In the beginning of 2025, the Malawi Stock Exchange informed a well-known story for a small however steadily maturing African market. It was residence to greenback multimillionaires, seasoned financiers whose wealth mirrored years of affected person capital and disciplined enlargement. None, nevertheless, crossed the billion-dollar line. The closest was Indian-Malawian banker and financier Hitesh Anadkat, whose stake in Mauritius-based FMB Capital Holdings Plc was price simply over $350 million on the time. Twelve months later, by the shut of December 2025, that image had modified in a method few native traders would have predicted initially of the 12 months. The bourse ended the 12 months having produced three billionaires, a primary in its historical past, pushed by a rare re-pricing of banking shares that turned long-held positions into fortunes measured in billions.

The shift was not gradual. In the beginning of 2025, the mixed market worth of the stakes held by Anadkat, Malawian banker and entrepreneur Thom Mpinganjira, and Kenyan banker Rasik Kantaria stood at MWK1.32 trillion ($763.3 million). By year-end, a surge within the share costs of FMB Capital and FDH Bank Plc had lifted that mixed determine to MWK7 trillion ($4.06 billion). Shares of FMB Capital climbed 476 % through the 12 months, pushing its market capitalization to MWK7.86 trillion ($4.5 billion), whereas FDH Financial institution’s inventory rose 304 %, valuing the lender at MWK4.14 trillion ($2.4 billion). The outcome was the quiet arrival of three new billionaires on a market that, solely months earlier, had none. Forbes has but to mirror this shift, however by the numbers tracked on the trade, the wealth is already there.

