- What’s the 3 5 7 Rule?

- How and Why the 3-5-7 Rule Was Developed?

- Breaking Down the three 5 7 Rule

- The ‘3’ within the 3 5 7 Rule

- The ‘5’ within the 3 5 7 Rule

- The ‘7’ within the 3 5 7 Rule

- Case Instance: Constructing a 3-5-7 Portfolio

- Implementing the 3-5-7 Rule in Your Buying and selling

- Adapting to Market Situations

- Making the 3-5-7 Rule Even Stronger

- FAQs

What’s the 3 5 7 Rule?

Merchants typically look for easy guidelines that deliver construction to threat management, place sizing, and revenue planning, and the 3 5 7 rule has gained traction as a result of it transforms advanced choices into a transparent percentage-based framework that applies throughout equities, crypto, futures, and techniques just like the strangle technique, particularly when timing entries throughout high-impact intraday buying and selling time home windows the place market conduct adjustments rapidly.

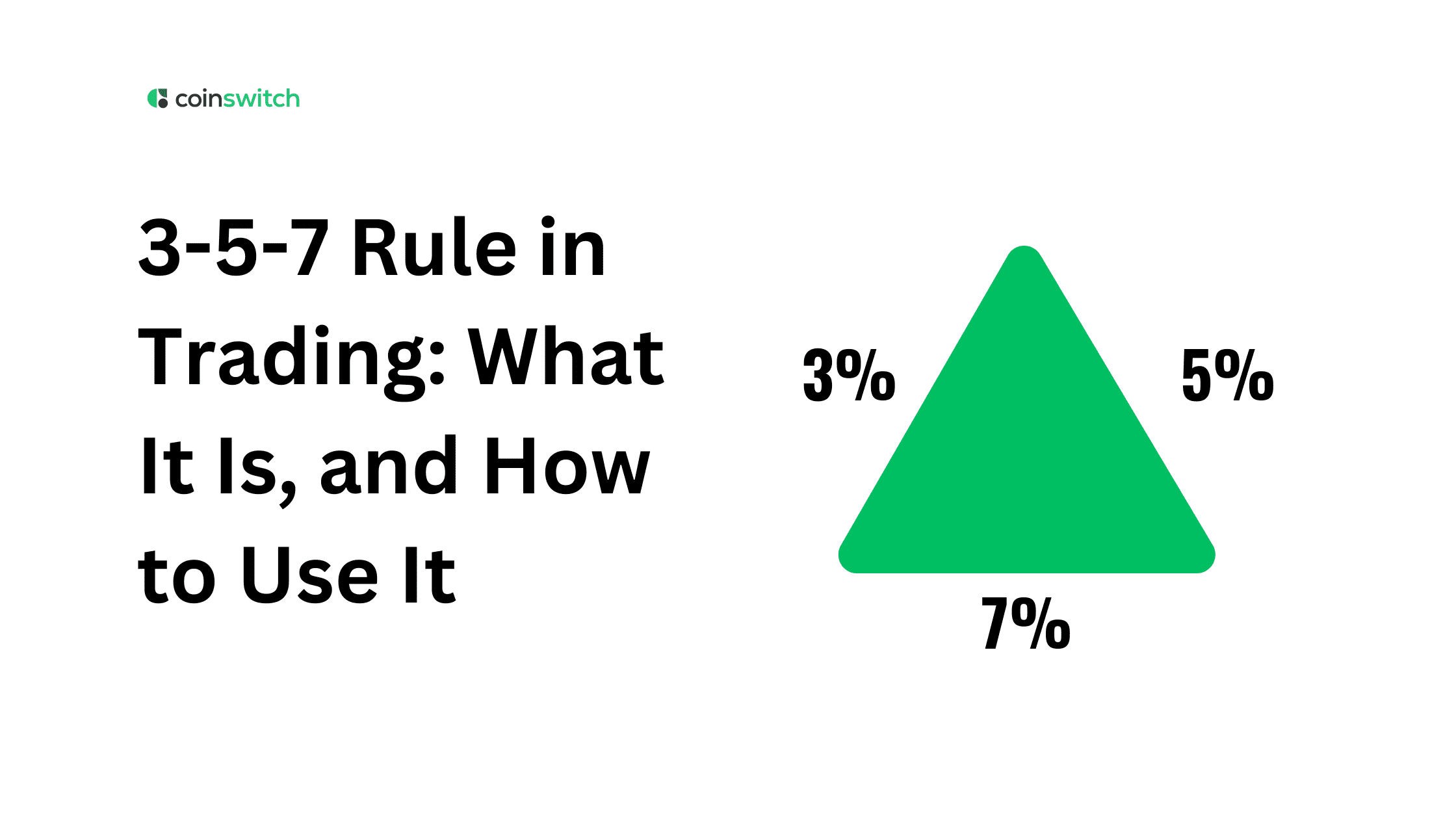

The 3 5 7 rule is a threat administration technique in buying and selling constructed round three core ideas:

- Danger not more than 3% of your capital on a single commerce

- Restrict publicity to five% of capital throughout all open positions

- Goal round 7% revenue or keep a reward goal aligned with that degree

The rule gives a transparent construction that merchants can apply immediately throughout belongings, timeframes, and techniques.

