- E-file.com – Is It Free?

- What’s New In 2026?

- Does E-file.com Make Tax Submitting Simple In 2026?

- E-file.com Notable Options

- e-file.com Notable Drawbacks

- Free Tier Requires Paying For State Submitting

- No Part Summaries

- Complicated “Wizards”

- Tech Assist Requires Cost

- E-file.com Plans And Pricing

- How Does E-file.com Evaluate?

- Is It Protected And Safe?

- How Do I Contact The E-file.com Assist Crew?

- Why Ought to You Belief Us?

- Who Is This For And Is It Price It?

- E-file.com FAQs

E-file.com is a tax submitting software program program that gives intuitive steering and a clutter-free interface designed to assist customers file their taxes shortly. Nevertheless, it isn’t simple to report your investment-related exercise. Whereas they provide free, restricted federal submitting, E-file.com is overpriced at each degree, notably in comparison with higher-quality free choices and extra sturdy paid options.

For these causes, we suggest avoiding E-file.com in 2026. If you happen to’re contemplating utilizing E-file.com to file your 2025 revenue taxes (filed in 2026), learn the next evaluate first. Or, take a look at how they evaluate to different main on-line tax prep corporations right here: Best Tax Software 2026.

E-file.com – Is It Free?

E-File.com gives a restrictive free federal submitting choice, however all customers should pay for state submitting. The “Free” choice solely consists of W-2 revenue and the Rebate Restoration Credit score. If you happen to reside in a state that doesn’t require a tax return and have very simple taxes, you’ll be able to file at no cost. However that’s very uncommon.

All different credit and deductions (together with the Child Tax Credit and HSA contributions) require you to improve to a paid product. As a result of an awesome majority of individuals received’t qualify at no cost submitting with E-file.com, it is best to think about it as a paid product.

What’s New In 2026?

Be aware: E-file.com made updates for The One Massive Lovely Invoice Act and different tax legislation adjustments.

E-file.com has made the required updates to deal with the brand new limits for tax credit and deductions for the 2025 tax 12 months (submitting in 2026). In any other case, it is principally unchanged from prior years. Because of IRS changes, anticipate new normal deduction limits, brackets, and different adjustments all through your tax return.

The navigation menus and type types have improved over time, making E-file.com an easy-to-navigate tax app. Customers with easy tax returns will doubtless have the ability to file their taxes shortly, although buyers and others with extra advanced wants should cope with tedious knowledge entry.

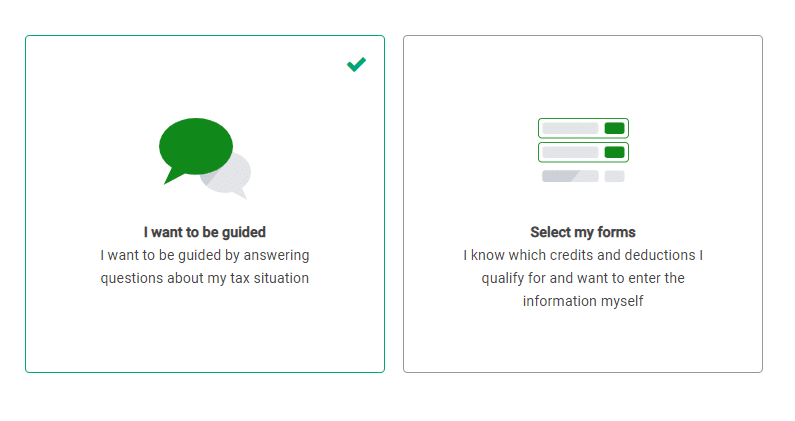

Select between questions and menu choice

Does E-file.com Make Tax Submitting Simple In 2026?

Warning: Funding outcomes have to be manually entered, a monotonous and error-prone course of

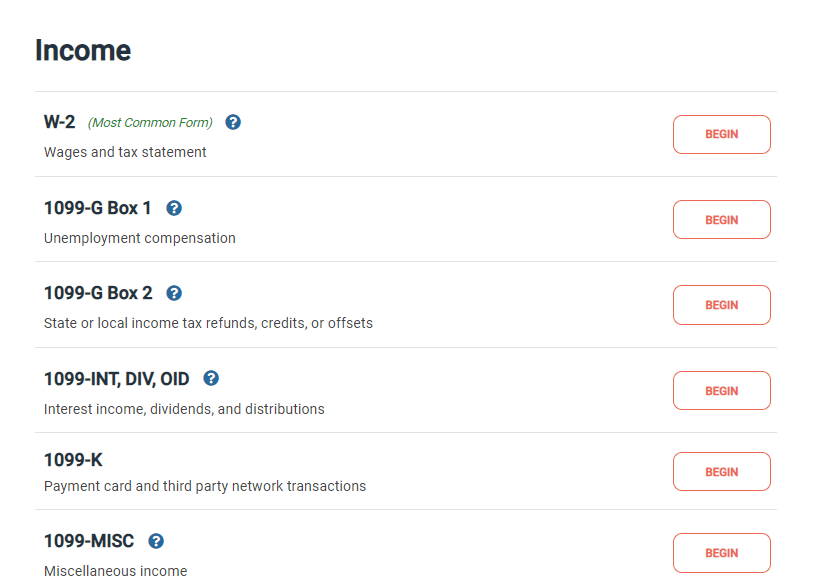

E-file.com gives a wonderful consumer expertise for filers with easy tax returns. Claiming deductions and credit is comparatively easy. Many customers can shortly discover related sections and enter info. The clutter-free screens make submitting intuitive.

