Faculty Ave is a scholar mortgage lender that provides among the greatest charges for personal scholar loans and scholar mortgage refinancing.

Pupil loans are a necessity for a lot of college students searching for the next training. The rising cost of higher education has led to over one million college students graduating with debt. The clock begins ticking for these graduates as quickly as they stroll throughout the stage. They should discover gainful employment earlier than their month-to-month scholar mortgage repayments start or else face repaying your mortgage with out a job.

Generally that may be troublesome and funds might grow to be a month-to-month burden. College Ave Student Loans is an organization based in 2015 by ex-Sallie Mae executives for the aim of making a greater mortgage course of. One explicit purpose helps college students lower your expenses on scholar mortgage repayments by refinancing existing loans.

Faculty Ave is also considered one of our top private student loan lenders. See how Faculty Ave compares here.

Faculty Ave Pupil Loans are on the Credible platform for refinancing. You may shortly evaluate and see if they’re the very best in 2 minutes or much less. Let’s dive into our Faculty Ave scholar loans overview.

Faculty Ave Pupil Loans

College Ave student loans provide aggressive charges and among the most versatile reimbursement choices that you will discover. This is a more in-depth take a look at the phrases and advantages.

Charges And Phrases

Faculty Ave affords each fastened and variable charges on all of its personal scholar mortgage merchandise. Presently, its undergraduate loans provide the bottom beginning rates of interest. The variable charges, particularly, have the potential to be very reasonably priced, with the low vary of the spectrum almost 1%.

- Variable APR: 3.89% – 17.99%

- Mounted APR: 2.74% – 17.99%

You may have the choice to pay again your personal scholar mortgage in 5, 8, 10, or 15 years. The minimal mortgage quantity is $1,000 and Faculty Ave will cowl as much as 100% of the price of attendance.

Faculty Ave’s normal graduate loans and MBA loans each provide the identical reimbursement phrases as its undergraduate loans. Nonetheless, they arrive with barely greater rates of interest. Listed here are their present APR ranges:

- Variable APR: 4.85% – 16.33%

- Mounted APR: 3.72% – 16.33%

Lastly, Faculty Ave affords medical, dental, and legislation faculty loans. These are the one personal loans Faculty Ave affords that may be repaid in 20 years. Listed here are their present charges:

- Variable APR: 4.76% – 16.315

- Mounted APR: 3.67% – 16.31%

|

Faculty Ave Particulars |

|

|---|---|

|

Product Title |

Faculty Ave Undergraduate Non-public Pupil Mortgage |

|

Min Mortgage Quantity |

$1,000 |

|

Max Mortgage Quantity |

As much as the price of attendance |

|

Variable APR |

3.89% – 17.99% |

|

Mounted APR |

2.74% – 17.99% |

|

Mortgage Phrases |

5, 8, 10, 15, and 20 years |

|

Promotions |

None |

Mortgage Compensation Choices

Faculty Ave affords all kinds of reimbursement choices that will let you tailor a mortgage expertise that works for you. Listed here are the choices it’s a must to select from:

- Full principal and curiosity reimbursement

- Curiosity-only funds

- Flat $25 funds

- Deferred payments

The grace interval on College Ave student loans is 6 months for undergraduate loans and 9 months for many of its graduate mortgage applications. Notably, Faculty Ave additionally affords full deferment throughout medical and dental residency.

How Do Faculty Ave Pupil Loans Examine?

Faculty Ave is persistently close to the highest of the pack for personal scholar mortgage lenders. They’ve versatile in-school reimbursement and even full deferment throughout residency. However that does not essentially imply they will be best for you. Take a look at this fast comparability right here:

|

Header

|

|

|

|

|---|---|---|---|

|

Ranking |

|||

|

Minimal Mortgage |

$1,000 |

$1,000 |

$1,000 |

|

APR Sort |

Variable and Mounted |

Variable and Mounted |

Variable and Mounted |

|

Cosigner |

Not Required |

Not Required |

Not Required |

|

Earliest Cosigner Launch Eligibility |

Midway By way of Your Compensation Interval |

None |

24 Months |

|

Cell

|

Faculty Age Pupil Mortgage Refinancing

Faculty Ave Refinance isn’t merely a consolidation firm. When consolidating, you’re taking a number of current loans and mix them into one for decrease month-to-month funds and, in some instances, decrease rates of interest. Nonetheless, with Faculty Ave, you’ll be able to refinance a single mortgage to get higher phrases or decrease charges.