How and Why the 3-5-7 Rule Was Developed?

The event of the 3 5 7 rule traces again to the evolution of retail buying and selling in schooling. As newcomers entered markets with restricted threat information, many began looking for easy percentage-based methods. Over time, mentors and authors highlighted the concept threat per commerce must be sufficiently small to outlive dropping streaks, publicity ought to stay capped, and winners ought to goal for significant targets.

The rule attracts on well-known concepts reminiscent of fastened fractional place sizing, reward-to-risk concentrating on, and publicity administration. Over time, buying and selling communities adopted the odds as a result of they have been simple to recollect. The sequence — 3, 5, 7 — gave merchants an prompt psychological guidelines. This construction helped newcomers and skilled merchants construct self-discipline in risky markets the place choices typically unfold rapidly, particularly throughout intense intraday buying and selling time durations when momentum surges.

The rule additionally adapts throughout the buying and selling spectrum. It fits directional trades, swing positions, and even volatility-oriented hedge setups. Merchants utilizing a strangle technique in choices typically depend on outlined threat and structured targets, and the 3-5-7 guideline aligns with that mindset.

Breaking Down the three 5 7 Rule

The rule breaks into three actionable elements that work in concord:

| Part | Goal | Impact on Buying and selling |

|---|---|---|

| 3% Danger | Max threat per commerce | Prevents giant capital drawdowns |

| 5% Publicity | Max whole open-trade publicity | Retains portfolio managed, avoids clustering |

| 7% Goal | Reward goal | Encourages significant earnings and favorable ratios |

Every half works independently but strengthens the others. When threat stays managed at 3%, publicity stays contained, and the dealer goals for targets with construction, decision-making turns into cleaner.

The ‘3’ within the 3 5 7 Rule

The primary element of this technique units a strict restrict: threat not more than 3% of capital on any commerce. Danger means the space between entry and stop-loss multiplied by place dimension. This quantity protects merchants from overcommitting. For instance, with ₹100,000 in capital, a dealer should restrict most loss per commerce to ₹3,000.

This rule encourages exact place sizing. Merchants should calculate the suitable lot dimension or token amount primarily based on their stop-loss distance. It refines considering round entry factors, cease placements, and commerce planning. Throughout risky intraday buying and selling time home windows — reminiscent of opening strikes or pre-close breakouts — the three% cap turns into particularly vital as volatility can rapidly widen cease distances.

The three% restrict additionally works nicely in choices buying and selling. When merchants construct a strangle strategy, threat per leg or the mixed premium may be managed inside the 3% threshold.

Learn Extra: Top 10 Cryptos To Invest By Tokenomics / Distribution

The ‘5’ within the 3 5 7 Rule

The second element ensures whole threat publicity throughout all open positions stays beneath 5% of capital. This prevents overextension.

As an illustration, if a dealer dangers 2% on two trades, each collectively threat 4%. A 3rd commerce risking 2% would push publicity to six%, violating the rule of thumb. The 5% restrict ensures all open trades align with managed portfolio conduct.

The rule helps diversification and prevents correlated loss sequences. Markets typically transfer in clusters — crypto pairs, sectors, indices — and when conduct synchronizes, a number of positions would possibly react the identical method. The 5% ceiling retains the general threat image secure.

Throughout energetic periods inside intraday buying and selling time, when merchants might really feel tempted to take a number of fast entries, this rule serves as an anchor. It reminds the dealer to judge the general portfolio threat earlier than opening new positions. The ceiling retains capital protected against chain reactions.

In methods just like the strangle technique, merchants should additionally monitor whether or not a number of possibility legs collectively exceed the 5% total threat mark.

The ‘7’ within the 3 5 7 Rule

The ultimate quantity focuses on reward: concentrating on roughly 7% revenue or sustaining a reward goal that represents significant upside in comparison with threat. With 3% threat and a 7% goal, the reward outweighs the chance comfortably.

