The brand new tax reform has lastly taken impact, with cryptocurrency transactions now topic to tax underneath the Nigeria Tax Administration Act (NTAA).

The NTAA, which got here into power from January 1, 2026, launched important compliance calls for on Digital Belongings Service Suppliers (VASPs).

VASPs are additionally mandated to register with the tax authority, to retain detailed KYC knowledge for seven years, and to report massive or suspicious transactions to each the tax authorities and the Nigerian Monetary Intelligence Unit (NFIU).

Non-compliance attracts a N10 million penalty within the first month and N1 million for every subsequent month, alongside potential licence suspension or revocation by the Securities and Alternate Fee (SEC).

That is an unfamiliar improvement within the crypto area, leaving service supplier and merchants susceptible to penalties.

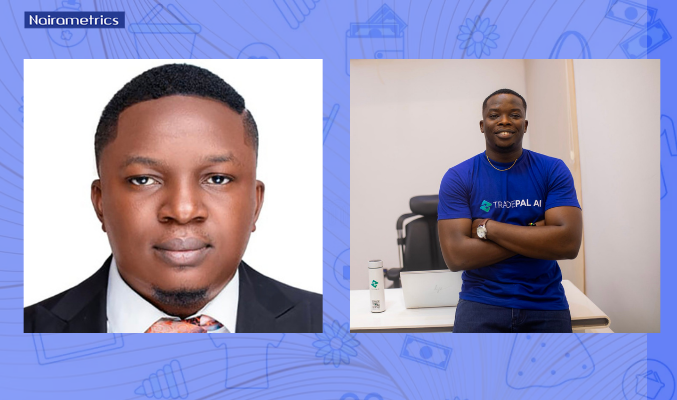

On this interview with Nairametrics, Tradepal AI co-founders, Femi Adegolu and Adebiyi Ayoyinka focus on compliance gaps, Ghana parliament’s legalisation of crypto, and how companies can keep away from penalties.

Nairametrics: Out of your perspective, what are essentially the most important compliance gaps that you simply suppose this tax reform is making an attempt to cowl for companies and people?

Femi Adegolu: Probably the most important compliance gaps that this new tax regulation exposes are the dearth of transparency and, after all, transaction monitoring. Final yr alone, a whole bunch of billions of {dollars} handed via Nigeria, via P2P, those that purchase and promote Bitcoin, foreign exchange, {dollars}, kilos, euros. And the federal government sees all these large numbers, however these are simply volumes.

To be very sincere, the revenue that has been generated is just not according to what the federal government thinks. Even fintechs, I’ve fintechs which have processed over $4 million in quantity, however what are their internet income? When you deduct working bills, you discover out that these guys are typically overtaxed by the federal government. So these loopholes are what this new tax regime will expose.

As a result of each firm proper now doesn’t perceive the significance of getting narrations. Like, typically once I need to ship cash, I don’t add narrations. However imagine me, any longer, I’m beginning to try this.

And so what this factor exposes is transparency. As a result of the federal government sees a lot quantity passing via our trade, the crypto trade particularly, they usually really additionally have no idea the nitty-gritty of what plenty of these operators are dealing with, particularly OTC merchants. And for a very long time, plenty of fintechs, service suppliers who really supply crypto providers, have been on the lookout for methods to get licenses from SEC.

However what number of of them can afford to pay one billion naira? So I feel that is the first step, as a result of now these guys are going to be submitting taxes and likewise letting the federal government know, ‘that is the influx, that is the outflow, that is the income, that is the turnover we’re making, that is the revenue that we’ve got made, and that is how a lot of taxable earnings that we will remit to the federal government’. These are the issues that I do know considerably will impression from this new tax regime.

Nairametrics: What’s the lacking hyperlink between the same old crypto buying and selling and this new tax regime that startups ought to be addressing with their options?

Adebiyi Ayoyinka: I might like to say it is a very distinctive interval within the crypto trade.

