Disclosure: Our objective is to characteristic services that we predict you will discover fascinating and helpful. If you are going to buy them, Entrepreneur could get a small share of the income from the sale from our commerce companions.

One thing uncommon is occurring in industrial actual property. It’s a second that comes round as soon as each 15 years or so. Costs begin to massively reward consumers. And consumers who perceive market cycles start assembling their struggle chests.

Prologis (NYSE: PLD) scaled their property holdings after 2008, and their inventory gained 950% by 2021.

American Tower Corp (NYSE: AMT) did the identical, and their inventory gained 910% in that point interval.

Lastly, Crown Fortress (NYSE: CCI) gained 1,300% after comparable shopping for exercise.

As we speak, these are a few of the largest industrial actual property homeowners on the earth, valued between $40 billion and $120 billion.

Now, the market is aligning once more. This time, AARE is letting everyday investors in on the action.

What makes AARE’s alternative much more fascinating is that they’re not but a public REIT. Like mutual funds for actual property, REITs (actual property funding trusts) enable traders to put money into large-scale property portfolios made up of income-producing actual property that’s owned, operated, and/or financed by the belief.

And AARE is stilll at ~$39 million valuation, when their publicly traded friends are valued at greater than 100x. A valuation hole this massive means AARE traders have a chance at upside in addition to the classic income REIT investment.

A REIT portfolio 20+ years within the making

AARE has spent the final 20+ years constructing towards the perfect industrial actual property portfolio. With $2.75 billion+ in actual property transactions underneath their belt, the REIT technique is easy:

- Purchase income-producing industrial properties at discounted costs.

- Construct a diversified portfolio positioned for regular, long-term earnings.

- Distribute as much as 100% of taxable income to shareholders.

The corporate is focusing on dividend funds inside 24 to 36 months. That’s grounded in actual efficiency, since they’re already producing money move and $7 million+ in recurring income, the corporate says.

Plus, as much as 75% of their investor capital is directed into onerous belongings, anchoring AARE in tangible worth, the corporate says. And now that the industrial actual property market favors consumers, AARE is including much more. For traders, which means sharing in additional income-generating residential and industrial properties.

Right here’s why now’s the second to join them.

Actual property’s subsequent ‘1,300%’ second is underway

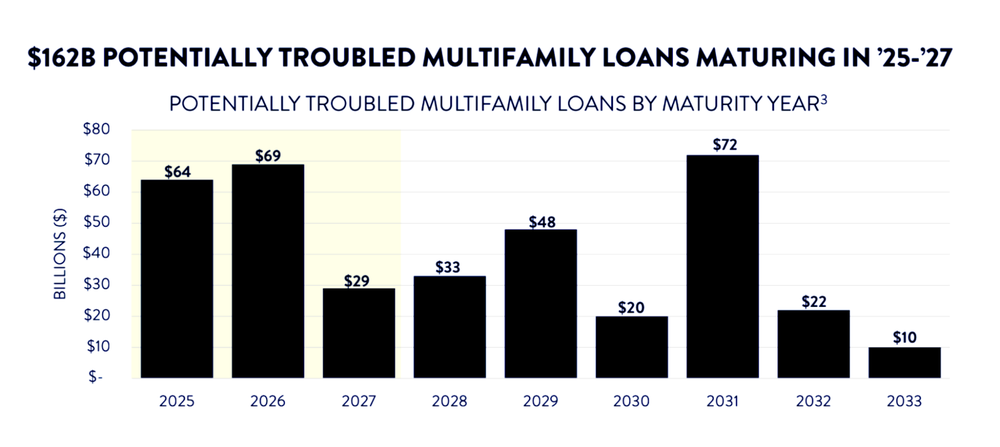

Between now and 2027, trillions of {dollars} in industrial loans, together with roughly $162 billion in multifamily loans, will come due. Many house owners can’t refinance at right this moment’s charges. When debt matures and refinancing isn’t an choice, sellers don’t all the time have a selection.

Picture credit score: AARE

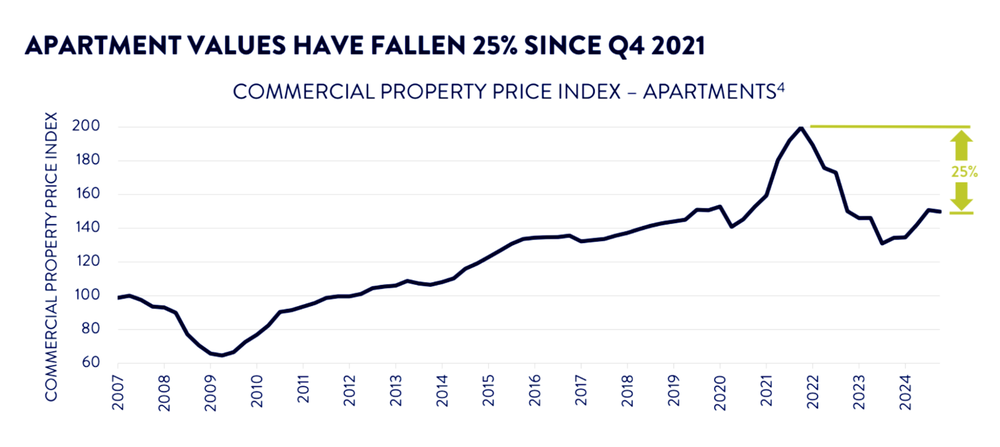

Since late 2021, condominium constructing values are down roughly 25%. That’s an enormous shift after a decade of regular progress.

