- 2026 IRS Tax Refund Schedule Chart

- What’s New For 2026?

- IRS Processing Timeline Defined

- 1. Return Accepted → IRS Begins Processing

- 2. Refund Permitted → Deposit Date Set

- 3. Refund Despatched → Cash in Your Account or Examine Mailed

- How “The place’s My Refund?” Updates

- Early Filers: Anticipate A Delay In Your Refund

- Paper Returns

- Errors or Id Verification

- Financial institution Account Points

- IRS Evaluation Flags or Offsets

- How To Monitor Your Tax Refund

- IRS “The place’s My Refund?” (Net + App)

- IRS2Go Cell App

- IRS Telephone Line

- Financial institution Notifications

- Prior Years’ Tax Refund Calendars

- Often Requested Questions About Tax Refunds

- Last Ideas

It is nearly tax season! And the primary query we see yearly is: when can I count on my tax refund? Most taxpayers obtain their IRS tax refund inside 21 days of submitting, however precise dates range relying on when your return is accepted, the way you file, and whether or not you declare sure tax credit.

For the 2026 submitting season, we count on the IRS to open e-file submissions in February and subject the first direct deposits by late February. Returns that embrace the Earned Income Tax Credit (EITC) or Further Little one Tax Credit score (ACTC) will proceed to be held till after February 15, as required by law.

The School Investor’s annual IRS Tax Refund Calendar under reveals the estimated deposit and verify mailing dates based mostly on IRS acceptance timing and direct deposit preferences. These are projections, not ensures — however yr after yr, they carefully match actual refund information reported by our readers.

⚠︎ Key Tax Dates This Yr ⚠︎

|

Occasion |

Timing |

|---|---|

|

IRS e-File Opens |

February 17, 2026 |

|

First Direct Deposits |

February 27, 2026 |

|

PATH Act Refunds Launched |

March 6, 2026 |

|

First Paper Examine Refunds |

March 6, 2026 |

|

Private Tax Submitting Deadline |

April 15, 2026 |

We imagine the IRS might be opening tax season exceptionally late this yr based mostly on comments by the IRS commissioner, together with the workload impacts of the government shutdown and changes due to the One Big Beautiful Bill Act (OBBBA).

Would you want to avoid wasting this?

Get Your Tax Refund Sooner

In the event you’re trying to get your tax return sooner, check out this list of banks that allow you to get your tax refund a few days early.

Whereas getting your tax return is thrilling, contemplate saving it in one of these top savings accounts.

2026 IRS Tax Refund Schedule Chart

Here’s a chart of when you possibly can count on your tax refund for when the return was accepted (based mostly on e-Submitting). That is an estimate, however based mostly on previous info, does appear correct for about 90% of taxpayers. Additionally, as all the time, you possibly can use the link after the calendar to get your specific refund status.

When are you able to file your 2025 federal tax return in 2026? Submitting season is anytime between February 17 and April 15, 2026.

Now, when to count on my tax refund based mostly on when it is accepted!

Observe: The IRS sends direct deposits to financial institution accounts each enterprise day throughout tax season. Our objective is to offer the top of the week through which it is best to hopefully obtain your tax refund.

Searching for a printable model of this tax refund schedule for 2026? Take a look at this hyperlink to DOWNLOAD THE PDF VERSION HERE.

Need an HTML model? See under:

