Key Factors

- The SAVE reimbursement plan is formally cancelled however debtors are ready for a date on when the executive forbearance will finish.

- The One Huge Stunning Invoice formally eliminates SAVE and transfer debtors right into a model of IBR, however the max authorized timing is June 2028.

- The timing of reimbursement for SAVE debtors is feasible in mid-2026, however extra possible by mid-2028.

The way forward for scholar mortgage reimbursement for SAVE borrowers has been finalized by a court settlement, however the timing will depend on how rapidly the Division of Schooling can execute on the One Big Beautiful Bill (OBBB) and the negotiated rulemaking required as a part of the settlement.

Debtors in administrative forbearance underneath the SAVE (Saving on a Beneficial Schooling) plan know the longer term now (there’ll by no means be a SAVE fee once more), however they do not know when. The OBBBA makes it clear that debtors within the SAVE forbearance can be pressured into the brand new Repayment Assistance Plan (RAP) if they do not choose to enroll in IBR or Standard earlier than the forbearance ends. However the query as to when stays.

When will the SAVE forbearance formally finish and debtors be required to make funds once more? Observe: This isn’t about interest accruing – that’s starting back on August 1 and no funds are nonetheless due. That is about when funds might resume.

A number of eventualities are on desk for SAVE reimbursement resuming – which seem to repeatedly be prolonged.

- ED forces SAVE debtors into reimbursement in early 2026: The Division of Schooling might return debtors to reimbursement as quickly as negotiated rulemaking is finalized. Nevertheless, debtors are seeing forbearance notices all the best way till 2028, so this appears unlikely. We put the chances at restarting something earlier than June 2026 at 10%.

- The Division of Schooling retains debtors in forbearance till migration to RAP: The Division of Schooling follows the OBBBA and retains debtors who do not choose a brand new reimbursement plan in forbearance till they migrate to RAP in July 2028. This might be much like how the Division of Schooling moved debtors from REPAYE into SAVE initially. This might additionally happen earlier, but in addition as late as June 2028 per the OBBBA. We put the chances of this at 70%.

- Different Timelines: Actually any timeline might occur between now and June 2028. It will be uncommon to maintain debtors in forbearance till 2028, and logistically it might be a nightmare for loan servicers NOT to coordinate with the opposite adjustments taking place. Nevertheless, the OBBBA formally says that the if debtors do not make a alternative by 2028. However it’s additionally attainable logistically to begin the migration in late 2027, or early 2028. We put these different extra “random” timelines at 20% odds.

The quickest possibility might see payments start again is early to mid 2026, although it is the least possible, as a result of negotiated rulemaking is required to maneuver debtors out of SAVE. Our opinion is the highest likelihood of funds resuming is mid-2026 to mid-2028 for SAVE plan borrower being robotically moved into RAP if they do not make a alternative earlier than then. Nevertheless, it would not be unparalleled to alter anytime within the center…

Here is a extra in-depth have a look at these three eventualities.

Editor’s Observe: This has been up to date to mirror the negotiated rulemaking and the most recent courtroom standing updates.

Would you want to avoid wasting this?

@thecollegeinvestor Replying to @JKeibler What’s subsequent for SAVE plan debtors? Listed below are the probably eventualities in our opinion. #greenscreen #studentloans #studentloandebt #studentloanforgiveness ♬ original sound – The College Investor

Possibility 1: ED Forces Debtors Out Of SAVE Shortly (10% Odds)

The Division of Schooling officially settled the court case to end SAVE on December 9, 2025.

The Division of Schooling might power debtors to different obtainable reimbursement choices presently allowed (resembling IBR), nevertheless it does require negotiated rulemaking to occur. The earliest a NegReg might begin could be finish of January.

It is necessary to keep in mind that SAVE being discovered unlawful means they can not restart you in your previous SAVE plan funds. They would want emigrate you to a different plan – which the OBBBA permits and says they’ll transfer you to RAP in case you do not elect one other alternative. However RAP does not exist till July 2026, so once more, this appears unlikely to occur earlier than mid-2026.

This looks as if a difficult timeline since this is able to possible require a brand new spherical of borrower communications and system updates, informing affected people that they need to select between remaining IDR plans resembling IBR or PAYE. And figuring out these plans are merely ending 6 months later… why do that? (That is our opinion)

Possibility 2: Clear Migration To IBR Or RAP In Between July 2026 and June 2028 (70% Odds)

Now that the price range reconciliation invoice has handed and we all know RAP goes to be legislation, the “cleanest” path ahead appears to be to coordinate the tip of the SAVE forbearance with the start of RAP and Amended IBR.