So it’s a really particular time that we’ve got to completely put together for, and over time, from my involvement thus far in doing OTC trades and even the conventional crypto commerce, lots of people are inclined to take part blindly in a single or two points of the trade.

Most of us do issues in a really disorganised method, whereby we don’t preserve correct information of issues that occur throughout day by day transactions or enterprise. This has created a mindset for each single OTC dealer, who tends to need to proceed following this identical sample over and over.

As a lot as I don’t like that the tax factor is right here, I really like the truth that it’s occurring proper now to present a future to everybody that have interaction in buying and selling digital property, in contrast to the best way we all the time have it earlier than, so now issues are higher, if we begin doing issues the best approach.

Simply think about when an OTC dealer or service provider goes shopping for and promoting and pays out an enormous sum of cash, and on the finish of the day, you don’t are inclined to know even the quantity you’ve made on that individual transaction. You don’t know the quantity you’ve made in every week, in a month, or in a yr.

So these gaps and this suddenness are actually affecting an entire lot, and relating to taxing now, the federal government are prepared and ready to begin taxing folks, so now could be the time when merchants or retailers see the place they’ve been doing issues wrongly as a result of they’re all considering how do I survive this?

And that’s the place our platform is available in. Tradepal AI ensures that transactions are correctly documented. It has an audit tray the place you may return there throughout the week or month to assessment these transactions, then print out the file everytime you’re going to a tax man.

We have now the software program with options in place whereby you may grant your login particulars to an auditor to entry your dashboard and audit your account remotely, when you monitor it from your individual gadget.

Nairametrics: Proper now, most Nigerians view this digital property taxation as very unclear and unenforceable. Do you share the identical view?

Femi Adegolu: So in a nutshell, the federal government has been on the lookout for a option to tax the crypto trade. It’s an early-stage trade, at the least lower than twenty years.

So, 2025, I might say was the yr of Institutional adoption of cryptocurrency throughout the globe, from the US presidency to different nations, even creating their very own cash just like the Central African Republic. Many different nations are additionally constructing reserves for his or her crypto property. El Salvador is already doing it.

Many nations throughout the Center East and Southeast Asia are already storing Bitcoin, and so for Nigeria, which is the biggest crypto market in Africa, the place a whole bunch of billions of {dollars} are being processed yearly, we imagine that we’re the perfect market to have the ability to have this experiment of taxing digital property.

Service suppliers have been on the lookout for a option to keep compliant the previous couple of years, and naturally this provides most particularly the OTC merchants, BDCs, foreign exchange merchants that capability to sit down down on the identical desk with the federal government, as a result of now they pay taxes like different companies, they pay tax like different company entities, and this additionally brings in additional regulatory readability, as a result of for Tradepal AI we’ve got additionally constructed a KYC system that may allow the federal government additionally know who the cash is coming from, the place the cash goes to, how the cash is being spent, and what’s additionally taxable.

You possibly can have an influx of N1.5 billion from only one transaction, however that’s simply influx, that isn’t turnover, that isn’t earnings, and that isn’t income. so it’s our revolutionary device that we’re going to use to make this readability rather more clear to the federal government, saying that this 1.5 billion that was despatched to this man’s account is just not flip over, it’s simply an influx and that is what revenue this individual created from this, and that is the proof, that is the proof that it’s the revenue that this man created from this explicit transaction.

In order that the federal government has a lot belief in our system and trade, additionally, the federal government believes that we’re extra like companions. As a result of plenty of occasions, one of many issues that has made the crypto area at loggerheads with the federal government is as a result of it seems to be just like the crypto trade is just not supportive of what legal guidelines or laws the governments are passing, as a result of it isn’t beneficial, however when we’ve got this new tax regulation and these property have been taxed, we’ll have that readability.

The federal government could have readability on how a lot is being processed in a single yr. We have now knowledge, and we will supply help when it comes to analysis, so those that need to write editorials in regards to the crypto area can come to us, and we’ll be capable of present all that knowledge and worth for them.

