- TL;DR

- The large image: Over $3.4 billion stolen in 2025

- Prime three hacks account for 69% of losses as outliers attain 1,000 occasions the median

- North Korea stays dominant crypto menace actor, regardless of fewer confirmed incidents

- Private pockets compromises: The escalating menace to particular person customers

- DeFi hacks: A diverging sample alerts market shift

- Implications for 2026 and past

TL;DR

- North Korean hackers stole $2.02 billion in cryptocurrency in 2025, a 51% year-over-year improve, pushing their all-time whole to $6.75 billion regardless of fewer assaults.

- The DPRK is reaching bigger thefts with fewer incidents, usually by embedding IT employees inside crypto providers or utilizing subtle impersonation techniques concentrating on executives.

- The DPRK reveals clear preferences for Chinese language-language cash laundering providers, bridge providers, and mixing protocols, with a 45-day laundering cycle following main thefts.

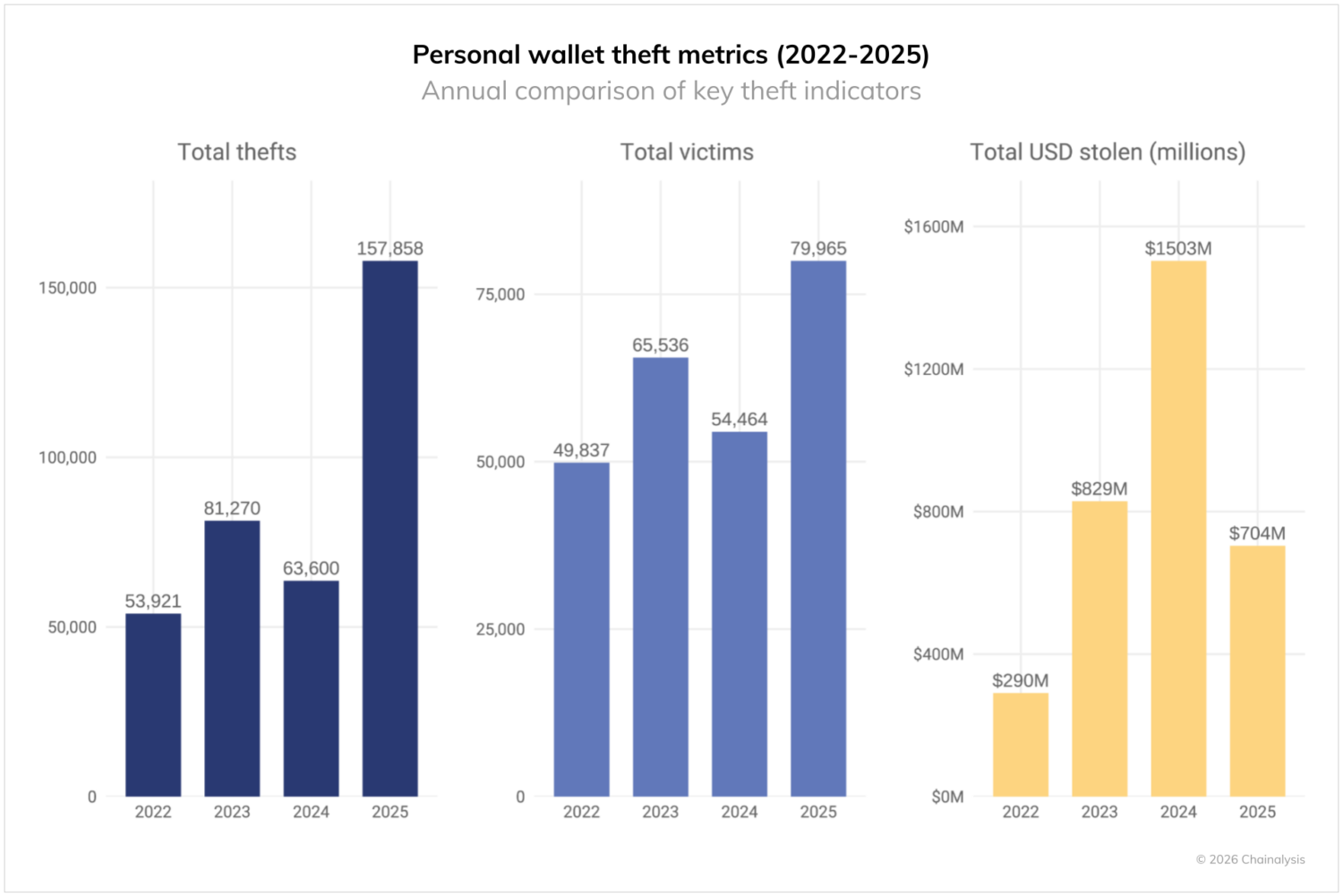

- Particular person pockets compromises surged to 158,000 incidents affecting 80,000 distinctive victims in 2025, although whole worth stolen ($713M) decreased from 2024.

- Regardless of elevated Whole Worth Locked in DeFi, hack losses remained suppressed in 2024-2025, suggesting improved safety practices are making a significant distinction.

The cryptocurrency ecosystem confronted one other difficult 12 months in 2025, with stolen funds persevering with their upward trajectory. Our evaluation reveals a shift in crypto theft patterns, characterised by 4 key developments: the persistence of the Democratic Individuals’s Republic of Korea (DPRK) as a major menace actor, the rising severity of particular person assaults on centralized providers, a surge in private pockets compromises, and an sudden divergence in decentralized finance (DeFi) hack developments.

These patterns emerge clearly from the info and reveal vital modifications in how crypto theft is happening throughout completely different platform varieties and sufferer classes. As digital asset adoption expands and valuations attain new heights, understanding these evolving safety threats has develop into more and more important.

