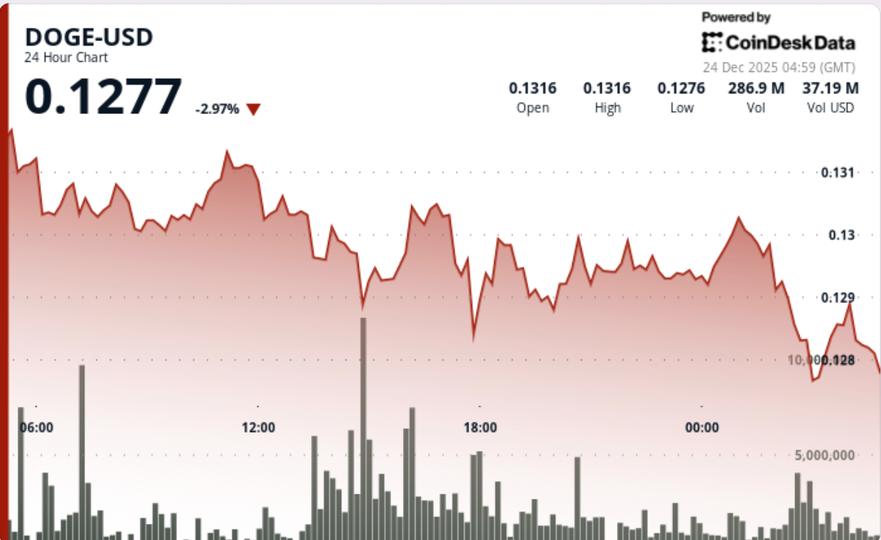

Dogecoin slipped underneath the $0.13 degree Tuesday as heavy spot promoting coincided with a pointy bounce in derivatives exercise, suggesting merchants are positioning for wider swings somewhat than a direct rebound.

Information background

BitMEX reported Dogecoin futures quantity surging 53,000% to $260 million as merchants ramped up publicity into the transfer, an indication that volatility expectations are rising at the same time as spot worth weakens. The burst in derivatives turnover got here alongside a heavy spot selloff that pushed DOGE by way of the $0.13 psychological ground, conserving the meme-coin complicated underneath strain whereas broader crypto markets remained uneven.

The rise in futures exercise additionally comes as merchants proceed to make use of meme cash as high-beta expressions of sentiment, making DOGE extra delicate to positioning shifts and liquidity pockets than many large-cap tokens. That dynamic tends to amplify strikes as soon as key ranges break, significantly round round-number helps like $0.13.

Technical evaluation

DOGE broke under $0.1300 after sellers pressed the market throughout U.S. hours, with the important thing affirmation coming at 16:00 on Dec. 23 when quantity hit 639 million tokens, about 101% above the session common. That spike marked a transparent change in move: consumers that had beforehand defended $0.13 stepped again, and the extent flipped from help into overhead provide.

On the intraday chart, promoting picked up once more from round 01:41, with worth slicing by way of interim helps at $0.1295 and $0.1292. The construction now resembles a descending channel, with DOGE leaning towards the decrease boundary because it trades under short-term transferring averages. That sometimes retains rallies shallow till the market can reclaim the damaged pivot.

Value motion abstract

- DOGE fell 2.3% from $0.1323 to $0.1292 over 24 hours

- The $0.1300 ground broke on the heaviest spot quantity of the session

- Value steadied close to $0.1290 late as quantity cooled sharply from peak ranges

- The intraday vary widened to $0.0047 (about 3.6%), signaling rising volatility

What merchants ought to know

$0.13 is now the extent that issues. If DOGE can reclaim and maintain it, the transfer appears extra like a flush-and-reset and will set off a short-covering bounce again towards $0.1320. If it fails to retake $0.13, the market is more likely to probe the following demand cluster round $0.1285–$0.1280, the place consumers might try one other protection.

The outsized bounce in futures quantity suggests merchants are bracing for continued volatility somewhat than a quiet drift. That may reduce each methods: it will increase the chances of sharp squeezes, however it additionally means breaks can lengthen shortly if stops set off under $0.1290 and liquidity thins.