- Gifting in 2025 – A Season of Generosity Meets IRS Present Tax Guidelines

- Present Tax Guidelines for 2025 – Annual Exclusion Fundamentals

- The Lifetime Present Tax Exclusion – The way it Impacts Annual Giving

- What Qualifies as a Present Below IRS Guidelines?

- Gifting Methods to Assist Maximize Your Household’s Wealth

- Lifetime giving

- Gifting appreciated belongings

- “Superfunding” contributions to a 529 faculty financial savings account

- Charitable giving

- Items to minors

- Items to special-needs family members

- Present Tax Reporting Necessities – When You Should File Kind 709

- Incessantly Requested Questions About Present Tax Guidelines

- Who pays the IRS present tax?

- What occurs if the donor dies earlier than paying the present tax?

- Do items scale back your lifetime present and property tax exclusion?

- Are you able to “claw again” earlier items if the legislation modifications?

- Do states additionally assess present taxes?

- The Significance of Working With an Skilled Advisory Crew

Key Takeaways

- The 2025 annual present tax exclusion means that you can give as much as $19,000 per recipient ($38,000 for married {couples}) with out incurring federal present tax.

- The lifetime present and property tax exemption of $13.99 million per particular person ($27.98 million for {couples}) allows you to switch vital wealth over time earlier than federal switch taxes apply.

- Structuring items utilizing methods like gifting appreciated belongings, “superfunding” 529 plans, donor-advised funds and special-needs trusts can enhance each tax effectivity and household outcomes.

For a lot of households, December is a month of giving. Whether or not you change vacation items with family and friends or help charitable causes which can be close to and expensive to you, you could be questioning learn how to maximize your influence in a tax-efficient method. Don’t fear, we’ve received you coated! Right here’s your 2025 information to federal present tax guidelines, the annual present tax exclusion, the lifetime present and property tax exemption and sensible gifting methods.

Gifting in 2025 – A Season of Generosity Meets IRS Present Tax Guidelines

Vacation giving is a beloved custom, and People are particularly beneficiant in the case of household and charitable gifts. Nevertheless, it’s essential to pay attention to how these items might influence your tax publicity and take steps to keep away from triggering federal present taxes.

The present tax is a federal switch tax imposed on transfers of property the place you don’t obtain equal worth in return. The aim of the tax is to forestall massive transfers of wealth from passing with out taxation. Below 2025 IRS present tax guidelines, the annual present tax exclusion permits people to make items of as much as $19,000 per recipient all year long with out triggering the present tax. Like most IRS provisions, there are some complexities and caveats to this present restrict. Learn on for what you want to know.

Present Tax Guidelines for 2025 – Annual Exclusion Fundamentals

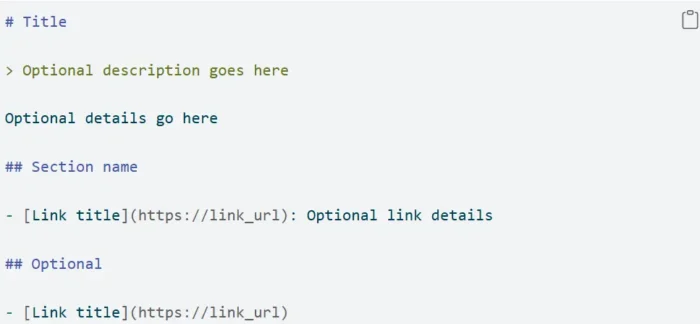

The next federal present tax guidelines apply to gifting in 2025:

- A person can provide as much as $19,000 in money or different belongings (e.g., shares, bonds, mutual funds, land, a brand new automotive, and many others.) in a single 12 months to anybody individual. In case you make a present in extra of $19,000 to a single recipient, you’ll have to file and report the present on a Kind 709 Present Tax return. Reporting the present doesn’t essentially set off the present tax, however it’ll scale back the quantity of your lifetime present and property tax exclusion (see particulars under).

- The $19,000 annual present tax exclusion is per recipient, which suggests you may make items of as much as this quantity to a number of recipients with out triggering the present tax. For instance, you can provide $19,000 to every of your three youngsters with out reporting the items or triggering taxes.

