The hidden price of compromise in monetary discipleship—and what church leaders can do about it

Church buildings throughout America have been operating monetary lessons for many years. But right here’s an uncomfortable query price asking: If these lessons are working, why isn’t the church turning into measurably extra financially free—or extra beneficiant?

The information tells a sobering story. Shopper debt continues climbing to report ranges. In accordance with Nonprofits Supply, church giving has remained caught at 2-3% of revenue for years. And by most monetary measures, Christians look remarkably much like everybody else in terms of how we deal with cash.

What if the monetary wrestle in our church buildings isn’t as a result of individuals gained’t change—however as a result of we’ve given them a compromised strategy that was by no means designed for the world they really stay in?

One thing unprecedented occurred between 1950 and at this time. In 1950, Diners Membership launched the primary multipurpose cost card. Eight years later, Financial institution of America launched what would change into Visa. By the top of the Nineteen Sixties, bank cards had remodeled from a novelty into an business.

The numbers inform the story. In accordance with the Federal Reserve Financial institution of New York’s This autumn 2024 report, client debt has exploded from almost zero within the Fifties to over $18 trillion at this time. Bank card debt alone now exceeds $1.2 trillion, with common rates of interest above 22%.

We’ve by no means seen something like this in human historical past.

No era earlier than ours has lived with this degree of frictionless spending, focused promoting, debt normalization, and fixed monetary comparability by means of social media. We’re dwelling inside an enormous experiment—and most of us had been by no means taught how you can survive it.

When church buildings first began serving to individuals with funds many years in the past, the world seemed nothing prefer it does at this time. The gig economic system didn’t exist. Instantaneous credit score didn’t exist. Social media-driven client stress didn’t exist. Even managing a dozen subscription funds wasn’t a factor.

So the primary wave of monetary instructing within the church made good sense for its time: “Let’s simply train individuals the Bible verses about cash. That ought to repair it.” And truthfully, in a less complicated monetary world, that strategy had benefit.

However the monetary world radically modified whereas a lot of that instructing stayed frozen in place. Individuals grew to become more and more overwhelmed, and what as soon as labored stopped working.

