- Earnest Scholar Mortgage Refinancing

- Earnest Non-public Scholar Loans

- What Borrower Protections Are Obtainable?

- Who Qualifies To Apply?

- Are There Any Charges?

- Earnest Scholar Mortgage Supervisor

- Enchantment Letter Generator

- Sensible Planner

- Contact

- Is It Secure And Safe?

- Why Ought to You Belief Us

- Who Is Earnest For And Is It Price It?

- Options

Earnest is a scholar mortgage lender that provides each scholar mortgage refinancing and personal scholar loans.

Certified debtors is not going to solely discover low rates of interest at Earnest, they’ll discover a custom-made scholar mortgage product. Earnest is main the non-public scholar mortgage market in innovation.

That is additionally why Earnest earned itself a spot on our annual record of the Best Places To Refinance Your Student Loans.

Right here’s what you could find out about refinancing scholar loans with Earnest. See how Earnest compares to other top lenders here!

|

Earnest Scholar Loans Particulars |

|

|---|---|

|

Product Identify |

Earnest Scholar Mortgage Refinancing |

|

Min Mortgage Quantity |

$5,000 |

|

Max Mortgage Quantity |

$550,000 |

|

Variable APR |

5.88% – 9.99% (Consists of 0.25% Auto Pay Low cost) |

|

Fastened APR |

3.72% – 9.99% (Consists of 0.25% Auto Pay Low cost) |

|

Mortgage Phrases |

5 to twenty years* |

|

Promotions |

None |

Earnest Scholar Mortgage Refinancing

By far, one of many coolest options that Earnest presents debtors is its “precision pricing” choice. Principally this implies that you would be able to choose your month-to-month cost, and Earnest will give you a time period between 5 and 20 years that permits you to hit your actual month-to-month cost (and repay your mortgage as quickly as attainable).

In whole, Earnest is ready to provide as much as 180 attainable compensation phrases. This precision pricing mannequin means you can find yourself with a 7.5 yr mortgage time period. That is one thing you will not seemingly see at different lenders.

Charges and Phrases

Earnest refinances loans starting from $5,000 to $550,000. Charges on these loans are very aggressive. It presents loans with the next charges:

- Variable Charge: 5.88% – 9.99% APR (Consists of 0.25% Auto Pay Low cost)

- Fastened Charge: 3.72% – 9.99% APR (Consists of 0.25% Auto Pay Low cost)

Earnest does permit cosigners on refinance loans. Debtors want a minimal credit score rating of 665.

Additionally, Earnest can also be one of many few lenders that does permit folks with incomplete bachelor’s or affiliate levels to refinance with them.

Charges are correct as of January 02, 2026. Our compliance crew checks these charges day by day to make sure that you are seeing essentially the most up-to-date data.

How Does Earnest Refinancing Evaluate?

Earnest is constantly on the prime of the pack relating to student loan refinancing. They’ve nice charges and phrases.

Try this fast comparability:

|

Header

|

|

|

|

|---|---|---|---|

|

Score |

|||

|

Variable APR |

5.88% – 9.99% |

4.74% – 10.24% |

4.74% – 8.24% |

|

Fastened APR |

3.72% – 9.99% |

4.24% – 10.24% |

4.88% – 8.44% |

|

Bonus Provide |

None |

As much as $500 |

As much as $1,100 |

|

Cell

|

Earnest Non-public Scholar Loans

Earnest can also be providing undergraduate and graduate non-public scholar loans. They’ve extremely aggressive charges and phrases for his or her undergraduate loans, in addition to versatile compensation plans.

Among the finest options of their non-public scholar loans is that they provide a 9-month grace interval after you graduate earlier than you must begin making funds. The nine-month grace interval will not be out there for debtors who select our Principal and Curiosity Reimbursement plan whereas at school. However nonetheless, that is one of many longest that we have seen.

