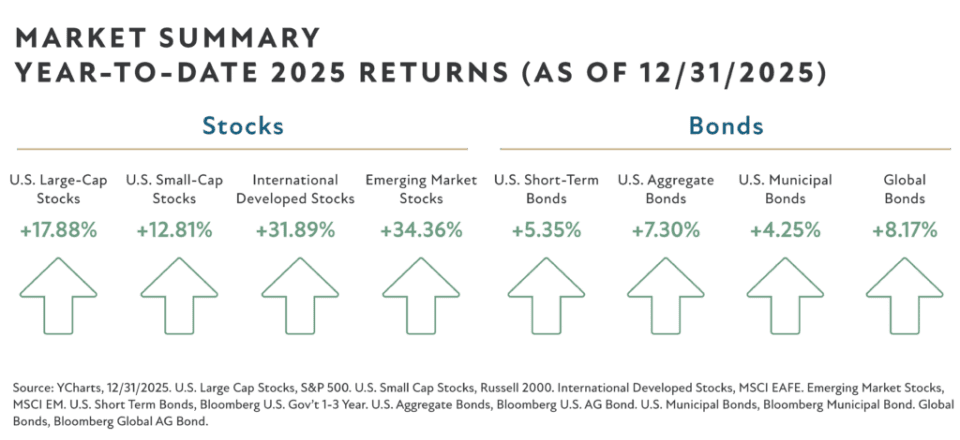

This picture exhibits year-to-date 2025 returns as of 12/31/2025. U.S. large-cap shares are up 17.88%. U.S. small cap shares are up 12.81%. Worldwide developed shares are up 31.89%. Rising markets shares are up 34.36%. U.S. short-term bonds are up 5.35%. U.S. combination bonds are up 7.30%. U.S. municipal bonds are up 4.25%. World bonds are up 8.17%

‘Tis the season of unkept guarantees. Consuming more healthy? Unlikely. Figuring out extra? Much more unlikely. The previous 12 months noticed false proclamations that had been plentiful — and financially painful for many who listened.

All main asset lessons ended 2025 at or close to all-time highs. Buyers continued to be rewarded extra for being an proprietor versus being a lender, a proven fact that’s unstable 12 months by 12 months however inevitable over the long run. After a greater than 15 12 months run of large outperformance by home shares, traders had been reminded why they don’t simply personal the S&P 500.

Worldwide shares outperformed home shares by one of many widest margins ever. Did Europe miraculously get its fiscal home so as? Under no circumstances. Did the demographic challenges throughout a lot of Asia by some means reverse? Additionally no. The variety of infants born in China reached an all-time low, whereas demographics are so unhealthy in Japan they promote extra grownup diapers than kids’s diapers.

Worldwide shares outperformed on account of a bunch of various, and infrequently random, causes — the U.S. greenback’s dramatic depreciation and large European stimulus efforts amongst them. However the level is that these holdings have at all times deserved, and sure will at all times deserve, a spot in a well-diversified portfolio.

As home shares plummeted by practically 20% earlier within the 12 months, worldwide shares had been up 10%, serving to present ballast within the storm. Don’t go operating towards worldwide shares now, similar to you shouldn’t have run from them beforehand. Sizzling dot chasing normally results in singed fingers, bruised egos and unnecessarily small account balances.

Boring previous bonds noticed wholesome returns as properly, after a number of very tough years. By some measurements, 2022 was the worst 12 months ever for public market bonds as rates of interest spiked greater (it appears bonds are typically not so boring in spite of everything!). Charges are actually trending decrease, which works as a tailwind for bond traders and debtors alike.

The Federal Reserve has diminished rates of interest and is beneath political stress to push charges even decrease. When rates of interest are being diminished whereas the economic system continues to be sturdy (most rate of interest cuts happen throughout a monetary disaster, like with COVID or in 2008), the market has been optimistic 100% of the time shifting ahead after the 22 separate instances this occurred beforehand.

It is a nice historic precedent. Even the political intrigue that appears so completely different with the Federal Reserve and Trump proper now isn’t actually that uncommon. Each Jimmy Carter and Richard Nixon (yay for bipartisanship!) blamed the Federal Reserve for dropping presidential elections. And Andrew Jackson bodily destroyed the Federal Reserve within the 1830s! Market, and political, volatility is older than even our nice republic, which is celebrating its 250th birthday in 2026. We must be so grateful we had been born once we had been and the place we had been.

With the wave of inexperienced highlighted, as each shares and bonds completed 2025 with wholesome returns, it’s straightforward to neglect the volatility that seized markets solely eight months prior — it was the fourth-worst begin to a 12 months in market historical past!

Because the S&P 500 slid towards a bear market by tumbling virtually 20% from mid-February by early April, Wall Road strategists slashed their forecasts on the quickest tempo because the COVID crash, solely to wind up bumping them again up as shares staged one of many swiftest comebacks on report.