Charges And Phrases

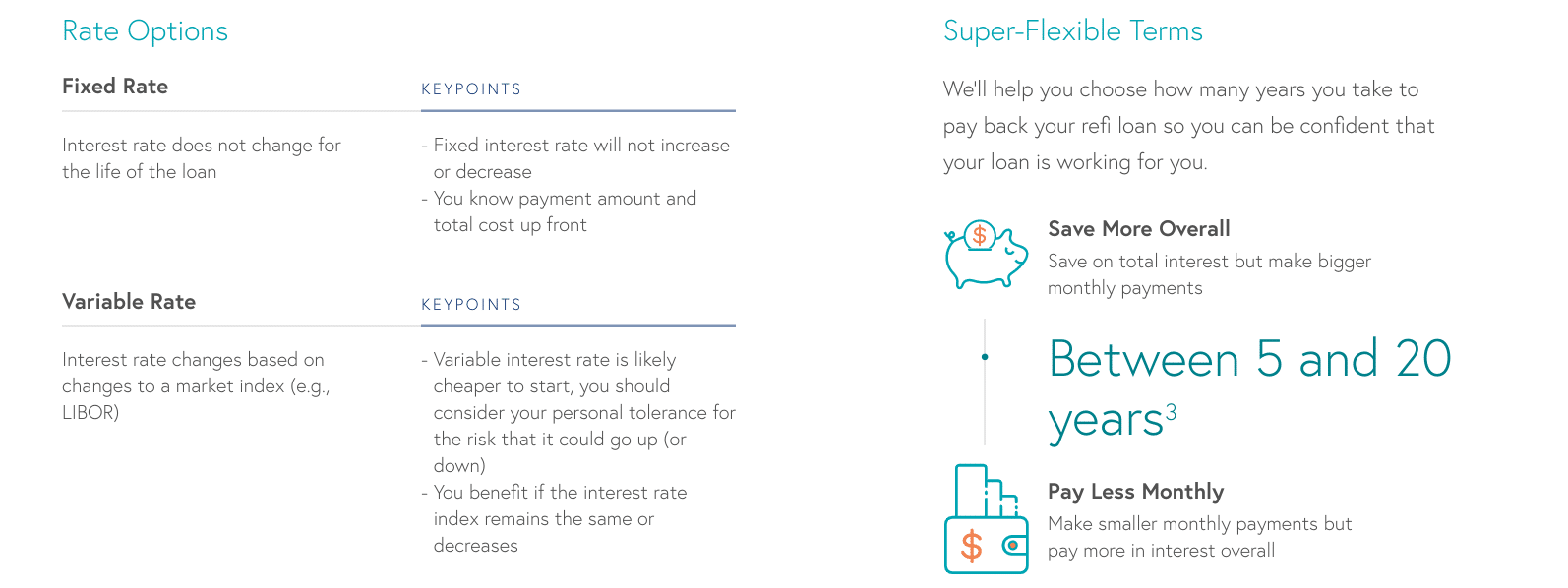

With Faculty Ave, you’ll be able to refinance a mortgage as little as $5,000. The utmost mortgage quantity for the overwhelming majority of diploma applications is $150,000. However if in case you have a medical, dental, pharmacy or veterinary doctorate diploma, you’ll be able to refinance as a lot as $300,000.

These low minimums and excessive maximums are what put Faculty Ave on our listing of the Best Places To Refinance Your Student Loans. Debtors can select from 16 completely different reimbursement phrases, starting from 5 to twenty years.

Faculty Ave Refinancing Choices. Screenshot by The Faculty Investor

Whereas that is not fairly the extent of customization that Earnest affords, it is nonetheless one of the crucial versatile refinance applications within the trade. Listed here are the present variable and stuck rates of interest for Faculty Ave’s refinance loans:

- Variable APR: 7.99% – 14.09%

- Mounted APR: 7.99% – 14.09%

Keep in mind, earlier than you take a look at any charges, be sure to evaluate Faculty Ave with different lenders. Utilizing Credible, you’ll be able to evaluate as much as 8 lenders to be sure to get the very best charge doable, together with Faculty Ave. Plus, Faculty Investor readers can stand up to an $1,000 bonus once they refinance with Credible. Check it out here.

|

Faculty Ave Pupil Mortgage Refinancing Particulars |

|

|---|---|

|

Product Title |

Faculty Ave Pupil Mortgage Refinancing |

|

Min Mortgage Quantity |

$5,000 |

|

Max Mortgage Quantity |

$150,000 or $300,000 (relying on diploma) |

|

Variable APR |

7.99% – 14.09% |

|

Mounted APR |

7.99% – 14.09% |

|

Mortgage Phrases |

5 to twenty years |

|

Promotions |

None |

How Does Faculty Ave Pupil Mortgage Refinancing Examine?

Faculty Ave’s scholar mortgage refinancing product affords 16 completely different reimbursement phrases and excessive mortgage limits. However you will nonetheless wish to get charge quotes from just a few extra lenders. Take a look at this comparability right here:

|

Header

|

|

|

|

|---|---|---|---|

|

Ranking |

|||

|

Variable APR |

7.99% – 14.09% |

5.67% – 10.63% |

5.88% – 9.99% |

|

Mounted APR |

7.99% – 14.09% |

5.44% – 10.14% |

3.72% – 9.99% |

|

Bonus Supply |

None |

As much as $1,000 (by way of Credible) |

None |

|

Cell

|

Who Qualifies To Apply?

Faculty Ave affords prompt pre-qualification standing and rate of interest ranges. When you resolve to maneuver ahead with a full mortgage utility, the method can be streamlined and easy.