|

2026 IRS Tax Refund Calendar |

||

|---|---|---|

|

Date Accepted |

Earliest Direct Deposit |

Paper Examine Mailed |

|

Feb 17 – Feb 21, 2026 |

Feb 27, 2026 |

Mar 6, 2026 |

|

Feb 22 – Feb 28, 2026 |

Mar 6, 2026 |

Mar 13, 2026 |

|

Mar 1 – Mar 7, 2026 |

Mar 13, 2026 |

Mar 20, 2026 |

|

Mar 8 – Mar 14, 2026 |

Mar 20, 2026 |

Mar 27, 2026 |

|

Mar 15 – Mar 21, 2026 |

Mar 27, 2026 |

Apr 3, 2026 |

|

Mar 22 – Mar 28, 2026 |

Apr 3, 2026 |

Apr 10, 2026 |

|

Mar 29 – Apr 4, 2026 |

Apr 10, 2026 |

Apr 17, 2026 |

|

Apr 5 – Apr 11, 2026 |

Apr 17, 2026 |

Apr 24, 2026 |

|

Apr 12 – Apr 18 2026 |

Apr 24, 2026 |

Might 1, 2026 |

|

Apr 19 – Apr 25, 2026 |

Might 1, 2026 |

Might 8, 2026 |

|

Apr 26 – Might 2, 2026 |

Might 8, 2026 |

Might 15, 2026 |

|

Might 3 – Might 9, 2026 |

Might 15, 2026 |

Might 22, 2026 |

|

Might 10 – Might 16, 2026 |

Might 22, 2026 |

Might 29, 2026 |

|

Might 17 – Might 23, 2026 |

Might 29, 2026 |

Jun 5, 2026 |

|

Might 24 – Might 30, 2026 |

Jun 5, 2026 |

Jun 12, 2026 |

|

Might 31 – Jun 6, 2026 |

Jun 12, 2026 |

Jun 19, 2026 |

|

Jun 7 – Jun 13, 2026 |

Jun 19, 2026 |

Jun 26, 2026 |

|

Jun 14 – Jun 20, 2026 |

Jun 26, 2026 |

Jul 3, 2026 |

|

Jun 21 – Jun 27, 2026 |

Jul 3, 2026 |

Jul 10, 2026 |

|

Jun 28 – Jul 4, 2026 |

Jul 10, 2026 |

Jul 17, 2026 |

|

Jul 5 – Jul 11, 2026 |

Jul 17, 2026 |

Jul 24, 2026 |

|

Jul 11 – Jul 18, 2026 |

July 24, 2026 |

Jul 31, 2026 |

|

Jul 19 – Jul 25, 2026 |

Jul 31, 2026 |

Aug 7, 2026 |

|

Jul 26 – Aug 1, 2026 |

Aug 7, 2026 |

Aug 14, 2026 |

Necessary Observe for PATH Act Filers: Your tax refund might be delayed till early March. Be taught extra concerning the PATH Act delays here.

What If You File A Tax Extension In 2026?

In the event you file a tax extension in 2026, you possibly can prolong your private tax deadline till October 15, 2026. Bear in mind, in case you select to file a tax extension in your Federal tax return, you’re nonetheless required to pay any taxes it’s possible you’ll owe by the April deadline. If you’re anticipating a tax refund, that does not actually matter – however you continue to must file to say your refund.

Here is a modified tax refund calendar particularly for individuals who filed a tax extension. We did not wish to litter the above chart given the dates for submitting an extension are usually 6 months later. Nonetheless, the rule of 21 days on common nonetheless applies in case you file a tax extension and declare your refund later.

|

2026 IRS Tax Extension Refund Calendar |

||

|---|---|---|

|

Date Accepted |

Direct Deposit Despatched |

Paper Examine Mailed |

|

Aug 2 – Aug 8, 2026 |

Aug 14, 2026 |

Aug 21, 2026 |

|

Aug 9 – Aug 15, 2026 |

Aug 21, 2026 |

Aug 28, 2026 |

|

Aug 16 – Aug 22, 2026 |

Aug 28, 2026 |

Sep 4, 2026 |

|

Aug 23 – Aug 29, 2026 |

Sep 4, 2026 |

Sep 11, 2026 |

|

Aug 30 – Sep 5, 2026 |

Sep 11, 2026 |

Sept 18, 2026 |

|

Sep 6 – Sep 12, 2026 |

Sept 18, 2026 |

Sept 25, 2026 |

|

Sep 13 – Sep 19, 2026 |

Sept 25, 2026 |

Oct 2, 2026 |

|

Sep 20 – Sep 26, 2026 |

Oct 2, 2026 |

Oct 9, 2026 |

|

Sept 27 – Oct 3, 2026 |

Oct 9, 2026 |

Oct 16, 2026 |

|

Oct 4 – Oct 10, 2026 |

Oct 16, 2026 |

Oct 23, 2026 |

|

Oct 11 – Oct 17, 2026 |

Oct 23, 2026 |

Oct 30, 2026 |

|

Oct 18 – Oct 24, 2026 |

Oct 30, 2026 |

Nov 6, 2026 |

What’s New For 2026?

The massive change for 2026 is the probably delayed begin to tax season. On the Tax Summit of the Nationwide Affiliation of Enrolled Brokers in Salt Lake Metropolis, IRS Commissioner Billy Lengthy said the start of the 2026 tax season needs to be round Presidents Day, which is February 16.

While you mix that with the federal government shutdown and the large modifications required to implement the OBBBA, we agree that tax season might be delayed this yr.

The result’s that eFiling will open later, which can delay tax refunds for hundreds of thousands of Individuals.

IRS Processing Timeline Defined

The IRS usually points most refunds inside 21 days of accepting your e-filed return. That 21-day clock doesn’t begin while you file your taxes – it begins as soon as the IRS formally accepts your return for processing.

Right here’s what occurs at every stage:

1. Return Accepted → IRS Begins Processing

When you hit “Submit,” your tax return is time-stamped and transmitted to the IRS. Inside 24 to 48 hours, the company verifies your private info and both accepts or rejects the return.

An “Accepted” standing means your submitting handed fundamental validation checks and entered the IRS processing system.

Discover: In the event you submit your tax return earlier than eFile opens (which many online tax software services permit), these corporations will maintain your return after which submit as quickly because the IRS begins accepting them. Some fortunate filers could get early entry in check batches as properly.

2. Refund Permitted → Deposit Date Set

After your return clears preliminary verification, the IRS confirms your refund quantity and approves fee.

This step triggers a deposit date, which seems within the “The place’s My Refund?” software or the IRS2Go cellular app.

3. Refund Despatched → Cash in Your Account or Examine Mailed

As soon as your refund is distributed, it usually takes one to 5 enterprise days to look in your bank account.

Paper checks can take longer, relying on U.S. Postal Service supply occasions and holidays.

How “The place’s My Refund?” Updates

The IRS updates refund statuses as soon as per day—often in a single day.

You received’t see extra frequent modifications by checking a number of occasions a day.

Go to the official IRS software right here: Where’s My Refund?

In the event you’re getting an error message or points, take a look at our full IRS Where’s My Refund Guide And Common Questions.