Through the darkest days of tariff-related market volatility, the largest retail financial institution on this planet (J.P. Morgan) mentioned markets would finish 2025 down 12%. The world’s largest funding financial institution (Goldman Sachs) has no particular clairvoyant powers both. Within the midst of COVID, they mentioned markets can be down a further 15% after already dropping 35%. With the 50% restoration that occurred over the subsequent 100 days, they primarily solely missed the mark by a measly 100%. Larger could also be higher for bodybuilding, however your dimension is completely nugatory in serving to to predict the longer term.

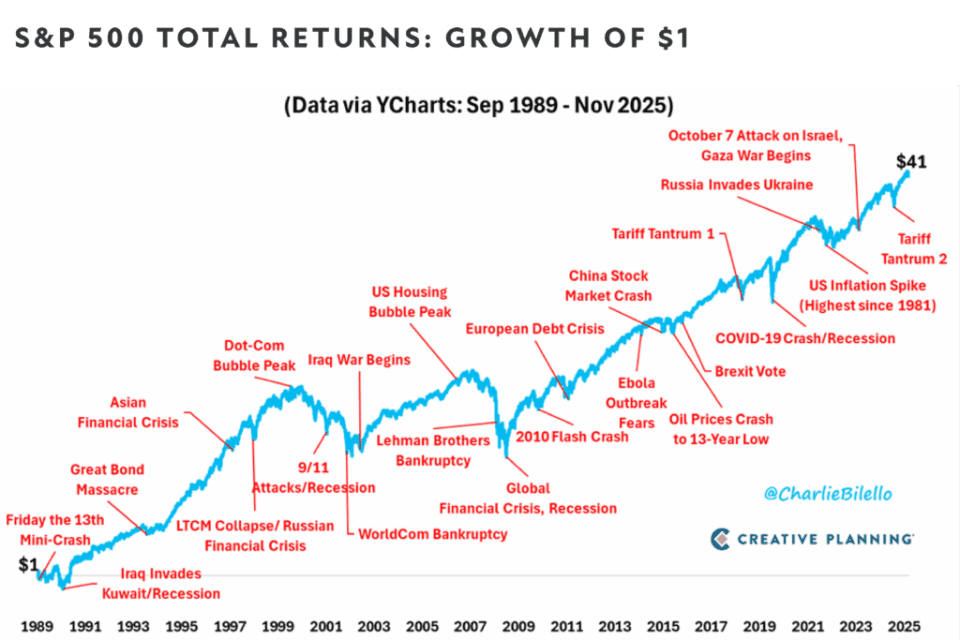

Whereas the magnitude of the 2025 comeback is bigger than most, the story of the inventory market can be a story of comebacks — one after one other. If we have a look at the S&P 500, each single 12 months has a drawdown, averaging -14% since 1980 as graphed beneath. Keep the course and keep invested, as all market storms finally move. The smart investor embraces volatility by persevering with to contribute to retirement plans frequently and/or rebalancing together with tax-loss harvesting, Roth conversions, and so forth. (when relevant).

This chart exhibits the utmost intra-year drawdown versus end-of-year whole returns by way of closing costs from 1980 by December 29, 2025. It exhibits that since 1980, the S&P 500 has had an annualized whole return of 12% regardless of a mean intra-year drawdown of 14%. Single-year drawdowns ranged from 3% to 49%, whereas single-year returns ranged from -37% to 38%.

