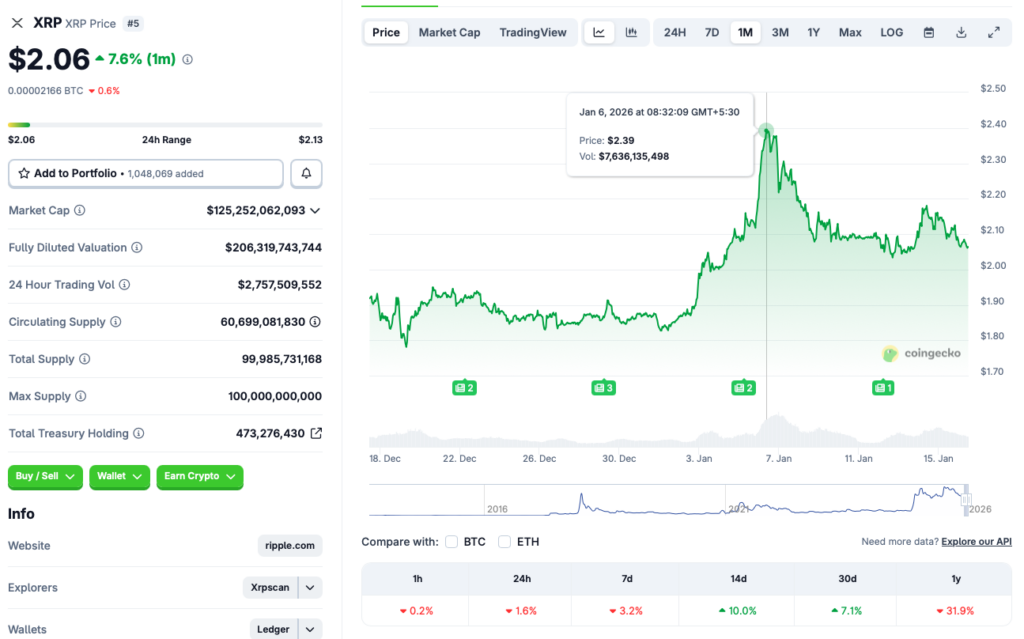

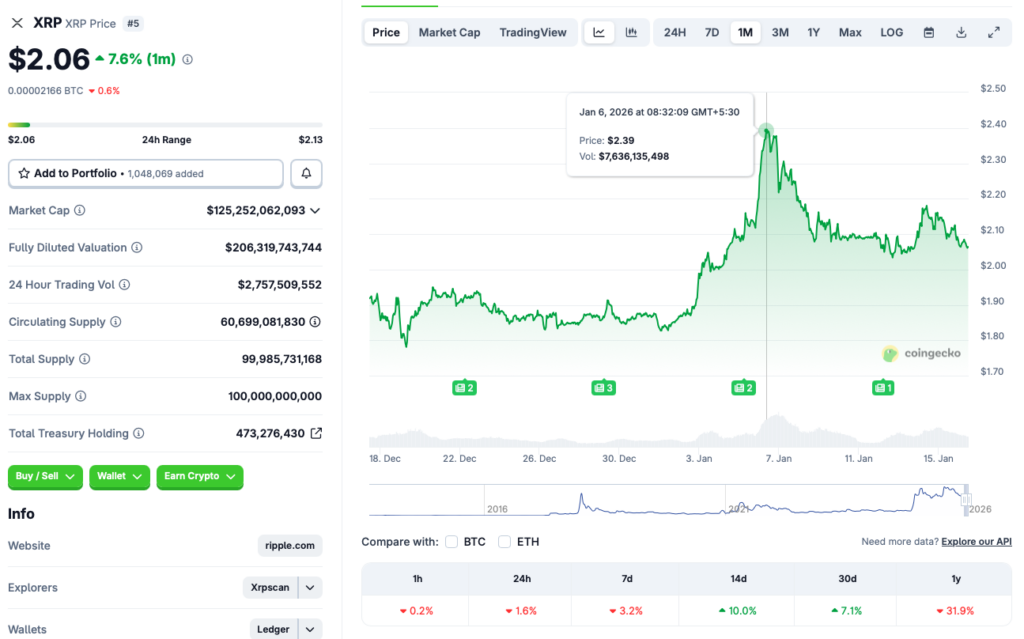

According to XRP-Insights, XRP ETFs have accumulated $1.71 billion worth of assets below administration. Regardless of the rising purchases by ETF autos, XRP’s worth is struggling to achieve momentum, albeit it did see some constructive worth actions early into the 12 months. XRP hit $2.39 on Jan. 6, 2026, however has since dipped again to across the $2 mark. According to CoinGecko data, XRP’s price has fallen 1.6% in the last 24 hours, 3.2% within the final week, and practically 32% since January 2025. Nevertheless, the asset has risen by 10% within the 14-day charts and seven.1% over the earlier month.

Can Elevated ETF Inflows Push XRP’s Value To $3 in January 2026?

ETF inflows performed a key position within the 2025 market cycle. Bitcoin (BTC) and Ethereum (ETH) climbed to new peaks final 12 months due to a surge in ETF purchases. XRP may see an analogous pattern this 12 months. Nevertheless, whether or not the asset breaches the $3 mark in January or not, is unclear. XRP final traded above the $3 mark in July 2025, when it climbed to a brand new all-time excessive of $3.65. Since July, XRP’s worth has seen a gradual decline.

Whereas ETF inflows play a job within the underlying asset’s worth, some belongings might take longer than others to rally. Ethereum (ETH), for instance, didn’t see any constructive worth actions arising from its ETF launch in 2024 till a 12 months later. There’s a chance XRP may additionally see a delayed response to its ETF merchandise.

Additionally Learn: Ripple’s $150M LMAX Deal to Send XRP Back to $3 Price Level?

Nonetheless, XRP has been named the “hottest crypto commerce of 2026” by CNBC. Many specialists anticipate the asset to see document inflows over the approaching months. Whereas the bigger bearish market tone could also be presenting challenges to the asset, we may see a pattern reversal as soon as the bigger economic system cools down.