Early Filers: Anticipate A Delay In Your Refund

We count on the tax season to be additional delayed in 2026 – as a result of IRS commissioner’s feedback, modifications to tax guidelines, and the federal government shutdown.

In the event you claimed the Earned Revenue Tax Credit score (EITC) or the Further Little one Tax Credit score (ACTC), federal legislation requires the IRS to carry your complete refund till no less than mid-February. That is due to the PATH Act.

For 2026, we count on the IRS to launch the primary wave of EITC/ACTC refunds to be by March 6, offered there are not any points and also you used direct deposit.

⚠ Reminder: Claiming the EITC or ACTC means no refunds earlier than February 15, even when your return was accepted early. “The place’s My Refund” ought to present updates for many early filers by February 22, 2026.

There are different causes for delays as properly.

Paper Returns

Paper-filed returns take the longest to course of as a result of IRS workers should manually enter and confirm info. Anticipate six to eight weeks for processing and mailing (no less than), in contrast with 21 days for e-filers.

Errors or Id Verification

Even small errors (like a misspelled title, incorrect Social Safety quantity, or mismatched W-2 income) could cause delays.

The IRS may additionally flag your return for added id verification if it suspects potential fraud.

Financial institution Account Points

If the direct-deposit info in your tax return is improper, or in case your checking account is closed, your refund could also be delayed or rerouted as a paper verify.

Examine that your routing and account numbers are appropriate earlier than submitting your return.

IRS Evaluation Flags or Offsets

Your refund will also be lowered or held for past-due federal or state taxes, youngster assist, or defaulted federal student loans. Sure, assortment exercise on pupil loans resumed – so the IRS will take your tax refund this year if you are in default.

Offsets are dealt with by the Treasury Offset Program (TOP). If this occurs, you’ll obtain a mailed discover explaining how your refund was utilized.

How To Monitor Your Tax Refund

As soon as your return is accepted, you possibly can observe progress utilizing IRS instruments and your financial institution’s alerts. Right here’s the right way to verify safely and successfully:

IRS “The place’s My Refund?” (Net + App)

The quickest method to get correct info.

Enter your Social Safety quantity, submitting standing, and actual refund quantity to see your personalised standing.

Updates publish as soon as each day, usually in a single day.

IRS2Go Cell App

This free IRS2GO app mirrors the identical information as the web site however provides push notifications.

Obtain it out of your gadget’s app retailer to get real-time updates with out visiting the IRS web site instantly.

IRS Telephone Line

If it’s been greater than 4 weeks previous your anticipated timeline, you possibly can name 1-800-829-1954 to verify standing.

Anticipate lengthy maintain occasions throughout peak tax season; this line received’t present extra element than the web instruments.

Here is a guide to contacting the IRS and getting a real human.

Financial institution Notifications

Generally your monetary establishment posts deposits earlier than the IRS web site updates.

Allow direct-deposit alerts or each day stability notifications so that you’ll know as quickly as your refund hits.

Discover Your State Tax Refund Too!

If you’re ready in your state tax refund, you may also verify the standing of that. We’ve our full information to Tracking And Finding Your State Tax Refund here >>

Prior Years’ Tax Refund Calendars

Searching for an outdated IRS refund chart? We saved them for you under.

Right here is the 2025 tax refund calendar:

Right here is the 2025 tax refund extension calendar:

|

2025 IRS Tax Extension Refund Calendar |

||

|---|---|---|

|

Date Accepted |

Direct Deposit Despatched |

Paper Examine Mailed |

|

Aug 3 – Aug 9, 2025 |

Aug 29, 2025 |

Sep 5, 2025 |

|

Aug 10 – Aug 16, 2025 |

Sep 5, 2025 |

Sep 12, 2025 |

|

Aug 17 – Aug 23, 2025 |

Sep 12, 2025 |

Sep 19, 2025 |

|

Aug 24 – Aug 30, 2025 |

Sep 19, 2025 |

Sep 26, 2025 |

|

Aug 31 – Sep 6, 2025 |

Sep 26, 2025 |

Oct 3, 2025 |

|

Sep 7 – Sep 13, 2025 |

Oct 3, 2025 |

Oct 10, 2025 |

|

Sep 14 – Sep 20, 2025 |

Oct 10, 2025 |

Oct 17, 2025 |

|

Sep 21 – Sep 27, 2025 |

Oct 17, 2025 |

Oct 24, 2025 |

|

Sept 28 – Oct 4, 2025 |

Oct 24, 2025 |

Oct 31, 2025 |

|

Oct 5 – Oct 11, 2025 |

Oct 31, 2025 |

Nov 7, 2025 |

|

Oct 12 – Oct 18, 2025 |

Nov 7, 2025 |

Nov 14, 2025 |

|

Oct 19 – Oct 25, 2025 |

Nov 14, 2025 |

Nov 21, 2025 |

Right here is the 2024 tax refund calendar:

Right here is the 2024 tax extension refund calendar:

|

2024 IRS Tax Extension Refund Calendar |

||

|---|---|---|

|

Date Accepted |

Direct Deposit Despatched |

Paper Examine Mailed |

|

Aug 4 – Aug 10, 2024 |

Aug 30, 2024 |

Sep 6, 2024 |

|

Aug 11 – Aug 17, 2024 |

Sep 6, 2024 |

Sep 13, 2024 |

|

Aug 18 – Aug 24, 2024 |

Sep 13, 2024 |

Sep 20, 2024 |

|

Aug 25 – Aug 31, 2024 |

Sep 20, 2024 |

Sep 27, 2024 |

|

Sep 1 – Sep 7, 2024 |

Sep 27, 2024 |

Oct 4, 2024 |

|

Sep 8 – Sep 14, 2024 |

Oct 4, 2024 |

Oct 11, 2024 |

|

Sep 15 – Sep 21, 2024 |

Oct 11, 2024 |

Oct 18, 2024 |

|

Sep 22 – Sep 28, 2024 |

Oct 18, 2024 |

Oct 25, 2024 |

|

Sept 29 – Oct 5, 2024 |

Oct 25, 2024 |

Nov 1, 2024 |

|

Oct 6 – Oct 12, 2024 |

Nov 1, 2024 |

Nov 8, 2024 |

|

Oct 13 – Oct 19, 2024 |

Nov 8, 2024 |

Nov 15, 2024 |

|

Oct 20 – Oct 25, 2024 |

Nov 15, 2024 |

Nov 22, 2024 |

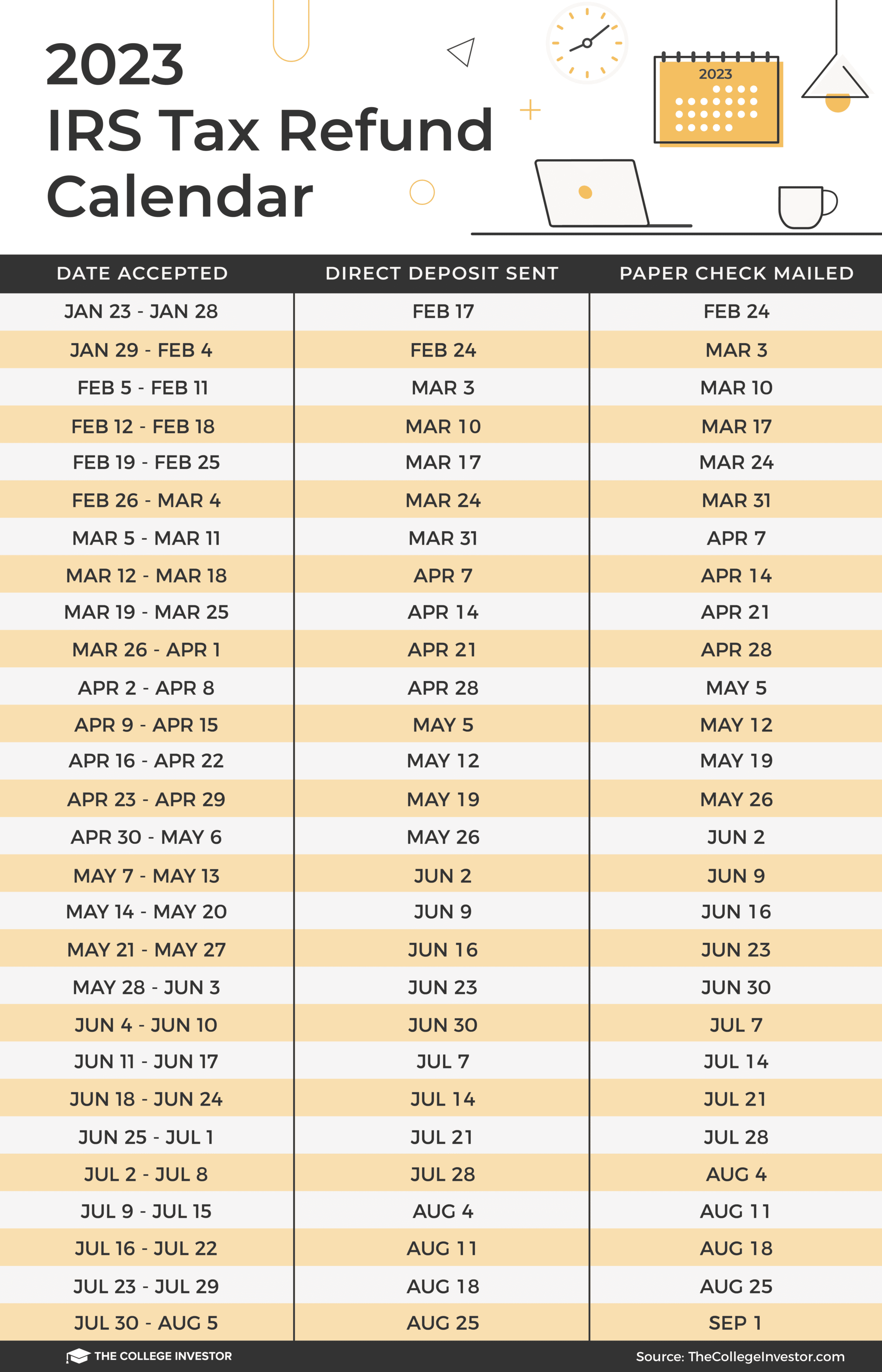

Right here is the 2023 IRS refund chart in case you’re nonetheless wanting to recollect what occurred final yr.

