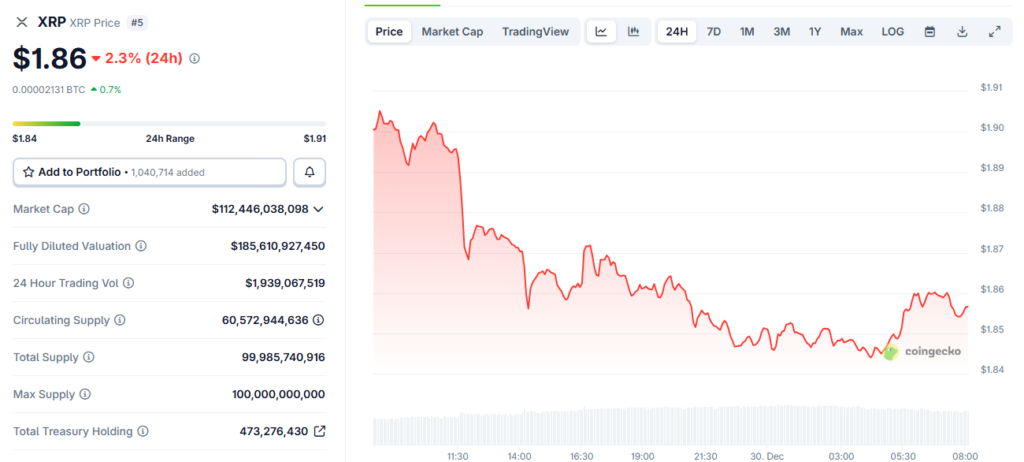

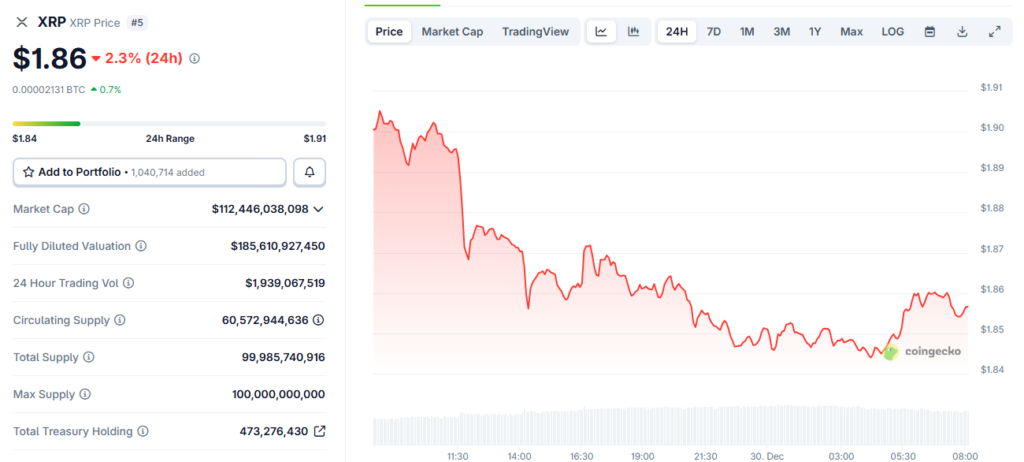

An XRP holders actuality examine has dominated market dialogue as we enter 2026, and roughly 70% of members now count on the token to remain beneath $2 within the quick time period. BullRunners founder Nick Anderson highlighted this polling information from Gemini’s prediction platform simply days in the past, and it alerts a shift from earlier optimism to acceptance of what seems to be like continued consolidation. Proper now, XRP trades near $1.86, confined inside a slim vary that has continued by way of lighter vacation buying and selling volumes and an absence of recent catalysts that may drive value volatility in both route.

Additionally Learn: XRP Will Reach This Price in 2026, Wall Street Says

XRP Worth Volatility And Crypto Market Dangers Sign Buying and selling Uncertainty

Ballot Reveals Actuality Examine For XRP Holders

Most individuals regard the unveiled Gemini ballot numbers from Anderson as a turning level when it comes to sentiment by XRP holders. The fact examine arrived when about 70% of respondents reported they count on XRP gained’t break the $2 mark by the point we enter additional into the brand new 12 months, and this means the market has elevated its acceptance that a formidable breakout gained’t materialize anytime quickly. Buyers who had been wanting ahead to a formidable late rally acquired this info as a wake-up name, and it exhibits that hopes have scaled again considerably over the previous few weeks, as buying and selling uncertainty round XRP has since taken management inside the market.

Anderson indicated exterior of XRP itself that turbulence in decentralized finance has been one other component that has been informing sentiment within the current previous. Governance strains involving Aave adopted issues over the function of founders in shopping for tokens in an important vote over the possession of key model property, and these incidences spotlight persistent fears over disconnect between growth groups and token shareholders.

XRP Prediction 2026 Hinges On Liquidity

Anderson prompt that with out new inflows or decisive optimistic information, conservative expectations are prone to form buying and selling habits as we transfer by way of the brand new 12 months. Skinny liquidity, he acknowledged, cuts each methods—whereas it will probably suppress momentum and contribute to cost volatility for XRP, it additionally leaves room for sharper strikes ought to shopping for strain return unexpectedly. For the XRP holders actuality examine functions, the ballot serves as a sign that many members are making ready themselves for stability somewhat than enlargement within the quick time period.

Additionally Learn: XRP Price Prediction: What Q1 2026 Could Look Like For Ripple?

The evaluation from Anderson facilities extra on preparation somewhat than prediction, and it portrays a market that’s coming into 2026 with warning as value volatility issues, crypto market dangers, and normal buying and selling uncertainty converge. The XRP prediction for 2026 outlook now seems to rely upon elements that embrace sentiment shifts, liquidity situations, and governance developments throughout the broader crypto market, and the XRP holders actuality examine information suggests restrained expectations will persist by way of a minimum of the early a part of this 12 months.

Market Prepares For Cautious Begin To 2026

What’s been fascinating about this XRP holders actuality examine is the way it contrasts with earlier optimism that was prevalent simply weeks in the past. The crypto market dangers that Anderson highlighted—starting from DeFi governance points to stablecoin de-pegging occasions—have created an setting the place XRP buying and selling uncertainty appears to be the dominant theme. As XRP value volatility continues and liquidity stays skinny throughout this era, the truth examine for XRP holders is perhaps precisely what the market wanted to reset expectations heading into 2026.