“I used to learn Mr. Cash Mustache”,

some individuals say as of late,

“Till he received all wealthy and fancy in order that he not understands the widespread particular person’s plight.

Stash in all probability doesn’t even observe any of those money-saving issues he preaches any extra!”

After I learn issues like this, I can’t assist however snort. As a result of on the one hand, whenever you put a bunch of private life particulars on-line like this, being misunderstood is simply a part of the bundle. However however, if the critics may peek in and see our actual lives – not simply mine however these of all of the Mustachians – they must hand over their conspiracy theories and settle for the truth that these things simply works.

As a result of actually, not a lot has modified in the case of the fundamentals. Like many MMM readers over the previous twelve years, my whole wealth degree has elevated fairly recurrently. But additionally like many people, I haven’t felt the necessity to change very a lot about my spending as a result of I used to be doing my greatest to reside an fulfilling life within the first place.

How have so many individuals discovered such nice success? I believe we Mustachians have one thing that’s a bit extra uncommon and particular than commonplace monetary recommendation, which is what makes it work so properly:

Commonplace Recommendation:

Slash your spending and make sacrifices till you attain a sure financial savings share, and past that it doesn’t matter, it’s all private alternative. Extra revenue? Nice, meaning you don’t should sacrifice as a lot! FatFIRE for everybody!

Mustachianism:

Domesticate a love of effectivity, creativity, self consciousness, and self enchancment. Use this data to enhance your life in all methods, together with these which enable you reside higher at the same time as your month-to-month expense charge drops over time.

So what does this imply in observe?

Nicely, I’ll provide you with some examples from my very own present-day life. Issues I do as a result of I occur to take pleasure in them, which additionally occur to save lots of some huge cash. A few of these are regular, some are foolish and should find yourself in some future gossip journal hit piece, however all of them occur to work for me, so the critics will be damned.

As I checklist every merchandise, I’ll embody an estimate of how a lot the exercise saves me per decade, since you ought to all the time assume a minimum of by way of many years.

To make that calculation your self, simply use the “rule of 172” – take a month-to-month expense and multiply it by 172 to estimate how a lot it could compound into over ten years, if invested.

1) Fixing my very own Home (and all people else’s too)

I’m an enormous believer in self-sufficiency, and dealing to construct up the abilities to handle an important elements of your individual life with out relying on too many issues (or individuals) which might be exterior of your management. In different phrases, one large recipe for a contented life is solely to Grow to be a Producer of the Issues You Most Take pleasure in Consuming.

And in my case, I occur to like homes. I like residing in stunning, useful areas and sharing them with mates. However most homes are ugly and poorly designed whenever you purchase them, so I spotted that I additionally love fixing issues and redesigning previous buildings to change into new once more. I take pleasure in this course of a lot that I spend most of my free time doing it – on each my very own properties and the properties of mates.

And I really like educating different individuals to realize energy over their very own homes too. It’s wonderful how nice individuals really feel as they lose their worry and dependence on exterior contractors, and acquire the flexibility to repair and preserve issues with their very own two fingers.

Financial savings: A mean of $20,000 per 12 months = $287,000 per decade

2) Craigslist and Group

You already know what’s nice? Having a lot cash that you could purchase no matter you need – top quality issues which get delivered to your entrance door the very subsequent day.

You already know what’s even higher? Not shopping for a few of these new issues, and as an alternative discovering methods to share, repurpose and purchase equally top quality objects from different individuals who don’t want them any extra. All whereas increase your individual group and creating new friendships within the course of.