The large image: Over $3.4 billion stolen in 2025

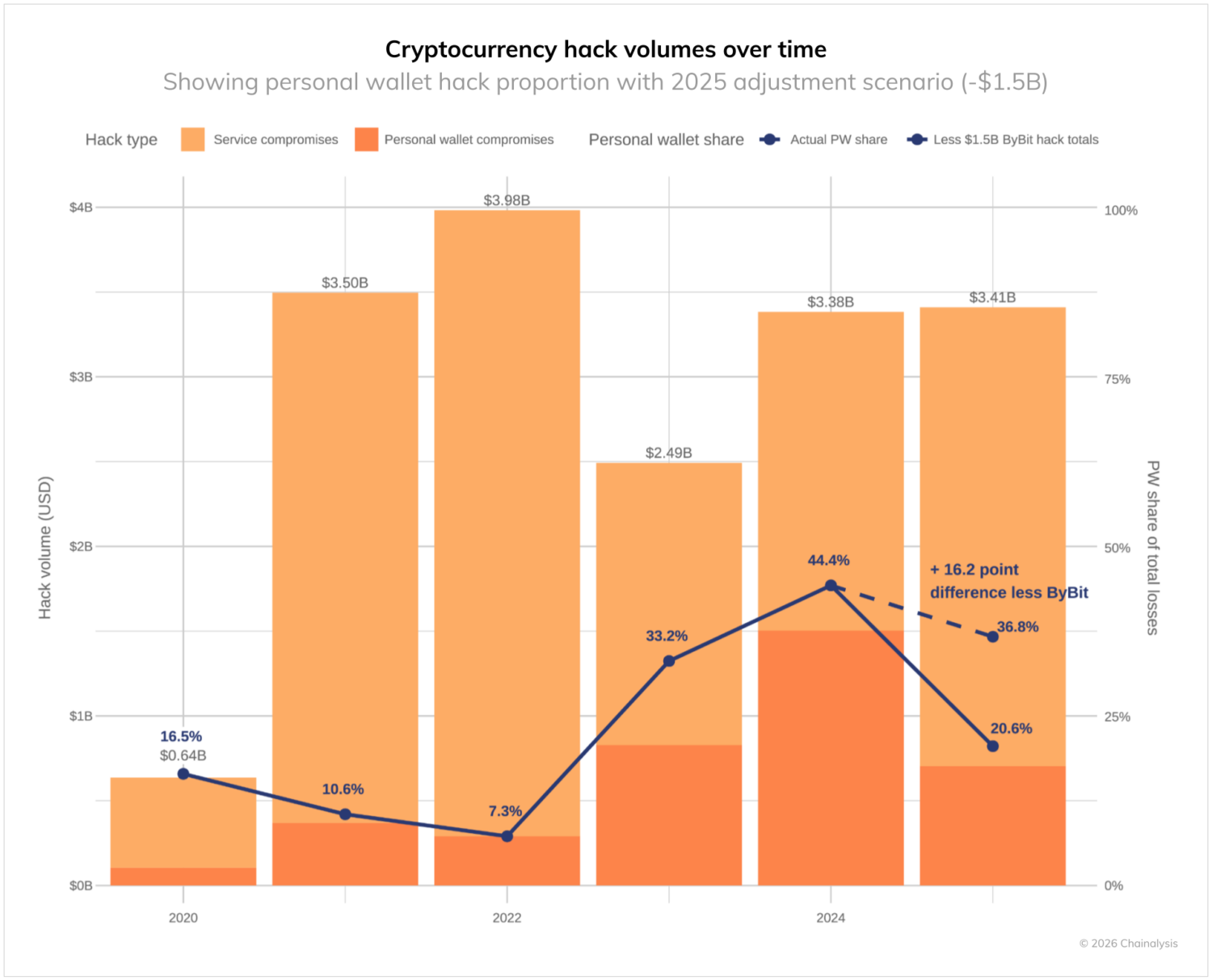

The cryptocurrency business witnessed over $3.4 billion in theft from January by way of early December 2025, with the February compromise of Bybit alone accounting for $1.5 billion of that whole.

Past the headline determine, the info reveal vital shifts within the composition of those thefts. Private pockets compromises have grown considerably, rising from simply 7.3% of whole stolen worth in 2022 to 44% in 2024. In 2025, the share would have been 37% if it weren’t for the outsized impression of the Bybit assault.

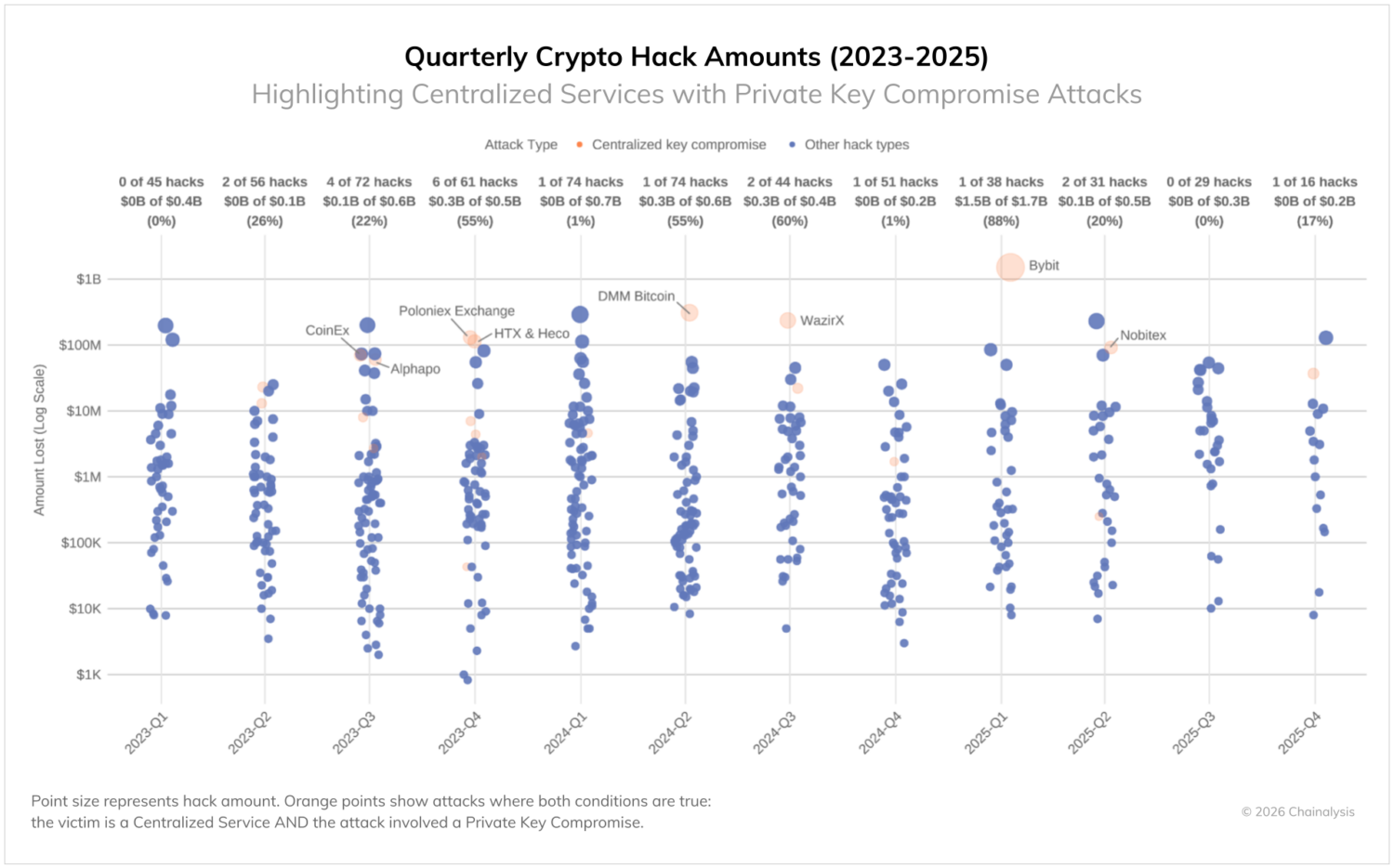

In the meantime, centralized providers are experiencing more and more giant losses attributable to personal key compromises. Regardless of their institutional sources {and professional} safety groups, these platforms stay weak due to this elementary safety problem. Whereas such compromises are rare (as proven within the chart beneath), their scale nonetheless drives monumental shares of stolen volumes once they do happen, accounting for 88% of losses in Q1 2025.

The persistence of excessive theft volumes signifies that whereas some areas of crypto security could also be enhancing, attackers proceed to seek out success throughout a number of vectors.