If you’re searching for when to count on your tax extension return, see this desk:

|

2023 IRS Tax Extension Refund Calendar |

||

|---|---|---|

|

Date Accepted |

Direct Deposit Despatched |

Paper Examine Mailed |

|

Aug 6 – Aug 12, 2023 |

Sep 1, 2023 |

Sep 8, 2023 |

|

Aug 13 – Aug 19, 2023 |

Sep 8, 2023 |

Sep 15, 2023 |

|

Aug 20 – Aug 26, 2023 |

Sep 15, 2023 |

Sep 22, 2023 |

|

Aug 27 – Sep 2, 2023 |

Sep 22, 2023 |

Sep 29, 2023 |

|

Sep 3 – Sep 9, 2023 |

Sep 29, 2023 |

Oct 6, 2023 |

|

Sep 10 – Sep 16, 2023 |

Oct 6, 2023 |

Oct 13, 2023 |

|

Sep 17 – Sep 23, 2023 |

Oct 13, 2023 |

Oct 20, 2023 |

|

Sep 24 – Sep 30, 2023 |

Oct 20, 2023 |

Oct 27, 2023 |

|

Oct 1 – Oct 7, 2023 |

Oct 27, 2023 |

Nov 3, 2023 |

|

Oct 8 – Oct 14, 2023 |

Nov 3, 2023 |

Nov 10, 2023 |

|

Oct 15 – Oct 21, 2023 |

Nov 10, 2023 |

Nov 17, 2023 |

|

Oct 22 – Oct 28, 2023 |

Nov 17, 2023 |

Nov 24, 2023 |

Right here is the 2022 IRS refund chart in case you’re nonetheless wanting to recollect what occurred final yr.

There’s most likely not a lot from 2021 you wish to keep in mind, however here is our tax refund schedule if you’re nonetheless searching for it.

Coronavirus Pandemic Delays And Date Modifications

One of many largest areas of delays are mail returns. In 2020, we noticed mail held up for months, and we count on mail delays to proceed. If attainable, all the time eFile. Sending your return by way of mail will trigger vital delays in processing.

In the event you’ve already filed your return, our assumption is there might be continued delays in processing occasions. In case your return is underneath evaluation or different info is required, it’s possible you’ll expertise vital delays resulting from staffing.

|

2021 IRS Tax Refund Calendar |

||

|---|---|---|

|

Date Accepted |

Direct Deposit Despatched |

Paper Examine Mailed |

|

Feb 12 – Feb 13, 2021 |

Feb 26, 2021 |

Mar 5, 2021 |

|

Feb 14 – Feb 20, 2021 |

Mar 5, 2021 |

Mar 12, 2021 |

|

Feb 21 – Feb 27, 2021 |

Mar 12, 2021 |

Mar 19, 2021 |

|

Feb 28 – Mar 6, 2021 |

Mar 19, 2021 |

Mar 26, 2021 |

|

Mar 7 – Mar 13, 2021 |

Mar 26, 2021 |

Apr 2, 2021 |

|

Mar 14 – Mar 20, 2021 |

Apr 2, 2021 |

Apr 9, 2021 |

|

Mar 21 – Mar 27, 2021 |

Apr 9, 2021 |

Apr 16, 2021 |

|

Mar 28 – Apr 3, 2021 |

Apr 16, 2021 |

April 23, 2021 |

|

Apr 4 – Apr 10, 2021 |

Apr 23, 2021 |

Apr 30, 2021 |

|

Apr 11 – Apr 17, 2021 |

Apr 30, 2021 |

Might 7, 2021 |

|

Apr 18 – Apr 24, 2021 |

Might 7, 2021 |

Might 14, 2021 |

|

Apr 25 – Might 1, 2021 |

Might 14, 2021 |

Might 21, 2021 |

|

Might 2 – Might 8, 2021 |

Might 21, 2021 |

Might 28, 2021 |

|

Might 9 – Might 15, 2021 |

Might 28, 2021 |

Jun 4, 2021 |

|

Might 16 – Might 22, 2021 |

Jun 4, 2021 |

Jun 11, 2021 |

|

Might 23 – Might 29, 2021 |

Jun 11, 2021 |

Jun 18, 2021 |

|

Might 30 – Jun 5, 2021 |

Jun 18, 2021 |

Jun 25, 2021 |

|

Jun 6 – Jun 12, 2021 |

Jun 25, 2021 |

Jul 2, 2021 |

|

Jun 13 – Jun 19, 2021 |

Jul 2, 2021 |

Jul 9, 2021 |

|

Jun 20 – Jun 26, 2021 |

Jul 9, 2021 |

Jul 16, 2021 |

|

Jun 27 – Jul 3, 2021 |

Jul 16, 2021 |

Jul 23, 2021 |

|

Jul 4 – Jul 10, 2021 |

Jul 23, 2021 |

Jul 30, 2021 |

|

Jul 11 – Jul 17, 2021 |

Jul 30, 2021 |

Aug 6, 2021 |

|

Jul 18 – Jul 24, 2021 |

Aug 6, 2021 |

Aug 13, 2021 |

|

Jul 25 – Jul 31, 2021 |

Aug 13, 2021 |

Aug 20, 2021 |

There’s most likely not a lot from 2020 you wish to keep in mind, however here is our tax refund schedule if you’re nonetheless searching for it:

