Empower (beforehand often known as Private Capital) has been a number one cash administration device for the previous few years. They provide nice spending and funding monitoring, all at no cost. In addition they just lately launched a web based financial savings account with a compelling yield.

My private love affair with Mint is now over. It is nonetheless an excellent free money management tool, however I’ve at all times had a detrimental view about how Mint dealt with investments and now they shutting down anyway. It simply did not do sufficient for my investments to actually assist me in my private funds. nd since investing is such an enormous a part of my funds, I at all times relied on Quicken as an alternative.

However in my continued quest to maneuver my funds to the cloud and on the lookout for Quicken alternatives, I’ve discovered a free device that basically nails all the pieces Mint does, PLUS investments. It is known as Empower.

See why we like this device in our Empower evaluate. Plus, study their upsells and their new compelling money account as properly. And see how they compare to the other top money and financial tracker apps out there.

|

Empower Particulars |

|

|---|---|

|

Product Title |

Empower |

|

Pricing |

Free To Strive, 0.89% AUM |

|

Platform |

On-line, Cellular App |

|

Money Account Yield |

4.20% APY |

|

Promotions |

None |

What Is Empower?

Empower is each a budgeting app and monetary monitoring device, in addition to an funding supervisor. They’re most well-known for his or her monetary dashboard – the place you’ll be able to observe your spending, finances, monitor your funding portfolio, and extra. The most effective half is that this device is at present free.

They’re additionally knowledgeable funding supervisor, the place you’ll be able to meet with a monetary planner and permit them to handle your portfolio for a charge. They successfully use their free dashboard as a lead generator for his or her funding administration companies.

Empower (which as beforehand often known as Private Capital) was based in 2010, and was acquired by Empower Retirement in July 2020.

In 2023, Private Capital was rebranded as Empower.

Empower was additionally named one of the best budgeting apps of 2025!

What Empower Has

The explanation I cherished Mint for thus lengthy is as a result of it robotically updates and categorizes your transactions for you. You at all times get an up-to-date image of your spending, and you’ll see the place your cash goes.