Prime three hacks account for 69% of losses as outliers attain 1,000 occasions the median

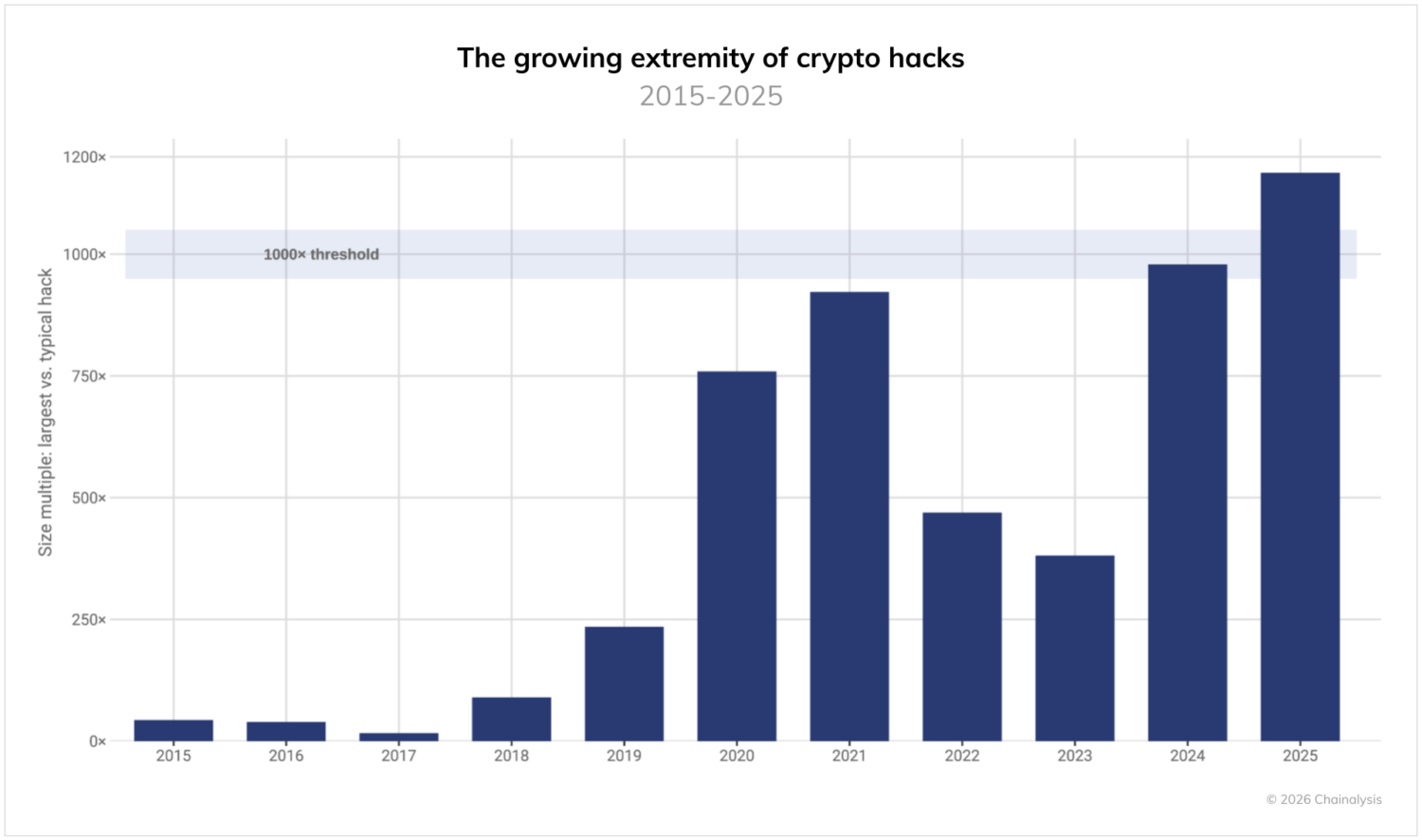

Stolen fund exercise has at all times been outlier-driven, with most hacks comparatively small and a few immense. However 2025 reveals a placing escalation: the ratio between the biggest hack and median of all incidents has crossed the 1,000x threshold for the primary time. Funds stolen within the largest assaults are actually 1,000 occasions bigger than these stolen within the typical incident, surpassing even the 2021 bull market peak. These calculations are based mostly on the USD values of funds stolen on the time of their theft.

This rising discrepancy has concentrated losses dramatically. The highest three hacks in 2025 account for 69% of all service losses, making a panorama the place particular person incidents have an outsized impression on yearly totals. Whereas the variety of incidents could fluctuate and median losses develop with asset costs, the potential for catastrophic particular person breaches is escalating sooner nonetheless.

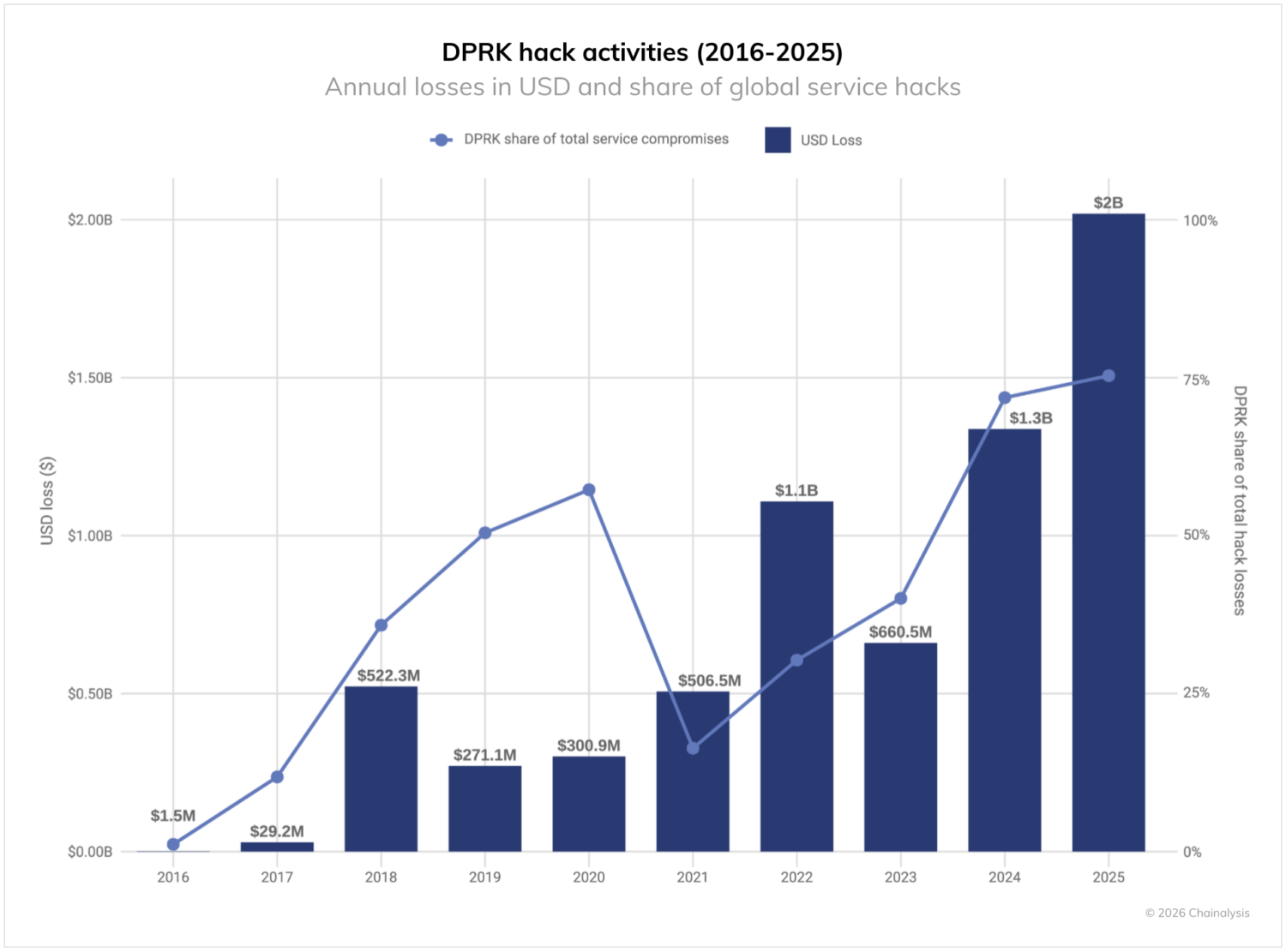

North Korea stays dominant crypto menace actor, regardless of fewer confirmed incidents

