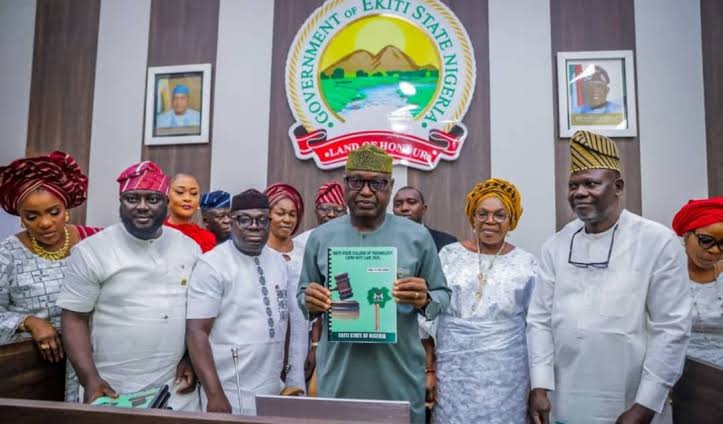

Ekiti State has taken a pioneering step in Nigeria’s ongoing tax reform course of by turning into the primary state within the federation to cultivate the Nigeria Tax Administration Act (NTAA). Governor Biodun Oyebanji formalised the transition on Wednesday by signing the Ekiti State Income Administration Legislation, 2025, into regulation.

The regulation was signed throughout a short ceremony on the Govt Council Chamber in Ado-Ekiti, the place Governor Oyebanji additionally assented to the state’s ₦415.57 billion 2026 price range.

By enacting this laws, Ekiti aligns its inner income framework with the federal authorities’s NTAA — a key part of Nigeria’s broader tax reform agenda geared toward harmonising tax evaluation, assortment, and enforcement throughout all ranges of presidency.

Key Adjustments and Reforms Below the New Legislation

Below the brand new Income Administration Legislation:

- Ekiti repealed the older Ekiti State Board of Inner Income Legislation of 2019 and changed it with a modernised framework designed for effectivity and transparency.

- The state launched a strictly digital fee, billing, and receipting system to cut back income leakages and enhance accountability.

- The Ekiti State Inner Income Service (EKIRS) now holds unique authority to gather taxes, curbing unauthorised third-party income assortment.

- EKIRS has been granted prosecutorial powers and administrative penalty authority to implement compliance successfully.

- The regulation adopts the harmonised record of taxes and levies accepted by the Joint Income Board (JRB), serving to to advertise equity and consistency in tax administration.

Governor Oyebanji described the regulation as a daring assertion of his administration’s dedication to transparency, trendy governance, and financial empowerment. He emphasised that the e-payment system will guarantee public funds circulation immediately into state coffers, decreasing alternatives for mismanagement.

Broader Impression and Enterprise Surroundings

Officers say the brand new income regulation is predicted to institutionalise concord, equity, certainty, and accountability in tax administration on the subnational stage, which might considerably enhance the ease of doing enterprise for people and enterprises working in Ekiti State.

By creating a transparent and unified income system, the regulation goals to cut back a number of taxation, defend companies from extortion, and strengthen institutional capability — reforms that would empower MSMEs and improve investor confidence.

Segun Adesokan, Govt Secretary of the Joint Income Board, counseled Ekiti for fulfilling a dedication made at a JRB retreat in Ikogosi earlier this yr, expressing optimism that different states would comply with Ekiti’s instance.

The NTAA — designed to take impact from January 2026 — is a cornerstone of nationwide tax reform, and Ekiti’s domestication alerts a shift towards extra coordinated and environment friendly tax programs throughout Nigeria’s subnational governments.

Publish Views: 25