- FileYourTaxes.com – Is It Free?

- What’s New In 2026?

- Does FileYourTaxes.com Make Submitting Straightforward In 2026?

- FileYourTaxes.com Options

- FileYourTaxes.com Drawbacks

- FileYourTaxes.com Plans And Pricing

- How Does FileYourTaxes.com Examine?

- How Do I Contact FileYourTaxes.com Help?

- Is It Secure And Safe?

- Why Ought to You Belief Us?

- Who Is This For And Is It Price It?

- FileYourTaxes.com FAQs

Execs

Cons

FileYourTaxes.com is tax-filing software program designed to make the method fast and simple. It has useful calculators and built-in error detection. Nevertheless, it’s costly and tough to navigate, placing it close to the underside of our suggestion checklist on your 2026 taxes.

Beneath, we element the areas of disappointment and some areas the place FileYourTaxes.com gives its most helpful options, in case you’re eager about utilizing it is platform to file your taxes.

In case you’re procuring round and know FileYourTaxes isn’t perfect on your wants, right here’s our list of the best tax software.

FileYourTaxes.com – Is It Free?

FileYourTaxes.com comes with a big price ticket. Most returns price $55 for Federal submitting and $50 per state. Enterprise house owners and others with extra complicated taxes pays a base price of $75.

Whereas it says on the FileYourTaxes.com web site that you would be able to “e-file” without cost, it’s positively not a free tax submitting service. The corporate expenses for each state and federal submitting. Just about each competitor gives digital submitting throughout all tiers.

Free variations can be found by way of the IRS Free File program should you meet these necessities:

- Seniors age 66 or above incomes between $8,500 and $79,000 per yr

- Energetic responsibility navy incomes below $79,000 per yr

In case you’re on the lookout for a free various, try our list of the best free tax software.

What’s New In 2026?

For Repeat Customers:

Costs Have Elevated, However Total High quality Has Not

The very first thing we observed is the brand new pricing for 2026. Most filers pays $10 to $20 greater than in prior years, relying on their submitting wants. In any other case, the app is usually the identical as final yr.

The software program has been up to date to replicate adjustments to the tax code for the 2025 tax yr (filed in 2026) from the IRS. The brand new tax brackets and limits for credit and deductions as a result of latest inflation have been most notable.

It’s good to see modest enhancements, however FileYourTaxes would want to make an enormous leap ahead to justify the excessive price.

Does FileYourTaxes.com Make Submitting Straightforward In 2026?

FileYourTaxes has a strong backend that features useful calculators and sturdy error checking. It gives helpful error messages to customers when one thing appears off. Sadly, this performance alone doesn’t make tax submitting straightforward.