The Democratic Individuals’s Republic of Korea (DPRK) continues to pose probably the most vital nation-state menace to cryptocurrency safety, reaching a record-breaking 12 months for stolen funds regardless of an assessed dramatic discount in assault frequency. In 2025, North Korean hackers stole a minimum of $2.02 billion in cryptocurrency ($681 million greater than 2024), representing a 51% improve year-over-year. This marks probably the most extreme 12 months on document for DPRK crypto theft when it comes to worth stolen, with DPRK assaults additionally accounting for a document 76% of all service compromises. Total, 2025’s numbers convey the lower-bound cumulative estimate for cryptocurrency funds stolen by the DPRK to $6.75 billion.

North Korean menace actors are more and more reaching these outsized outcomes usually by embedding IT employees – one of DPRK’s principal attack vectors – inside crypto providers to realize privileged entry and allow excessive‑impression compromises. A part of this document 12 months possible displays an expanded reliance on IT employee infiltration at exchanges, custodians, and web3 corporations, which may speed up preliminary entry and lateral motion forward of huge‑scale theft.

Extra lately, nonetheless, DPRK-linked operators have flipped this IT employee mannequin on its head. As an alternative of merely making use of for roles and embedding themselves as workers, they’re more and more impersonating recruiters for outstanding web3 and AI corporations, orchestrating faux hiring processes that culminate in “technical screens” designed to reap credentials, supply code, and VPN or SSO entry to the sufferer’s present employer. On the govt stage, an analogous social‑engineering playbook seems within the type of bogus outreach from purported strategic buyers or acquirers, who use pitch conferences and pseudo–due diligence to probe for delicate methods data and potential entry paths into excessive‑worth infrastructure — an evolution that builds immediately on the DPRK’s IT employee fraud operations and their give attention to strategically vital AI and blockchain corporations.

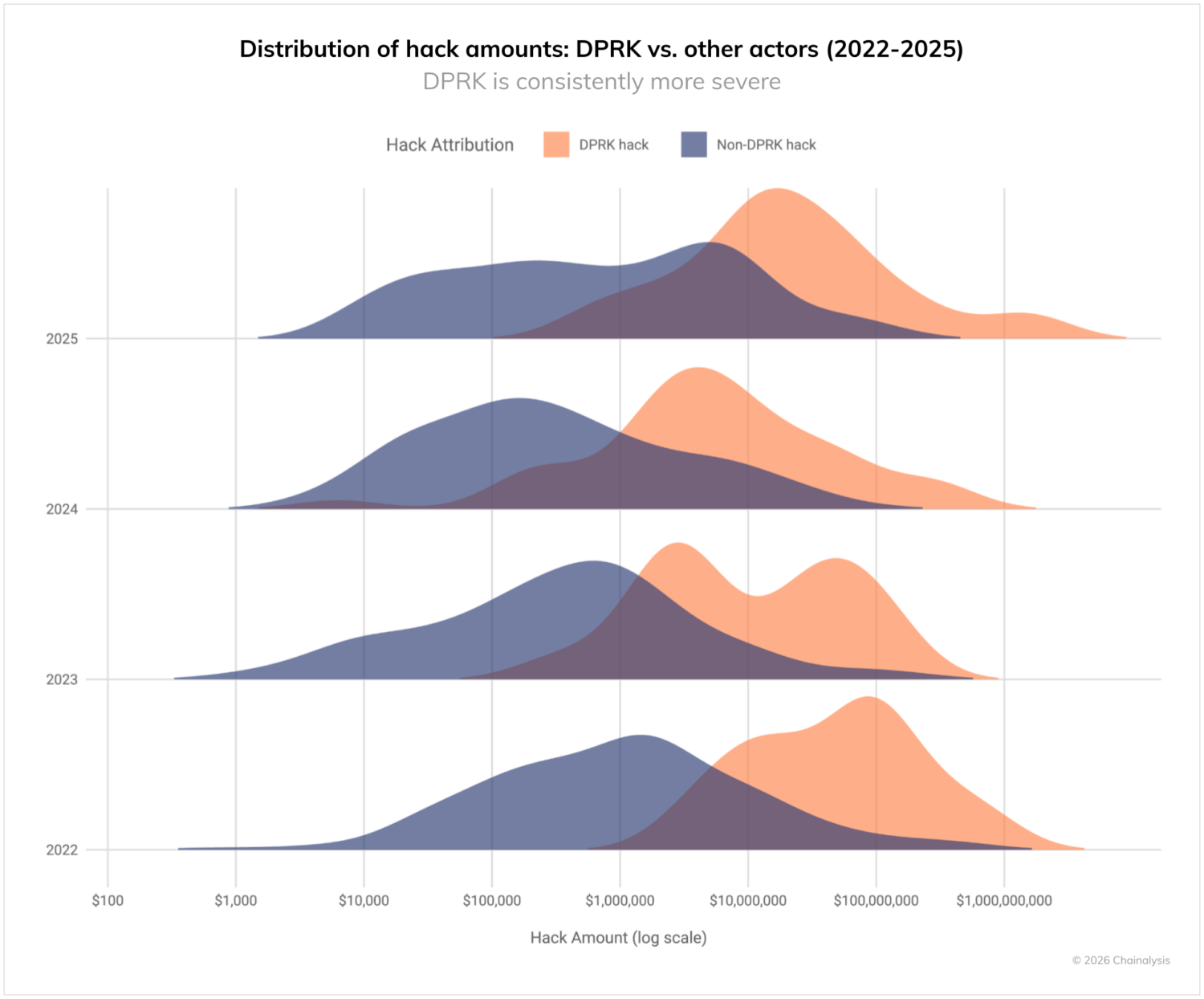

As we’ve got seen in years previous, the DPRK continues to undertake considerably higher-value assaults than different menace actors. As proven within the chart beneath, from 2022-2025, DPRK-attributed hacks occupy the best worth ranges, whereas non-DPRK hacks present extra regular distributions throughout all theft sizes. This sample reinforces that when North Korean hackers strike, they aim giant providers and goal for max impression.

This 12 months’s document haul got here from considerably fewer identified incidents. This shift — fewer incidents yielding far better returns — displays the impression of the huge Bybit hack in February 2025.

The DPRK’s distinctive laundering patterns

The huge inflow of stolen funds in early 2025 supplies unprecedented visibility into how DPRK-linked actors launder cryptocurrency at scale. Their patterns differ markedly from these of different cybercriminals and evolve over time, revealing present operational preferences and potential vulnerabilities.

