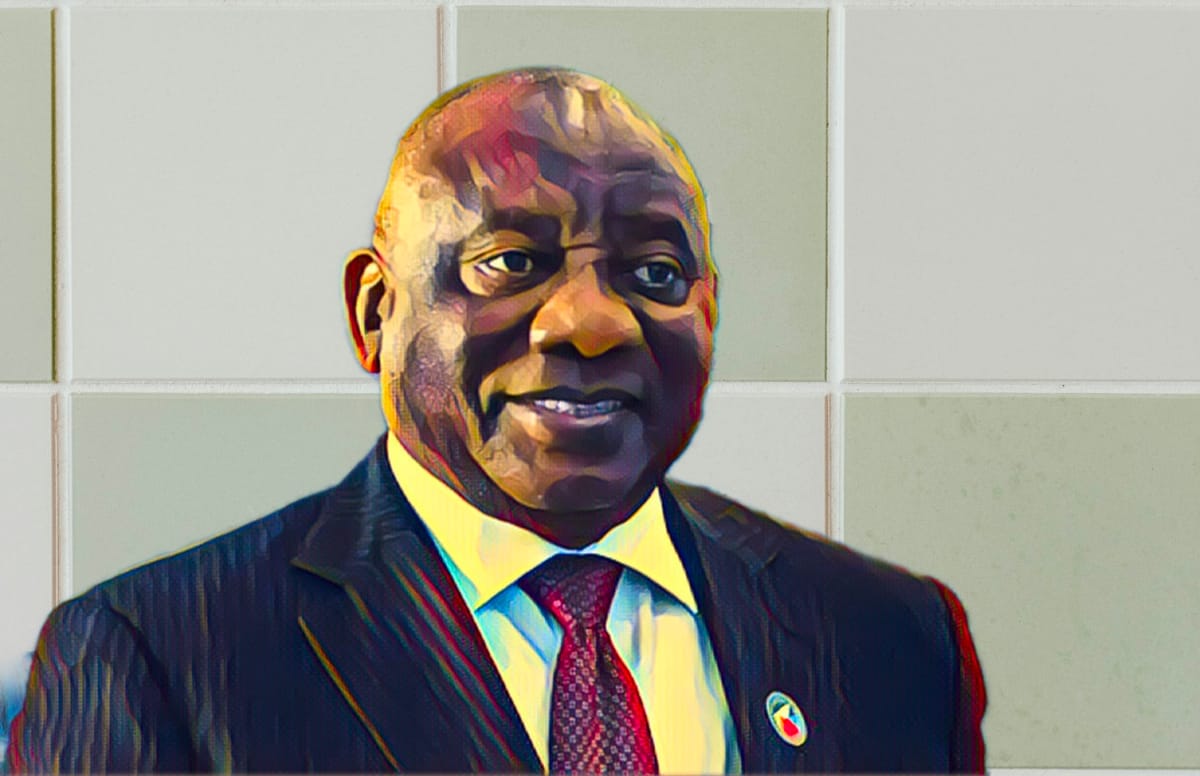

Cyril Ramaphosa didn’t arrive on the Union Buildings as a politician who had solely ever lived on get together salaries. Lengthy earlier than he grew to become South Africa’s president, he constructed an lively, public profession as a businessperson, with a résumé that moved from the picket line to company boardrooms and funding offers.

His political story started within the apartheid period, when he rose by the labor motion and have become a central determine within the Nationwide Union of Mineworkers. He later entered the African Nationwide Congress management and performed a distinguished function within the negotiations that ended white minority rule, a interval that made him nationally recognized and internationally related. After 1994, as the brand new authorities and massive enterprise tried to remake the financial system, black financial empowerment took form as a push to broaden possession and administration in a rustic the place capital was nonetheless concentrated in a couple of palms.

Early empowerment was usually deal-driven: consortia, bank-backed transactions, stakes purchased with leverage, and partnerships with established firms keen to satisfy new expectations. Ramaphosa, with credibility throughout labor, politics and enterprise, grew to become one of many best-positioned beneficiaries of that second. He used entry and networks to assemble stakes, be a part of main boards and, ultimately, construct Shanduka Group, the funding holding firm that grew to become the engine room of his fortune.

Shanduka at full stride

Shanduka’s peak years have been outlined by a portfolio constructed to seem like South Africa’s financial system itself: client manufacturers, heavy trade, finance, assets, telecoms and vitality. It was not a single trophy asset. It was an internet of bets, some quiet and long-term, others flashy sufficient to place Ramaphosa’s identify on billboards and storefronts.

One of many clearest examples of Shanduka’s industrial attain was packaging. Shanduka entered Mondi’s South African packaging companies by a landmark empowerment transaction and stayed related to the sector for years. The attraction was regular demand, factories that would not be wished away, and clients unfold throughout meals, retail and exports.

Banking publicity ran in parallel. Shanduka’s relationship with Normal Financial institution was ceaselessly cited in reporting in regards to the period, with Normal Financial institution linked as a shareholder in Shanduka and Shanduka described as holding important Normal Financial institution shares. In apply, it was the sort of mutually reinforcing construction widespread in empowerment offers: a rising black-owned funding car with capital and credibility, backed and banked by a longtime monetary establishment.

Shanduka additionally wished money circulation individuals might acknowledge. The group secured the grasp franchise for McDonald’s South Africa on a long-term settlement, turning a world model into an area funding story. That asset mattered as a result of it sat on the intersection of client spending and property, with retailers tied to prime retail places and the rhythms of middle-class progress.