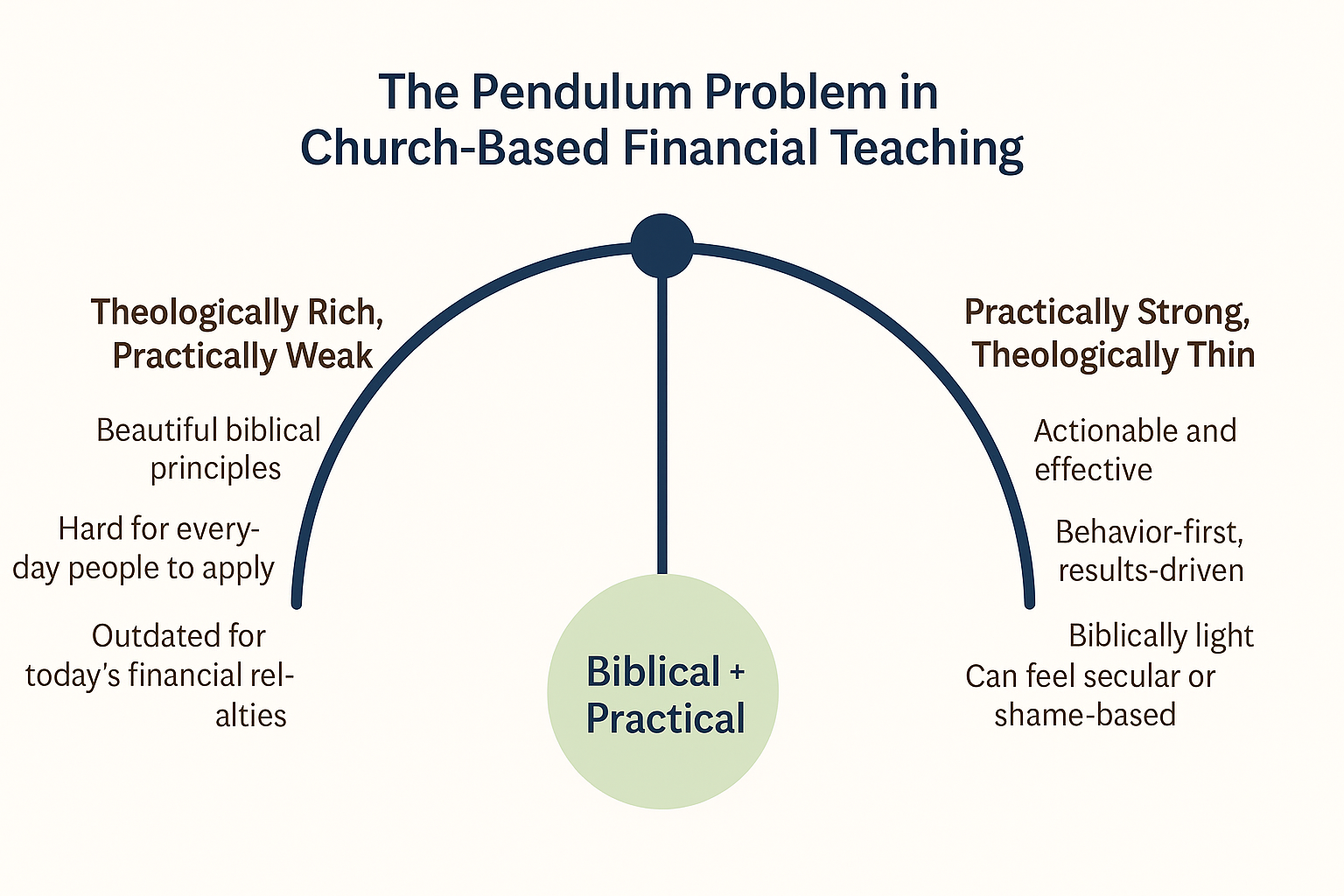

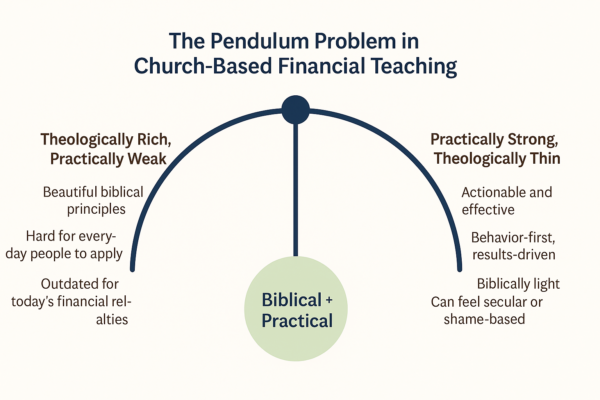

When church leaders attempt to tackle private finance, the pendulum virtually at all times swings to one among two extremes.

On one aspect: theologically wealthy however virtually weak.

That is the world of biblical rules—that are lovely and true—however usually actually arduous for on a regular basis individuals to really do something with. Individuals nod their heads, agree with the instructing, however nothing modifications of their day-to-day monetary lives. Because the monetary actuality for a lot of has change into extra sophisticated, that hole has solely grown.

On the opposite aspect: virtually robust however theologically skinny.

These packages get very step-by-step, very behavior-first. They usually can work—however typically they really feel extra like secular monetary teaching with a pair Bible verses sprinkled on prime. The deeper discipleship will get misplaced. Pastors really feel that pressure, even when they will’t fairly title it.

For many years, church buildings have been requested to decide on: Do we wish one thing deeply Biblical however arduous for individuals to stay out? Or one thing actually sensible however not very Scripturally rooted?

“God’s Phrase speaks to each monetary resolution anybody makes at any time, underneath any set of circumstances.”

— Ron Blue, Founding father of Kingdom Advisors

In the meantime, thousands and thousands of Christians are faithfully exhibiting up at church each week whereas quietly drowning financially—not as a result of they’re irresponsible, however as a result of nobody taught them how you can survive the world they really stay in.

Compromise at all times feels innocent within the second. It seems like “that is the most effective we are able to do proper now.” However compromise has a value—and it’s not small.

Analysis from Barna Group reveals a troubling actuality about Christian monetary well being:

- 32% of training Christians wrestle with private debt

- 40% of Millennial Christians wrestle with debt

- 33% of born-again Christians say it’s not possible to get forward due to debt

- 37% of normal church attenders give nothing to their church

Compromise prices individuals their freedom. Once we do nothing or depend on outdated instruments, individuals keep caught—in debt, in anxiousness, in patterns they don’t know how you can break.

Compromise prices marriages. Doing nothing—or doing the flawed factor—leaves {couples} preventing battles alone that the church may assist them win.

“Arguments about cash is by far the highest predictor of divorce.”

