The idea of creating the Lumi currency emerged from long-standing conversations about African unity, both for people living on the continent and those in the diaspora with African roots, such as in the Caribbean and Black Americans.

- Introduction

- What Is the Lumi Currency?

- Why Is It Called “Lumi”?

- Understanding the Fourth Industrial Revolution (4IR)

- Africa’s Digital Economy: Challenges and Opportunities

- The Lumi’s Proposed Role in Digital Inclusion and Trade

- Case Studies: Startups and Platforms Exploring Lumi-Based Transactions

- Conclusion

Introduction

African leaders have frequently reflected on the paradox of a continent rich in natural resources yet still reliant on foreign aid to address development gaps.

These discussions encouraged greater collaboration between Africans at home and those abroad, focusing on shared economic goals and cultural ties.

In 2018, an African Union–related meeting in Addis Ababa included discussions acknowledging the African diaspora as a conceptual ‘Sixth Region.’ This was a symbolic cultural and developmental framework, not the creation of a new political or monetary region

This initiative became known as the Economic Community of the Sixth African Diaspora Region (ECO-6), headquartered in the Maroon communities of Jamaica.

As part of the region’s economic vision, proponents explored the idea of a common currency similar in concept to how the European Union uses the Euro.

This eventually contributed to discussions around the Lumi, which supporters describe as a symbolic tool intended to encourage trade and cultural exchange. These ideas reflect the views of its promoters and are not official economic policies of African governments

Timothy McPherson, who serves in an interim leadership role within ECO-6, has spoken about the Lumi as a medium of exchange for community-based initiatives.

However, the currency’s role and recognition vary widely and remain a subject of ongoing discussion.

What Is the Lumi Currency?

The Lumi is described by its promoters as the community currency of ECO-6 and is said to be issued through an organization they refer to as the ‘African Diaspora Central Bank’ (ADCB), which functions only within their internal framework and is not a recognized financial authority.

Why Is It Called “Lumi”?

The name “Lumi” is derived from the word illuminate. Supporters claim that the Lumi’s concept includes renewable-energy themes and an internal gold-based valuation model. These statements form part of ECO-6’s promotional narrative and have not been independently verified or recognized by financial authorities.

These ideas exist entirely within ECO-6’s self-defined framework and have no legal, regulatory, or financial backing from African central banks, governments, or continental financial institutions.

ECO-6 promotional materials reference an internal valuation model tied to four grains of gold (0.2592g). This is not an officially recognized or regulated gold standard, and no independent financial authority has validated this model.

Understanding the Fourth Industrial Revolution (4IR)

To understand the Lumi’s place in current conversations, it helps to revisit Africa’s broader developmental eras:

1st Revolution: Pre-colonial forms of production and trade

2nd Revolution: Colonial-era structured trade and formal education

3rd Revolution: Post-independence governance and nation-building

4th Revolution: A modern push toward digital systems, automation, and technology-driven economies

Africa’s Fourth Industrial Revolution (4IR) centers on innovation, digital infrastructure, and using indigenous resources to fuel sustainable development.

Many countries have expressed interest in reducing dependency on foreign loans, although progress varies across regions.

Africa’s Digital Economy: Challenges and Opportunities

Many African nations have begun prioritizing digital transformation, but significant gaps remain.

Challenges

- Infrastructural limitations: Large segments of rural areas lack reliable internet or telecommunications access.

- Limited digital skills: Advanced technology skills such as full-stack development and data science remain relatively scarce in many communities.