Picture credit score: AARE

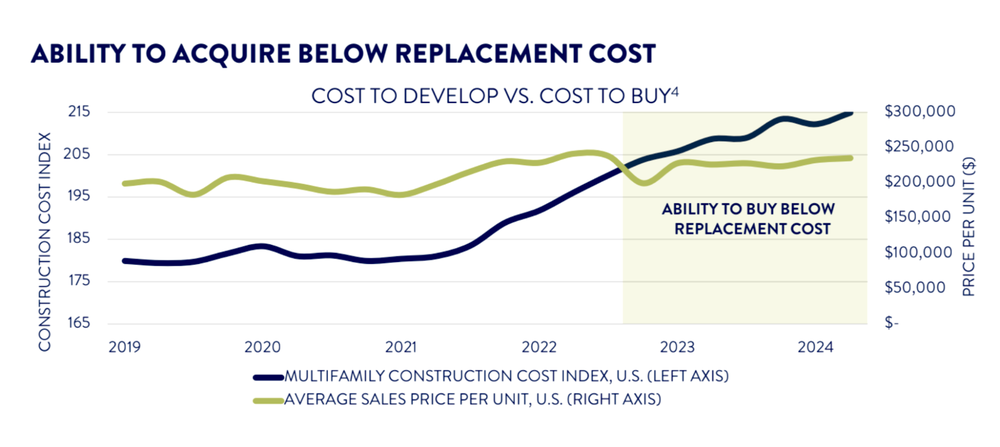

Development prices have additionally jumped as a consequence of inflation and labor shortages. On the identical time, constructing costs have fallen. This has created a promising scenario for buyers: current properties now value lower than constructing new ones. It’s known as shopping for “under substitute value,” a basic worth sign in actual property.

Picture credit score: AARE

The outcome: a few of the most valuable real estate in the marketplace is altering arms at 30% to 40% reductions.

Lastly, rates of interest have reshaped the market over the previous few years. From 2022 by 2024, the Federal Reserve raised charges at a historic tempo. It elevated borrowing prices and put strain on property values throughout the industrial actual property market. However the cycle is now turning.

Because the Federal Reserve begins reducing charges, financing circumstances might slowly enhance. This shift has the potential to create a tailwind that may flip disciplined acquisitions into worth because the market recovers.

The AARE funding alternative

Whereas upside and earnings are by no means assured, one factor is obvious: industrial actual property is getting repriced. AARE has seen this cycle earlier than, and now they’re appearing on it.

Together with on a regular basis traders is a key a part of this mission. They’re constructing long-term worth by sharing entry and earnings extra broadly. And their Beneficiant CapitalismTM initiative takes that even additional, making certain a portion of firm earnings are donated to rigorously vetted charities. This manner, traders can take part in proudly owning income-generating properties whereas additionally having a significant impression on the group.

However there’s yet one more issue that separates AARE from an atypical REIT. They’ve a complete providers division that may generate income alongside the actual property portfolio. It’s additionally been working for 20+ years, with the potential to pay particular dividends along with REIT earnings.

AARE has already expanded to 25 states and plans to proceed to increase to all 50 states as quick as operationally attainable with its actual property providers arm, the corporate says.

Traditionally, alternatives like this in industrial actual property offers have been blocked by profit-eating middlemen and charges. AARE is selecting a unique path. By opening their portfolio to on a regular basis traders earlier than turning into a public REIT, they’re permitting people to take part earlier.

Learn more about becoming an AARE shareholder here.

It is a paid commercial for AARE Regulation CF providing. Please learn the providing round at https://invest.aare.com/

Investments in non-public placements, and start-up investments specifically, are long-term, illiquid, speculative and contain a excessive diploma of threat and people traders who can’t afford to lose their total funding shouldn’t put money into start-ups.

One thing uncommon is occurring in industrial actual property. It’s a second that comes round as soon as each 15 years or so. Costs begin to massively reward consumers. And consumers who perceive market cycles start assembling their struggle chests.

Prologis (NYSE: PLD) scaled their property holdings after 2008, and their inventory gained 950% by 2021.

American Tower Corp (NYSE: AMT) did the identical, and their inventory gained 910% in that point interval.