- Key Black Friday statistics for 2025

- Hostinger’s Black Friday research: Key insights

- Black Friday spending and gross sales developments

- Black Friday shopper conduct and buying preferences

- Black Friday cellular and system utilization

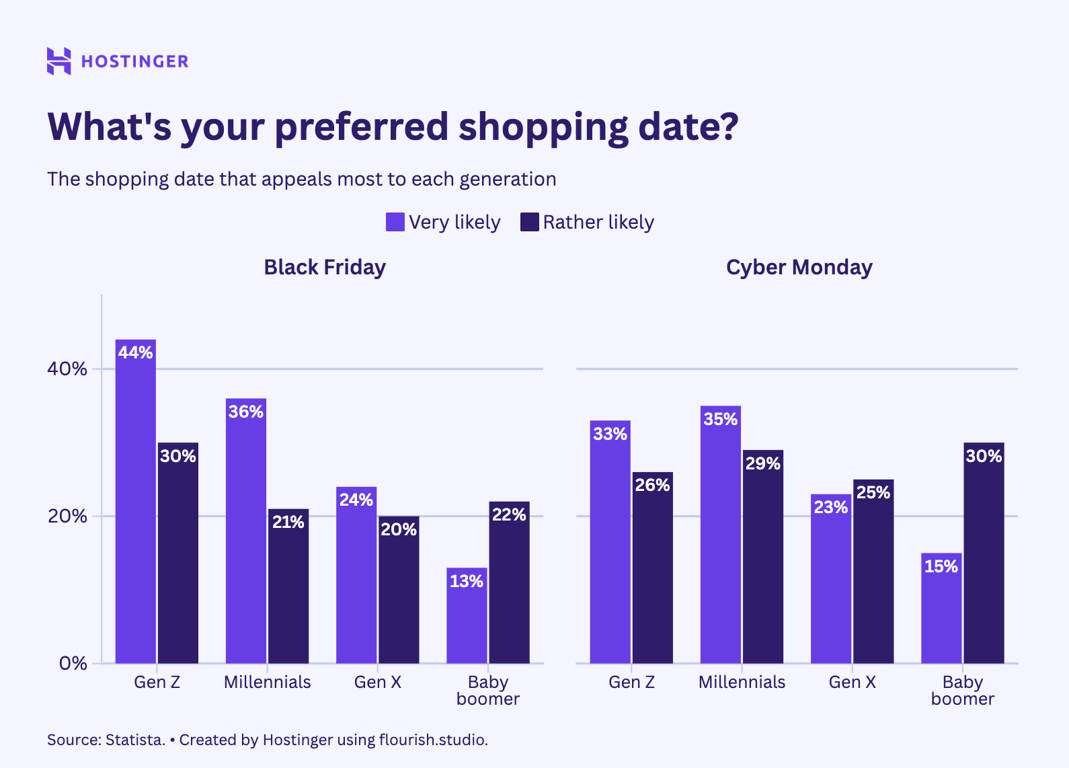

- Black Friday demographics and generational variations

- Black Friday advertising and conversion drivers

- The way forward for Black Friday

Black Friday 2025 is projected to surpass $11 billion in US ecommerce gross sales, representing an 8.7% year-over-year improve. This progress indicators elevated transaction quantity, heightened competitors amongst retailers, and expanded {discount} alternatives for customers.

Procuring developments replicate sturdy shopper engagement throughout digital channels. Globally, over half of consumers make purchases on-line, whereas roughly 40% analysis merchandise digitally earlier than finishing in-store transactions.

Black Friday and Cyber Monday have advanced from two separate 24-hour occasions into an prolonged buying season. Information reveals 45% of customers started vacation purchases earlier than November.

The next Black Friday statistics study spending patterns, shopper conduct, system utilization, demographic variations, and advertising efficiency through the Black Friday buying interval.

Hostinger’s 2024 research surveyed 1,000 US customers about their Black Friday and Cyber Monday buying preferences, spending habits, and product pursuits. Though collected in 2024, this knowledge gives historic context that enhances present trade developments in 2025.

