Since August 2025, Meta Platforms’ inventory has dropped considerably, with the start of November seeing the most important decline. Fortuitously, the inventory picked again up in December, climbing practically 11% within the final 30 days. With the latest run to shut out 2025, analysts wish to 2026 with greener hopes, and therefore elevating their inventory forecasts for META.

Analysts at Baird just lately revealed a report that Meta Platforms presents each dangers and alternatives heading into 2026. Analyst Colin Sebastian urged buyers to “be opportunistic patrons,” noting that whereas near-term sentiment dangers stay, “embedded expectations are in higher steadiness vs. three months in the past.”

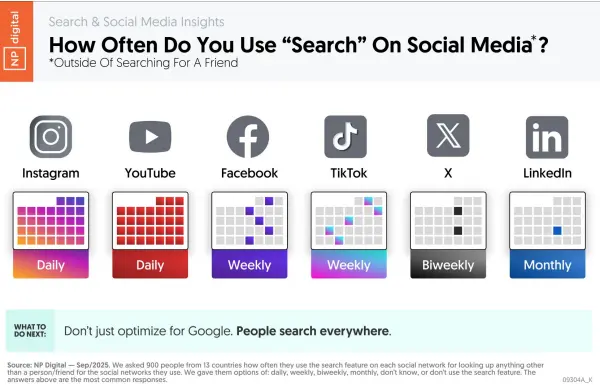

Baird went on to Baird highlighted a number of potential catalysts for a extra constructive outlook, together with a “clearing occasion with Q1 steering/margin outlook,” the “launch of subsequent Llama mannequin constructed by TBD Lab,” updates to Meta AI, and “ramping WhatsApp and Threads monetization.” Meta Platforms (META) has seen sturdy progress powered by its AI investments. The lessening fears round AI have helped gasoline META to its double-digit rally, after being down by as a lot as 20%.

Also Read: Intel (INTC) vs. AMD: Which Chip Stock Will Outperform in 2026?

With the Fb developer leaning away from its Metaverse plans to open the yr, investor curiosity in META is gaining steam. Outdoors of Baird, different prime corporations protecting the inventory have additionally given a bullish case for Meta in 2026. Wolfe Analysis, with a excessive general rating of 87.9, maintains a optimistic outlook on Meta. Guggenheim’s $875 goal signifies important upside, supported by its sturdy historic accuracy in worth predictions. Wolfe Analysis’s $730 goal displays comparable optimism.

At press time, META is buying and selling in the midst of its 52-week vary and beneath its 200-day easy transferring common.