- In case you’re married, every partner can provide as much as $19,000 per recipient below the gift-splitting guidelines, for a complete mixed present of $38,000 per particular person recipient.

- Sure items are excluded from the $19,000 restrict, together with:

- Direct funds of medical or academic bills

- Items to a partner (there could also be limits if the partner isn’t a U.S. citizen)

- Direct items to a political group

Understanding which transfers qualify for the annual exclusion versus people who should be reported is a key a part of good present tax planning.

The Lifetime Present Tax Exclusion – The way it Impacts Annual Giving

In 2025, particular person taxpayers might exclude as much as $13.99 million in items over a lifetime, or $27.98 for married {couples} submitting collectively. The lately handed One Huge Stunning Invoice Act will improve the exemption to $15 million per particular person or $30 million per married couple submitting collectively and index it for inflation every year thereafter.

This unified credit score quantity is sometimes called the lifetime present and property tax exemption. Chances are you’ll use all of your lifetime present tax exclusion throughout your lifetime or reserve it for use by your property to scale back or get rid of property taxes following your loss of life.

For instance, let’s say you, as an single persion, give your daughter a present of $50,000 in 2025.

- The primary $19,000 is roofed by the annual present tax exclusion quantity and doesn’t influence your lifetime restrict.

- The remaining $31,000 is taken into account a taxable present and is subtracted out of your $13.99 million lifetime exemption, decreasing your remaining exemption to $13,959,000.

- You’d have to file Kind 709 to doc the transaction; nonetheless, no present tax is owed except you exceed your lifetime exemption.

What Qualifies as a Present Below IRS Guidelines?

It’s essential to notice that the IRS defines a present as any switch of property the place an equal worth isn’t returned. Meaning it’s not simply money that may be deemed a present for present tax functions. Examples of different items embrace:

- Securities, resembling shares, bonds or mutual funds

- Automobiles, boats, paintings, jewellery, and many others.

- The fee of another person’s debt

- The sale of a house for lower than truthful market worth

The next forms of items aren’t thought of taxable items and are due to this fact excluded from the annual restrict:

- Items to U.S. citizen spouses

- Direct funds to a medical supplier or medical insurance firm to pay for another person’s medical bills

- Direct funds to an academic establishment to pay for another person’s training bills

- As much as 5 years’ value of 529 faculty financial savings account gifting in a single 12 months ($95,000 most for 2025, or $19,000 x 5)

Gifting Methods to Assist Maximize Your Household’s Wealth

The next tax planning methods can assist you maximize each your giving influence and your loved ones’s long-term wealth-building potential.

Lifetime giving

One good thing about giving belongings all through your lifetime, slightly than leaving them as a financial legacy after you die, is that items below the annual exclusion scale back your taxable property whereas permitting you to witness their influence throughout your lifetime. Maybe the extra invaluable profit is that you’ve got the enjoyment of seeing the influence your monetary help can have in your family members’ lives, which generally is a priceless present.

Gifting appreciated belongings

Making an in-kind present of appreciated belongings to a different particular person means that you can keep away from paying capital beneficial properties tax on the time of the switch. The recipient of the securities then assumes your unique price foundation and holding interval and shall be assessed capital beneficial properties tax when she or he finally sells the safety, which might improve the recipient’s tax exposure. Nevertheless, this generally is a profit if the recipient is in a decrease tax bracket than you, as she or he shall be taxed at a decrease capital beneficial properties charge on the long-term beneficial properties (probably even 0% if their earnings is under sure thresholds).

It’s essential to train warning when gifting belongings to minor youngsters or full-time college students below age 24, as any unearned earnings above a sure threshold could also be taxed on the father or mother’s or donor’s greater tax charge. Your wealth supervisor can assist you keep away from this potential pitfall, often called the “kiddie tax,” as a part of your broader present and earnings tax planning.