Nairametrics: Not too long ago, Ghana’s parliament legalised cryptocurrency. What do you suppose this imply particularly when we’ve got an enormous inhabitants of Nigerians in Ghana who commerce crypto?

Femi Adegolu: Actually, I do know plenty of Nigerians who commerce crypto in Ghana who’re proud of that new regulation. In Nigeria, for instance, crypto is just not unlawful, however the one situation is that the CBN and SEC should not in alignment when it comes to how these legal guidelines are being executed or applied.

And I’ll say for the information from Ghana, I’m very excited for it as a result of it reveals that Ghana is considering forward, they’re considering of the long run, positioning themselves, as a result of should you take a look at the most important conferences, it’s all going to Ghana or Kenya and that’s as a result of there may be plenty of regulatory disparities in Nigeria and no investor needs to spend money on the nation that has no steady regulation or regulation that may defend them. It’s referred to as investor safety.

However with our taxation regulation, it will be in sync with what the federal government has carried out already prior to now with the previous legal guidelines, with the previous coverage of blockchain paperwork which were enacted through the time of President Buhari. We’re going to see rather more involvement with this new dispensation and that will even allow the sub-Saharan commerce in West Africa appeal to rather more investments, it would appeal to rather more startup funding.

It’s additionally going to allow extra startups speak in confidence to the West Africans sub-Saharan area, and with Nigeria well-positioned to be shut brothers to Ghana, we’ll see lot extra legislative legal guidelines handed within the Nationwide Meeting.

We’re going to see a lot better laws handed by our authorities as a result of Ghana is our closest brother right here in Africa. And I’m positive that may allow extra inflows. So congratulations to Ghana, we’re completely happy for them, we all know that Nigeria can also be main in that entrance to allow crypto turn out to be a way more on a regular basis factor that we use for our day by day commerce.

Nairametrics: How ready do you suppose the Nigerian SMEs, fintechs and startups are for automated tax computation and reporting?

Femi Adegolu: To be very sincere, I’ll say the casual sector and SMEs should not so ready and that’s why we’re right here to assist them, some months in the past, we’ve got really foreseen that that is going to occur when Ambassador Adebiyi informed me about this concept that we have to construct one thing that may assist companies, fintechs, and repair suppliers turn out to be very compliant and likewise keep away from tax penalties by the federal government.

Already, there’s plenty of information flying round about how crypto taxes ought to work; the SMEs are additionally very scared. I can inform you there’s plenty of worry in Nigeria, however folks shouldn’t be scared. I’m very positive with what we’ve constructed already, it’s similar to a plug-and-play. Folks might come, log of their trades, have entry to correct knowledge, file holding, transaction monitoring, and transparency, as a result of now Tradepal AI might be that device that may assist channel narrative.

It’s not a taxman that may really come to inform you how a lot is coming into your checking account, It’s you that may really say that is cash that has come into my checking account as my very own cash, that is the opposite one coming as a mortgage.

So it’s in your individual capability to inform the federal government that that is how a lot you’re making, and that is how a lot you’re really paying again as mortgage. So if SMEs use the best platform, they’ll be extra ready,

I can inform you proper now, plenty of SMEs should not ready as a lot as they suppose, plenty of SMEs are additionally struggling to see how they’ll slot in in order to be very compliant, significantly in paying taxes, due to the income they make.

As a result of the federal government sees these billions passing via accounts, however they don’t know that these billions are simply perhaps a millionaire in revenue or two million in revenue. So what Tradepal goes to do is to make it possible for folks can even have that confidence after they need to file their taxes. They’ve correct information of what they’re giving out or tendering to the federal government as taxable earnings.

Nairametrics: What function do you suppose Nigerian banks and fintechs play in enabling or hindering digital asset tax compliance?