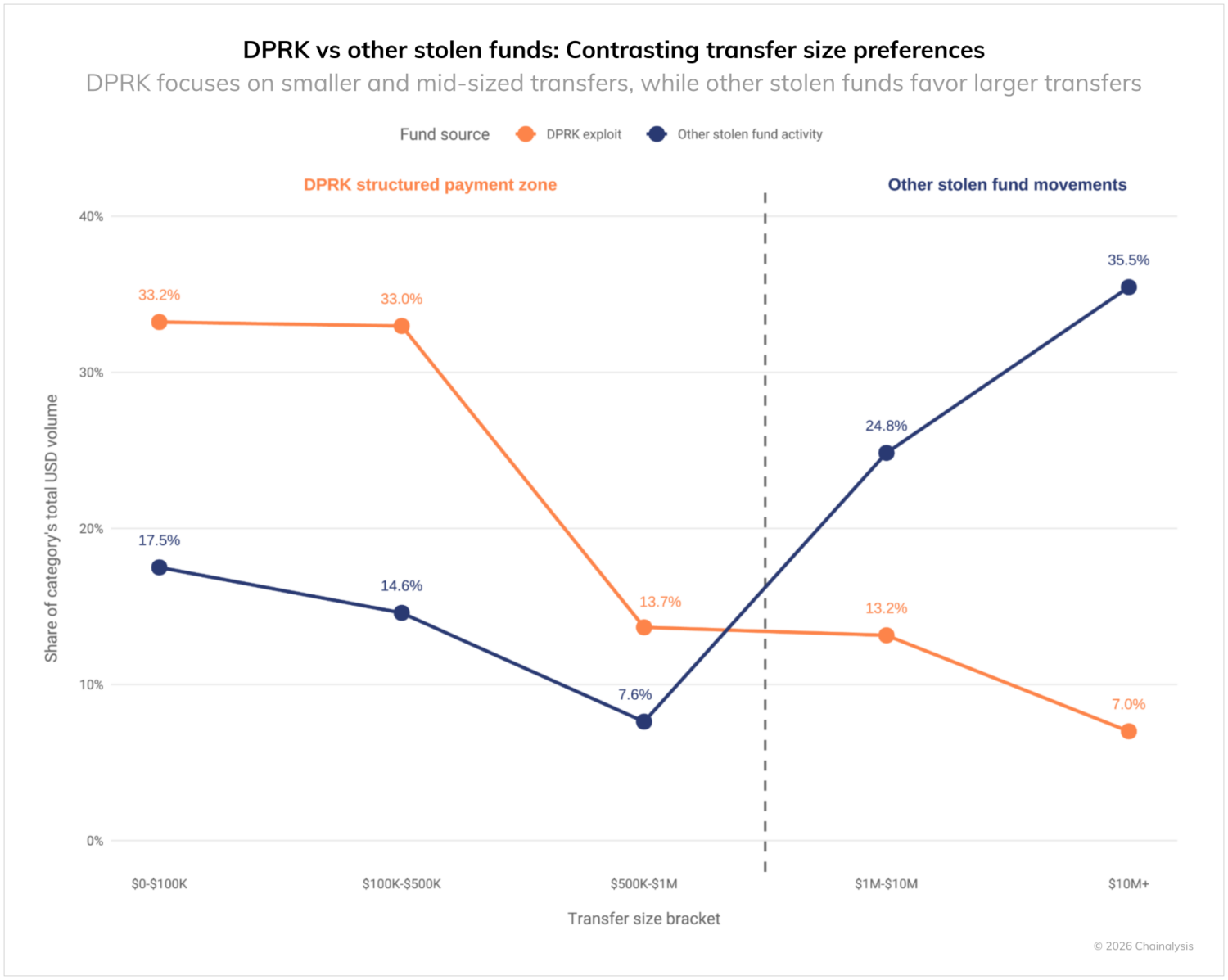

DPRK laundering reveals distinctive bracketing patterns, with barely over 60% of quantity concentrated beneath a $500,000 switch worth. In distinction, different stolen fund actors ship over 60% of their funds on-chain in tranches within the $1M to $10M+ vary. Even whereas the DPRK persistently steals bigger quantities than different stolen fund menace actors, they construction on-chain funds in smaller tranches, talking to the sophistication of their laundering.

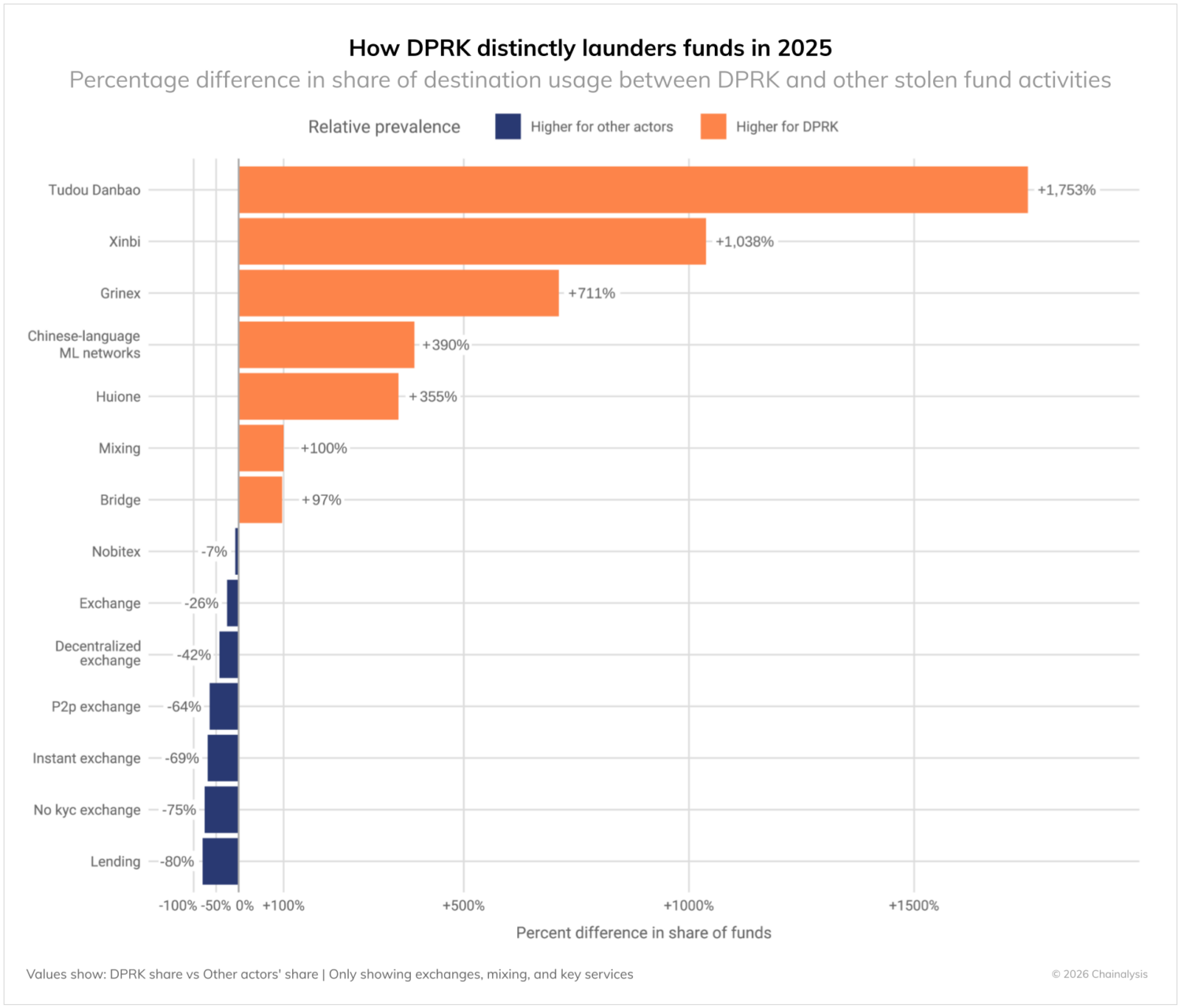

In comparison with different stolen fund actors, the DPRK reveals clear preferences for sure laundering touchpoints:

DPRK hackers are likely to strongly choose:

- Chinese language-language cash motion and assure providers (+355% to +1000%+): Their most distinctive attribute, displaying heavy reliance on Chinese language-language assure providers and cash laundering networks comprised of many alternative laundering operators which will have weaker compliance controls

- Bridge providers (+97% distinction): Heavy reliance on cross-chain bridges to maneuver belongings between blockchains and try and complicate tracing

- Mixing providers (+100% distinction): Higher use of blending providers to aim to obscure the stream of funds

- Specialised providers like Huione (+356%): Strategic use of particular providers that facilitate their laundering operations

Different stolen fund actors are likely to strongly choose:

- Lending protocols (-80% distinction): DPRK avoids these DeFi providers, displaying restricted integration with the broader DeFi ecosystem

- No KYC exchanges (-75% distinction): Surprisingly, different menace actors use KYC-free exchanges greater than DPRK

- P2P exchanges (-64% distinction): DPRK reveals restricted curiosity in peer-to-peer platforms

- Centralized exchanges (-25% distinction): Different criminals show extra direct interactions with typical change platforms

- Decentralized exchanges (DEXs) (-42% distinction): Different menace actors strongly choose DEXs for his or her liquidity and pseudonymity

These patterns recommend that the DPRK operates beneath completely different constraints and targets than these of non-state-backed cybercriminals. Their heavy use {of professional} Chinese language-language cash laundering providers and over-the-counter (OTC) merchants means that DPRK menace actors are tightly built-in with illicit actors throughout the Asia-Pacific area, and is per Pyongyang’s historic use of China-based networks to realize entry to the worldwide monetary system.

The timeline of stolen fund laundering post-DPRK hacks

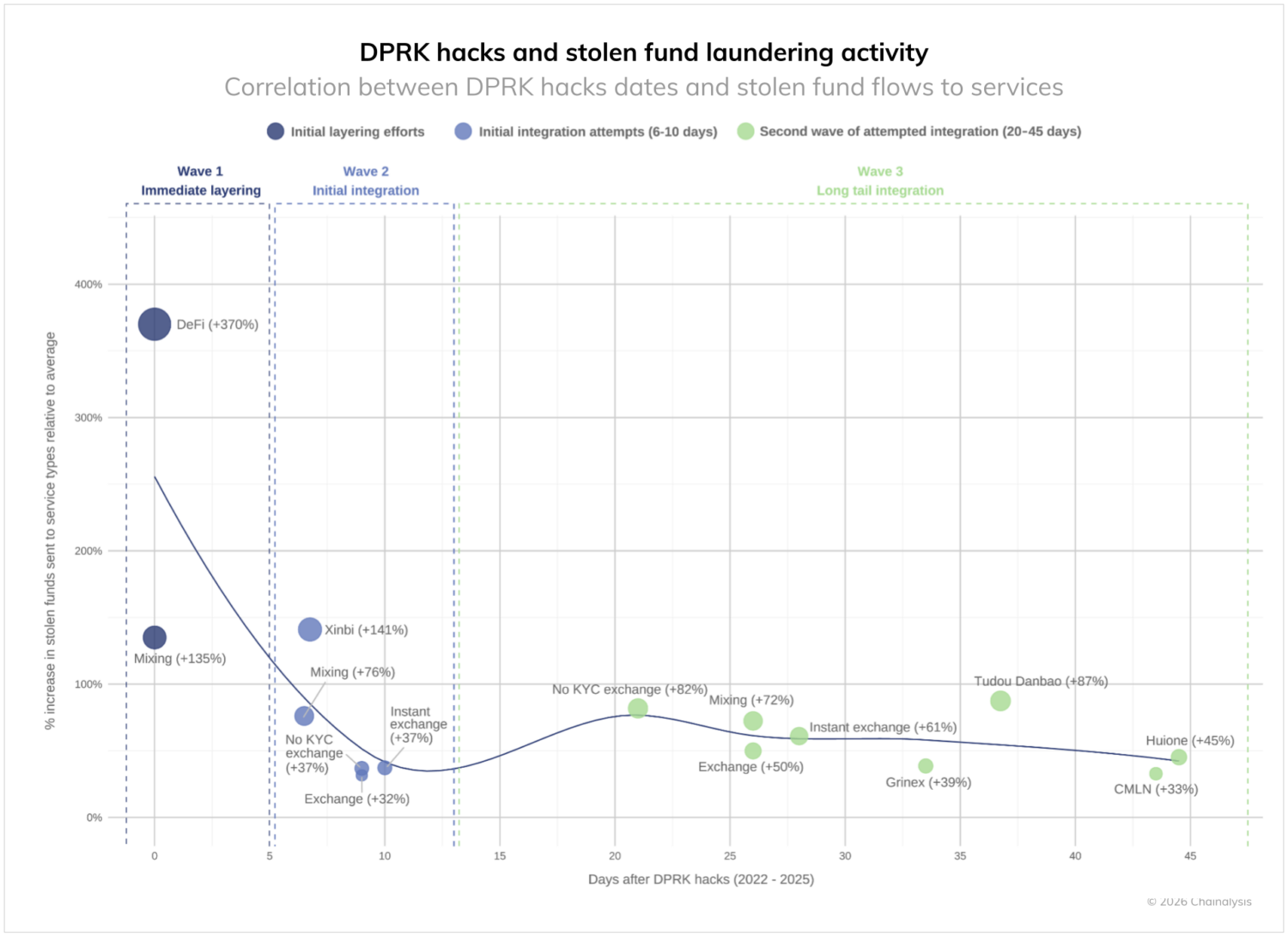

Our evaluation of on-chain exercise following DPRK-attributed hacks reveals a constant sample in how these occasions are related to the motion of stolen funds all through the cryptocurrency ecosystem. Following main theft occasions between 2022-2025, stolen funds observe a structured, multi-wave laundering pathway that unfolds over roughly 45 days:

Wave 1: Quick layering (days 0-5)

Throughout the preliminary days after a hack, we observe a rare spike in exercise targeted on quick distancing of funds from the theft supply:

- DeFi protocols see probably the most dramatic improve (+370%) in stolen fund flows, serving as the first entry level

- Mixing providers expertise substantial quantity will increase (+135-150%), creating the primary layer of obfuscation

- This section represents pressing “first-move” efforts to ascertain distance from the unique theft

Wave 2: Preliminary integration (days 6-10)

Because the second week begins, the technique shifts towards providers that may assist combine funds into the broader ecosystem:

- Exchanges with restricted KYC (+37%) and centralized exchanges (+32%) start receiving flows

- Second-tier mixing providers (+76%) proceed the laundering course of at decreased depth

- Cross-chain bridges like XMRt (+141%) assist fragment and obscure fund motion throughout blockchains

- This section represents the important transitional interval the place funds start transferring towards potential off-ramps

Wave 3: Lengthy tail integration (days 20-45)

The ultimate section reveals clear desire for providers that may facilitate final conversion to fiat or different belongings:

- No-KYC exchanges (+82%) and assure providers like Tudou Danbao (+87%) see vital will increase

- Instantaneous exchanges (+61%) and Chinese language-language platforms like Huione (+45%) function ultimate conversion factors

- Centralized exchanges (+50%) additionally obtain funds, suggesting subtle makes an attempt to combine with authentic flows

- Much less regulated jurisdictions represented by platforms similar to Chinese language-language cash laundering networks (+33%) and Grinex (+39%) full the sample

This normal 45-day window for laundering operations supplies essential intelligence for regulation enforcement and compliance groups. The sample’s persistence throughout a number of years signifies operational constraints dealing with DPRK-linked actors, possible associated to their restricted entry to monetary infrastructure and must coordinate with particular facilitators.