— Dr. Sonya Britt, Kansas State College research of 4,500+ {couples}

Compromise prices discipleship. Cash is forming our individuals each single day. If the church doesn’t disciple them right here, the world completely will. And is.

Compromise prices pastors their time and vitality. In accordance with Lifeway Analysis, 65% of pastors work 50+ hours per week. They find yourself counseling the signs of monetary issues—marriage battle, anxiousness, burnout—as a substitute of addressing the basis.

Compromise prices generosity and mission capability. Individuals genuinely wish to give. They wish to stay generously. However they’re financially strapped and emotionally exhausted. In accordance with Nonprofits Supply, Christians at this time give roughly 2.5% of their revenue—lower than the 3.3% given throughout the Nice Melancholy.

Compromise prices the church credibility. When the church avoids the subject that creates probably the most stress in individuals’s lives, it unintentionally communicates: “We are able to’t allow you to with the factor you’re really fighting.”

The painful reality is that almost all of those prices keep hidden till it’s too late—till a pair is in disaster, till an individual is drowning in debt, till a pastor is overwhelmed, till giving is down and ministry is strained.

Someplace alongside the best way, we began believing our solely selections had been to do nothing (and go away it to another person), accept good instructing however little change, or settle for legalistic rule-thumping that guilts individuals into motion.

However what if these weren’t the one choices?

Church buildings don’t should accept both/or. Christians shouldn’t have to decide on between being discipled Biblically and really getting the sensible assist they want.

There’s a center house—one that’s each absolutely Biblical and absolutely sensible, designed for the monetary world individuals are really dwelling in at this time. An strategy that honors discipleship and drives actual conduct change.

What does that seem like in observe?

It begins with grace, not guilt. After instructing 10,000+ college students over 15 years, we’ve discovered that individuals are already burdened with monetary guilt and disgrace. They don’t want extra. What they want is a judgment-free house to study, develop, and uncover the liberty that comes from aligning their funds with God’s will.

It focuses on what really works at this time—not 20 years in the past. The particular apps, instruments, and programs that assist individuals handle cash in a world of subscriptions, gig revenue, and instantaneous credit score. Not textbook principle. Sensible utility.

It’s rooted in stewardship, not accumulation. We’re not homeowners however managers of every part in our possession. True monetary freedom isn’t about yachts and personal islands—it’s about being free to meet your God-given objective with out cash getting in the best way.

It makes generosity the objective, not an afterthought. Monetary success shouldn’t be measured by how a lot we accumulate however by how a lot we give. When individuals get their funds so as by means of a grace-based strategy, generosity turns into the pure overflow—not a guilt-driven obligation.

For any chief within the church, it comes right down to this: Why are we compromising?

The world has modified dramatically. Individuals’s monetary pressures have multiplied. And the church has a possibility—perhaps even a duty—to satisfy individuals the place they really are with one thing that truly works.

As a result of compromise isn’t impartial. It’s shaping individuals whether or not we acknowledge it or not.

The excellent news? There’s a greater path. One which doesn’t require selecting between two unhealthy extremes. One which transforms the best way individuals take into consideration cash, helps them discover monetary freedom, and makes them naturally extra beneficiant alongside the best way.

That’s not simply attainable. It’s occurring in church buildings proper now.

The one query is whether or not your church can be one among them.

• • •

In regards to the Creator

Bob Lotich is a Licensed Educator in Private Finance and co-creator of True Monetary Freedom, a grace-based monetary curriculum for church buildings. Alongside along with his spouse Linda, he’s spent 15 years serving to Christians uncover that managing cash for God’s glory doesn’t should contain guilt or disgrace.

Their work has been featured on Concentrate on the Household, the Carey Nieuwhof Management Podcast, Proverbs 31 Ministries, and the YouVersion Bible app. Their e-book Easy Cash, Wealthy Life was named the 2022 Christian E book of the 12 months.

To study extra about bringing True Monetary Freedom to your church, go to seedtime.com/true.

—

Sources

Federal Reserve Financial institution of New York, Quarterly Report on Family Debt and Credit score, This autumn 2024

Barna Group, Christian monetary well being and tithing analysis (2008-2024)

Dr. Sonya Britt, Kansas State College, “Analyzing the Relationship Between Monetary Points and Divorce,” Household Relations (2012)

Lifeway Analysis, Pastor time utilization and ministry well being research (2008-2023)

Nonprofits Supply, Charitable Giving Statistics 2024

Ron Blue Institute for Monetary Planning