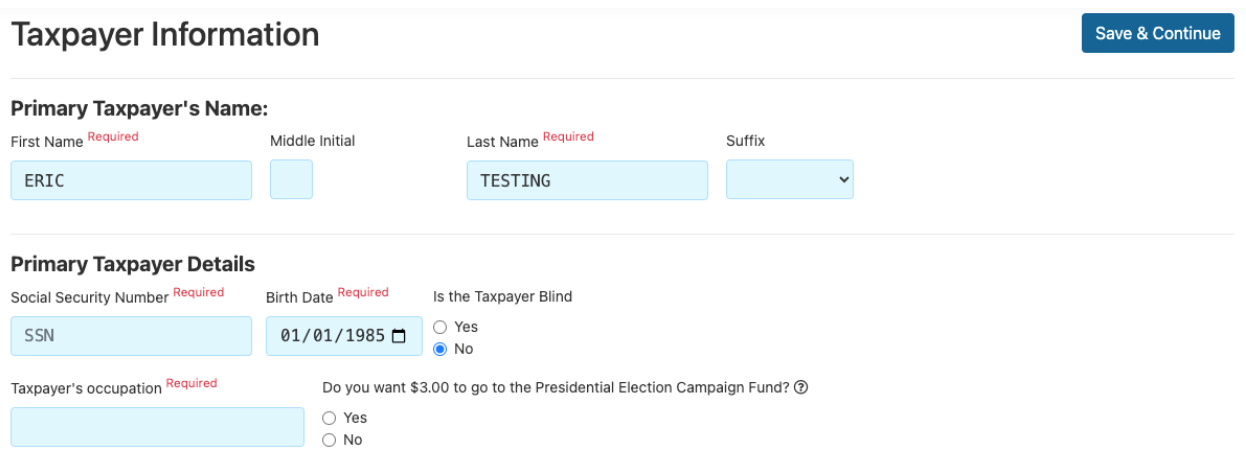

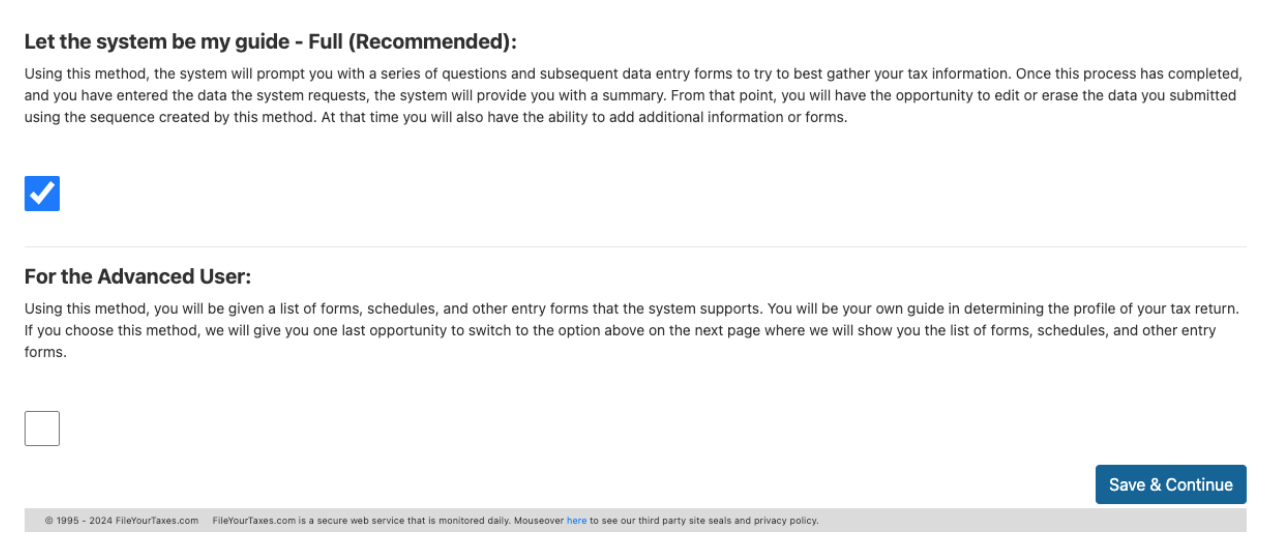

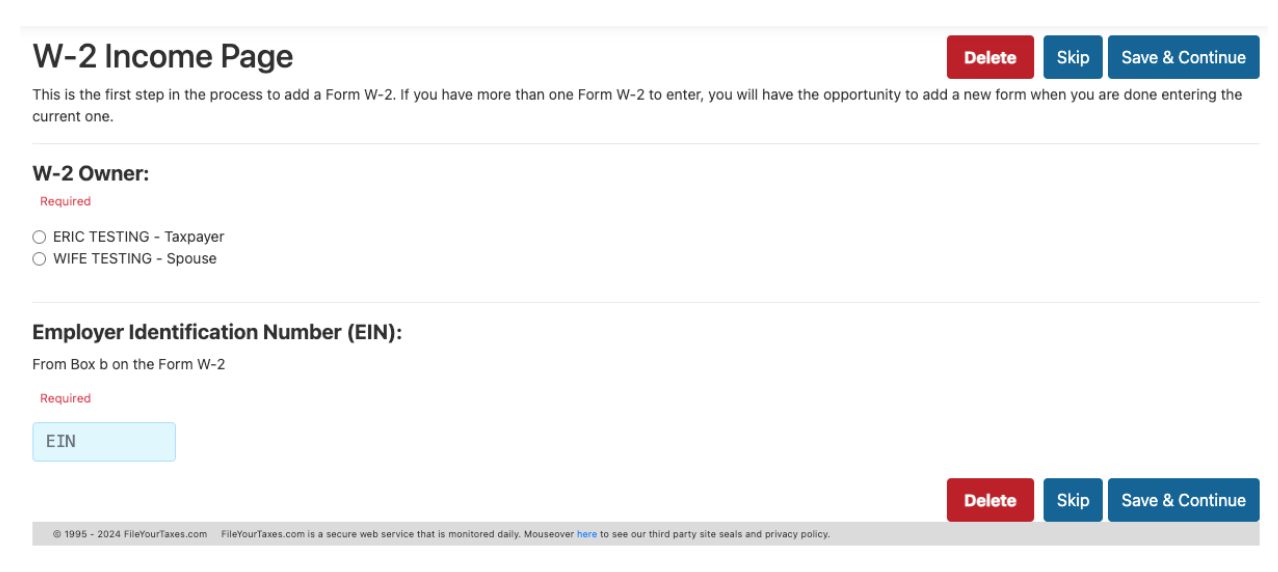

FileYourTaxes has jumbled, poorly designed screens that really feel extra like Nineties Home windows apps than fashionable internet functions. Customers must reply questions that the software program ought to decide by itself. The corporate has an excessive amount of textual content on each display, resulting in tax-filing fatigue.

Web site errors, together with inconsistent pricing throughout pages and spelling errors in the primary navigation menu, give us little confidence that the ultimate consequence will probably be correct and simple to realize.

FileYourTaxes.com Options

FileYourTaxes.com is sort of totally different from most different tax applications we examined. A lot of the variations are detractors, however the software program has a number of shining moments.

Glorious Error Messages

Each time a consumer receives an error message, File Your Taxes explains why the error occurred and what corrective motion the consumer ought to take. This may be useful when customers might need missed a easy examine mark in a field or a greenback quantity.

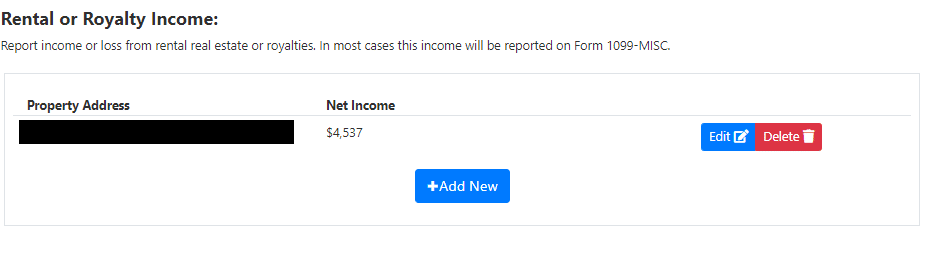

Useful Intra-Part Summaries

Some competitors don’t present in-section or end-of-section summaries to assist customers assess whether or not they’ve accomplished the part correctly. FileYourTaxes.com gives many helpful summaries that present customers the consequences of all the things they’ve carried out.

Helpful abstract for web earnings from a rental property.

FileYourTaxes.com Drawbacks

A lot of the drawbacks of FileYourTaxes.com relate to the consumer expertise. Filers could possibly use it successfully, however can have a horrible time whereas finishing taxes.

Poorly Designed Interface