Adebiyi Ayoyinka: I don’t suppose banks have the potential of hindering such a factor proper now as a result of governments, too, are totally ready as a result of the thought of the federal government is to place extra folks into the tax internet, and that’s what they’re really doing. Not too long ago, we noticed a information report going round that the FIRS has said that the NIN of particular person customers of the financial institution might be used as tax ID. Whereas the registration variety of each firm is their enterprise tax ID.

What is that this telling you? That is telling you that extra banks will really comply as a result of there’s no escape route for everyone who makes use of a checking account, as a result of they’ll really adhere and need to comply with the laid-down guidelines and legal guidelines of the federal government so as to not be sanctioned.

So they’ll need to be certain that each consumer of the banking system is adhering to the brand new tax regulation, and whoever is just not adhering or shifting such quantity throughout financial institution accounts might be sanctioned or they’ll alert the FIRS over such individual. So I imagine it’s going to be very troublesome for people or Nigerians to really keep away from paying tax.

Crucial factor now could be to file your tax return even if you’re not making a revenue, which I imagine that’s what we ought to be trying ahead to.

Nairametrics: What’s your relationship with regulatory our bodies just like the SEC?

Femi Adegolu: We are literally engaged on getting a partnership with the NRS. We imagine that partnership could be very strategic for us as a result of simply doing remittance handles all of the collections for presidency businesses. If you wish to get your passport funds, if you wish to get your NIN fee, any fee in any respect goes via remittance.

So we need to have that strategic partnership with the NRS the place Tradepal AI would even be that companion that helps them to do the collation of taxes that may be generated from the service suppliers and operators within the digital asset trade, as a result of that is among the industries that the federal government has not been in a position to determine prior to now. And I feel lastly we’ve got that innovation that may energy this strategy. We’re additionally going to be participating the SEC.

We’re supporting this dispensation in enabling our know-how to energy these collections and knowledge, as a result of a very powerful factor right here for the federal government is knowledge. SEC wants knowledge, the NRS wants knowledge, and even NITDA wants knowledge. So we’re participating these authorities businesses. We’re additionally participating each stakeholder, each within the public sector and the non-public sector, to return collectively and be capable of champion this innovation that we’ve got created.

That is going to be a game-changer for Nigeria and for Africa as an entire, as a result of Nigeria has all the time been the enormous of Africa. We’re the primary movers, and we perceive the impression of what this product goes to do within the markets. Significantly, compliance is a really main factor.

In 2025, authorities has taken time to get taken with crypto, not simply Nigeria, however everywhere in the world. So 2026 goes to be a giant yr for compliance. And we’re right here, we’re ready for this new rising sector.

Nairametrics: Information safety is a giant deal for a lot of. How safe is folks’s knowledge on the platform?

Adebiyi Ayoyinka: Up to now, we’re licensed by the Nigeria Information Safety Fee (NDPC), and the information is encrypted. We perceive the significance of knowledge privateness and knowledge safety.

Nairametrics: We have now seen a few pushbacks from folks concerning this tax reform, some are saying it’s designed to make the poor poorer, and the wealthy richer. What do you suppose is the actual situation?

Femi Adegolu: So first issues first, everywhere in the world, no one likes to pay taxes, not simply in Nigeria alone. In the event you go to the UK, the US, or Canada, and also you run a ballot at present, I can inform you that 95% of the inhabitants doesn’t need to pay taxes. In reality, the tax bracket in Nigeria is admittedly low. And I feel that this explicit regulation was meant to additionally additional drive authorities income era.

It’s not my very own notion that may really change what the federal government needs to do. However I feel relatively than complain, we’ve got really constructed an answer that may energy this explicit compliance tradition that we at the moment are having because the begin of January.

Lots of people should not going to be high quality with it. And as I mentioned earlier, it’s the identical factor that occurs in each different nation on the earth. Within the UK, folks pay as a lot as 40% private earnings tax. In Nigeria, it’s between 15 to 25%. So actually, there may be instructional content material that we’re going to place out. And we’re already doing that on our socials to allow folks perceive that this tax factor is just not one thing that may destroy you as an individual or that may really kill your online business.