“Superfunding” contributions to a 529 faculty financial savings account

The annual 529 contribution restrict is similar because the annual present tax exclusion ($19,000 per particular person in 2025). Nevertheless, the IRS permits taxpayers to frontload as much as 5 years’ value of 529 contributions in a single 12 months. Meaning you can provide as much as $95,000 per recipient in 2025. This quantity doubles to $19,000 in the event you and your partner each want to help a cherished one’s educational aspirations.

This technique, typically known as “superfunding” a 529 plan, generally is a highly effective property and present tax planning instrument, as a result of it removes belongings out of your taxable property whereas nonetheless utilizing the annual present tax exclusion guidelines over a 5‑12 months averaging interval.

Charitable giving

Though charitable donations are exempt from present tax reporting necessities, it’s essential to take steps to assist maximize each your philanthropic impact and your earnings tax advantages. Charitable giving generally is a core a part of your general present and property tax technique.

In-kind donation of appreciated securities

Somewhat than promoting securities to fund a charitable donation, it could make sense to make an in-kind switch of appreciated shares. Doing so means that you can keep away from paying capital beneficial properties tax on the sale of the securities whereas additionally permitting you to assert the securities’ full market worth as a charitable deduction in your itemized tax return. And, as a result of charitable organizations are tax-exempt, they will promote the securities and obtain the complete worth to fund their operations.

Donor-advised fund (DAF)

A DAF is a 501(c)(3) charitable fund that means that you can make an irrevocable donation, declare a tax deduction in your present 12 months’s itemized tax return and make grants to charities over time. This may be an efficient technique for decreasing your tax publicity throughout a high-income 12 months.

Donation “bunching”

In case you don’t at the moment meet the edge for submitting an itemized tax return, you should still be capable of take a charitable deduction through the use of a technique known as “bunching.” This technique includes making a number of years’ value of charitable donations in a single 12 months to exceed the usual deduction and maximize your tax advantages. This technique is especially efficient when funneled by way of a DAF, as you possibly can bunch your donations in a single 12 months whereas allocating belongings to charities over time.

For instance, in the event you usually donate $5,000 to charities every year, it could make sense to “bunch” these contributions right into a $25,000 donation each 5 years so that you could file an itemized tax return and declare a charitable deduction.

Items to minors

Gifting to minors typically includes completely different methods than these talked about above and requires further care from a present tax and earnings tax perspective.

Custodial accounts

One easy technique to present belongings to minors is thru a custodial account, resembling these created below the Uniform Items to Minors Act (UGMA) and Uniform Transfers to Minors Act (UTMA).

- UGMA – Primarily holds monetary belongings, resembling money, shares, bonds and mutual funds

- UTMA – Can maintain a wide range of asset sorts, together with tangible property resembling actual property, artwork and royalties, along with monetary belongings

These accounts are simple to ascertain and don’t require a separate tax return. Nevertheless, it’s essential to notice that the beneficiary beneficial properties full management of the belongings as soon as she or he reaches the age of majority.

Trusts

A belief can assist facilitate the present of belongings to minors whereas additionally supplying you with extra management over how the belongings are used. There are two predominant forms of trusts used for this objective:

- Part 2503(c) belief – Meant for a single beneficiary below the age of 21, the belief’s principal and earnings can be utilized for the kid’s profit on the discretion of the trustee. At age 21, the beneficiary is given the choice to withdraw any remaining belongings or go away them within the belief.

- Crummey belief – This sort of belief gives the beneficiary with a restricted window of time to withdraw belongings which have been gifted to the belief. Property may also be distributed to the beneficiary at particular ages, as designated by the donor within the belief settlement, whereas preserving annual present tax exclusion therapy for contributions.

Items to special-needs family members

It’s essential to train warning when offering monetary help to special-needs family members, as belongings held of their title might jeopardize their eligibility for advantages resembling Supplemental Safety Revenue (SSI), which serves because the gateway to Medicaid and different vital help packages.

A special-needs belief (SNT) permits belongings to be put aside for the good thing about a special-needs particular person with out interfering with their eligibility for public advantages. Property held in an SNT can be utilized to help the person with a variety of bills, together with training, journey, recreation, dental care and extra.