The FileYourTaxes consumer interface appears like an internet site from the early 2000s. The textual content and containers are sometimes crammed onto the display with poor alignment. This will likely seem to be a minor concern, however it will probably result in many errors when customers can’t see the knowledge they’re getting into.

No Choice To Import Info

Customers can’t import tax types like W-2 or 1099 forms. Given the value of FileYourTaxes.com, customers ought to anticipate to snap photos and have the software program enter data on their behalf. Nevertheless, FileYourTaxes doesn’t have this selection, so customers should manually transcribe data from their tax types to the software program.

Too A lot Textual content

A major concern with FileYourTaxes is the quantity of textual content on every web page. Filers must learn prolonged questions afterward and proceed scrolling to finish every display. The sheer quantity of textual content on every display causes submitting to take for much longer than obligatory. Plus, it may lead you to by chance glaze over a essential element buried within the tremendous print.

FileYourTaxes.com Plans And Pricing

FileYourTaxes.com breaks pricing into two main buckets. The fundamental tier covers most individuals besides those that are self-employed. The Complicated tier covers self-employed folks and enterprise house owners.

|

Plan |

Primary |

Complicated |

|---|---|---|

|

Finest For |

Anybody who is not self-employed |

Self-employed folks |

|

Federal Worth |

$55 |

$75 |

|

State Worth |

$50 per state |

$50 per state |

|

Whole Value |

$105 |

$225 |

FileYourTaxes.com doesn’t supply many extras. You should use the location to file extensions or amended returns, however different main software program providers supply related choices (and are simpler to make use of).