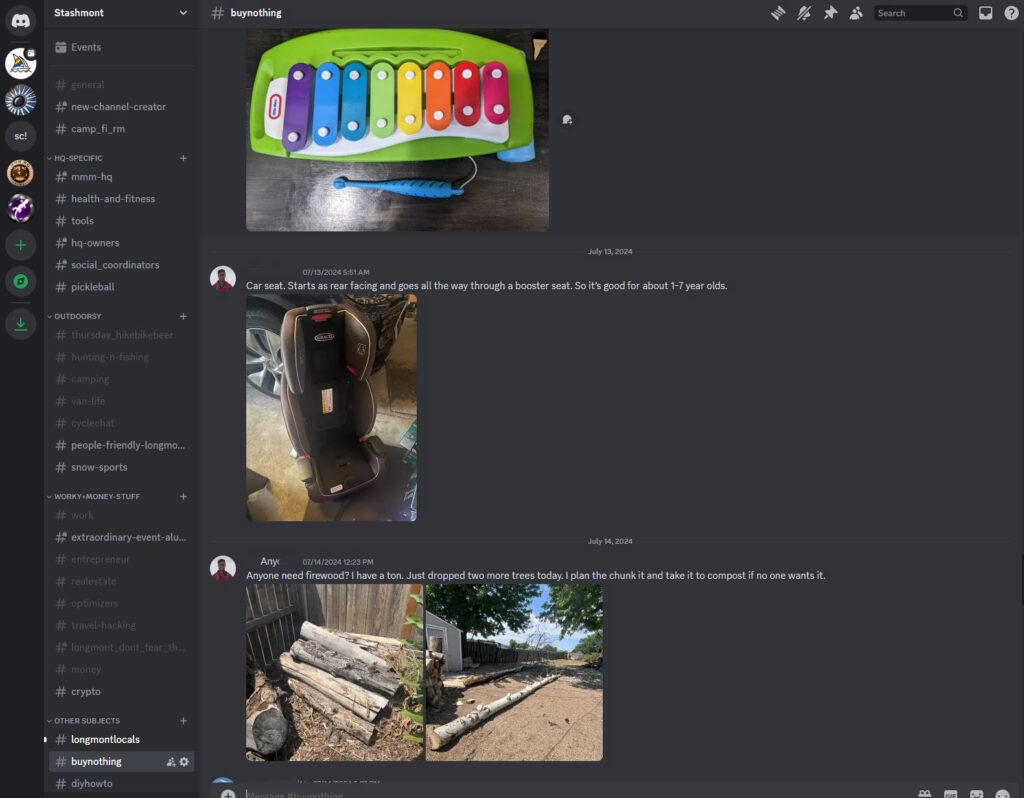

Craigslist, Fb Market, and even NextDoor all have Purchase Nothing teams for many areas. Within the MMM-HQ community, we run a Discord server with about 200 native individuals, who chat across the clock on a variety of topics. They assist one another with main tasks in a single channel known as #diyhowto, and provides away and promote issues on #forsale and #buynothing.

Though our non-public Discord group is my favourite, I additionally use Craigslist recurrently, and possibly save (and earn) just a few thousand yearly due to the behavior:

Financial savings: About $42,000 per decade

3) Bikes over Automobiles

Everyone knows that Mr. Cash Mustache’s largest contribution to non-public finance is to insist that bike transportation is one of the best ways to get round. And I nonetheless really feel this manner. As we realized in The True Cost of Commuting, vehicles price a minimum of 50 cents per mile to function, whereas bikes are less expensive, primarily because of decreased depreciation and upkeep prices (that are even larger than the gasoline financial savings).

I do nonetheless use bikes (or strolling) for a minimum of 95% of my native journeys as of late, however as a result of I reside within the middle of a small metropolis, my life is fairly native. So this nonetheless solely provides as much as about 2000 miles per 12 months, a financial savings of “solely” $14,000 per decade.

However whenever you select energetic transportation, there’s far more to the image than simply reducing your automotive bills. You’re altering every little thing about your bodily and psychological well being image for the higher, which brings us to the following level of…

4) Muscle over Motor

Though I’m no aggressive athlete, every time I see an choice to make my physique work a bit more durable, I normally take it. Stairs as an alternative of elevators, operating the golf course as an alternative of utilizing a golf cart, shifting my very own furnishings and home equipment as an alternative of calling a mover, shoveling snow and raking leaves as an alternative of utilizing a machine.

After I face a choice like this, I merely ask myself the query:

“Nicely, Mustache. Would you like MORE well being and health, or LESS?”

Placing it in that context makes the reply apparent. Each bit helps, as a result of in the case of your physique, the rule is just about use it or lose it.

However how a lot cash does this save? There’s no actual approach to calculate it precisely, however I like to consider it this manner: The US common well being care spending is about $13,000 per particular person per 12 months. My lifetime prices because of sickness or medicine to date have been nearly zero, plus I do know I’ve had extra power and higher productiveness because of being wholesome. Let’s simply put it very conservatively and set the estimated financial savings and advantages at $10k per 12 months which suggests

Estimated Financial savings: $140,000 per decade.

5) Saving Power by Operating my residence like a Glamping Retreat

Right here’s the place issues get a bit foolish, however my degree of pleasure is definitely at its biggest.

My character sort might be a bizarre mixture of an engineer, a carpenter, an artsy hippie, and a mad scientist. Oh, and a loyal homebody too. Due to this, my favourite exercise most days is to simply run round my home caring for issues and attempting new little experiments and enhancements.