Key Black Friday statistics for 2025

Black Friday has expanded past a single day into an prolonged interval that units the tone for your entire vacation season. These statistics illustrate the size, shopper engagement, and financial affect of this buying occasion.

- Vacation ecommerce gross sales are projected to develop 7%–9% year-over-year, reaching $305–$310.7 billion.

- The 2024 Thanksgiving weekend attracted 197 million consumers, the second-highest whole on document behind 2023.

- Black Friday and Cyber Monday mixed are anticipated to exceed $25 billion in US on-line gross sales.

- Over half of internet buyers made purchases utilizing cellular gadgets.

- Bodily shops drew 81.7 million guests, the very best quantity because the pandemic started.

- Common vacation spending reached $235 per shopper, an $8 improve from the earlier 12 months.

- Purchase Now, Pay Later companies processed practically $1 billion in Cyber Monday purchases, representing a 5.5% improve from 2023.

- Regardless of issues about inflation, 22% of consumers plan to extend their vacation spending.

- Influencer and online marketing transformed consumers at six instances the speed of ordinary social media campaigns.

- Cell gadgets accounted for 63% of Cyber Monday purchases, up from 55% in 2023.

Hostinger’s Black Friday research: Key insights

In 2024, Hostinger surveyed US customers to know their buying behaviors throughout Black Friday. The research revealed key patterns in spending intentions, product preferences, and the affect of selling channels.

Whereas this knowledge is from 2024, it gives worthwhile historic context that enhances 2025 statistics.

- 82% of customers deliberate to buy throughout Black Friday. Excessive anticipation for offers confirms Black Friday’s standing as a significant retail occasion (Hostinger).

- 31% of US consumers supposed to extend their spending. US shopper optimism was increased in comparison with 2023 (Hostinger).

- Almost 30% of respondents shopped completely on-line. Constructing accessible ecommerce platforms, comparable to these created with Hostinger Website Builder, helps companies attain digital-first customers successfully (Hostinger).

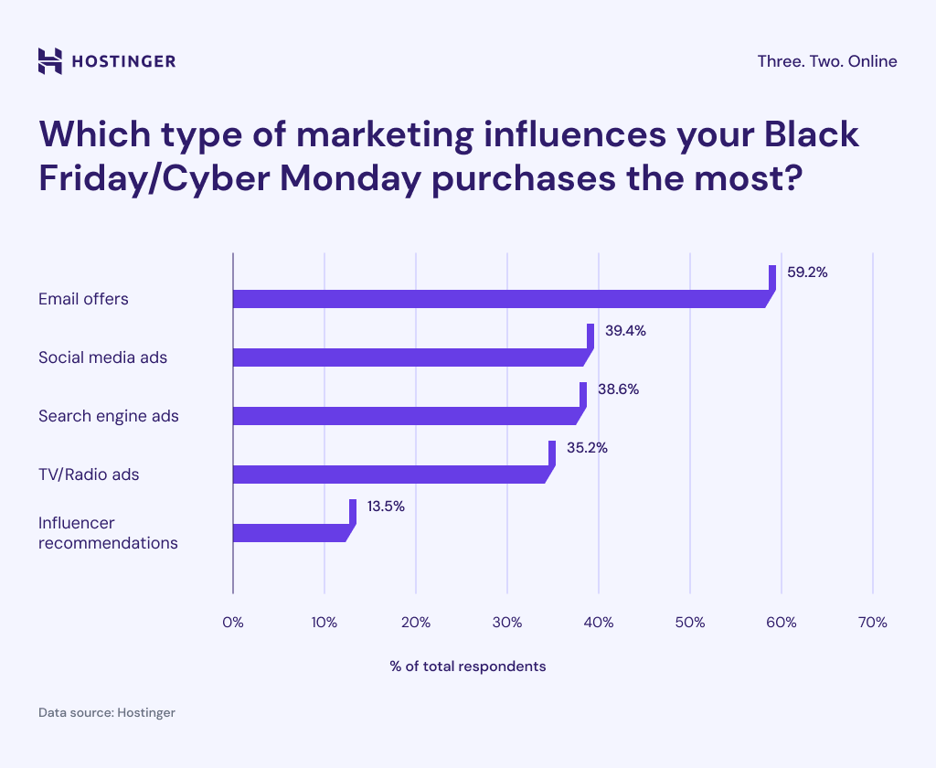

- 59% of US customers reported that electronic mail advertising influenced their buying choices. E mail advertising achieves an 8% conversion price and delivers $36–$50 ROI per greenback spent, outperforming most social channels (Hostinger).