|

2020 IRS Tax Refund Calendar |

||

|---|---|---|

|

Date Accepted |

Direct Deposit Despatched |

Paper Examine Mailed |

|

Jan 27 – Feb 1, 2020 |

Feb 14, 2020 |

Feb 21, 2020 |

|

Feb 2 – Feb 8, 2020 |

Feb 21, 2020 |

Feb 28, 2020 |

|

Feb 9 – Feb 15, 2020 |

Feb 28, 2020 |

Mar 6, 2020 |

|

Feb 16 – Feb 22, 2020 |

Mar 6, 2020 |

Mar 13, 2020 |

|

Feb 23 – Feb 29, 2020 |

Mar 13, 2020 |

Mar 20, 2020 |

|

Mar 1 – Mar 7, 2020 |

Mar 20, 2020 |

Mar 27, 2020 |

|

Mar 8 – Mar 14, 2020 |

Mar 27, 2020 |

Apr 3, 2020 |

|

Mar 15 – Mar 21, 2020 |

Apr 3, 2020 |

Apr 10, 2020 |

|

Mar 22 – Mar 28, 2020 |

Apr 10, 2020 |

Apr 17, 2020 |

|

Mar 29 – Apr 4, 2020 |

Apr 17, 2020 |

April 24, 2020 |

|

Apr 5 – Apr 11, 2020 |

April 24, 2020 |

Might 1, 2020 |

|

Apr 12 – Apr 18, 2020 |

Might 1, 2020 |

Might 8, 2020 |

|

Apr 19 – Apr 25, 2020 |

Might 8, 2020 |

Might 15, 2020 |

|

Apr 26 – Might 2, 2020 |

Might 15, 2020 |

Might 22, 2020 |

|

Might 3 – Might 9, 2020 |

Might 22, 2020 |

Might 29, 2020 |

|

Might 10- Might 16, 2020 |

Might 29, 2020 |

Jun 5, 2020 |

|

Might 17 – Might 23, 2020 |

Jun 5, 2020 |

Jun 12, 2020 |

|

Might 24 – Might 30, 2020 |

Jun 12, 2020 |

Jun 19, 2020 |

|

Might 31 – Jun 6, 2020 |

Jun 19, 2020 |

Jun 26, 2020 |

|

Jun 7 – Jun 13, 2020 |

Jun 26, 2020 |

Jul 3, 2020 |

|

Jun 14 – Jun 20, 2020 |

Jul 3, 2020 |

Jul 10, 2020 |

|

Jun 21 – Jun 27, 2020 |

Jul 10, 2020 |

Jul 17, 2020 |

|

Jun 28 – Jul 4, 2020 |

Jul 17, 2020 |

Jul 24, 2020 |

|

Jul 5 – Jul 11, 2020 |

Jul 24, 2020 |

Jul 31, 2020 |

|

Jul 12 – Jul 18, 2020 |

Jul 31, 2020 |

Aug 7, 2020 |

|

Jul 19 – Jul 25, 2020 |

Aug 7, 2020 |

Aug 14, 2020 |

|

Jul 26 – Aug 1, 2020 |

Aug 14, 2020 |

Aug 21, 2020 |

Right here is the 2019 IRS refund calendar in case you’re nonetheless searching for it.

|

2019 IRS Tax Refund Calendar |

||

|---|---|---|

|

Date Accepted |

Direct Deposit Despatched |

Paper Examine Mailed |

|

Jan 28 – Feb 2, 2019 |

Feb 15, 2019 |

Feb 22, 2019 |

|

Feb 3 – Feb 9, 2019 |

Feb 22, 2019 |

Mar 1, 2019 |

|

Feb 10 – Feb 16, 2019 |

Mar 1, 2019 |

Mar 8, 2019 |

|

Feb 17 – Feb 23, 2019 |

Mar 8, 2019 |

Mar 15, 2019 |

|

Feb 24 – Mar 2, 2019 |

Mar 15, 2019 |

Mar 22, 2019 |

|

Mar 3 – Mar 9, 2019 |

Mar 22, 2019 |

Mar 29, 2019 |

|

Mar 10 – Mar 16, 2019 |

Mar 29, 2019 |

Apr 5, 2019 |

|

Mar 17 – Mar 23, 2019 |

Apr 5, 2019 |

Apr 12, 2019 |

|

Mar 24 – Mar 30, 2019 |

Apr 12, 2019 |

Apr 19, 2019 |

|

Mar 31 – Apr 6, 2019 |

Apr 19, 2019 |

April 26, 2019 |

|

Apr 7 – Apr 13, 2019 |

April 26, 2019 |

Might 3, 2019 |

|

Apr 14 – Apr 20, 2019 |

Might 3, 2019 |

Might 10, 2019 |

|

Apr 21 – Apr 27, 2019 |

Might 10, 2019 |

Might 17, 2019 |

|

Apr 28 – Might 4, 2019 |

Might 17, 2019 |

Might 24, 2019 |

Right here is the 2018 tax refund calendar.

