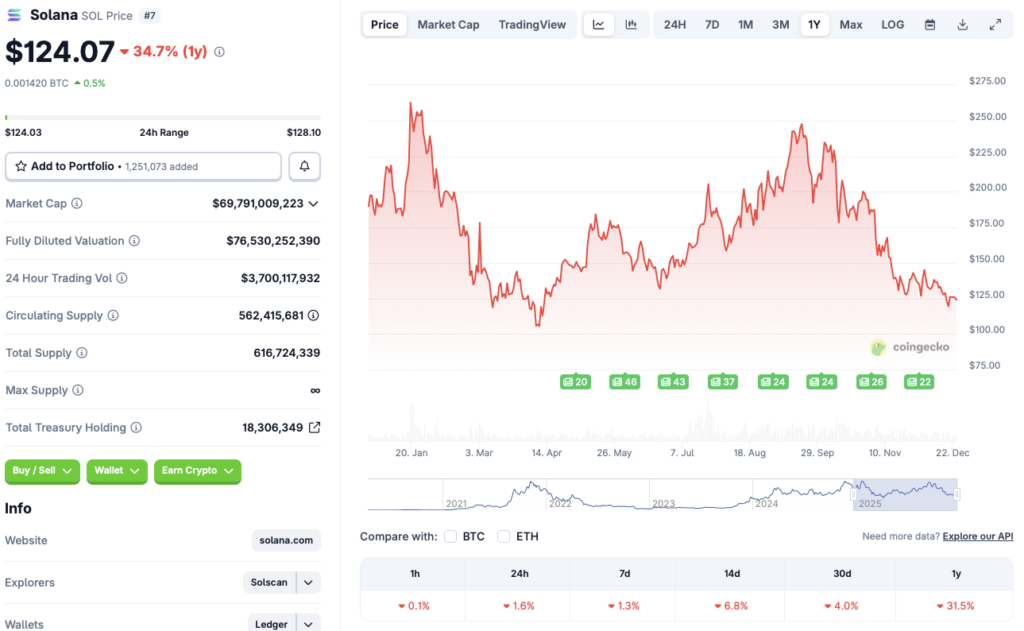

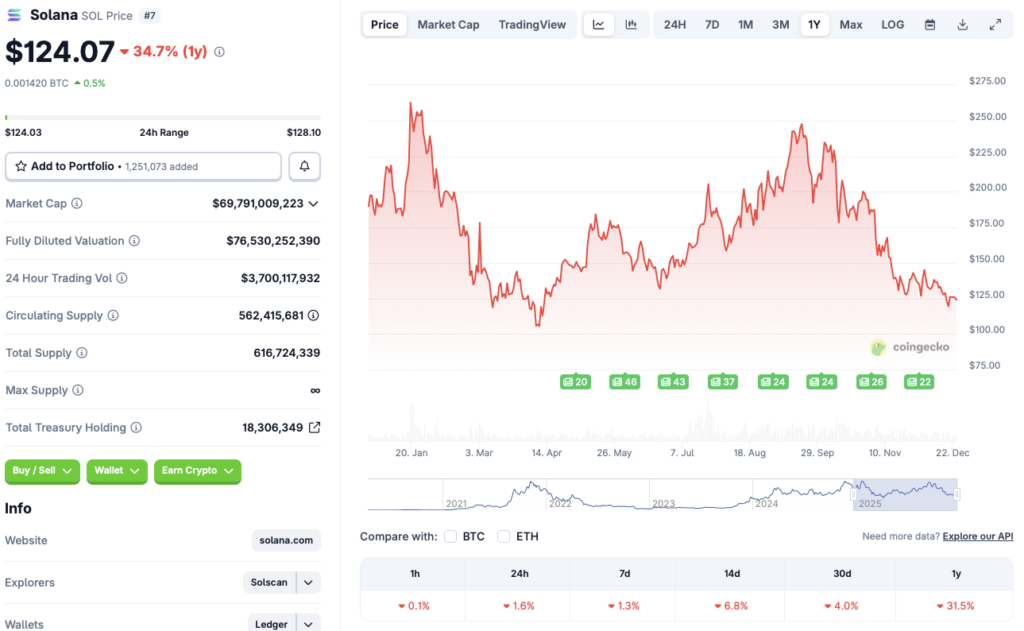

Solana (SOL) is not any stranger to violent worth swings. The asset climbed to a brand new all-time excessive of $293.31 earlier this yr, however has since fallen by greater than 57%. In accordance with CoinGecko, SOL is presently down by 1.6% within the every day charts, 1.3% within the weekly charts, 6.8% within the 14-day charts, and 4% over the earlier month. SOL can be down by 31.5% since December 2024, which is regarding, contemplating the truth that SOL was one of many best-performing cryptocurrencies of final yr. Nevertheless, the present worth dip may very well be a superb alternative to purchase Solana (SOL) for a reduction. Let’s talk about why.

Now Might Be a Good Time To Purchase Solana

Solana’s (SOL) worth fell to under $9 after the collapse of FTX in 2022. Since its 2022 lows, SOL’s worth has hit a number of all-time highs. SOL’s rebound over the previous few years is a testomony to its resilience. Whereas the present worth dip is worrisome for a lot of, there’s a excessive probability that SOL will get well its worth over the approaching months, if not years.

Solana (SOL) tends to observe Bitcoin’s (BTC) trajectory. Many monetary establishments anticipate BTC to rally within the coming months. VanEck has released a report claiming that BTC could be nearing its bottom. The monetary establishment cites BTC’s miner capitulation to assist its argument. Grayscale can be of the opinion that BTC will climb to a brand new peak in 2026. Together with Grayscale, Bernstein has additionally predicted BTC to hit a brand new excessive subsequent yr, anticipating a worth of $150,000 in 2026 and $200,000 in 2027. BTC hitting a brand new peak will doubtless result in Solana (SOL) making the same transfer.

Additionally Learn: Skybridge Analyst Gives Huge Solana Prediction: SOL to $2,500?

Solana (SOL) additionally noticed the launch of a number of spot ETFs over the previous few months. Whereas ETF inflows have been low, contemplating the risk-off strategy from buyers, the development could change over the approaching months. ETF inflows might result in SOL hitting a brand new peak in 2026.