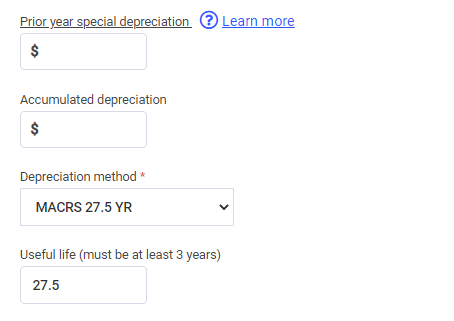

Nevertheless, filers with investments or self-employment revenue are prone to discover that e-file.com is much less user-friendly. Our workforce of testers questioned whether or not they have been coming into info within the right bins. The depreciation “wizards” for actual property and enterprise have been fairly complicated since they by no means confirmed the quantity of depreciation claimed.

Inventory or crypto merchants would even be required to manually enter their trades through long-form screens quite than importing spreadsheets or importing 1099 kinds.

Instance of surprising complexity- Accrued Depreciation is one thing that needs to be calculated.

E-file.com Notable Options

These are among the options that set e-file.com aside from mid-priced options.

Guided And Self-Guided Navigation Choices

Customers can select guided or self-guided navigation on E-file.com. Filers who really feel comfy in a single part (say Earnings) can go for self-guided navigation in that part. Then they’ll resume a guided choice (together with questions and solutions) for the deductions or credit sections.

Helps Multi-State Submitting

Filers who earned revenue in a number of states can file in a number of states. E-file.com expenses customers on a per-state foundation, so this isn’t a very nice deal.

e-file.com Notable Drawbacks

E-file.com’s notable drawbacks make it lower than the best product for many filers. These are some drawbacks potential customers ought to perceive.

Free Tier Requires Paying For State Submitting

E-file.com’s free tier is extremely restrictive. Filers with kids, investments, HSA contributions, unemployment revenue, student loan interest deductions, and some other main tax conditions should improve. However even worse, the Free tier isn’t truly free in apply. Filers should pay $32.99 to file their state return.

No Part Summaries

Many tax packages present part summaries to assist filers see their numbers. These assist filers work out whether or not they could have missed a supply of revenue or an necessary deduction. E-file.com doesn’t have these summaries, making submitting tougher, particularly for filers with investments.

Complicated “Wizards”

E-file.com has a couple of calculators it calls “wizards”. These wizards, which can be utilized to calculate depletion, mileage deductions, or depreciation, have been pretty complicated. They didn’t clarify the place a filer may discover sure info, and some contained unclear tax jargon.

Tech Assist Requires Cost

Customers who need tech assist should improve to E-file.com’s Deluxe tier. That is tech assist solely and doesn’t embody assist submitting taxes.

E-file.com Plans And Pricing

E-file.com pushes a shocking variety of individuals to the “Premium” plan. The Free version is very restrictive, as was beforehand mentioned.

The Deluxe tier solely helps W-2 revenue, unemployment income, and some deductions (together with mortgage curiosity). It additionally helps the Little one Tax Credit score however is proscribed to households with revenue under $100,000. Filers with increased revenue, different sources of revenue, or different deductions or credit to assert should improve to premium.

As of this writing, coupon code FED15OFF will get you 15% off the federal submitting value on the Deluxe and Premium Plus plans.

|

Free Version |

Deluxe |

Premium |

|

|---|---|---|---|

|

Greatest For: |

W-2 Earnings, No dependents, revenue lower than $100,000 |

Kids (no dependent care credit), unemployment revenue, revenue lower than $100,000 |

Everybody else (HSA, enterprise revenue, all different deductions, and many others.) |

|

Federal Price: |

$0 |

$29.99 |

$49.99 |

|

State Price: |

$32.99 per state |

$32.99 per state |

$32.99 per state |

|

Complete: |

$32.99 |

$62.98 |

$82.98 |

How Does E-file.com Evaluate?