How Does FileYourTaxes.com Examine?

FileYourTaxes.com is priced on the excessive finish of the market, however cut price opponents like Cash App Taxes and TaxHawk supply a greater consumer expertise.

We additionally in contrast FileYourTaxes.com to H&R Block, which is premium software program that makes submitting straightforward for nearly all customers.

|

Header

|

|

|

|

|

|---|---|---|---|---|

|

Ranking |

||||

|

Unemployment Revenue (1099-G) |

Primary |

Free |

Free |

Free+ |

|

Scholar Mortgage Curiosity |

Primary |

Free |

Free |

Free+ |

|

Import Final 12 months’s Taxes |

Not Supported |

Free |

Free |

Free+ |

|

Snap a Image of W-2 |

Not Supported |

Not Supported |

Not Supported |

Free+ |

|

A number of States |

Primary |

Not Supported |

$15.99 Per State |

Free+ |

|

A number of W2s |

Primary |

Free |

Free |

Free+ |

|

Earned Revenue Tax Credit score |

Primary |

Free |

Free |

Free+ |

|

Baby Tax Credit score |

Primary |

Free |

Free |

Free+ |

|

HSAs |

Primary |

Free |

Free |

Deluxe+ |

|

Retirement Contributions |

Primary |

Free |

Free |

Deluxe+ |

|

Retirement Revenue (SS, Pension, and many others.) |

Primary |

Free |

Free |

Free+ |

|

Curiosity Revenue |

Primary |

Free |

Free |

Free+ |

|

Itemize |

Primary |

Free |

Free |

Free+ |

|

Dividend Revenue |

Primary |

Free |

Free |

Premium+ |

|

Capital Positive aspects |

Primary |

Free |

Free |

Premium+ |

|

Rental Revenue |

Complicated |

Free |

Free |

Premium+ |

|

Self-Employment Revenue |

Complicated |

Free |

Free |

Deluxe+ |

|

Small Enterprise Proprietor (Over $5k In Bills) |

Complicated |

Free |

Free |

Self-Employed |

|

Audit Help |

Not Accessible |

Free |

Deluxe |

Fear Free Audit Help Add-On ($19.99) |

|

Recommendation From |

Not Accessible |

Not Accessible |

Professional Help |

On-line Help Add-On (begins at $39.99) |

|

First Tier Value |

Primary $55 Fed & |

Free $0 Fed & |

Free $0 Fed & |

Free $0 Fed & |

|

Second Tier Value |

Complicated $75 Fed & |

N/A |

Deluxe $7.99 Fed & |

Deluxe $35 Fed & |

|

Third Tier Value |

N/A |

N/A |

Professional Help $44.99 Fed & |

Premium $55 Fed & |

|

Fourth Tier Value |

N/A |

N/A |

N/A |

Self-Employed $85 Fed & |

|

Cell

|

How Do I Contact FileYourTaxes.com Help?

WARNING: Contacting Buyer Service By Cellphone Prices $17.50 additional!

Buyer help just isn’t considered one of FileYourTaxes.com’s strengths. In contrast to its opponents, there aren’t any choices to obtain recommendation from tax execs and even audit help.

Primary customer support is on the market by cellphone at 805-256-1788 and through safe messaging.

Working hours for the cellphone help group are Monday to Friday, 9 a.m. to 4:30 p.m. (PT). Help by cellphone requires an extra price of $17.50.

In case you e-mail them at taxman@FileYourTaxes.com, the everyday response time is 24 to 48 hours.

In case you’d desire to attempt to discover questions by yourself, you’ll be able to try the free self-help part of the web site.

Is It Secure And Safe?

FileYourTaxes makes use of multi-factor authentication and boasts a number of impartial safety credentials. It makes use of encryption to guard consumer data.