This helps merchants keep optimistic expectancy even with reasonable win charges. If losses stay small and winners carry important weight, the portfolio grows steadily.

The 7% goal applies throughout contexts:

- In smaller timeframes throughout intraday buying and selling time, it might symbolize a reward-to-risk ratio quite than a precise 7%.

- In multi-day trades, 7% would possibly map straight to cost targets or volatility expansions.

- In a strangle technique, merchants typically body the potential reward round volatility breakouts that align with the chance administration technique.

Learn Extra: Top 10 Cryptos To Invest by Total Supply

Case Instance: Constructing a 3-5-7 Portfolio

Let’s contemplate a sensible instance with ₹200,000 in capital.

Making use of the rule provides:

| Technique | Calculation | Output |

|---|---|---|

| 3% Danger Per Commerce | 0.03 × 200,000 | ₹6,000 most threat |

| 5% Publicity Cap | 0.05 × 200,000 | ₹10,000 most uncovered |

| 7% Goal | 0.07 × 200,000 | ₹14,000 revenue goal |

Right here, the dealer enters the commerce risking ₹6,000 by inserting a stop-loss aligned with volatility. A goal is about close to ₹14,000. If that is the one open commerce, publicity stays inside the 5% ceiling.

If the dealer needs two open trades, every commerce should threat round 2% to take care of the 5% total restrict. This construction ensures that even correlated losses is not going to severely influence capital.

Throughout highly effective setups in risky intraday buying and selling time, merchants might modify place sizes to take care of these limits whereas reacting rapidly to cost motion. When buying and selling derivatives with a strangle technique, threat outlined by premium outlay should stay inside the ₹6,000 cap.

Implementing the 3-5-7 Rule in Your Buying and selling

Implementing the 3 5 7 rule requires consistency and planning. The rule matches simply into most buying and selling workflows, and merchants typically combine it into journals, scanners, and automatic alerts.

Key Implementation Steps:

- Resolve capital per commerce primarily based on the three% restrict.

- Place stop-losses instantly, aligned with volatility.

- Consider cumulative publicity earlier than opening a brand new place.

- Set targets reflecting the 7% goal.

- Handle trades actively throughout intraday buying and selling home windows when volatility gives alternatives.

- When utilizing a strangle technique, outline most premium threat forward of time.

Sensible Instruments to Help the Rule:

- Place-size calculators

- Danger dashboards

- Journaling templates

- Alert methods

- Volatility scanners

- Multi-asset publicity trackers

Adapting to Market Situations

Market conduct adjustments throughout periods, weeks, and financial cycles, and the 3 5 7 rule adapts nicely when merchants apply its percentages with flexibility.

Adaptation Concepts:

- Cut back threat beneath 3% throughout high-uncertainty occasions.

- Develop targets past 7% throughout sturdy tendencies.

- Tighten publicity beneath 5% if a number of belongings transfer in correlation.

- Alter sizing throughout quiet intraday buying and selling time durations.

- When utilizing a strangle technique, modify strike spacing to maintain threat contained in the rule.

Avoiding Widespread Errors

A number of recurring errors are made by merchants who attempt to implement the three 5 7 rule:

- Miscalculating threat and exceeding 3% restrict unintentionally

- Opening too many trades and crossing the 5% threshold

- Setting unrealistic 7% targets in low-volatility circumstances

- Ignoring the correlation between belongings

- Utilizing incorrect place sizes throughout a strangle technique

- Buying and selling aggressively throughout weaker intraday buying and selling time durations

- Shifting stop-losses with out adjusting threat accurately

Making the 3-5-7 Rule Even Stronger

Merchants improve the three 5 7 rule by pairing it with structured evaluation, volatility metrics, and efficiency opinions.

Enhancement Strategies:

- Mix the rule with trend-confirmation instruments

- Use volatility indicators to put correct cease losses

- Establish optimum intraday buying and selling time home windows for execution

- Apply the rule to hedge positions in a strangle technique setup

- Again-test the rule to know efficiency

- Observe expectancy by way of journaling

- Keep a constant exposure-tracking dashboard

FAQs

1. What’s the 3 5 7 technique?

It’s a percentage-based buying and selling framework that limits threat to three%, caps publicity at 5%, and goals for a revenue of round 7%.

2. What’s the 90-90-90 rule for merchants?

The 90-90-90 notion holds that 90% of merchants lose 90% of their capital, typically inside the first 90 days. It’s a group remark quite than a proper rule.

3. What’s the inventory 7% rule?

The inventory 7% rule is an exit guideline, the place merchants select to exit positions if the worth declines roughly 7% from their entry level.