TL;DR

- Iran’s crypto ecosystem reached over $7.78 billion in 2025, having grown at a sooner tempo for a lot of the yr in comparison with the yr prior.

- Iranian cryptocurrency exercise is correlated to political occasions and battle at dwelling and overseas.

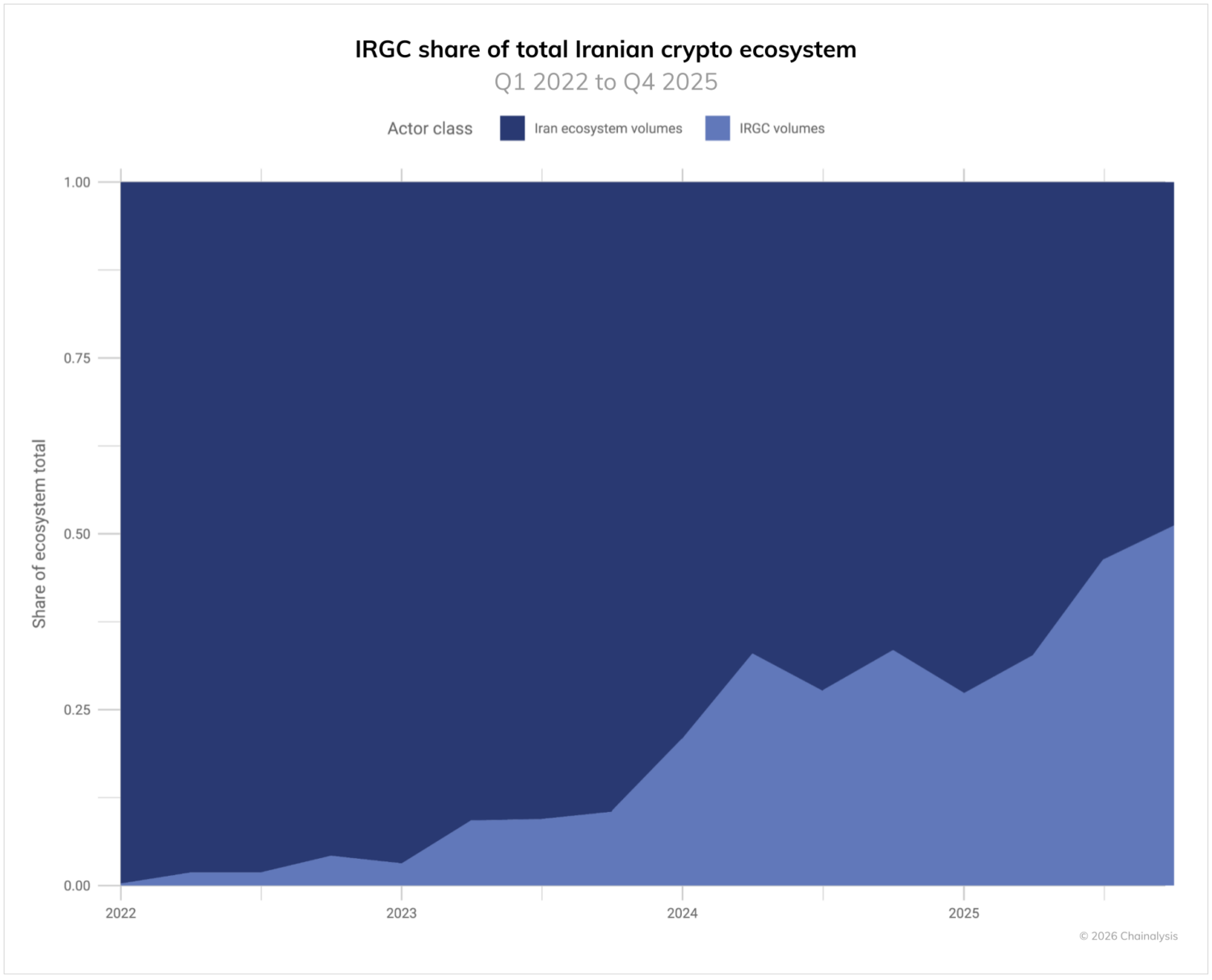

- The IRGC’s on-chain exercise represents roughly 50% of Iran’s whole crypto ecosystem in This fall of 2025 and has steadily elevated its share over time, mirroring its dominance in Iran’s financial system extra broadly.