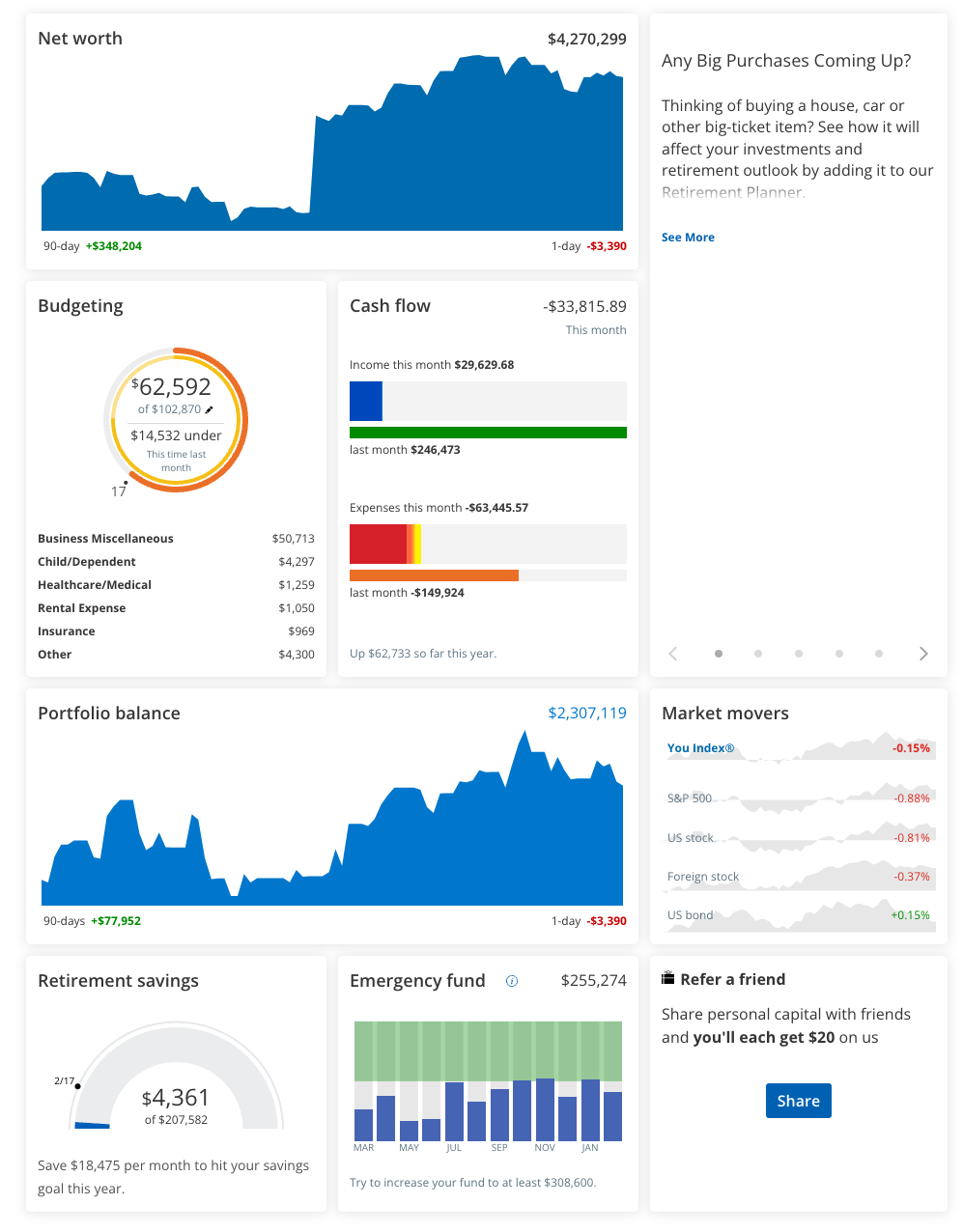

Empower covers all of the bases. Once you log-in, you are greeted with a dashboard that’s similar to Mint. On the left facet, you’ll be able to see all of your accounts listed, in addition to your complete web value on the high. Empower connects with all the identical banks and establishments as Mint, and likewise allows you to add asset accounts, like your own home. Then, you get to see a dashboard that features the next:

A foundation of your spending:

Empower Dashboard [Screenshot by The College Investor]. Supply: Empower

In addition they have an summary of how your portfolio is performing versus the whole market:

Empower Portfolio Monitoring [Screenshot by The College Investor]. Supply: Empower

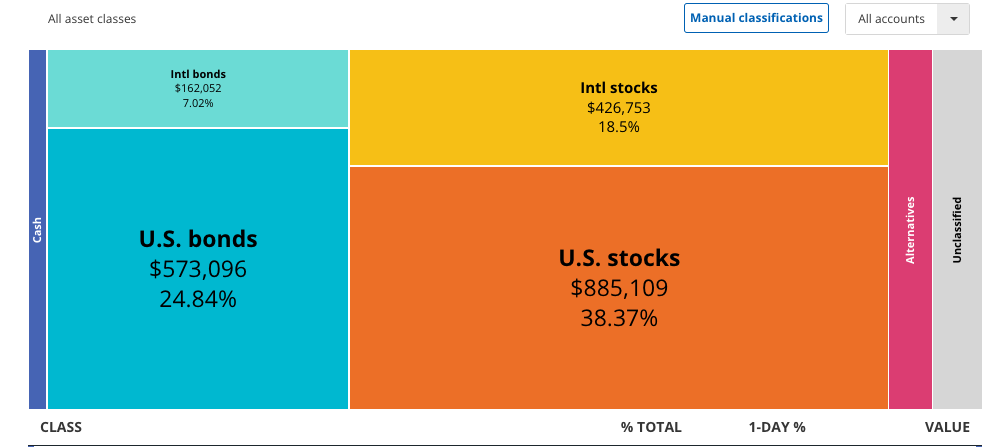

In addition they have a useful asset allocation device:

Empower Asset Allocation [Screenshot by The College Investor]. Supply: Empower

In addition they have useful budgeting and spending instruments. You possibly can see your money stream every month, in addition to a breakdown of your spending classes.

You could find this within the “Budgeting” tab.

Associated: The Best Portfolio Analysis Tools

Investing Instruments

The most effective a part of Empower are the investing instruments, that are easy, but way more highly effective than what Mint was providing. Empower does funding administration proper, however specializing in a number of staple items:

- The Worth of Your Portfolio

- The Efficiency of Your Portfolio (as a complete and of every particular person funding)

- An Overview of Your Holdings

- An Evaluation of Your Allocation

- Good Transaction Administration

What at all times annoyed me about Mint (and typically Quicken) was the transaction administration. To date, I’ve discovered Empower to be glorious at appropriately managing all imported transactions from my brokerages. For one asset, they did not get the image (because of the truth it’s in a switch firm, not a brokerage), however I used to be manually in a position to enter the image.

How Does Empower Examine For Budgeting And Web Value Monitoring?

Empower presents each their free dashboard and web value monitoring, as properly investing recommendation. We’ll cowl the investing recommendation beneath, however since most individuals merely use their free dashboard, we thought we would evaluate simply the dashboard first.