Along with sustaining advantages eligibility, SNTs additionally assist guarantee belongings are used in response to your intentions. For instance, with out an SNT in place, many mother and father try to help their particular wants youngster by giving belongings to a different youngster, with directions to help the sibling. Nevertheless, this strategy carries vital dangers, together with publicity to the sibling’s collectors, divorce, untimely loss of life or failure to comply with by way of. An SNT helps to make sure the belongings stay protected and used solely for the meant beneficiary.

One other good thing about SNTs is that relations and others all for serving to the special-needs particular person could make items to the SNT of as much as the annual present tax exclusion quantity with out being topic to tax.

SNTs might be funded with money, securities or life insurance coverage proceeds. One efficient technique is to implement a second-to-die life insurance coverage coverage, which gives a tax-efficient technique to fund the belief after each mother and father have handed.

Present Tax Reporting Necessities – When You Should File Kind 709

You could file IRS Form 709, United States Present (and Technology-Skipping Switch) Tax Return, in the event you made any of the next items within the relevant tax 12 months:

- Items that exceed the annual exemption quantity ($19,000 per donor per recipient in 2025)

- Items of a “future curiosity,” the place the advantages of the present are delayed till a later date (e.g., sure belief transfers)

- Items to a non-U.S. citizen partner that exceed the particular annual present tax exclusion ($19,000 in 2025)

- Items which can be break up along with your partner (as much as $38,000 per recipient in 2025), as every partner should consent to the therapy of the present

You don’t have to file Kind 709 if the items you made meet the next standards:

- The present was lower than the annual exemption quantity and was a present of “current curiosity,” which means the recipient had fast entry to and use of the present

- Direct funds to an academic establishment for tuition bills

- Direct funds to a medical care supplier or medical insurance firm for medical bills

- Items to a political group

- Deductible charitable donations

It’s essential to notice that submitting Kind 709 doesn’t essentially imply you’ll owe present tax. You can provide as much as the lifetime present and property tax exclusion quantity ($13.99 million in 2025) with out paying federal present tax. Reporting the present merely reduces your remaining lifetime exclusion quantity.

Incessantly Requested Questions About Present Tax Guidelines

Who pays the IRS present tax?

The individual giving the present (the donor) should report it and pay any relevant federal present tax.

What occurs if the donor dies earlier than paying the present tax?

If the donor dies earlier than paying the present tax, the accountability for reporting and paying taxes on the present falls to the donor’s property. The unpaid present tax is considered as a debt of the property.

Do items scale back your lifetime present and property tax exclusion?

Items as much as the annual present tax exclusion quantity aren’t counted towards your lifetime present and property tax exclusion. Any quantity exceeding the annual exemption reduces your lifetime present and property tax exclusion.

Are you able to “claw again” earlier items if the legislation modifications?

No. You usually can’t revoke a accomplished present because of a change in present tax legal guidelines. Items are considered as irrevocable transfers the place the donor has completely given up all management over the gifted belongings.

Do states additionally assess present taxes?

States have the best to impose extra state-level present taxes; nonetheless, most states have moved away from this observe. Presently, Connecticut is the one state that imposes a state-level present tax. Minnesota taxes transfers of Minnesota property valued at greater than $1 million.

The Significance of Working With an Skilled Advisory Crew

Not solely can gifting to family members enhance their lives and monetary circumstances however it may possibly additionally offer you immeasurable pleasure and success. Nevertheless, if not fastidiously managed, gifting belongings can result in vital tax penalties, which is why it’s essential to hunt the steering of an skilled wealth supervisor previous to implementing a gifting technique.

Inventive Planning is a trusted, credentialed useful resource for tax and gifting recommendation. Our skilled wealth and tax professionals work collectively to assist guarantee all elements of shoppers’ monetary lives are aligned to assist them obtain their targets. We help shoppers with world-class assets delivered by extremely credentialed professionals, together with CERTIFIED FINANCIAL PLANNER® professionals, CPAs, attorneys, insurance coverage specialists and extra. And since we function a fiduciary, you might be assured the recommendation you obtain is at all times guided by your finest pursuits.