Whereas these actors don’t at all times observe this precise timeline—some stolen funds stay dormant for months or years—this sample represents their typical on-chain habits when actively laundering proceeds. It’s additionally vital to acknowledge potential blind spots on this evaluation, as sure actions like personal key transfers or OTC crypto-for-fiat gross sales wouldn’t be seen on-chain with out corroborative intelligence.

Private pockets compromises: The escalating menace to particular person customers

Via evaluation of on-chain patterns, along with reporting from victims and business companions, we are able to acquire an understanding of the magnitude of private pockets compromises, though the true variety of compromises is probably going far better. Based mostly on our decrease sure estimates, private pockets compromises now account for 20% of all worth stolen in 2025, down from 44% of the whole in 2024, representing an evolution in each scale and sample. Whole theft incidents surged to 158,000 in 2025, almost triple the 54,000 recorded in 2022. Distinctive victims elevated from 40,000 in 2022 to a minimum of 80,000 in 2025. These dramatic will increase are possible attributable to better crypto adoption. For instance, Solana, one of many blockchains with the best variety of energetic private wallets, had by far the biggest variety of incidents (~26,500 victims).

But regardless of extra incidents and victims, the whole USD worth stolen from particular person victims really declined from 2024’s peak of $1.5 billion to $713 million in 2025. This means that attackers are concentrating on extra customers, however stealing smaller quantities per sufferer.

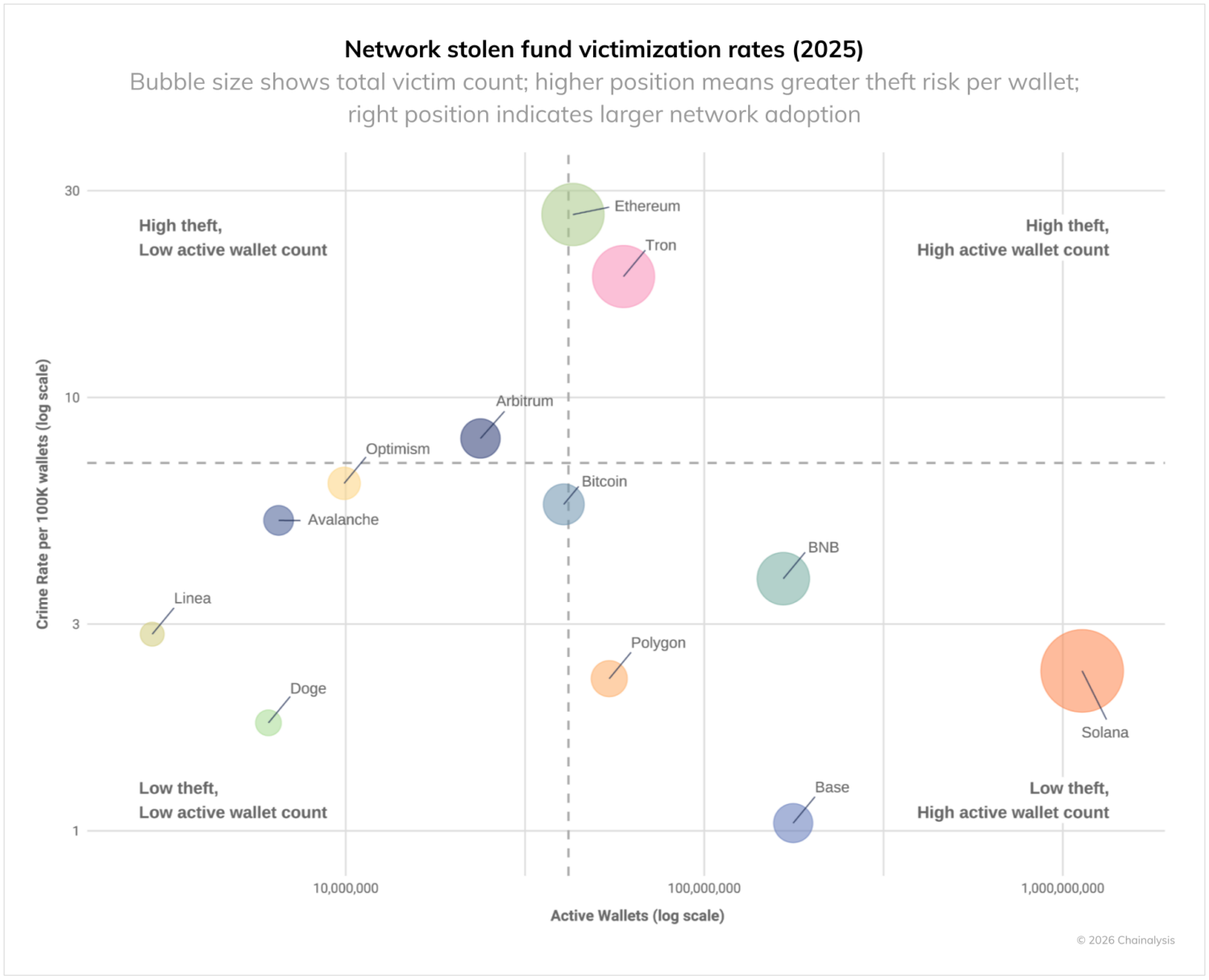

Community-specific victimization knowledge supplies extra perception into which domains current the best danger to crypto customers. The chart beneath presents victimization knowledge adjusted for energetic private wallets throughout networks. When measuring crime charges per 100K wallets in 2025, Ethereum and Tron present the best charges of theft. Ethereum’s giant measurement signifies each excessive charges of theft and excessive sufferer rely, whereas Tron’s place reveals elevated price of theft regardless of a smaller energetic pockets base. In distinction, Base and Solana present decrease victimization charges regardless of vital person bases.

These measurable variations spotlight that non-public pockets safety dangers are usually not uniform throughout the crypto ecosystem. The variation in victimization charges throughout chains with comparable technical architectures means that components past know-how — similar to person demographics, widespread purposes, and legal infrastructure — play vital roles in figuring out theft charges.