- Gen Z and Millennials prioritized style and sustainable manufacturers. Child Boomers centered extra on toys and presents (Hostinger).

Our 2024 research highlights the sustained dominance of on-line buying and the continued effectiveness of electronic mail advertising in driving Black Friday gross sales.

Black Friday spending and gross sales developments

Black Friday 2024 set new gross sales data, establishing sturdy momentum heading into 2025. Black Friday spending demonstrates constant progress, with customers exhibiting sustained curiosity regardless of financial pressures.

- Black Friday 2024 on-line gross sales reached $10.8 billion within the US. This represents a ten.2% improve from 2023 and units a brand new single-day document (Adobe).

- Black Friday 2025 on-line gross sales are projected to succeed in $11.7 billion. Cyber Monday is anticipated to be the season’s largest on-line buying day, with gross sales projected to succeed in $14.2 billion (Adobe).

- Cyber Week 2024 generated $41.1 billion in on-line gross sales. The 8.2% year-over-year progress underscores the significance of the prolonged vacation interval (Adobe).

- Solely 22% of consumers plan to spend extra this season. This represents a lower from the 31% who deliberate elevated spending in Hostinger’s 2024 research. Present warning is attributed to 2.9% inflation within the US (Experian).

- Common vacation spending reached $235 per shopper. The $8 improve from the earlier 12 months signifies sustained shopper engagement, with 86% of customers buying presents (NRF).

- Vacation ecommerce gross sales are forecast at $305–$310.7 billion. The projected 7–9% progress signifies wholesome growth for on-line retail (Deloitte).

- The vacation season accounts for twenty-four% of annual on-line buying. This focus makes it probably the most essential gross sales interval for ecommerce companies, in line with our ecommerce statistics.

- Black Friday accounted for 33% of BFCM weekend gross sales. This outperformed Cyber Monday’s 23% share (Global-e).

- 197 million consumers transacted between Thanksgiving and Cyber Monday. The 2024 weekend ranks because the second-highest participation on document, simply behind 2023’s 200 million (NRF).

