- What Is a Tax Identification Quantity (Tax ID)?

- Who Can Use the NIN Technique to Get a Tax ID?

- Necessities Earlier than You Begin

- Step-by-Step Information: Tips on how to Get hold of Your Tax ID Utilizing NIN

- Step 1: Go to the Official Tax ID Portal

- Step 2: Choose “Particular person”

- Step 3: Select NIN as Your Retrieval Technique

- Step 4: Click on “Retrieve Tax ID”

- Step 5: Enter Your Private Particulars

- Step 6: Submit Your Request

- Step 7: View Your Tax ID

- What to Do If Your Tax ID Does Not Present

- Why This Course of Issues for Small Enterprise Homeowners

- Ceaselessly Requested Questions (FAQs)

- Is getting a Tax ID with NIN free?

- How lengthy does it take to get a Tax ID utilizing NIN?

- Can I exploit this technique if I wouldn’t have a enterprise?

- What ought to I do if my particulars don’t match?

- Is the Tax ID the identical as TIN?

- Can I retrieve my Tax ID on my telephone?

- Why do I would like a Tax ID in Nigeria?

Many Nigerians now want a Tax Identification Quantity for banking, employment, enterprise registration, and authorities providers. To make the method simpler, the Federal Inland Income Service (FIRS) now permits people to retrieve their Tax ID utilizing their Nationwide Identification Quantity (NIN).

You possibly can receive your Tax ID in Nigeria on-line by utilizing your NIN via the official FIRS Tax ID portal. The method is free, totally on-line, and takes just a few minutes in case your particulars are right.

What Is a Tax Identification Quantity (Tax ID)?

A Tax Identification Quantity, typically referred to as Tax ID or TIN, is a singular quantity issued by the Federal Inland Income Service. It’s used to trace tax data for people and companies.

For people, a Tax ID is required for:

- Opening sure financial institution accounts

- Authorities applications and grants

- Employment documentation

- Enterprise {and professional} transactions

With the mixing of NIN into authorities methods, retrieving a Tax ID has turn into simpler.

Who Can Use the NIN Technique to Get a Tax ID?

The NIN-based Tax ID retrieval is for people who:

- Are Nigerian residents or authorized residents

- Have a legitimate and lively NIN

- Have private particulars that match NIN data

You do not want to personal a registered enterprise to make use of this technique.

Necessities Earlier than You Begin

Earlier than visiting the portal, be sure to have:

- Your 11-digit Nationwide Identification Quantity

- Right spelling of your first and final identify

- Your date of beginning as registered with NIMC

- Web entry in your telephone or pc

Your particulars should match precisely together with your NIN data.

Step-by-Step Information: Tips on how to Get hold of Your Tax ID Utilizing NIN

Comply with the steps under fastidiously:

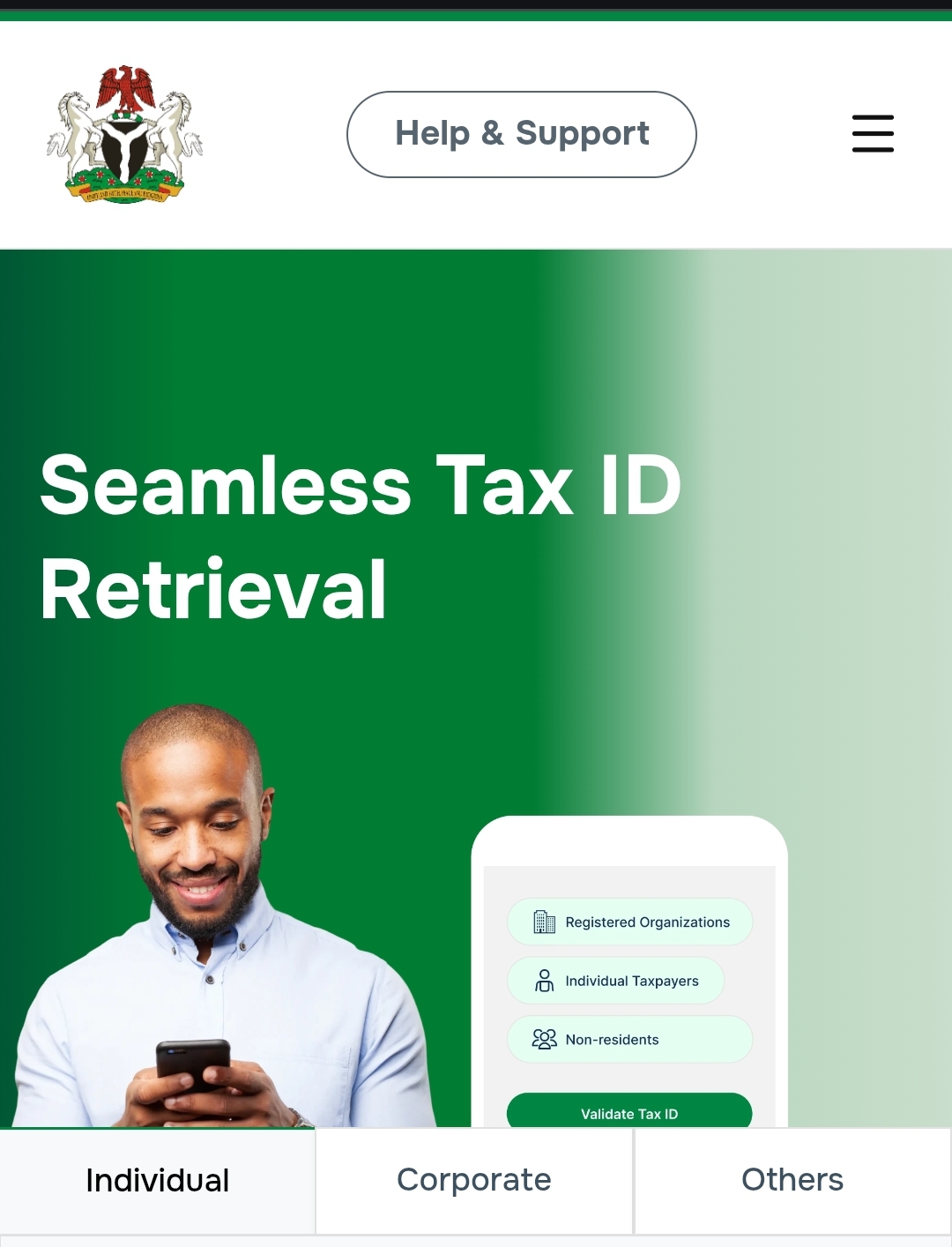

Step 1: Go to the Official Tax ID Portal

Go to the official FIRS Tax ID web site:

https://taxid.firs.gov.ng/

Step 2: Choose “Particular person”

On the homepage, click on on Particular person to proceed.

Step 3: Select NIN as Your Retrieval Technique

From the Tax ID Retrieval Technique dropdown menu, choose NIN.

Enter your 11-digit NIN within the discipline supplied.

Step 4: Click on “Retrieve Tax ID”

After coming into your NIN, click on Retrieve Tax ID.

A pop-up field will seem requesting extra particulars.

Step 5: Enter Your Private Particulars

Present the next info precisely as registered:

- First identify

- Final identify

- Date of beginning

Tick the checkbox to offer consent for id verification.

Step 6: Submit Your Request

Click on Submit to finish the method.

Step 7: View Your Tax ID

In case your info matches FIRS data, a affirmation message will seem.

Your Tax ID shall be displayed on the display.

You possibly can copy or save the quantity for future use.

What to Do If Your Tax ID Does Not Present

In case your Tax ID doesn’t seem, attainable causes embrace:

- Identify mismatch between NIN and FIRS data

- Incorrect date of beginning

- NIN not correctly synced with tax data

In such instances, chances are you’ll must contact FIRS help or go to a tax workplace for help.

Why This Course of Issues for Small Enterprise Homeowners

For MSMEs, having a Tax ID helps with:

- Accessing authorities loans and grants

- Registering companies and company accounts

- Taking part in official applications and tenders

Many federal applications now require a legitimate Tax ID as a part of eligibility checks.

Ceaselessly Requested Questions (FAQs)

Is getting a Tax ID with NIN free?

Sure. Retrieving your Tax ID utilizing your NIN on the FIRS portal is totally free. You do not want to pay any payment or use an agent.

How lengthy does it take to get a Tax ID utilizing NIN?

The method often takes a couple of minutes. As soon as your NIN particulars are verified, your Tax ID will seem immediately on the display.

Can I exploit this technique if I wouldn’t have a enterprise?

Sure. This technique is for people. You do not want a registered enterprise identify or firm to acquire a Tax ID utilizing your NIN.

What ought to I do if my particulars don’t match?

In case your particulars don’t match, verify that your identify and date of beginning are precisely the identical as these in your NIN file. If the difficulty continues, contact FIRS help or go to a tax workplace for help.

Is the Tax ID the identical as TIN?

Sure. Tax ID and Tax Identification Quantity are sometimes used to imply the identical factor in Nigeria. Each seek advice from the distinctive quantity issued by FIRS.

Can I retrieve my Tax ID on my telephone?

Sure. The FIRS Tax ID portal works on cell phones and computer systems. You solely want a secure web connection.

Why do I would like a Tax ID in Nigeria?

A Tax ID is required for a lot of official actions, together with authorities grants, loans, enterprise registration, banking providers, and employment-related documentation.

Submit Views: 200