DeFi hacks: A diverging sample alerts market shift

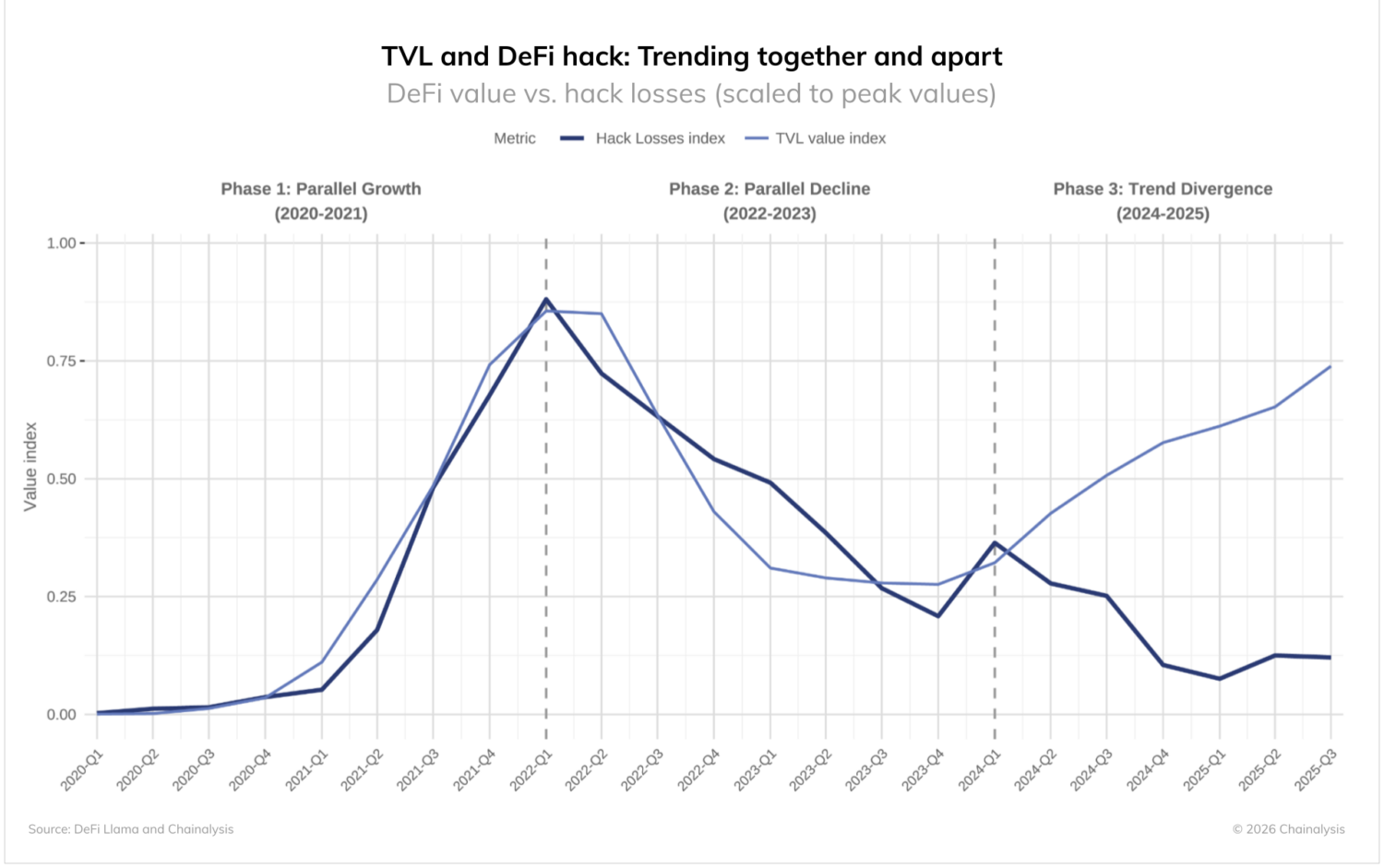

The DeFi sector presents a singular sample in 2025’s crime knowledge, displaying a transparent divergence from historic developments.

The information reveal three distinct phases:

- Section 1 (2020-2021): DeFi whole worth locked (TVL) and hack losses grew in parallel

- Section 2 (2022-2023): Each metrics declined collectively

- Section 3 (2024-2025): TVL recovered whereas hack losses remained suppressed

The primary two phases observe an intuitive sample: better worth in danger means each extra worth to steal and better legal effort concentrating on high-value protocols. Because the notorious financial institution robber Willie Sutton supposedly stated: “As a result of that’s the place the cash is.”

This makes Section 3’s divergence from historic precedent all of the extra notable. DeFi TVL has recovered considerably from its 2023 lows, but hack losses haven’t adopted swimsuit. The sustained decrease stage of DeFi hacks whilst billions of {dollars} have returned to those protocols represents a significant change.

Two components could clarify this divergence:

- Improved safety: Persistently decrease hack charges regardless of rising TVL recommend that DeFi protocols could also be implementing simpler safety measures in comparison with the 2020-2021 interval.

- Goal substitution: The concurrent rise in private pockets thefts and centralized service compromises means that attacker consideration could also be shifting to different targets.

Case examine: Venus Protocol’s safety response

The Venus Protocol incident of September 2025 exemplifies how improved safety practices are making a tangible distinction. When attackers used a compromised Zoom shopper to realize system entry and manipulate a person into granting delegate standing over a $13 million account, the end result may have been catastrophic. Nonetheless, Venus had onboarded Hexagate‘s safety monitoring platform only one month prior.

The platform detected suspicious exercise 18 hours earlier than the assault and generated one other alert as quickly because the malicious transaction occurred. Inside 20 minutes, Venus had paused its protocol, stopping any fund actions. The coordinated response demonstrated the evolution of DeFi safety:

- Inside 5 hours: Partial performance restored after safety checks

- Inside 7 hours: Pressure-liquidation of the attacker’s pockets

- Inside 12 hours: Full restoration of stolen funds and repair resumption

Most remarkably, Venus handed a governance proposal to freeze $3 million in belongings nonetheless managed by the attacker; the attacker not solely didn’t revenue, however really misplaced cash, as effectively.

This incident illustrates tangible enhancements in DeFi safety infrastructure. The mixture of proactive monitoring, fast response capabilities, and governance mechanisms that may act decisively has made the ecosystem extra agile and resilient. Whereas assaults nonetheless happen, the flexibility to detect, reply, and even reverse them represents a elementary shift from the early DeFi period when profitable hacks usually meant everlasting losses.

Implications for 2026 and past

The 2025 knowledge current a posh image of DPRK’s evolution as a crypto menace actor. The nation state’s capacity to execute fewer however way more damaging assaults demonstrates rising sophistication and persistence. The Bybit incident’s impression on its yearly exercise patterns means that when DPRK efficiently executes a serious theft, it reduces operational tempo to give attention to laundering the proceeds.

For the cryptocurrency business, this evolution calls for enhanced vigilance round high-value targets and improved detection of DPRK’s particular laundering patterns. Their constant preferences for sure service varieties and switch quantities present detection alternatives, distinguish them from different criminals, and may also help investigators determine their on-chain behavioral footprint.

As North Korea continues to make use of cryptocurrency theft to fund state priorities and circumvent worldwide sanctions, the business should acknowledge that this menace actor operates by completely different guidelines than typical cybercriminals. The nation’s record-breaking 2025 efficiency — achieved with 74% fewer identified assaults — suggests we could also be seeing solely probably the most seen portion of its actions. The problem for 2026 might be detecting and stopping these high-impact operations earlier than DPRK-affiliated actors inflict one other Bybit-scale incident.

This web site incorporates hyperlinks to third-party websites that aren’t beneath the management of Chainalysis, Inc. or its associates (collectively “Chainalysis”). Entry to such data doesn’t indicate affiliation with, endorsement of, approval of, or suggestion by Chainalysis of the location or its operators, and Chainalysis isn’t liable for the merchandise, providers, or different content material hosted therein.

This materials is for informational functions solely, and isn’t supposed to supply authorized, tax, monetary, or funding recommendation. Recipients ought to seek the advice of their very own advisors earlier than making a majority of these selections. Chainalysis has no accountability or legal responsibility for any choice made or every other acts or omissions in reference to Recipient’s use of this materials.

Chainalysis doesn’t assure or warrant the accuracy, completeness, timeliness, suitability or validity of the knowledge on this report and won’t be liable for any declare attributable to errors, omissions, or different inaccuracies of any a part of such materials.