Key Factors

- In the event you claimed the Earned Revenue Tax Credit score (EITC) or Further Little one Tax Credit score (ACTC), your refund might be held till no less than February 15, 2026 as a result of PATH Act.

- Tax season is not prone to even open up till February 17, so this can be moot in 2026

- The earliest refunds for affected taxpayers utilizing direct deposit are anticipated round March 6, 2026, assuming e-file and no return points.

In the event you declare both the Earned Income Tax Credit (EITC) or the Additional Child Tax Credit (ACTC) in your federal return, the PATH Act requires the Internal Revenue Service (IRS) to carry your whole refund till no less than February 15. But check out the Path Act Refund Chart below to see your estimate >>

The PATH Act (Defending Individuals Towards Tax Hikes) was designed to assist fight tax refund fraud that was estimated to be costing the federal government over $100 million annually. An evaluation discovered that a number of fraud was being performed utilizing “refundable tax credit”.

Tax credits cut back your tax legal responsibility greenback for greenback – and refundable tax credit may give you more cash again than you even paid in taxes. This makes them prime for fraud.

Nonetheless, the results of the Path Act is that people and households who file tax returns claiming these credit have to attend. They may see their tax refunds delayed.

Here is what it’s good to know concerning the PATH Act and when you possibly can count on your tax refund in case you declare PATH Act impacted tax credit.

Would you want to avoid wasting this?

What Is The PATH ACT?

The PATH Act, quick for Defending Individuals Towards Tax Hikes, was handed in 2015 as a tax reform invoice. This invoice had 50 tax credit and deductions, and made everlasting a number of well-liked tax credit.

Nonetheless, one of many greatest impacts of the PATH Act was a delay that was required for sure tax returns to combat tax refund fraudd. Particularly, tax payers who filed tax returns that included the Earned Income Tax Credit (EITC) or the Little one Tax Credit score (CTC) might NOT obtain their tax refund earlier than February 15.

The rationale for the delay is that tax refunds are processed “first come, first served”. And in case you wished to file a fraudulent tax refund, you’d achieve this very early in order that the actual taxpayer wouldn’t have filed but.

An evaluation of fraudulent returns discovered that returns with EITC and CTC have been frequent culprits as a result of these tax credit have been refundable – that means that you could possibly get again much more cash than you paid in taxes.

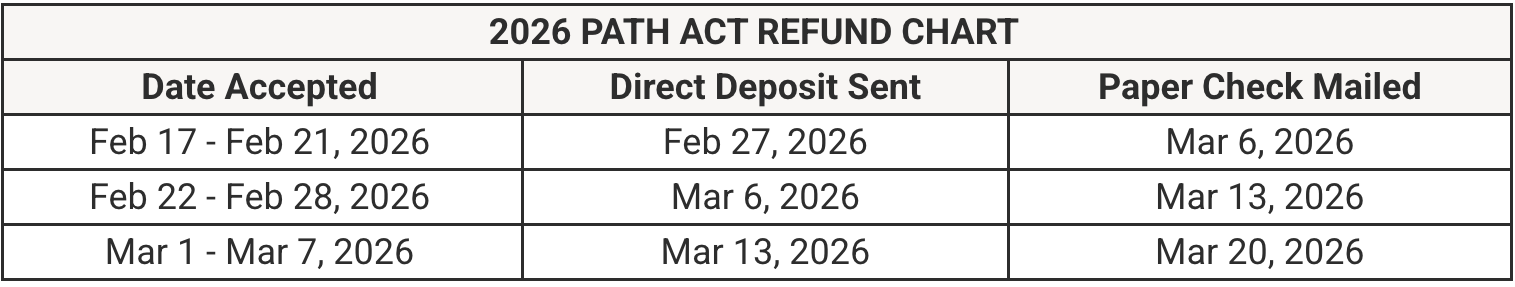

PATH Act Refund Chart

On account of the PATH Act, people and households submitting tax returns with the EITC or CTC now have to attend till after February 15 annually. On condition that the IRS begins may not start even processing returns till February 17 this 12 months, and most filers can count on their refund inside 21 days, this is probably not as huge of an influence in comparison with previous years.

You may see our “regular” estimated tax refund calendar here.

Primarily based on prior years’ information, folks with PATH ACT refunds sometimes see their tax refunds arrive within the first week of March. For 2026, we count on that the earliest PATH Act tax refunds will arrive round February 27, however the bulk of earlier filers will see their refund the week of March 2. Some could not even get their refunds till the week of March 9, relying on while you filed your tax return.

Keep in mind, we estimate the IRS will not even open for e-File till February 17.

Right here is an HTML model of the Path Act Refund Chart:

|

2026 PATH ACT REFUND CHART |

||

|---|---|---|

|

Date Accepted |

Direct Deposit Despatched |

Paper Examine Mailed |

|

Feb 17 – Feb 21, 2026 |

Feb 27, 2026 |

Mar 6, 2026 |

|

Feb 22 – Feb 28, 2026 |

Mar 6, 2026 |

Mar 13, 2026 |

|

Mar 1 – Mar 7, 2026 |

Mar 13, 2026 |

Mar 20, 2026 |

Keep in mind, in case you file your tax return after the necessary delay interval, your tax return (and tax refund) will course of usually.

Unintended PATH Act Penalties

One of many greatest unintended penalties of the PATH Act is that thousands and thousands of low revenue households have to attend nearly a further 6 weeks earlier than receiving their tax refund. In consequence, many of those similar households are turning to tax advance refund loans to shut the hole.

The Authorities Accountability Workplace (GAO) did a study and located that over 20 million households used tax refund loans, and that quantity is rising. Contemplating that 25 million households file the EITC (and 31 million are eligible for do not file a tax return to say it) in accordance with the IRS, the correlation is staggering.

Whereas the PATH Act is reducing down on refund fraud and saving the federal government cash, it could possibly be costing tax payers nationwide cash resulting from tax refund mortgage charges, curiosity, and extra.

Widespread Questions

Listed here are some frequent PATH Act questions.

What Is The PATH ACT?

The PATH Act, quick for Defending Individuals Towards Tax Hikes, was handed in 2015 as a tax reform invoice.

What Are The Largest Penalties Of The PATH ACT?

The largest consequence for taxpayers is that tax returns that embrace the Earned Revenue Tax Credit score (EITC) and Little one Tax Credit score (CTC) can’t be processed earlier than February 15. The result’s that these tax refunds are delayed till early March.

Is The PATH ACT A Good Factor?

The PATH Act has lowered tax refund fraud, which is estimated to price the IRS $100 million per 12 months. Nonetheless, the delay in processing tax returns places a burden on many low-income Individuals.

When will I get my PATH Act refund in 2026?

In the event you e-file early, select direct deposit, and don’t have any points along with your return, most refunds ought to arrive by March 9, 2026.

The publish Path Act 2026 Tax Refund Dates appeared first on The College Investor.