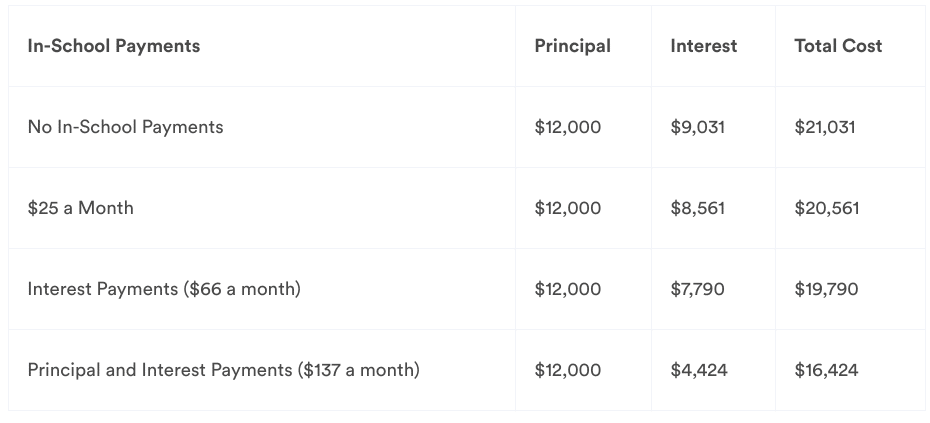

Additionally they present 4 totally different in-school repaymenskipt choices: full funds, mounted funds ($25/month), interest-only funds, or deferred funds, whilst you’re at school and for the primary 9 months after commencement.

Charges And Phrases

It is necessary to notice that Earnest’s Precision Pricing choice does not apply to its non-public scholar loans. In case you apply with a cosigner, Earnest will give you phrases of 5, 7, 10, 12, and 15 years. In the meantime, if you happen to apply alone, your solely choices might be 10, 12, or 15 yr compensation phrases.

At the moment, they provide the next charges:

Fastened Charges:

2.79% – 16.49% (contains 0.25% autopay low cost)

Sadly, Earnest doesn’t settle for cosigner launch requests on its cosigned non-public scholar loans. Nonetheless, you could possibly take away a cosigner by refinancing your scholar loans.

See how Earnest compares on our list of the best private student loans.

Charges are correct as of January 02, 2026. Our compliance crew checks these charges day by day to make sure that you are seeing essentially the most up-to-date data.

How Does Earnest Non-public Scholar Loans Evaluate?

Earnest is constantly a prime lender on our list of the best private student loans. They usually have among the lowest charges on non-public loans for extremely certified debtors.

Nonetheless, to get one of the best fee you may seemingly want a cosigner.

Try this fast comparability:

|

Header

|

|

|

|

|---|---|---|---|

|

Score |

|||

|

Minimal Mortgage |

$1,000 |

$1,000 |

$3,000 |

|

APR Sort |

Fastened |

Variable and Fastened |

Variable and Fastened |

|

Cosigner? |

Not Required |

Not Required |

Not Required |

|

Cell

|

What Borrower Protections Are Obtainable?

Earnest presents higher protections than most non-public scholar mortgage lenders. For instance, debtors can defer loans throughout graduate faculty, Peace Corps, or energetic army service. Student loan deferment means that you’re not required to make funds, however curiosity continues to accrue.

In case you’re going through financial hardship, Earnest could assist you to put loans into forbearance. Throughout forbearance curiosity continues to accrue in your mortgage, however you don’t should make funds. Earnest particularly permits debtors to take forbearance throughout an unpaid parental go away. The one main loss for Earnest’s debtors is that they won’t qualify for earnings primarily based compensation packages.

The final safety that Earnest presents is a considerably doubtful one. Debtors can skip one cost each 12 months with the additional cost being unfold throughout the remaining funds**. In case you’re going through an sudden automobile restore or hospital invoice, skipping a cost appears like a terrific profit. Sadly, this raises your month-to-month minimal cost, and the quantity of curiosity you’ll pay, so it’s robust to rely it as an apparent win.

Who Qualifies To Apply?

Earnest has stringent underwriting standards, however the standards are fairly totally different than most lenders. In case you’re a current grad who manages cash effectively, you’re prone to qualify for a mortgage refinance with Earnest even if you happen to don’t have a terrific credit score rating but.

Earnest solely requires a 650 credit score, however its monetary underwriting doesn’t cease with credit score scores. Debtors should have a secure supply of earnings, two months of financial savings of their bank account, and be present on hire, mortgage and scholar loans. Carrying an excessive amount of bank card debt may disqualify you from the mortgage.

Earnest can also be one of many few lenders we all know of that permits you to refinance with incomplete bachelor’s or affiliate’s levels. Which means if you happen to did not end faculty, you’ll be able to nonetheless doubtlessly qualify.

Earnest is without doubt one of the few lenders that additionally seems to be into your private funds. To qualify to refinance with Earnest, you must spend lower than you’re incomes. (In fact, this makes a ton of sense, nevertheless it’s notable that Earnest really seems to be into it).

In case you’re a guardian trying to refinance Parent PLUS loans, Earnest has a refinancing choice for you. The qualifying standards are the identical as for the scholar refinancing choice.

Are There Any Charges?

Like most non-public lenders, Earnest does not cost charges for refinancing or taking out a personal scholar mortgage. This implies you will not have to fret about utility and origination charges or prepayment penalties. Notably, Earnest additionally does not cost a charge for late funds.