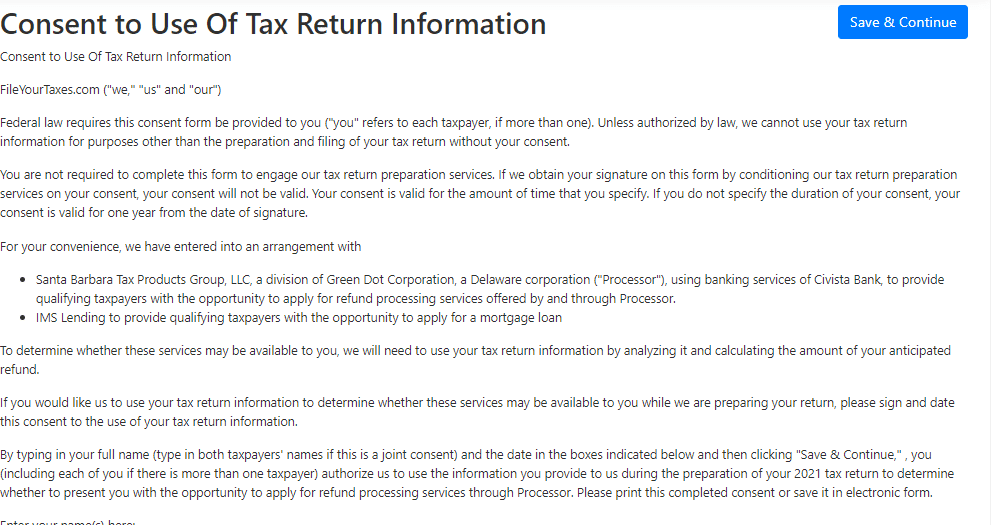

Nevertheless, FileYourTaxes does seem to share your data with others. After finishing a fundamental data part (together with a required consumer settlement), FileYourTaxes asks for consent to promote your data to 2 particular lenders – and considered one of them does not even must do with tax submitting, however slightly mortgage loans.

After all, customers can decline, however the decline button is a small examine field, whereas the consent button is giant and blue. We do not like this considerably deceptive follow.

Slipping in a protracted boring type that agrees to offer your data to lenders

Why Ought to You Belief Us?

The Faculty Investor group spent years reviewing the highest tax submitting choices, and we have now private expertise with most tax software program instruments. I personally have been the lead tax software program reviewer since 2022, and have in contrast a lot of the main firms on {the marketplace}.

Our editor-in-chief, Robert Farrington, has been testing tax software program instruments since 2011 and has tried nearly each tax submitting product. Moreover, our group has created reviews and video walk-throughs of all of the major tax preparation companies, obtainable on the Faculty Investor YouTube channel.

We’re tax DIYers and desire a whole lot, similar to you. We work laborious to supply knowledgeable and sincere opinions on each product we take a look at.

How Was This Product Examined?

In our authentic checks, we used FileYourTaxes.com to finish a real-life tax return that included W-2 earnings, self-employment earnings, rental property earnings, and funding earnings. We tried to enter all the information and use each obtainable characteristic. We then in contrast the consequence to all the opposite merchandise we have examined, in addition to a tax return ready by a tax skilled.

This yr, we went again by way of and re-checked all of the options we initially examined, in addition to any new options. We additionally validated the pricing choices.

Who Is This For And Is It Price It?

FileYourTaxes.com gives calculators and helpful summaries in 2026. Nonetheless, the software program’s strengths aren’t sufficient for us to advocate it.

It’s miles too costly for what you get, and customers paying a premium value for software program can discover higher alternate options. Fairly than utilizing FileYourTaxes.com, filers ought to check out the best tax software for their situation.

FileYourTaxes.com FAQs

Let’s reply a number of of the most typical questions that individuals ask about tax software program websites like FileYourTaxes.com:

Can FileYourTaxes assist me file my crypto investments?

FileYourTaxes helps crypto buying and selling, however filers must manually enter every transaction on the Capital Positive aspects and Losses Itemizing Web page. The web page is lengthy and sophisticated and filers can solely enter one transaction per web page. Fairly than enduring the cumbersome process of manually getting into data, crypto merchants could wish to use software program like TurboTax Premier and add IRS type 8949 from TaxBit.com.

Can FileYourTaxes.com assist me with state submitting in a number of states?

Sure, FileYourTaxes helps multi-state submitting. Customers should choose all of the states requiring returns, and FileYourTaxes expenses $40 per state return.

Does FileYourTaxes supply refund advance loans?

No, FileYourTaxes.com doesn’t immediately supply refund advance loans.

The publish FileYourTaxes.com Review 2026 appeared first on The College Investor.