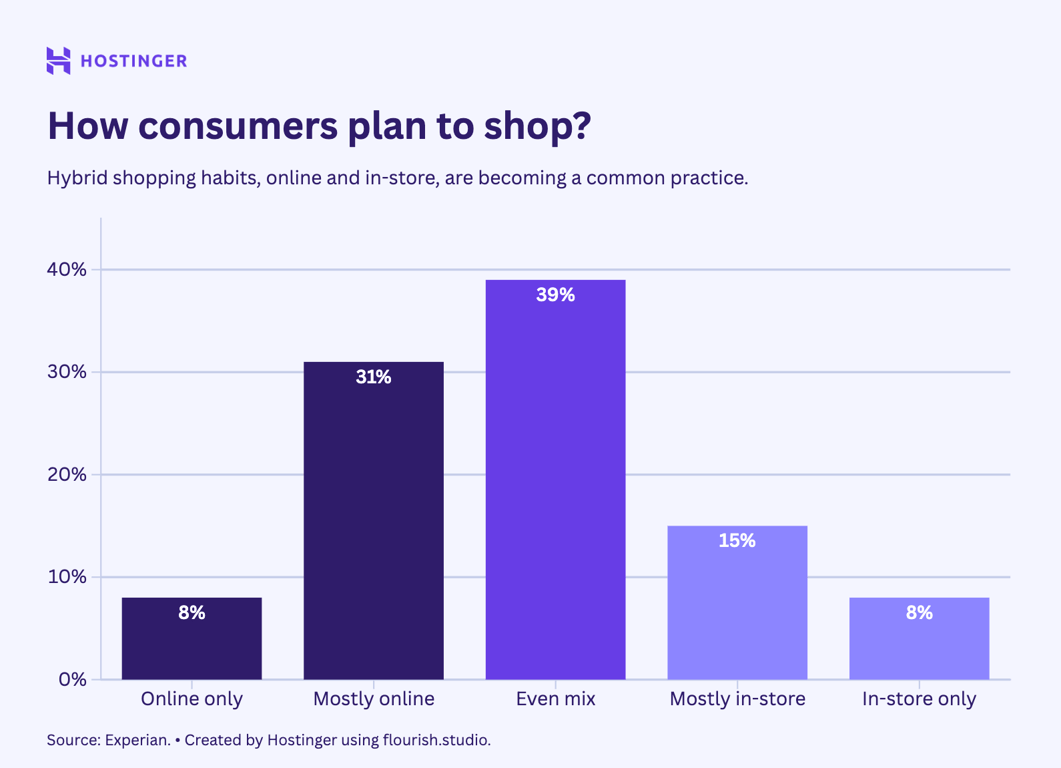

- 39% of consumers comply with a hybrid buying technique. Most customers browse on-line earlier than finishing in-store purchases (Experian).

Black Friday stays a dominant pressure in retail gross sales. Constant year-over-year progress in on-line spending demonstrates the necessity for strategic preparation, together with aggressive pricing, focused advertising, and product innovation.

Black Friday shopper conduct and buying preferences

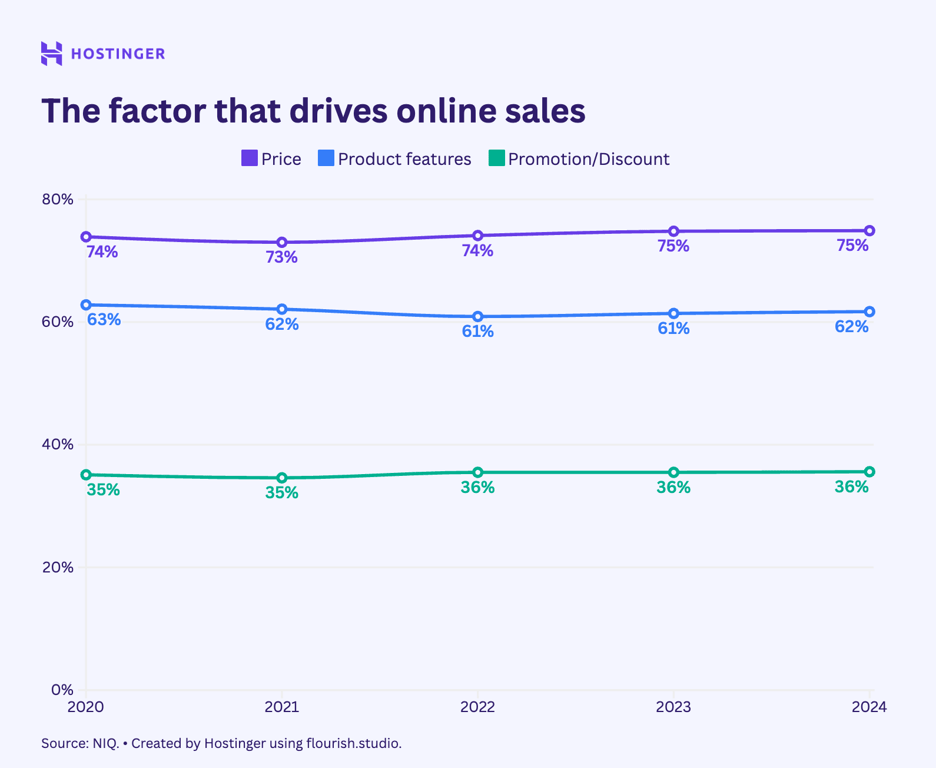

Client buying patterns reveal strategic behaviors that mix on-line analysis with in-store buying. Whereas worth stays the first consideration, an omnichannel presence and early buying home windows are more and more influencing shopper choices.