Earnest Scholar Mortgage Supervisor

Earnest just lately partnered with debt compensation firm, Payitoff, to launch a free instrument, referred to as Scholar Mortgage Supervisor. This system is designed to assist federal scholar mortgage debtors with the next:

- Discover a borrower’s mortgage servicer

- Enroll eligible borrower’s in federal compensation help packages

- Ship automated steerage on federal help program eligibility

- Share individualized compensation plan suggestions

In case you want help getting on observe along with your scholar loans, Scholar Mortgage Supervisor could possibly assist.

Enchantment Letter Generator

In case you’re a scholar who has submitted a FAFSA, however your monetary assist letter doesn’t mirror your present scenario, you would possibly want an aid appeal. Earnest has created a free instrument, referred to as The Enchantment Letter Generator, which supplies college students with customized suggestions and deadline reminders. Utilizing this instrument might help you’re feeling ready earlier than Nationwide Resolution Day arrives on Could 1st.

Sensible Planner

Highschool college students who plan to go to school have so much to consider earlier than they get there. Earnest’s Sensible Planner is one more free instrument designed to assist highschool college students navigate the assorted steps they might want to take, resembling FAFSA, college application dates, and scholarship search deadlines.

Contact

Its customer support hours are Monday – Friday, 8 AM – 5 PM (PST). You will get in contact with them over the telephone at 1-888-601-2801, through dwell chat, or by electronic mail at howdy@meetearnest.com.

Along with common buyer assist, Earnest now presents Over The Cellphone submissions for scholar mortgage functions. To initiation a phone utility, contact Earnest at (866)-492-1222, Monday by Friday, 5 AM to five PM PST.

Bear in mind to say The School Investor whenever you name so as to begin the applying.

Is It Secure And Safe?

Earnest is not going to solely require your private data in the course of the utility course of, however it should additionally ask you to hyperlink your financial institution and funding accounts. You may even be requested to supply your LinkedIn credentials and to add a authorities ID.

How does Earnest shield all this knowledge? First, all the data you enter is encrypted with bank-grade SSL expertise earlier than its despatched to Earnest’s off-site servers. The lender additionally pledges to by no means promote its borrower knowledge to 3rd events.

Earnest additionally has a 4.6 our of 5 star overview on Trustpilot, primarily based on over 7,400 critiques.

Why Ought to You Belief Us

I’m America’s Scholar Mortgage Debt Skilled&commerce; and have been actively writing about and overlaying scholar loans since 2009. Myself and the crew right here at The School Investor have been actively monitoring student loan providers since 2015 and have reviewed, examined, and adopted nearly each supplier and lender within the house.

Moreover, our compliance crew critiques the charges and phrases on these itemizing each weekday to make sure they’re correct. That means you might be positive you are taking a look at an correct and up-to-date fee whenever you’re comparability buying.

Who Is Earnest For And Is It Price It?

Earnest doesn’t provide the bottom rates of interest available on the market. Nevertheless it’s the one lender that provides low charges to folks with mediocre credit score scores.

If it can save you cash by refinancing with Earnest, it may very well be a terrific transfer for you. Alternatively, if you happen to’ve obtained a credit score rating above 700, you might discover higher charges. Think about evaluating charges with different non-public lenders earlier than selecting Earnest.

We suggest evaluating Earnest with different lenders on the Credible Marketplace. Earnest is not listed however most different lenders are. You’ll be able to rise up to a $1,000 reward card bonus regardless of which lender you go together with on Credible – so examine Earnest and see if they’re one of the best for you. All bonus funds are by e-gift card. See terms. Check it out here!

Options

|

Min Mortgage Quantity |

|

|

Max Mortgage Quantity |

|

|

APR |

|

|

Auto-Pay Low cost |

0.25% |

|

Charge Sort |

Fastened or variable |

|

Mortgage Phrases |

5 to twenty years |

|

Origination Charges |

None |

|

Prepayment Penalty |

None |

|

Reimbursement Choices For In-Faculty Loans |

|

|

Forbearance Interval |

As much as 12 months (issued in 3-month increments) |

|

Cosigners Allowed |

|

|

Cosigner Launch |

No |

|

Grace Interval |

9 Months |

|

Eligible Faculties |

Title IV-accredited faculties |

|

Buyer Service Cellphone Quantity |

1-888-601-2801 |

|

Buyer Service Hours |

Mon-Fri, 8 AM – 5 PM (PST) |

|

Buyer Service E mail |

howdy@meetearnest.com |

|

Handle For Sending Funds |

PO Field 9202 Wilkes Barre, PA 18773-9202 |

|

Promotions |

None |

Earnest Non-public Scholar Loans are made by One American Financial institution, Member FDIC, or FinWise Financial institution, Member FDIC. One American Financial institution, 515 S. Minnesota Ave, Sioux Falls, SD 57104. Finwise Financial institution, 756 East Winchester, Suite 100, Murray, UT 84107.