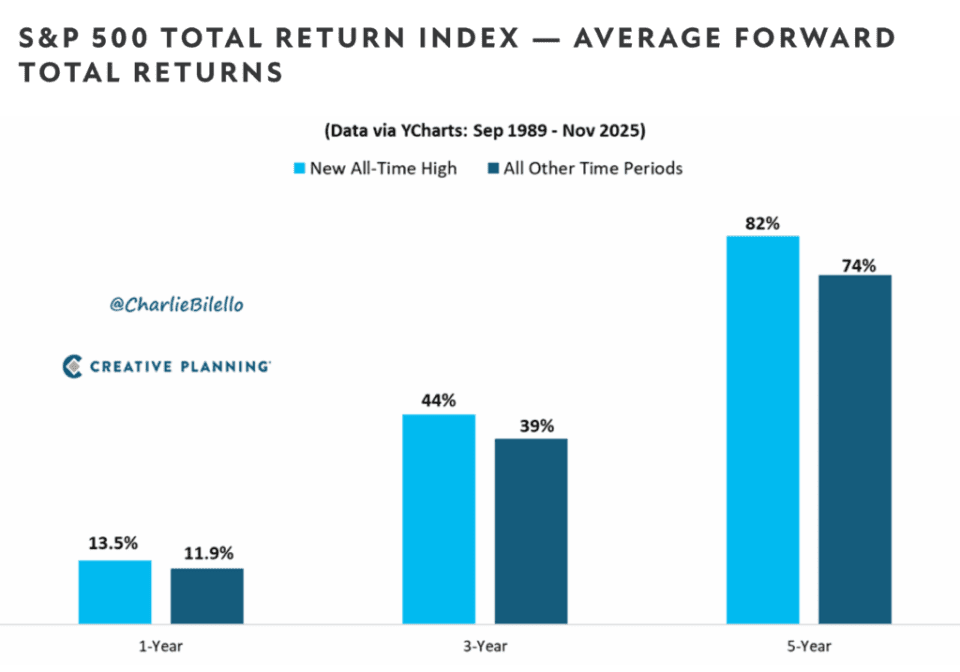

One other emotional rip-off to keep away from is reluctance to proceed investing when markets are at all-time highs on account of concern of downturns. After the volatility of early 2025 subsided, the market hit practically 40 new all-time highs all through the rest of the 12 months. As graphed, counterintuitively, ahead returns are literally greater after markets hit all-time highs than as in comparison with every other time interval. Does this assure optimistic returns shifting ahead? Completely not. However the odds are in opposition to you if the choice is to “await a greater entry level.” Far more cash has been misplaced in anticipation of downturns than has been misplaced to the precise downturns themselves.

This chart exhibits the typical ahead whole returns of the S&P 500 from September 1989 by November 2025. For a one-year interval, the brand new all-time excessive common is 13.5%, whereas the typical for all different time durations is 11.9%. For a three-year interval, the brand new all-time excessive common is 44%, whereas the typical for all different time durations is 39%. For a five-year interval, the brand new all-time excessive common is 82%, whereas the typical for all different time durations is 74%.

Greed, one other toxic emotion that must be prevented, was additionally on show in 2025. A number of high-flying expertise shares soared as pleasure related to AI continued to permeate. The problem is that this handful of shares is at all times altering over time. Whereas it’s expertise shares proper now, vitality shares drove markets greater for a protracted time period prior. It was metal shares earlier than that — and railroad shares earlier than that — all the way in which again to the equal of fireside shares in caveman days.

Markets powering greater have at all times been pushed by a small handful of shares skyrocketing. Key findings from a associated research on shareholder wealth enhancement by Hendrik Bessembinder embrace:

- Simply 3.44% of all U.S. companies accounted for 100% of the web shareholder wealth generated between 1926 and 2022. To place this otherwise, roughly 97% of all shares ever issued (there have been practically 30,000 completely different shares) have successfully contributed completely nothing to long-term shareholder wealth creation.

- The highest 1.88% of firms had been chargeable for 90% of whole inventory market positive factors.

- A mere 0.26% of companies created half of all web shareholder wealth.

The important thing takeaway is that diversification stays some of the efficient methods to place your portfolio to personal the large winners, which produce practically all shareholder wealth over time. As a result of we don’t know who these large winners will likely be, the very best technique is to easily personal every part. Why not simply attempt to decide the large winners and exclude every part else? As a result of that’s practically unattainable to do.

Are we in a bubble related to expertise and AI? Over a protracted sufficient time interval, the reply is that it’s extremely doubtless. As a result of there’s by no means been a major technological leap ahead (e.g., the web, the economic revolution, and so forth.) that hasn’t had a bubble come together with it in some capability. Whereas a bursting bubble will be momentarily painful, markets at all times discover a manner greater over time. We’re certain some poor caveman actually caught hearth in his pleasure over harnessing the primary technological leap ahead. It was doubtless mankind’s first — however positively not its final — fiery dance with irrational exuberance.

Take the final 50 years as graphed beneath. There have been many bubbles (just like the web or housing), and many different scary stuff has occurred too (just like the Macarena), however markets at all times discover a manner greater over the long term. Cisco inventory (primarily the Nvidia of the expertise increase that occurred on the flip of the century) solely simply obtained again to its all-time excessive inventory value — final reached 25 years in the past — in mid-December 2025. The broader inventory market over that very same time interval is up roughly 400%. You take part within the particular person winners by not truly attempting to select the person winners.

This chart exhibits the expansion of $1 within the S&P 500 from September 1989 by October 2025 (ending at $41). All through the years, main occasions linked to market crashes are labeled, such because the European debt disaster, Brexit vote, COVID-19 crash and extra, for example the resiliency of the market over time.

As at all times, it’s prudent to tune out the noise and give attention to what you’ll be able to management. Proceed to take a position, diversify and optimize your tax and/or property planning particulars. Let fundamentals, as a substitute of concern or greed, drive your decision-making. Don’t attempt to decide winners or losers, and don’t take heed to anybody who says they know what’s going to occur over the quick run.

Possibly we do report again that we’ve saved our New Yr’s resolutions and turn into chiseled like a Greek god who eats solely kale and cauliflower. However, like market efficiency within the quick run, don’t depend on it.

Finest needs for a secure and affluent 2026.