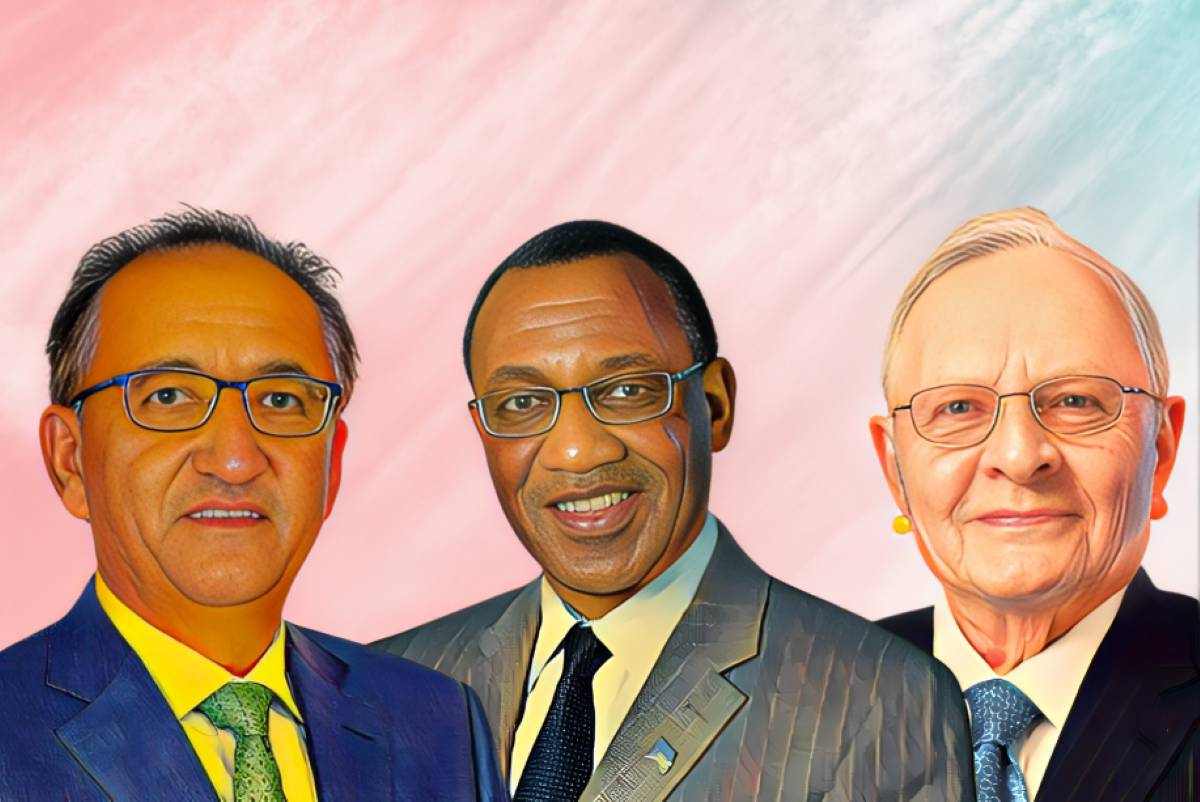

Three founders reap banking fortunes

For Hitesh Anadkat, the 12 months capped a journey that started three many years earlier. He co-founded First Service provider Financial institution in 1995, which later grew to become FMB Capital, and helped information its enlargement throughout Southern Africa. As we speak, the group runs banking operations in Botswana, Malawi, Mozambique, Zambia and Zimbabwe, serving a broad base of company and retail purchasers. In accordance with knowledge tracked by Billionaires.Africa, Anadkat recorded the most important paper beneficial properties on the Malawi Inventory Change in 2025. His 45.35 % stake, representing 1,114,939,081 shares, rose in market worth by MWK2.94 trillion ($1.69 billion) through the 12 months. What was price MWK618.8 billion ($356 million) on Jan. 1, 2025, stood at MWK3.56 trillion ($2.05 billion) by Dec. 31. The rise alone exceeded the market cap of FMB Capital only a 12 months earlier, a mirrored image of how sharply investor sentiment turned in favor of the group.

Rasik Kantaria’s path to a billion-dollar stake ran alongside Anadkat’s, formed by a serious transfer within the mid-Nineteen Nineties. The Kenyan businessman, founder and chairman of Prime Financial institution Restricted and Prime Capital Holdings, teamed up with Anadkat in 1995 to co-found FMB Capital. Kantaria’s wager on banking, made greater than three many years in the past, was rooted in seeing room for progress in native monetary providers and in constructing a platform that might increase past one market. In 2025, that conviction paid off. His 525 million shares in FMB Capital Holdings, equal to a 21.36 % stake, rose by MWK1.4 trillion ($820 million) over the 12 months. The holding elevated from MWK291.4 billion ($167 million) initially of January to MWK1.7 trillion ($1.01 billion) by the top of December, putting him firmly among the many trade’s greatest winners.

The third member of the trio, Thom Mpinganjira, constructed his fortune nearer to residence. A Malawian banker and entrepreneur, he’s the founding father of FDH Monetary Holdings Restricted, the father or mother firm of FDH Financial institution. His 40.73 % stake, amounting to 2.81 billion shares, rose in market worth by MWK1.3 trillion ($750 million) in 2025. Originally of the 12 months, the stake was valued at MWK416.5 billion ($240 million). By the point of drafting this report, it stood at about MWK1.7 trillion, or roughly $1 billion. The acquire mirrored a 12 months through which FDH Financial institution’s inventory grew to become some of the sought-after names on the Malawi Inventory Change.

Financial institution earnings mint billionaires on the Malawi Inventory Change

Behind the sharp rise in share costs was sustained shopping for curiosity in 2025, spurred by monetary outcomes that gave traders little motive to look away. FMB Capital Holdings entered 2025 on the again of a powerful 2024. The group reported a full-year profit after tax of $103.5 million, up 13 % year-on-year, and posted a 41 % return on common fairness. 4 of its 5 banks delivered revenue after tax in extra of $20 million, signaling constant earnings energy throughout its regional operations at the same time as working situations remained demanding. FDH Financial institution’s numbers informed an identical story. In 2024, it reported a profit after tax of MK74.06 billion ($42.6 million), greater than double the MK35.64 billion ($20.51 million) recorded the earlier 12 months. Web curiosity earnings jumped 136 %, supported by progress within the mortgage ebook, authorities securities and placements. Mixed with increased non-interest earnings, whole earnings rose 90 %, thus giving traders clear proof of steadiness sheet progress translating into earnings.

That tempo carried into 2025. For the six months ended June 30, FMB Capital reported profit after tax of $72.9 million, a 56 % enhance from the identical interval in 2024, with a 12-month rolling return on common fairness of 42 %. Administration pointed to continued steadiness sheet progress, regular margins and improved effectivity throughout its markets. FDH Financial institution, for its half, posted a consolidated revenue after tax of MK60.28 billion ($34.7 million) in the first half of 2025, up 116 % from MK27.94 billion ($16.07 million) a 12 months earlier. Web curiosity earnings rose 92 % because the mortgage ebook expanded 62 % year-on-year, at the same time as curiosity expense climbed on the again of stronger deposit progress and better long-term borrowings.

Taken collectively, the numbers clarify why traders stayed engaged and why valuations moved as they did. What stands out just isn’t solely the pace of the wealth creation however the place it occurred. The Malawi Inventory Change, typically missed in conversations about Africa’s capital markets, closed 2025 having produced three billionaires in a single 12 months. For Anadkat, Kantaria and Mpinganjira, the beneficial properties have been the results of long-held positions assembly a 12 months of outstanding market recognition. For the trade itself, 2025 might be remembered because the 12 months shares rewrote expectations and positioned Malawi, decisively, into discussions about Africa’s billionaires.