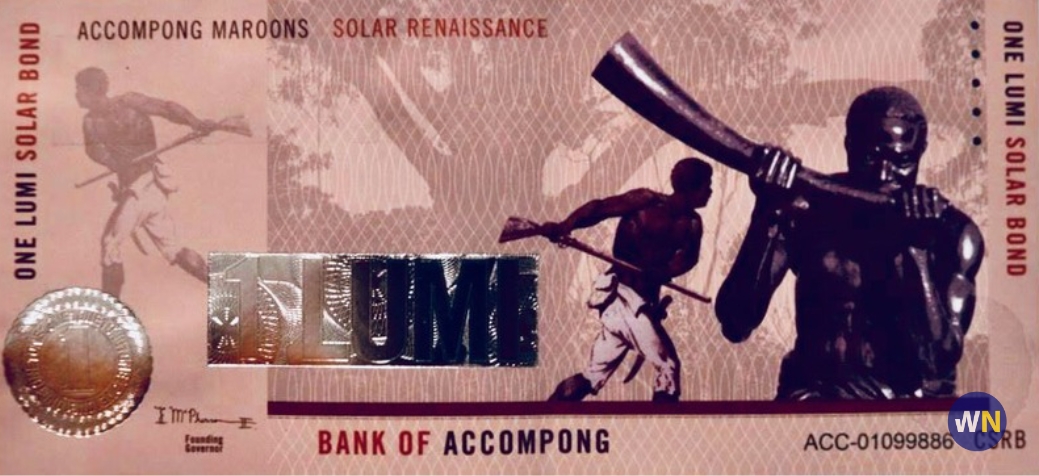

Rex Semako I & VI King Mc Pherson both holding the Lumi Currency Bank Note

Opportunities

Despite gaps, progress is accelerating:

- Job creation: Digital industries offer significant opportunities for young people.

- Growing population: Africa’s young, tech-curious population forms a massive potential market.

- Improved service delivery: Financial services, ticketing, and e-government systems have benefitted greatly from digitization.

- Enhanced security: Tools such as blockchain, biometrics, and device tracking support modern security frameworks.

The Lumi’s Proposed Role in Digital Inclusion and Trade

Supporters of the Lumi often mention various aspirational goals related to digital inclusion and economic participation, though these views remain promotional and unverified.

Digital Inclusion Efforts

ECO-6 materials previously discussed community-led initiatives involving Lumi-denominated digital credits through the Swifin platform. These activities were independent of national governments or central banks and remain unverified by regulators.

These programs were community-driven and not affiliated with national governments or central banks.

The organization has expressed long-term aspirations to use the Lumi as a symbol of unity among member communities in Africa and the Caribbean.

These objectives, however, depend on broader adoption, regulatory approval, and institutional recognition, all of which remain limited at this stage.

Trade and Remittances

In cross-border trade, African exporters are often paid in U.S. Dollars or in the currency of the importing country.

Lumi proponents have speculated about the possibility of using a community-focused currency for certain intra-community exchanges, but such ideas remain conceptual and lack regulatory or practical confirmation.

These ideas are theoretical and exploratory. National governments and central banks have not adopted the Lumi for official trade settlements.

Smart Payment Interoperability

Supporters claim that a digital version of the Lumi uses blockchain-based infrastructure. These technical claims are self-reported and have not been independently audited, tested, or confirmed by external experts.

Note: These claims come from promoters and remain unverified by independent regulators or financial institutions.

This reflects broader global trends toward digital payments. However, Lumi’s integration into mainstream financial systems has not been documented, and adoption remains limited to specific platforms like Swifin.

Nigeria’s e-Naira, for example, is a government-issued Central Bank Digital Currency (CBDC). There is no relationship or connection between the e-Naira and the Lumi, and no official framework has ever linked the two.

Case Studies: Startups and Platforms Exploring Lumi-Based Transactions

Note: The following examples reflect reported activities and do not indicate endorsement, verification, or formal recognition by financial regulators.

The Swifin platform has been one of the platforms previously associated with Lumi-related community initiatives, according to public reports. However, participation remained limited, and the extent of actual adoption varied widely.

Some online posts have alleged that a few stores or institutions experimented with Lumi-based transactions. However, these claims are anecdotal, unverified, and should not be interpreted as evidence of formal adoption or regulatory approval.

ECO-6 has expressed interest in encouraging startups, especially in the technology space, but these plans remain aspirational.

Conclusion

The Lumi currency reflects a broader conversation about African unity, economic independence, and digital transformation. Its supporters envision it as a tool for community integration and innovation.

At the same time, widespread adoption depends on regulatory clarity, official recognition, and practical infrastructure areas that are still evolving.

As Africa moves deeper into the Fourth Industrial Revolution, discussions about digital currencies, regional cooperation, and technological growth will continue to shape the continent’s future.

Disclaimer: This article is for informational and educational purposes only. It does not promote or provide financial advice about any currency. This article does not encourage investment, trading, or participation in any currency or platform. No part of this article should be interpreted as an endorsement of the Lumi or any related platform. Readers are encouraged to verify information independently and consult licensed financial professionals where necessary.

Commendable

Weldone my mentor @Terfa Ukende. You are doing an impressive work.