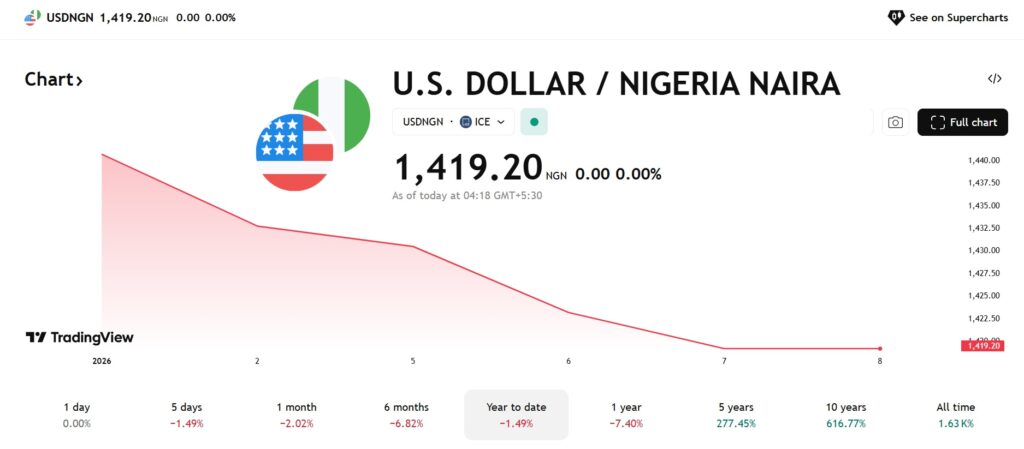

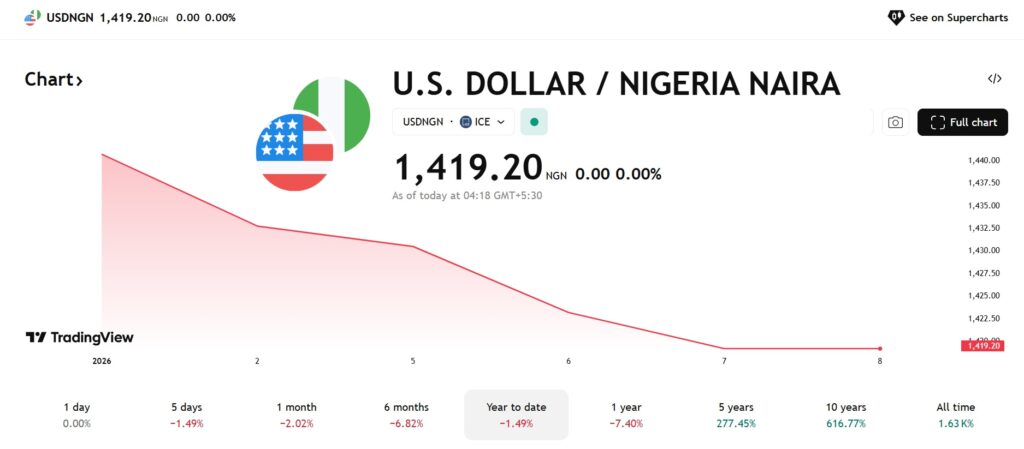

The Nigerian naira (NGN) is appreciating towards the US greenback within the foreign exchange market in 2026. The NGN continued its super rally from 2025, rising by 7.40% in a yr. This yr alone, it spiked almost 1.5% towards the USD, marking a stellar rise within the charts. The rise comes after Nigeria’s international reserves rose to $45.62 billion in the course of the first week of January. The DXY index, which tracks the efficiency of the USD, exhibits the foreign money falling 9% in a yr.

The latest data from the Central Bank of Nigeria shows that the naira reached N1,418.26 per US dollar. It’s up from N1,419.07 on Tuesday and additional firmed up towards the dollar. Foreign money buyers are betting huge on the native foreign money because the dollar is on the again foot. The nation’s exterior reserves are additionally offering a psychological cushion for the native foreign money. Investor confidence is hovering, and native companies are gaining essentially the most from the scenario.

Nigeria’s Naira Goes Up Towards the US Greenback

Wednesday’s uptrend noticed the Nigerian naira expertise a slight achieve of N0.80 vs the US greenback. General, the native foreign money is faring properly on a day-to-day foundation and staying on high of the dollar. Even within the black market, demand for the naira stays sturdy and is buying and selling at a slight premium. The foreign money is stabilizing, making it a viable funding for foreign exchange merchants.

Additionally Learn: Nvidia Insists China Pay Upfront For Its H200 AI Chips

The optimistic outlook for the naira comes after the Nigerian authorities took a number of steps to guard the foreign money from the US greenback. It contains accepting oil funds within the native foreign money and never the dollar. Nationwide refiners have been accepting the native foreign money for six months, strengthening the naira. Nevertheless, a number of refiners have opposed the transfer because it eats into their income and stability sheets.