E-file.com has mid-market pricing, so we’ve in contrast it to low-cost opponents. Cash App Taxes gives one of the best total consumer expertise, however customers could favor FreeTaxUSA as a result of it helps multi-state submitting. We do not anticipate filers ever discovering a specific purpose to make use of E-file.com over one among these inexpensive options.

|

Header

|

|

|

|

|---|---|---|---|

|

Ranking |

|||

|

Stimulus Credit score |

Free |

Free |

Free |

|

Unemployment Earnings (1099-G) |

Deluxe |

Free |

Free |

|

Scholar Mortgage Curiosity |

Premium |

Free |

Free |

|

Import Final 12 months’s Taxes |

Solely from E-file.com |

Free |

Free |

|

Snap a Pic of W2 |

Not out there |

Not out there |

Not out there |

|

A number of States |

$32.99 per state |

$15.99 per state |

Not supported |

|

A number of W2s |

Free |

Free |

Free |

|

Earned Earnings Tax Credit score |

Free |

Free |

Free |

|

Little one Tax Credit score |

Deluxe |

Free |

Free |

|

Dependent Care Deductions |

Premium |

Free |

Free |

|

HSAs |

Premium |

Free |

Free |

|

Retirement Contributions |

Premium |

Free |

Free |

|

Retirement Earnings (SS, Pension, and many others.) |

Premium |

Free |

Free |

|

Curiosity Earnings |

Premium |

Free |

Free |

|

Itemize |

Premium |

Free |

Free |

|

Dividend Earnings |

Premium |

Free |

Free |

|

Capital Beneficial properties |

Premium |

Free |

Free |

|

Rental Earnings |

Premium |

Free |

Free |

|

Self-Employment Earnings |

Premium |

Free |

Free |

|

Small Enterprise Proprietor (Over $5k in Bills) |

Premium |

Free |

Free |

|

Audit Assist |

Premium |

Deluxe ($7.99) |

Free |

|

Assist From Tax Professionals |

Not Accessible |

Professional Assist ($44.99) |

Not Accessible |

|

First Tier Pricing |

Free Version $0 Fed & |

Free Version $0 Fed & |

$0 Fed & $0 State |

|

Second Tier Pricing |

Deluxe $29.99 Fed & |

Deluxe $7.99 Fed & |

N/A |

|

Third Tier Pricing |

Premium $49.99 Fed & |

Professional Assist $44.99 Fed & |

N/A |

|

Cell

|

Is It Protected And Safe?

E-file.com makes use of knowledge encryption and multi-factor authentication to guard consumer info. This ensures that the positioning meets the IRS requirements.E-file.com has by no means reported any main knowledge breaches, so it appears doubtless that the corporate maintains excessive knowledge safety requirements. Nevertheless, no firm can assure 100% knowledge safety. Customers ought to rigorously consider any tax software program supplier earlier than deciding to make use of it.

How Do I Contact The E-file.com Assist Crew?

That is an space the place E-file.com falls quick. As talked about beforehand, except you improve to a minimum of the “Deluxe” version, you will not even get entry to primary telephone and on-line assist. No matter your plan, you will not have the choice to succeed in out to tax execs for recommendation.

Regardless of the shortage of assist, most clients on Trustpilot report constructive experiences, and the corporate maintains an A+ ranking with the Better Business Bureau (BBB). That is doubtless as a result of e-file.com attracts filers who’re comfy dealing with their tax returns on their very own. However in case you’re in search of some hand-holding alongside the way in which, e-file.com will not be the right tax software for you.

Why Ought to You Belief Us?

The School Investor workforce spent years reviewing the top tax filing options, and we have now private expertise with a lot of the tax software program instruments. I personally have been the lead tax software program reviewer since 2022, and have in contrast a lot of the main corporations on {the marketplace}.

Our editor-in-chief, Robert Farrington, has been testing tax software program instruments since 2011 and has tried nearly each tax submitting product. If you happen to favor watching over studying, our workforce created evaluations and video walk-throughs of the major tax preparation companies on our YouTube channel.

We’re tax DIYers and desire a whole lot, identical to you. We work laborious to supply knowledgeable and trustworthy opinions on each product we check.

How Was This Product Examined?

In our authentic checks, we used e-File.com to finish a real-life tax return that included W-2 revenue, self-employment revenue, rental property revenue, and funding revenue. We tried to enter all the information and use each out there characteristic. We then in contrast the consequence to all the opposite merchandise we have examined, in addition to a tax return ready by a tax skilled.

This 12 months, we went again via and re-checked all of the options we initially examined, in addition to any new options. We additionally validated the pricing choices.

Who Is This For And Is It Price It?

Whereas E-file.com has a good consumer interface, the product solely works effectively for filers with comparatively easy returns. These with easy returns can discover lower-cost options that work equally effectively.

However if in case you have a considerably advanced return, you will most likely need to go for a extra sturdy various. For 2026, we suggest that almost all filers skip e-file.com. As an alternative, select the best tax software for your situation.

E-file.com FAQs

Listed here are the solutions to a couple of the commonest questions that filers ask about E-file.com:

Can E-file.com assist me file my crypto investments?

E-file.com helps crypto trades, nevertheless it requires filling out an in depth type for every commerce all year long. Most merchants received’t need to spend the time wanted to do that. This 12 months, a greater various is TurboTax Premier.

Can E-file.com assist me with state submitting in a number of states?

Sure, E-file.com helps multi-state submitting. Customers should pay $32.99 per state.

Does E-file.com provide refund advance loans?

No, E-file.com doesn’t provide refund advance loans in 2026.

The submit E-file.com Review 2026 appeared first on The College Investor.