- 42% of customers interact in omnichannel buying. Customers mix on-line and in-store channels for analysis and purchases, requiring built-in retail methods (NIQ). Hostinger’s 2024 research discovered that just about 30% of respondents shopped completely on-line, a proportion anticipated to develop in 2025 (Hostinger).

- 45% of customers begin vacation buying earlier than November. The season extends into December, with 62% of consumers persevering with to make purchases all through the month (Experian).

- Value is the deciding issue for 74.9% of customers. Price stays probably the most essential buy consideration (NIQ).

- Department shops and on-line retailers tied as high locations at 42% every. Grocery shops (40%) and clothes shops (37%) adopted as in style channels (NRF).

- On-line buying attracted 87.3 million Black Friday consumers. In-store buying drew 81.7 million, the very best bodily retailer rely because the pandemic began (NRF).

- Saturday in-store buying reached 61.1 million consumers. Cyber Monday on-line buying totaled 64.4 million, down from 73.1 million in 2023 (NRF).

- 52% of vacation buying remained incomplete after the BFCM weekend. This means sturdy December gross sales potential (NRF).

Client demand for each on-line comfort and in-store experiences requires omnichannel methods that reach past Black Friday and Cyber Monday. The early buying development creates a number of touchpoints for buyer engagement all through the season.

Black Friday cellular and system utilization

Cell gadgets have change into the first buying instrument for over half of on-line customers. Smartphones dominate Black Friday shopping, worth comparability, and buying actions.

- 63% of Cyber Monday consumers accomplished purchases on cellular gadgets. This represents the very best cellular share on document and an 8 proportion level improve from 2023 (NRF). Hostinger’s 2024 research confirmed desktop and cellular utilization practically tied at 44%–46%, indicating speedy cellular progress (Hostinger).

- Cell spending reached $69.8 billion, accounting for 53.1% of on-line gross sales. This 14.1% year-over-year improve confirms cellular because the dominant ecommerce channel (Adobe).

- 55% of world customers store on cellular gadgets. Gen Z leads this development, with 68% preferring smartphones for buying (BCG).

- 42% of customers want retailer apps over web sites. Apps present enhanced buying experiences (BCG).

- Gen Z cellular fee customers are projected to succeed in 50 million by 2028. This progress displays youthful customers’ choice for digital wallets (eMarketer).

- Responsive electronic mail design will increase cellular clicks by 15%. With 64% of net visitors from cellular gadgets, mobile-first advertising is crucial for engagement, in line with our email marketing statistics.

Cell optimization is crucial for Black Friday success. Companies that prioritize responsive design and app experiences are higher positioned to capitalize on the rising cellular gross sales market.

Black Friday demographics and generational variations

Every era approaches Black Friday with completely different priorities and preferences. Whereas Gen Z is drawn to social commerce and stylish manufacturers, Millennials depend on established social networks.

- 75% of Gen Z customers store throughout Black Friday and Cyber Monday. Gen Z prioritizes style and sustainable manufacturers, differentiating them from older generations (Statista). Hostinger’s 2024 research equally discovered Gen Z and Millennials centered on style and sustainability, whereas Child Boomers prioritized toys and presents (Hostinger).

- 43% of Western customers bought from Temu prior to now six months. Half of Gen Z customers purchased from Shein not less than as soon as, indicating Chinese language retail apps play a major function throughout BFCM (OBS).

- 73% of males view Black Friday offers nearly as good worth, in comparison with 67% of ladies. Ladies present extra skepticism, with 23% suspecting inflated pre-discount pricing (OBS).

- Fb is the popular platform for 53% of Millennial consumers. TikTok Store leads amongst Gen Z, attracting 40% of customers, in line with Hostinger’s social commerce statistics (Hostinger).

Completely different demographics require tailor-made approaches based mostly on platform utilization and product preferences. Retailers concentrating on Gen Z ought to prioritize TikTok Store and emphasize sustainability of their branding, whereas these concentrating on Millennials ought to give attention to sustaining a robust Fb presence.