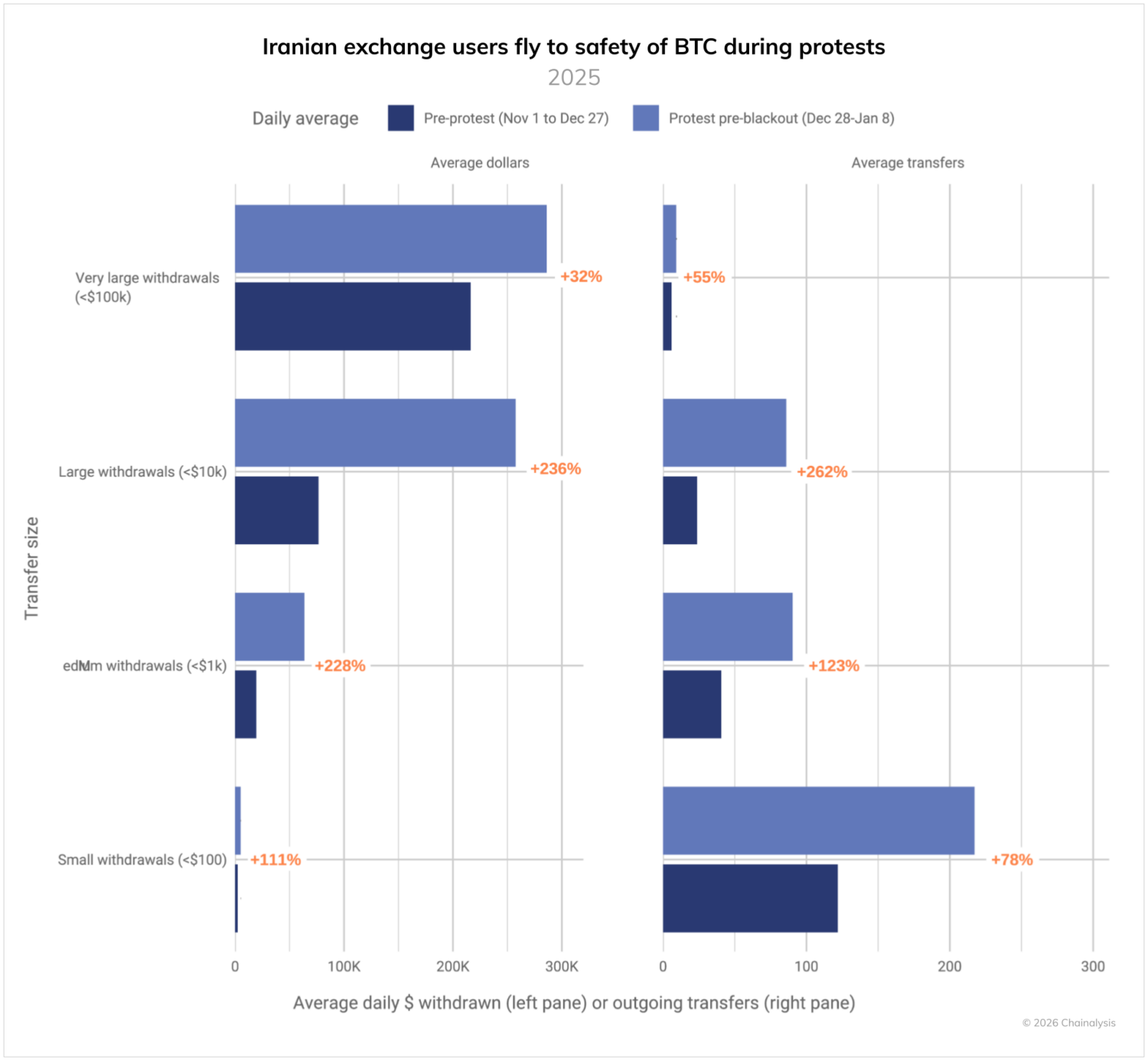

- In the course of the current mass protests, Iranians have considerably elevated withdrawals of Bitcoin to private wallets, probably as a flight to security amid forex collapse and political instability

Towards the backdrop of Iran’s more and more beleaguered regime, going through extraordinary strain each internally and externally, cryptocurrency has emerged as a important monetary various for a lot of Iranians. The ruling institution, battling widespread protest actions domestically and the looming menace of exterior army intervention, has watched the Iranian rial plummet by roughly 90% since 2018, with depreciation accelerating amid escalating regional conflicts. For Iranian residents residing underneath a authorities struggling to keep up financial stability amid inflation charges of 40-50%, cryptocurrency represents not only a sanctions workaround however a solution to decide out of a failing system managed by an more and more determined regime. Notably, it isn’t simply abnormal Iranians who’ve turned to crypto—the Islamic Revolutionary Guard Corps (IRGC) has extensively leveraged digital property to finance its malign actions each domestically and thru its community of proxy networks throughout the Center East. This evaluation examines three key traits: how Iranian crypto exercise correlates with political occasions, the IRGC’s rising dominance in Iran’s cryptoeconomy, and the way Iranians have turned to Bitcoin as a protected haven throughout current protests.