Earnest loans are serviced by Earnest Operations LLC, 300 Frank H. Ogawa Plaza, Suite 340, Oakland 94612. NMLS #1204917, with assist from Greater Training Mortgage Authority of the State of Missouri (MOHELA) (NMLS# 1442770) One American Financial institution, FinWise Financial institution, and Earnest LLC and its subsidiaries, together with Earnest Operations LLC, should not sponsored by companies of america of America.

Earnest loans are serviced by Earnest Operations LLC with assist from Greater Training Mortgage Authority of the State of Missouri (MOHELA) (NMLS# 1442770). Earnest LLC and its subsidiaries, together with Earnest Operations LLC, should not sponsored by companies of america of America.

Scholar Mortgage Origination

Precise fee will differ primarily based in your monetary profile. Fastened annual proportion charges (APR) vary from 4.74% to 10.24% (4.49% – 9.99% with .25% auto pay low cost). Variable annual proportion charges (APR) vary from 6.13% to 10.24% (5.88% – 9.99% with .25% auto pay low cost). Earnest variable rate of interest scholar mortgage refinance loans are primarily based on a publicly out there index, the 30-day Common Secured In a single day Financing Charge (SOFR) revealed by the Federal Reserve Financial institution of New York. The variable fee is predicated on the speed revealed on the twenty fifth day, or the subsequent enterprise day, of the previous calendar month, rounded to the closest hundredth of a p.c. The speed is not going to enhance greater than as soon as a month, however there isn’t any restrict on the quantity that the speed may enhance at one time. Please observe, we’re not capable of provide variable fee loans in AK, IL, MN, MS, NH, OH, TN, and TX. Our lowest charges are solely out there for our most credit score certified debtors and requires number of our shortest time period provided and enrollment in our .25% auto pay low cost from a checking or financial savings account. Enrolling in autopay will not be required as a situation for approval.

Scholar Mortgage Refinancing

*Scholar Mortgage Refinancing: These examples present estimates primarily based on funds starting instantly upon mortgage disbursement. Variable annual proportion fee (“APR”): A $10,000 mortgage with a 20-year time period (240 month-to-month funds of $101.46) and a ten.74% APR would lead to a complete estimated cost quantity of $24,350.40. For a variable mortgage, after your beginning fee is ready, your fee will then differ with the market. Fastened APR: A $10,000 mortgage with a 20-year time period (240 month-to-month funds of $101.46) and a ten.74% APR would lead to a complete estimated cost quantity of $24,350.40. Your precise compensation phrases could differ.

Precise fee will differ primarily based in your monetary profile. Fastened annual proportion charges (APR) vary from 3.97% APR to 10.24% APR (3.72% – 9.99% with .25% auto pay low cost). Variable annual proportion charges (APR) vary from 6.13% APR to 10.24% APR (5.88% – 9.99% with .25% auto pay low cost). Earnest variable rate of interest scholar mortgage refinance loans are primarily based on a publicly out there index, the 30-day Common Secured In a single day Financing Charge (SOFR) revealed by the Federal Reserve Financial institution of New York. The variable fee is predicated on the speed revealed on the twenty fifth day, or the subsequent enterprise day, of the previous calendar month, rounded to the closest hundredth of a p.c. The speed is not going to enhance greater than as soon as a month, however there isn’t any restrict on the quantity that the speed may enhance at one time. Please observe, we’re not capable of provide variable fee loans in AK, IL, MN, MS, NH, OH, TN, and TX. Our lowest charges are solely out there for our most credit score certified debtors and requires number of our shortest time period provided and enrollment in our .25% auto pay low cost from a checking or financial savings account. Enrolling in autopay will not be required as a situation for approval.

** Earnest shoppers could skip a cost by a one, one-month forbearance throughout a 12 month interval. Your first request to skip a pay might be made when you’ve made no less than 6 months of consecutive on-time full principal and curiosity funds, and your mortgage is in good standing. The curiosity accrued in the course of the skipped month will lead to a rise in your remaining minimal cost. The ultimate payoff date in your mortgage might be prolonged by the size of the skipped cost durations. Any unpaid accrued curiosity could capitalize (added to the principal stability) on the finish of the forbearance interval by including unpaid accrued curiosity to the excellent principal as permitted by legislation and the phrases of the mortgage settlement.

nmlsconsumeraccess.org

© 2026 Earnest LLC. All rights reserved.

The submit Earnest Student Loans Review: Pros, Cons, And Alternatives appeared first on The College Investor.