Typically I’ll reduce just a few massive holes on on the South aspect of the home and set up sliding doorways and large home windows to permit good sunbeams and passive photo voltaic power to get into my home and provides me free warmth within the winters. Different occasions it’s simply smaller issues to save lots of power and reside extra at at one with the seasons of my space:

- optimizing using air con by operating followers at night time and constructing warmth tolerance throughout the days (we set the A/C to solely kick on at about 80F)

- Having fun with most of my showers exterior, with free sizzling water from the 100 foot backyard hose that occurs to be coiled in a sunny spot

- Cooling myself and get free power boosts by leaping within the “chilly plunge”, which is solely an unheated sizzling tub I’ve arrange in my again yard

- Doing most of my cooking and eating outdoor with an induction cooktop, gasoline grill, espresso machine, and mini convection toaster oven deal that I maintain arrange exterior throughout the hotter months of the 12 months

- Drying 99% of my a great deal of laundry out on the road as an alternative of utilizing the garments dryer

- I even cost my automotive with a bit of off-grid array of photo voltaic panels arrange within the driveway (from Craisglist, in fact!), which provides me free electrical energy for driving with out going by way of the permit-hell trouble of a full grid-tied system in my metropolis’s at present photo voltaic unfriendly atmosphere.

Even taken all collectively, these items are fairly small – the common mixed gasoline and electrical invoice for my space is about $250 per thirty days, whereas my utilization provides as much as about $75. So whereas we’re solely saving about $30,000 per decade for what appears like a lot of labor to most individuals, I contemplate this to be the most important win as a result of I take pleasure in residing in “MMM’s Power Effectivity Playground” a lot.

6) Native Residing over Fixed Journey

“Hey, we’re having an enormous again yard pool get together subsequent weekend to have fun Amy’s commencement from kindergarten, are you able to make it?”

“OH NOOOO!!! We shall be off in at Disneyland that complete week! We deliberate the journey months in the past, I want we may make it!

As I sort this within the peak of the summer season season, I actually really feel this impact at its fullest: nearly all of my mates are off on journeys, and my visitor suite right here at residence is sort of continually full. Persons are touring a lot, and plenty of of them sound like they need they might spend just a few extra of their treasured summer season weeks and weekends at residence.

I’ll allow you to in on a bit of secret: you may! The trick is saying, “no thanks” extra typically to plans that contain you being away, and “sure please” to issues that allow you to keep at residence. The advantages are quite a few:

- You nurture your native friendships extra and meet new individuals who reside close by

- You spend approach much less cash on aircraft tickets, accommodations, eating places gasoline, and automotive repairs

- Your ranges of well being and health can go approach up since you aren’t lacking exercises and spending hours sitting in aircraft and automotive and bus seats. And you may higher management your meals – extra salads with grilled salmon, much less McDonald’s and Pizza Hut

- You sleep higher

- And you’ve got extra time to handle tasks round your own home the place you study extra expertise which compound for all times

Estimated Financial savings: Even in case you change simply two weeks of journey for a household of 4, with equal time at residence you may save $5,000 per 12 months in direct prices and an additional $5,000 per 12 months in incidental advantages just like the well being and native friendships. This is able to work out to a surprising $143,000 per decade of wealth enhance!

In fact, journey is mostly a good factor for broadening the life expertise of you and your children. It’s value spending on, lavishly at occasions. However the secret’s to stability it out and be discerning, maintaining essentially the most enriching journeys and pruning just a few off the underside of the checklist. And remembering that residence time is effective and wholesome too.

And Whoa! We’ve already constructed up an enormous checklist and I really feel like I used to be simply getting began.

Taken all collectively, we’ve already detailed issues that compound to $656,000 each decade, which already greater than double the median wealth that almost all American seniors have as they cruise nervously into their retirement years – after over 40 years of labor!

And now that I’ve been penning this weblog for over ten years myself, I can safely say that over $656,000 of even my most up-to-date value will increase are immediately attributable to those easy habits. The identical ones many people have been having fun with and preaching about all alongside, each earlier than and after our retirement dates.

If cash is in genuinely quick provide, you might go rather a lot additional than the examples on this article. And certainly, there’s much more specified by this weblog or the MMM Boot Camp e mail collection.

However one of many factors of Mustachianism is that you just normally don’t should strive all that arduous. Simply tweaking your life-style to be barely much less ridiculous and extra environment friendly than common is normally all it takes.

—

Within the feedback: what are your quirks and frugal indulgences? The belongings you do now to economize, or belongings you nonetheless do even after it’s not in regards to the cash? I typically marvel how widespread this frugality-just-for-fun is. However since we People are a naturally curious and downside fixing species in our pure state, I think there are various extra of us on the market.