Blockchain as barometer: On-chain habits amid instability

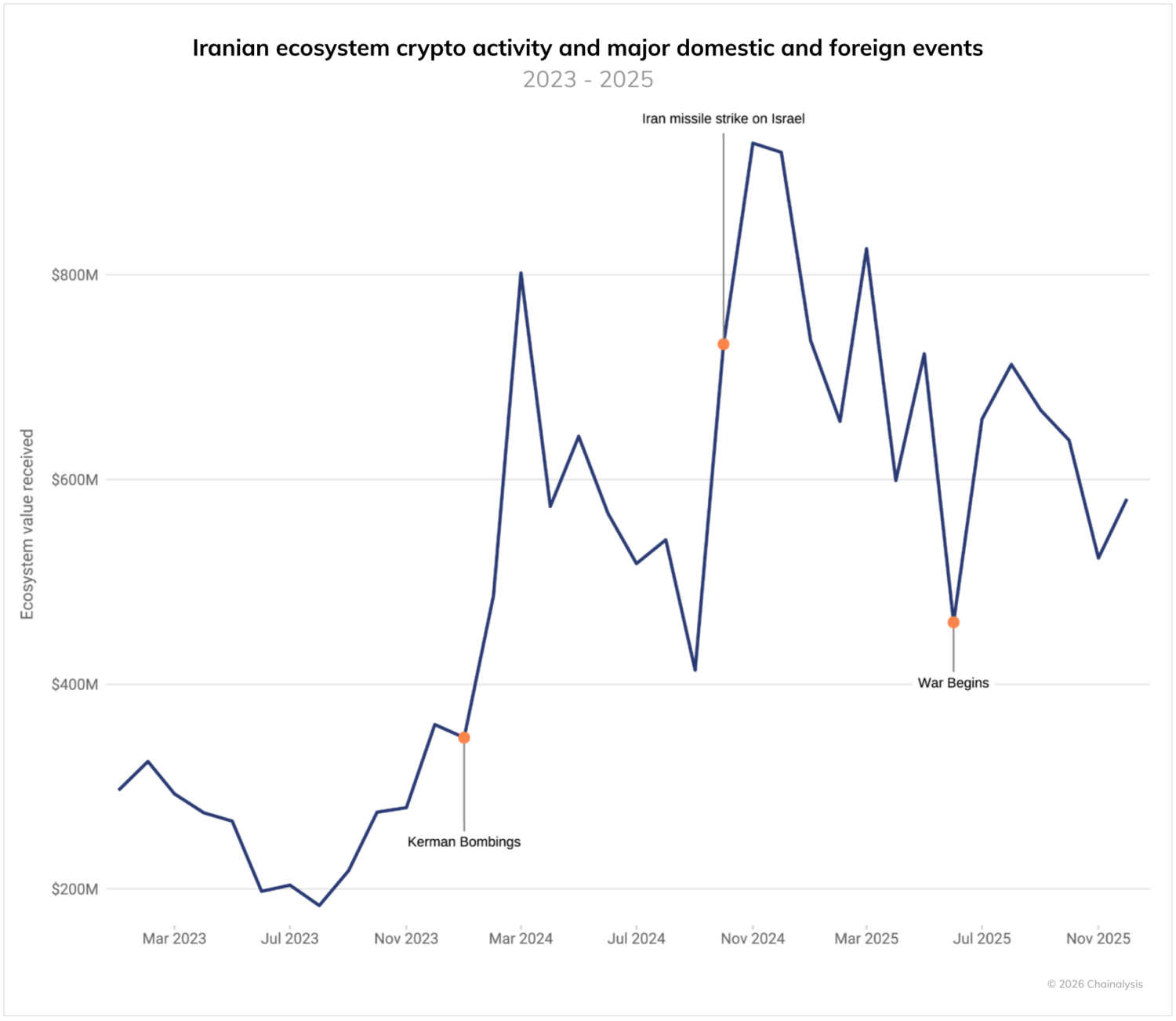

Iran’s crypto ecosystem reached over $7.78 billion in 2025, having grown at a notably sooner tempo in comparison with the yr prior. As proven within the chart under, and following trends from final yr’s Crypto Crime Report, Iran’s crypto exercise reveals important spikes comparable to main home and geopolitical occasions.

These embody the next occasions:

- The Kerman bombings in January 2024, which killed almost 100 individuals at a memorial ceremony for former Islamic Revolutionary Guard Corps-Qods Power (IRGC-QF) Commander Qasem Soleimani

- Iran’s missile strikes towards Israel in October 2024 following the assassinations of Hamas chief Isma’il Haniyeh in Tehran and Hezbollah Secretary Basic Hasan Nasrallah in Beirut.