We all know that debtors within the SAVE forbearance will robotically migrate to RAP if they do not enroll in another repayment plan (resembling IBR).

It appears essentially the most cheap that this could possibly be a simple coordination for each timing, communication, and execution to have the SAVE debtors start funds presently. This might be much like how debtors initially in REPAYE have been merely migrated to SAVE.

We do not view it possible that debtors who’ve already been informed they’re in forbearance would see that timeline shortened. Whenever you additionally mix that with the logistical workload required emigrate 7-8 million student loan borrowers in SAVE, once more, mid-2028 appears extra sensible.

The timeline would appear like:

- RAP goes dwell in July 2026

- Debtors are given choices to alter

- Debtors who fail to alter by June 2028 are robotically moved

- July 1, 2028 is the primary authorized fee underneath the brand new reimbursement plan

This complete timeline looks as if July 2028 ought to be the goal restart date. Nevertheless, once more, this might occur earlier and anytime between RAP launch after which is truthful recreation.

Possibility 3: Wildcard Timelines

It is attainable any timeline can occur, simply much less possible due to all of the steps required.

For instance, the legislation says that SAVE, ICR, and PAYE have to be eradicated by June 2028. So, theoretically, these plans might final that lengthy. However the starting of the transition is July 1, 2026 – so anytime between these dates can be truthful recreation.

We have additionally heard from mortgage servicers that the preliminary plan emigrate PAYE and IBR is ending enrollments in late 2027 or early 2028, to allow them to migrate in mid 2028.

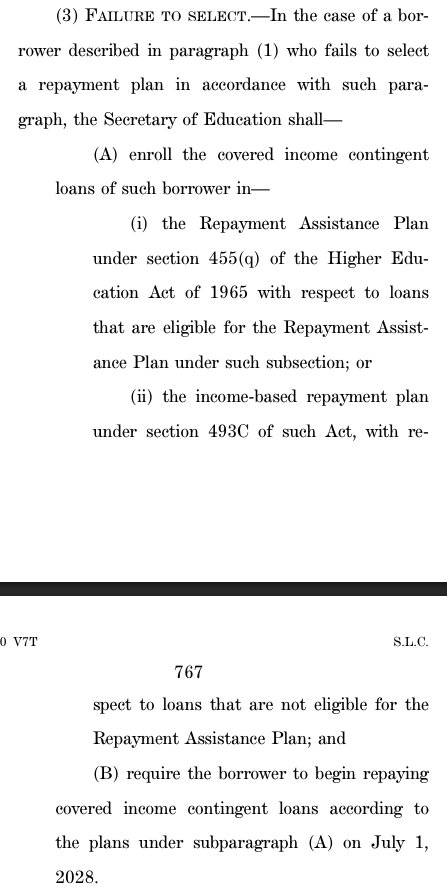

The legislation does make a point out particularly of resuming funds on July 1, 2028 in instances the place a borrower fails to pick out – so it is to be seen if this can be an possibility.

The courtroom or the Division of Schooling might expedite issues to show issues again on – assuming they accomplish that legally. That could possibly be 2026 for first payments due or something in-between. Nevertheless, as a result of debtors can not possible resume SAVE plan funds, restarting this rapidly would require borrower motion to maneuver to an energetic reimbursement plan.

Once more, due to the logistics required, communication required, and extra, it is unlikely that it might occur at an “off” timing. However we have seen stranger issues. Particularly in gentle of the ongoing IDR processing backlog.

What Occurs Subsequent?

Now that Congress has passed the Bill, the Division of Schooling goes to need to get to work creating all of the official guidelines and insurance policies for these new plans. Then they need to coordinate with the mortgage servicers to get them going as nicely.

This stuff take time, effort, manpower (which the Division is missing), authorized evaluation, and extra.

Regardless, the 7 to eight million debtors in SAVE should make some selections with their loans within the subsequent six to 12 months. And that choice will be between IBR and RAP.

Do not Miss These Different Tales:

Editor: Colin Graves

The publish SAVE Student Loan Plan Timeline Estimates: What To Expect appeared first on The College Investor.