptocurrency has risen round 5% within the first 5 days of the 12 months, briefly topping $93,000 at one level early Monday.

“Put up-[December] expiry positioning has shifted. BTC perpetual funding on Deribit has jumped above 30%, signaling sellers at the moment are brief gamma to the upside. This dynamic was evident as spot pushed by 90k, triggering hedging flows into perpetuals and near-dated calls,” QCP Capital mentioned final week.

“A sustained transfer above 94k might amplify this impact,” the agency added.