|

2018 IRS Tax Refund Calendar |

||

|---|---|---|

|

Date Accepted |

Direct Deposit Despatched |

Paper Examine Mailed |

|

Jan 29 – Feb 4, 2018 |

Feb 17, 2018 |

Feb 24, 2018 |

|

Feb 5 – Feb 11, 2018 |

Feb 24, 2018 |

Mar 3, 2018 |

|

Feb 12 – Feb 18, 2018 |

Mar 3, 2018 |

Mar 10, 2018 |

|

Feb 19 – Feb 25, 2018 |

Mar 10, 2018 |

Mar 17, 2018 |

|

Feb 27 – Mar 4, 2018 |

Mar 17, 2018 |

Mar 24, 2018 |

|

Mar 5 – Mar 11, 2018 |

Mar 24, 2018 |

Mar 31, 2018 |

|

Mar 12 – Mar 18, 2018 |

Mar 31, 2018 |

Apr 7, 2018 |

|

Mar 19 – Mar 25, 2018 |

Apr 7, 2018 |

Apr 14, 2018 |

|

Mar 26 – Apr 1, 2018 |

Apr 14, 2018 |

Apr 21, 2018 |

|

Apr 2 – Apr 8, 2018 |

Apr 21, 2018 |

April 28, 2018 |

|

Apr 9 – Apr 15, 2018 |

April 28, 2018 |

Might 5, 2018 |

|

Apr 16 – Apr 22, 2018 |

Might 5, 2018 |

Might 12, 2018 |

|

Apr 23 – Apr 29, 2018 |

Might 12, 2018 |

Might 19, 2018 |

Nonetheless searching for the 2017 tax refund calendar? We saved it for you right here:

|

2017 IRS Tax Refund Calendar |

||

|---|---|---|

|

Date Accepted |

Direct Deposit Despatched |

Paper Examine Mailed |

|

Jan 23 – Jan 28, 2017 |

Feb 10, 2017 |

Feb 17, 2017 |

|

Jan 29 – Feb 4, 2017 |

Feb 17, 2017 |

Feb 24, 2017 |

|

Feb 5 – Feb 11, 2017 |

Feb 24, 2017 |

Mar 3, 2017 |

|

Feb 12 – Feb 18, 2017 |

Mar 3, 2017 |

Mar 10, 2017 |

|

Feb 19 – Feb 25, 2017 |

Mar 10, 2017 |

Mar 17, 2017 |

|

Feb 27 – Mar 4, 2017 |

Mar 17, 2017 |

Mar 24, 2017 |

|

Mar 5 – Mar 11, 2017 |

Mar 24, 2017 |

Mar 31, 2017 |

|

Mar 12 – Mar 18, 2017 |

Mar 31, 2017 |

Apr 7, 2017 |

|

Mar 19 – Mar 25, 2017 |

Apr 7, 2017 |

Apr 14, 2017 |

|

Mar 26 – Apr 1, 2017 |

Apr 14, 2017 |

Apr 21, 2017 |

|

Apr 2 – Apr 8, 2017 |

Apr 21, 2017 |

April 28, 2017 |

|

Apr 9 – Apr 15, 2017 |

April 28, 2017 |

Might 5, 2017 |

|

Apr 16 – Apr 22, 2017 |

Might 5, 2017 |

Might 12, 2017 |

|

Apr 23 – Apr 29, 2017 |

Might 12, 2017 |

Might 19, 2017 |

Right here is the 2016 tax refund calendar:

|

2016 IRS Tax Refund Calendar |

||

|---|---|---|

|

Date Accepted |

Direct Deposit Despatched |

Paper Examine Mailed |

|

Jan 19 – Jan 23, 2016 |

Feb 5, 2016 |

Feb 10, 2016 |

|

Jan 24 – Jan 30, 2016 |

Feb 12, 2016 |

Feb 17, 2016 |

|

Jan 31 – Feb 6, 2016 |

Feb 19, 2016 |

Feb 24, 2016 |

|

Feb 7 – 13, 2016 |

Feb 26, 2016 |

Mar 2, 2016 |

|

Feb 14 – 20, 2016 |

Mar 4, 2016 |

Mar 9, 2016 |

|

Feb 21 – 27, 2016 |

Mar 11, 2016 |

Mar 16, 2016 |

|

Feb 28 – Mar 5, 2016 |

Mar 18, 2016 |

Mar 23, 2016 |

|

Mar 6 – 12, 2016 |

Mar 25, 2016 |

Mar 30, 2016 |

|

Mar 13 – 19, 2016 |

Apr 1, 2016 |

Apr 6, 2016 |

|

Mar 20 – 26, 2016 |

Apr 8, 2016 |

Apr 13, 2016 |

|

Mar 27 – Apr 2, 2016 |

Apr 15, 2016 |

Apr 20, 2016 |

|

Apr 3 – Apr 9, 2016 |

Apr 22, 2016 |

April 27, 2016 |

|

Apr 10 – Apr 16, 2016 |

April 29, 2016 |

Might 4, 2016 |

|

Apr 17 – Apr 23, 2016 |

Might 6, 2016 |

Might 11, 2016 |

|

Apr 24 – Apr 30, 2016 |

Might 13, 2016 |

Might 18, 2016 |

Right here is the 2015 tax refund calendar:

|

2015 IRS Tax Refund Calendar |

||

|---|---|---|

|

Date Accepted |

Direct Deposit Despatched |

Paper Examine Mailed |

|

Jan 20 – Jan 24, 2015 |

Feb 6, 2015 |

Feb 9, 2015 |

|

Jan 25 – Jan 31, 2015 |

Feb 13, 2015 |

Feb 16, 2015 |

|

Feb 1 – Feb 7, 2015 |

Feb 20, 2015 |

Feb 23, 2015 |

|

Feb 8 – 14, 2015 |

Feb 27, 2015 |

Mar 2, 2015 |

|

Feb 15 – 21, 2015 |

Mar 6, 2015 |

Mar 13, 2015 |

|

Feb 22 – 28, 2015 |

Mar 13, 2015 |

Mar 20, 2015 |

|

Mar 1 – 7, 2015 |

Mar 20, 2015 |

Mar 27, 2015 |

|

Mar 8 – 14, 2015 |

Mar 27, 2015 |

Apr 3, 2015 |

|

Mar 15 – 21, 2015 |

Apr 3, 2015 |

Apr 10, 2015 |

|

Mar 22 – 28, 2015 |

Apr 10, 2015 |

Apr 17, 2015 |

|

Mar 29 – Apr 4, 2015 |

Apr 17, 2015 |

Apr 24, 2015 |

|

Apr 5 – Apr 11, 2015 |

Apr 24, 2015 |

Might 1, 2015 |

|

Apr 12 – Apr 15, 2015 |

Might 1, 2015 |

Might 8, 2015 |

|

Apr 16 – Apr 25, 2015 |

Might 8, 2015 |

Might 15, 2015 |

|

Apr 26 – Might 2, 2015 |

Might 15, 2015 |

Might 22, 2015 |

Right here is the 2014 tax refund calendar:

|

2014 IRS Tax Refund Calendar |

||

|---|---|---|

|

Accepted Date |

Direct Deposit Despatched |

Paper Examine Mailed |

|

Jan 31 – Feb 3, 2014 |

Feb 13, 2014 |

Feb 21, 2014 |

|

Feb 4 – 10, 2014 |

Feb 21, 2014 |

Feb 24, 2014 |

|

Feb 11 – 17, 2014 |

Feb 28, 2014 |

Mar 3, 2014 |

|

Feb 18 – 24, 2014 |

Mar 7, 2014 |

Mar 10, 2014 |

|

Feb 25 – Mar 3, 2014 |

Mar 14, 2014 |

Mar 17, 2014 |

|

Mar 4 – 10, 2014 |

Mar 21, 2014 |

Mar 24, 2014 |

|

Mar 11 – 17, 2014 |

Mar 28, 2014 |

Mar 31, 2014 |

|

Mar 18 – 24, 2014 |

Apr 4, 2014 |

Apr 7, 2014 |

|

Mar 25 – 31, 2014 |

Apr 11, 2014 |

Apr 14, 2014 |

|

Apr 1 – 7, 2014 |

Apr 18, 2014 |

Apr 21, 2014 |

|

Apr 8 – 14, 2014 |

Apr 25, 2014 |

Apr 28, 2014 |

|

Apr 15 – 21, 2014 |

Might 2, 2014 |

Might 5, 2014 |

|

Apr 22 – 28, 2014 |

Might 9, 2014 |

Might 12, 2014 |

Often Requested Questions About Tax Refunds

Listed below are a number of the most typical questions and FAQs round this tax refund calendar and tax refund schedule:

When will I get my tax refund in 2026?

Most refunds arrive inside 21 days of e-file acceptance. Returns with EITC/ACTC are held till no less than mid-February, with most direct deposits by March 6.

How do I verify my tax refund standing?

You possibly can verify your tax refund standing in your federal tax return on the IRS Refund Status page. You possibly can verify your state tax refund on your state’s tax refund status page.

What does it imply when your refund is pending with the IRS?

In case your refund standing says “Pending”, because of this your tax return is in progress.

How lengthy can the IRS maintain your refund?

The IRS can technically maintain your refund so long as essential to resolve any points together with your tax return. Nonetheless, most individuals see a maintain resolved inside 21 days of the IRS receiving the requested info from an extra evaluation (equivalent to id verification).

What if I filed EITC or ACTC?

You probably have the Earned Revenue Tax Credit score or Further Child Tax Credit, your refund doesn’t begin processing till February 15. Your 21 day common begins from this level – so you possibly can often count on your tax refund the final week of February or first week of March.

How lengthy does it take to course of a return despatched by mail?

In the event you mailed your tax return, permit twelve weeks for processing, then your 21 day interval begins as soon as your tax return is within the IRS system.

What if I get Tax Matter 152?

Tax Matter 152 merely means you are getting a refund! Sit again, chill out, and await that direct deposit or verify to come back!

What if I get Tax Matter 151?

This implies you’ve gotten a tax offset. Some or all your refund is being garnished. Learn our full information to this here.

Last Ideas

Probably the greatest methods we hold observe of what is taking place with tax refunds throughout tax season is your feedback and suggestions. Please drop a remark under and share your refund dates so others can know!

Editor’s Observe: This text is up to date constantly all through tax season because the IRS releases new info. Information relies on prior IRS cycles, company bulletins, and user-reported refund timelines.

The publish IRS Tax Refund Calendar And Schedule 2026 (Updated) appeared first on The College Investor.