Earlier than making use of, think about the everyday eligibility necessities it’s essential to meet to qualify for a mortgage. For in-school scholar loans, you will have to be at the very least 18 years outdated, a US citizen or everlasting resident and attending an accredited faculty. Any college students, no matter enrollment standing, can apply for loans. However you will have to be enrolled at the very least half-time to qualify for in-school deferment.

For refinancing, Faculty Ave does have a commencement requirement. Nonetheless, it is extra versatile than different lenders in that it would not require a bachelor’s diploma. This might make it an incredible choice for debtors who stopped their training after incomes their affiliate diploma.

Are There Any Charges?

As a low-fee supplier, you will not have to fret about origination charges, origination charges, or prepayment penalties with Faculty Ave. If a fee is greater than 15 days late, nevertheless, a late charge of 5% or $25 (whichever is much less) will probably be assessed.

Contact

In contrast to many lenders, Faculty Ave truly self-services its loans. So if in case you have any questions on your payments or funds, you’ll be able to merely attain out to its buyer help workforce.

To speak with somebody over the telephone, name 844-803-0736 from 8 AM to PM (ET), Monday – Friday. Faculty Ave additionally affords dwell chat, SMS help at 855-910-0510, and e mail help at servicing@collegeave.com.

Is It Secure And Safe?

Faculty makes use of Safe Socket Layer (SSL) know-how to safe its web site and the data that it collects. It additionally offers prospects a number of choices to manage the usage of their private knowledge. You may request disclosure of your knowledge here and deletion of your knowledge here. To make a “Do Not Promote My Information,” fill out this form.

Why Ought to You Belief Us

I’m America’s Pupil Mortgage Debt Knowledgeable&commerce; and have been actively writing about and overlaying scholar loans since 2009. Myself and the workforce right here at The Faculty Investor have been actively monitoring student loan providers since 2015 and have reviewed, examined, and adopted virtually each supplier and lender within the area.

Moreover, our compliance workforce evaluations the charges and phrases on these itemizing each weekday to make sure they’re correct. That means you could be certain you are an correct and up-to-date charge if you’re comparability purchasing.

Who Is This For And Is It Price It?

Faculty Ave scholar mortgage affords some in-school merchandise and a viable refinancing choice. The corporate is a strong lender to who only recently began providing each fastened charge and variable charge scholar loans.

Be sure to compare them using Credible to different lenders earlier than making a call. Remember, Faculty Investor readers stand up to a $1,000 bonus once they refinance with Credible. Check it out here.

Be sure to take a look at our Student Loan Refinancing Tool to compare all of the different student loan lenders.

Frequent Questions

Let’s reply some frequent questions on Faculty Ave.

Is Faculty Ave scholar loans legit?

Sure, Faculty Ave is an actual lender that has been offering personal scholar loans and scholar mortgage refinancing since 2015. It affords among the most versatile reimbursement phrases available on the market and it says that 99% of its debtors are making on-time funds.

Is Faculty Ave a federal scholar mortgage?

No, Faculty Ave solely affords personal scholar loans, which implies they are not eligible for any of the federal income-driven reimbursement plans or forgiveness applications.

Does Faculty Ave have an effect on your credit score rating?

Checking your pre-qualified rate of interest with Faculty Ave will not have an effect in your credit score rating. Nonetheless, when you resolve to maneuver ahead with a full mortgage utility and onerous credit score inquiry, your credit score rating will probably be affected.

Do it’s a must to be a graduate to refinance with Faculty Ave?

Sure, you will have to have an affiliate’s diploma or greater to qualify for Faculty Ave scholar mortgage refinancing.

Are you able to repay a Faculty Ave mortgage early?

Sure, you’ll be able to repay your mortgage at any time and Faculty Ave by no means prices prepayment penalties.

Options

|

Min Mortgage Quantity |

|

|

Max Mortgage Quantity |

|

|

Pre-Certified Charges (Tender Credit score Examine) |

Sure |

|

Autopay Low cost |

0.25% |

|

Mortgage Phrases |

|

|

Origination Charges |

None |

|

Prepayment Penalty |

No |

|

In-College Funds |

|

|

Late Fee Payment |

5% of the quantity due or $5 (whichever is much less) |

|

Cosigners Allowed |

Sure |

|

Cosigner Launch |

Sure, however can solely be requested after half of the scheduled reimbursement interval has elapsed. |

|

Grace Interval |

Sure, 6 to 9 months |

|

Eligible Faculties |

Title-IV accredited colleges |

|

Enrollment Standing (For Pupil Loans) |

Full-time, half-time, or beneath half-time *Enrollment standing of at the very least half-time required to qualify for in-school deferment |

|

Commencement Requirement (For Refinancing) |

Sure, affiliate’s diploma or greater |

|

Buyer Service Cellphone Quantity |

844-803-0736 |

|

Buyer Service Hours |

Monday – Friday, 8 AM to PM (ET) |

|

Mortgage Servicer |

Faculty Ave |

|

Deal with For Sending Funds |

Faculty Ave Pupil Loans |

|

Promotions |

None |

The submit College Ave Student Loans Review: Pros, Cons, & Alternatives appeared first on The College Investor.