Empower’s dashboard is a good possibility for these trying to observe each spending and investing. Mint was an in depth runner up till it shutdown, in addition to Quicken (nonetheless, Quicken is a paid product). One other runner up is Monarch, which has been growing a number of nice instruments to compete – nevertheless it’s additionally paid. YNAB is one other extremely popular possibility, nevertheless it’s totally different in its strategy. See our full YNAB vs. Empower comparison here.

In the event you’re taking a look at merely web value monitoring, Kubera is a strong possibility.

The difficulty with “free” is that these corporations can not maintain all the prices of operating this sort of software program with connections to the varied platforms. It prices roughly $0.005 per thirty days, per account, for each connection. Contemplating somebody like myself has upwards of 20 connections (banks and brokerages), that is $0.10 per thirty days. Does not sound like a lot, however it will probably add up actually quick!

Therefore, Empower is without doubt one of the final of the free instruments – since you are literally the product. They will attempt to promote you on funding administration (see beneath).

In the event you’re merely trying to evaluate their free dashboard, listed here are among the choices. See the full list of Mint Alternatives here.

|

Header

|

|

|

|

|---|---|---|---|

|

Ranking |

|||

|

Worth |

Free |

$99.99/yr |

$109/yr |

|

Budgeting Options |

Good |

Good |

Sturdy |

|

Funding Monitoring |

Good |

Restricted |

Restricted |

|

Banking? |

|||

|

Cell

|

Investing Recommendation

To me, it’s at all times necessary to know the way an organization providing a free service makes cash. And Empower makes cash by selling their monetary advisers that can assist you together with your portfolio. Their purpose is to finally get you as an asset administration shopper – and when you cross $100,000 in property, you’ll be able to count on their advisors to start calling you and inspiring you to satisfy with them to evaluate your portfolio.

In the event you determine to work with them, they do cost (fairly a bit) to handle your portfolio. Whereas their charges are all inclusive, you’ll be able to count on to begin paying 0.89% AUM (assets-under-management) if in case you have lower than $1,000,000 invested with them.

They really name you totally different ranges based mostly on how a lot you’ve gotten invested:

- $100,000 to $200,000: Funding Companies Shopper

- $200,000 to $999,999: Wealth Administration Shopper

- Over $1,000,000: Non-public Shopper

As you’ve gotten extra funds invested, your AUM goes down. When you hit “Non-public Shopper” standing, you will begin saving just a little in AUM charges. Nonetheless, it’s tiered:

|

Steadiness |

AUM |

|---|---|

|

Beneath $3M |

0.79% |

|

$3M to $5M |

0.69% |

|

$5M to $10M |

0.59% |

|

Over $10M |

0.49% |

How Does Empower Wealth Administration Examine?

Truthfully, Empower’s Wealth Administration companies are dearer than different corporations. Whereas they’ve an excellent free dashboard, they funding companies are costly than different corporations. They are not a robo-advisor, however they’re additionally dearer than different companies who do direct human-assisted investing.

Here is how they evaluate to a few of their principal rivals.

|

Header

|

|

|

|

|---|---|---|---|

|

Ranking |

|||

|

Annual Price |

0.89% |

0.25% |

0.30% |

|

Min Funding |

$100,000 |

$500 |

$50,000 |

|

Recommendation Choices |

Human |

Auto |

Auto and Human |

|

Banking? |

|||

|

Cell

|

Empower Money

Empower just lately introduced Empower Money. This can be a money administration account, and it acts like a high yield savings account.

The Empower Money account yields 3.00 APY – which is a really compelling supply. The account can also be FDIC insured, and since it is a money administration account, there are not any transaction limits on deposits or withdrawals.

In the event you’re a Empower Advisory shopper, you truly can earn a better price (0.10% extra) – 3.10% APY.

Why Ought to You Belief Us?

I’ve deep expertise with utilizing “Private Monetary Managers” or PFMs like Empower. I began utilizing Quicken within the early 2000s to trace my private funds, and since then, I’ve used or examined virtually each budgeting app and funding monitoring app within the market.

I’ve spent over a whole lot of hours utilizing Empower for each testing and monitoring my very own funds – utilizing each the net model and app model on my iPhone.

Mix my private expertise with that of our wonderful staff of editors and testers, and we’ve over 100 years of mixed expertise utilizing, reviewing, and testing budgeting apps and instruments!

Who Is This For And Is It Value It?

Do not simply take my phrase for it – see for your self. Similar to Mint, Empower is free. It solely takes a matter of minutes to enter your financial institution logins and get your information dwell. Empower even advertises it would take simply 29 seconds if in case you have one account so as to add.

In the event you’re not bought on Empower, take a look at these Mint Alternatives which may give you the results you want.

Spend 29 seconds proper now and take a look at Empower, after which go away your ideas beneath! I would love to listen to what you concentrate on this product.

The publish Empower (Personal Capital) Review: Pros And Cons appeared first on The College Investor.