Digital asset treasury firm Metaplanet (3350) rose 4% in Tokyo on Wednesday after index supplier MSCI decided not to exclude companies constructing cryptocurrency stockpiles from its world indexes.

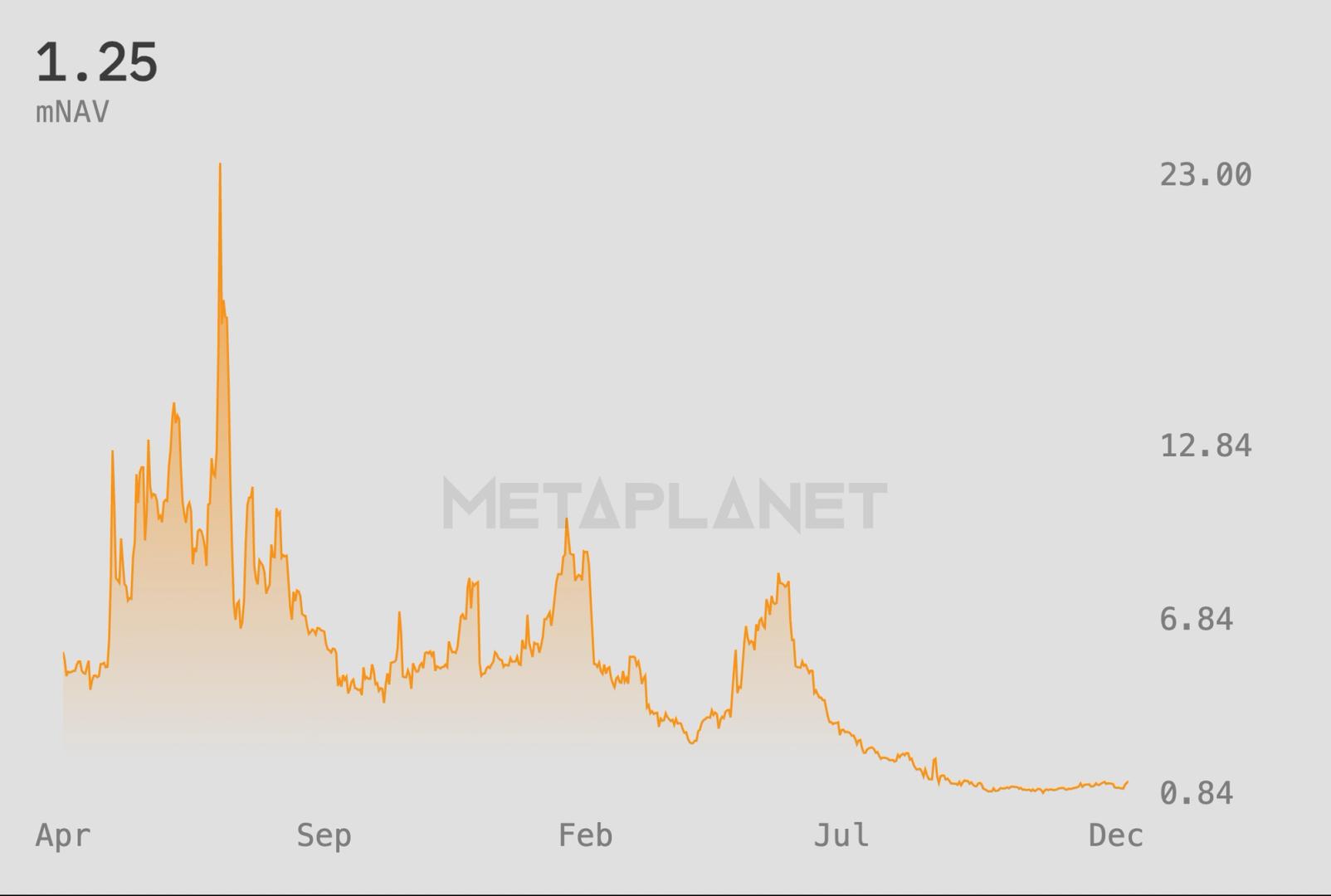

Metaplanet is now up 20% for the reason that begin of the yr. The rally means firm is valued at a premium to its bitcoin holdings, with a a number of to internet asset worth (mNAV) of round 1.25, the best degree since earlier than October’s plunge in crypto costs, based on the company’s dashboard.

The choice ended months of uncertainty round index eligibility and lifted U.S. friends when the announcement was made after common buying and selling hours on Tuesday. Strategy (MSTR), the biggest company holder of bitcoin was lately 5% increased in pre-market buying and selling. Different digital asset treasury corporations rose to a lesser extent.

Metaplanet shares closed at 531 yen ($3.4), having bottomed close to 340 yen on Nov. 18. The corporate holds 35,102 BTC, making it the fourth-largest publicly listed bitcoin treasury firm globally.

MSCI’s announcement removes a close to time period overhang for crypto treasury shares, significantly these already included in main indexes. Nonetheless, the index supplier additionally signaled {that a} broader session on non working and funding oriented corporations is forthcoming, indicating that regulatory and index associated dangers for bitcoin treasury companies have been deferred, not eradicated.