- A smaller however notable spike occurred throughout the 12-day battle in June 2025, which noticed Iran’s shadow battle with Israel attain a boiling level. Not solely did this battle end in joint U.S.-Israeli strikes towards Iran’s nuclear weapons and ballistic missiles programs, however the battle additionally noticed cyberattacks towards Nobitex, Iran’s largest crypto trade, and Financial institution Sepah, Iran’s oldest financial institution which is used closely by the IRGC. Hackers additionally breached Iranian state TV, airing footage of ladies’s protests and urging Iranians to take to the streets.

The IRGC’s rising crypto footprint

Significantly noteworthy is the IRGC’s rising dominance inside Iran’s cryptocurrency panorama. Addresses related to the IRGC’s sprawling transnational facilitation networks have fluctuated over current years, however as seen under, have risen steadily over time as a share of the general Iranian crypto financial system and accounted for over 50% of whole values obtained in This fall of 2025. This pattern has not occurred in a vacuum, mirroring the IRGC’s expanding control over Iran’s broader financial system and political establishments. In 2024, the quantity of funds obtained by IRGC-associated addresses on-chain reached over $2 billion, spiking to greater than $3 billion in 2025. Importantly, even these extraordinary figures are a lower-bound estimate that features solely a restricted variety of addresses from sanctions designations of IRGC wallets by the U.S. Division of the Treasury’s Workplace of Overseas Belongings Management (OFAC) and Israel’s Nationwide Bureau for Counter Terror Financing (NBCTF). Nonetheless, this doesn’t account for potential shell firms, financiers, or different wallets not but recognized to be IRGC-controlled. We count on this determine will improve as extra IRGC-affiliated wallets are publicly disclosed, and bigger elements of their laundering community is uncovered. These addresses embody not solely IRGC operatives working in Iran, but additionally facilitators in quite a few nations and networks that transfer commodities and illicit oil, launder cash, switch funds and arms to Iran’s internet of regional militia proxies, and assist Iran evade sanctions.

Bitcoin as protest: Withdrawal patterns throughout civil unrest

Our most up-to-date information reveals a major shift in on-chain habits through the present mass protest motion. Evaluating the pre-protest window (November 1 to December 27, 2025) with the interval from December 28, 2025, to January 8, 2026 (when Iran’s blanket web blackout started), we noticed substantial will increase in each the common every day greenback quantity transacted and the variety of every day transfers to private wallets. Most telling is the surge in withdrawals from Iranian exchanges to unattributed private Bitcoin (BTC) wallets. This surge suggests Iranians are taking possession of Bitcoin at a markedly larger price throughout protests than they had been beforehand. This habits represents a rational response to the collapse of the Iranian rial, which has misplaced almost all of its worth, rendering it successfully nugatory towards main currencies just like the euro.

BTC’s position throughout this disaster extends past mere capital preservation. For a lot of Iranians, cryptocurrency has change into a component of resistance, offering liquidity and optionality in an more and more restricted financial surroundings. In contrast to conventional property which are illiquid and infrequently topic to authorities management, BTC’s censorship-resistant and self-custodial nature provides monetary flexibility — notably priceless in a state of affairs the place people might must flee or function outdoors government-controlled monetary channels. This sample of elevated BTC withdrawals throughout occasions of heightened instability displays a world pattern we’ve noticed in different areas experiencing battle, financial turmoil, or authorities crackdowns.

As sanctions strain and worldwide opprobrium intensify, and Iran’s financial volatility persists, cryptocurrency will seemingly stay a vital software for Iranians searching for monetary sovereignty. The correlation between main political occasions and spikes in crypto exercise underscores how blockchain analytics can present distinctive insights in real-time into the financial impacts of geopolitical developments, whereas highlighting cryptocurrency’s evolving position as each a monetary lifeline and potential automobile for resistance in authoritarian economies.

This web site incorporates hyperlinks to third-party websites that aren’t underneath the management of Chainalysis, Inc. or its associates (collectively “Chainalysis”). Entry to such info doesn’t indicate affiliation with, endorsement of, approval of, or suggestion by Chainalysis of the positioning or its operators, and Chainalysis is just not liable for the merchandise, providers, or different content material hosted therein.

This materials is for informational functions solely, and isn’t supposed to offer authorized, tax, monetary, or funding recommendation. Recipients ought to seek the advice of their very own advisors earlier than making a majority of these choices. Chainalysis has no accountability or legal responsibility for any resolution made or every other acts or omissions in reference to Recipient’s use of this materials.

Chainalysis doesn’t assure or warrant the accuracy, completeness, timeliness, suitability or validity of the knowledge on this report and won’t be liable for any declare attributable to errors, omissions, or different inaccuracies of any a part of such materials.