The portfolio prolonged into drinks. Coca-Cola Shanduka Drinks carried the group’s identify in a sector constructed on scale, logistics and distribution. It later fashioned a part of a broader consolidation within the Coke bottling enterprise in southern and east Africa, a reminder that Shanduka didn’t solely chase cyclical industries.

Assets have been at all times near the middle. Shanduka Coal grew to become a serious pillar, structured by a three way partnership by which Shanduka moved right into a controlling place whereas sharing operational affect with Glencore. Coal is profitable in good cycles and politically flamable in unhealthy ones, which meant the funding carried each upside and reputational threat.

Telecoms introduced the largest continental swing. Shanduka invested in a stake related to MTN’s Nigerian enterprise, a wager on Africa’s largest market and the sort of play that would repay spectacularly or bitter shortly relying on regulation, foreign money and competitors.

Power and infrastructure have been additionally on the map. Shanduka was linked to an unbiased energy producer venture in Mozambique, the kind of funding that guarantees long-term returns however may be buffeted by financing, regional politics and altering companions. In a portfolio like Shanduka’s, that was the purpose: unfold threat throughout sectors whereas holding a seat on the desk in strategic industries.

The unwind into public life

Ramaphosa started pulling again from Shanduka when he returned to government authorities, first as deputy president in 2014 and later as president in 2018. The political logic was easy. A senior public official can’t plausibly oversee coverage in banking, mining, telecoms and vitality whereas privately benefiting from the identical industries. The enterprise actuality was messier, as a result of Shanduka’s property weren’t the type you promote with a single signature and a press launch.

Publicly, the divestment was framed as a firewall in opposition to conflicts of curiosity. The language across the time emphasised stepping away, promoting down, and putting household pursuits into belief buildings meant to create distance. That method additionally mirrored how wealth is commonly held in South Africa’s elite circles: layered possession, a number of entities, trustees, beneficiaries, and confidentiality constructed into the design.

As Ramaphosa moved out, Shanduka’s possession shifted. Institutional buyers and long-standing companions remained a part of the construction, and a belief linked to growth work emerged as a serious shareholder. In sensible phrases, it meant Shanduka might hold working as an funding platform with out Ramaphosa because the seen principal.

The headline property didn’t all keep put. The McDonald’s South Africa franchise, the buyer jewel that made Shanduka a family identify, ultimately modified palms, with the enterprise bought on to new homeowners. Different holdings have been restructured or folded into successor entities as Shanduka itself developed, together with a later merger into Pembani Group that signaled a brand new chapter for the platform after Ramaphosa’s exit.

Some divestments have been easy gross sales. Others have been financial exits that also left traces, equivalent to deferred funds, residual pursuits, or oblique publicity by entities not simply untangled from the skin. That’s the reason Ramaphosa’s wealth story continues to draw consideration. The broad path is seen, but the wonderful print is commonly locked behind personal agreements and belief deeds.

Trusts, property and the web value query

Trusts sit on the coronary heart of what stays publicly seen. Parliamentary disclosure summaries have listed Ramaphosa with residential property pursuits, together with Cape City flats and a cluster of Johannesburg townhouses that have been broadly reported years earlier. Those self same disclosures have referenced trusts by which he’s a trustee and beneficiary, together with the Tshivhase Belief, which has been repeatedly linked to his farming pursuits.

Agriculture is the one space Ramaphosa has constantly described as appropriate along with his public function, no less than in contrast with regulated sectors equivalent to mining, banking and telecoms. His farming pursuits, together with cattle and recreation operations related to Phala Phala, hold a tangible asset base in view: land, livestock, infrastructure and a enterprise that may generate income even when valuations are onerous to pin down.

Public controversy has additionally pressured sure particulars into daylight. Reviews tied to the Phala Phala matter have described the farm as owned by way of the Tshivhase Belief, and have famous that Ramaphosa is each trustee and beneficiary. That construction doesn’t robotically reveal each asset contained in the belief, nevertheless it issues as a result of it factors to a seamless nexus between his private wealth and a authorized car that may maintain property and enterprise pursuits past the glare of day-to-day politics.

So what’s the quantity in the present day? Public estimates have assorted over time, with some putting him within the mid-hundreds of thousands and thousands of {dollars}. An inexpensive present-day vary, primarily based on what is thought in regards to the scale of his peak-era holdings, subsequent divestments, and the persevering with presence of property and farming property, is roughly $400 million to $500 million.

The height possible sat increased, across the interval when Shanduka’s portfolio was at its broadest and most beneficial, and when massive institutional companions and working property sat closest to Ramaphosa’s financial curiosity. A believable peak vary is $500 million to $650 million, relying on how one treats the implied worth of Shanduka’s main stakes, the property portfolio reported on the time, and the realized proceeds of later transactions.

The valuation case rests on three pillars. Shanduka at its prime had stakes in actual working companies, together with client franchises, industrial packaging, coal operations, telecom publicity and monetary holdings. Divestment into public life nearly definitely decreased direct publicity, both by gross sales or restructuring, which tends to crystallize some worth whereas giving up future upside. Belief-held property, property and agriculture possible hold a considerable base intact, even when the general public can’t see a clear, itemized listing.

Ramaphosa’s wealth, in different phrases, seems much less like a single vault and extra like a narrative of timing: empowerment-era entry, a strong funding car constructed within the growth years, then a political return that pressured a reshaping slightly than a disappearance.