Black Friday advertising and conversion drivers

Client publicity to numerous Black Friday affords makes understanding buy motivators essential. Efficient Black Friday marketing begins early and leverages a number of channels to construct momentum.

- Free transport, promotions, and constructive opinions are high conversion drivers. These incentives successfully convert shopping into purchases (NRF). Impulse purchases accounted for 33% of transactions in Hostinger’s 2024 research, indicating that spontaneous spending stays a major issue (Hostinger).

- 59% of US customers reported electronic mail advertising influenced purchases. E mail stays a direct, efficient channel for driving gross sales (Hostinger).

- Purchase Now, Pay Later companies generated $991 million in Cyber Monday gross sales. This represents a 5.5% year-over-year improve, with 75% of BNPL orders positioned on cellular gadgets (Adobe).

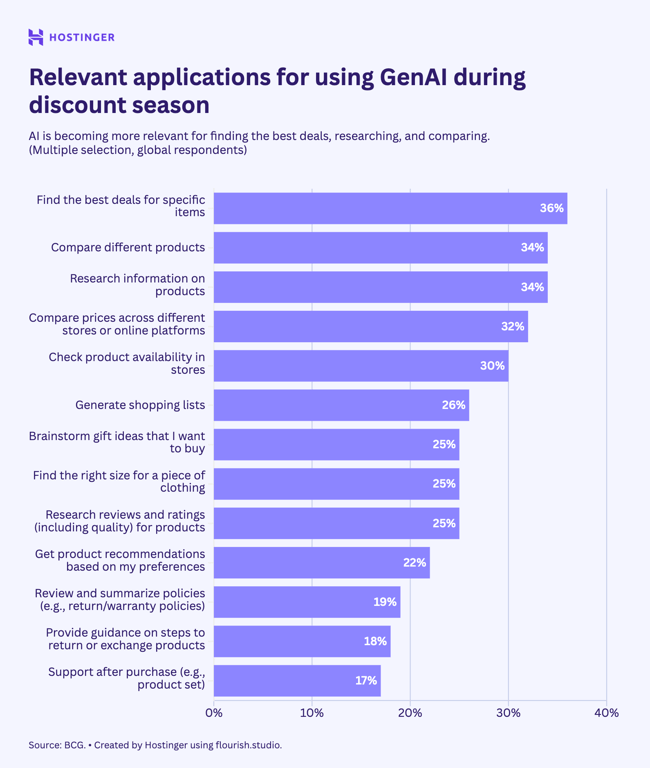

- AI-powered chatbots drove 1,950% year-over-year progress in retail visitors. Whereas adoption stays modest, this surge indicators rising shopper acceptance of AI buying help (Adobe).

- 39% of customers use AI for on-line buying. A 5,000-response Adobe survey discovered that over half plan to make use of AI buying instruments in 2025 (Adobe).

- Associates and influencers drove 20.3% of Cyber Monday income. Influencers transformed consumers six instances extra successfully than customary social media advertising (Adobe).

- Early November promotions correlate with increased conversion charges. Reductions and urgency messaging earlier than peak buying days assist construct sustained gross sales momentum (International-e).

Profitable Black Friday advertising combines a number of channels with strategic incentives. Free transport and constructive opinions drive conversions, whereas early November promotions preserve momentum all through the season.

The way forward for Black Friday

Black Friday continues evolving as a multi-week buying interval with growing AI integration and various buyer journeys.

- The buying season continues to increase into October and December. Retailers compete for early consumers by launching promotions earlier every year.

- AI-driven suggestions and dynamic pricing have gotten customary. Personalised product solutions and real-time worth changes create individualized buying experiences.

- Cell optimization is crucial. Customers are more and more favoring smartphones over desktops, with model interactions going down throughout social media, web sites, and cellular apps.

Supporting an prolonged buying season and mobile-first prospects requires a dependable and scalable infrastructure. Hostinger’s Black Friday web hosting deals present the efficiency it’s essential deal with elevated vacation visitors.

The entire tutorial content material on this web site is topic to

Hostinger’s rigorous editorial standards and values.