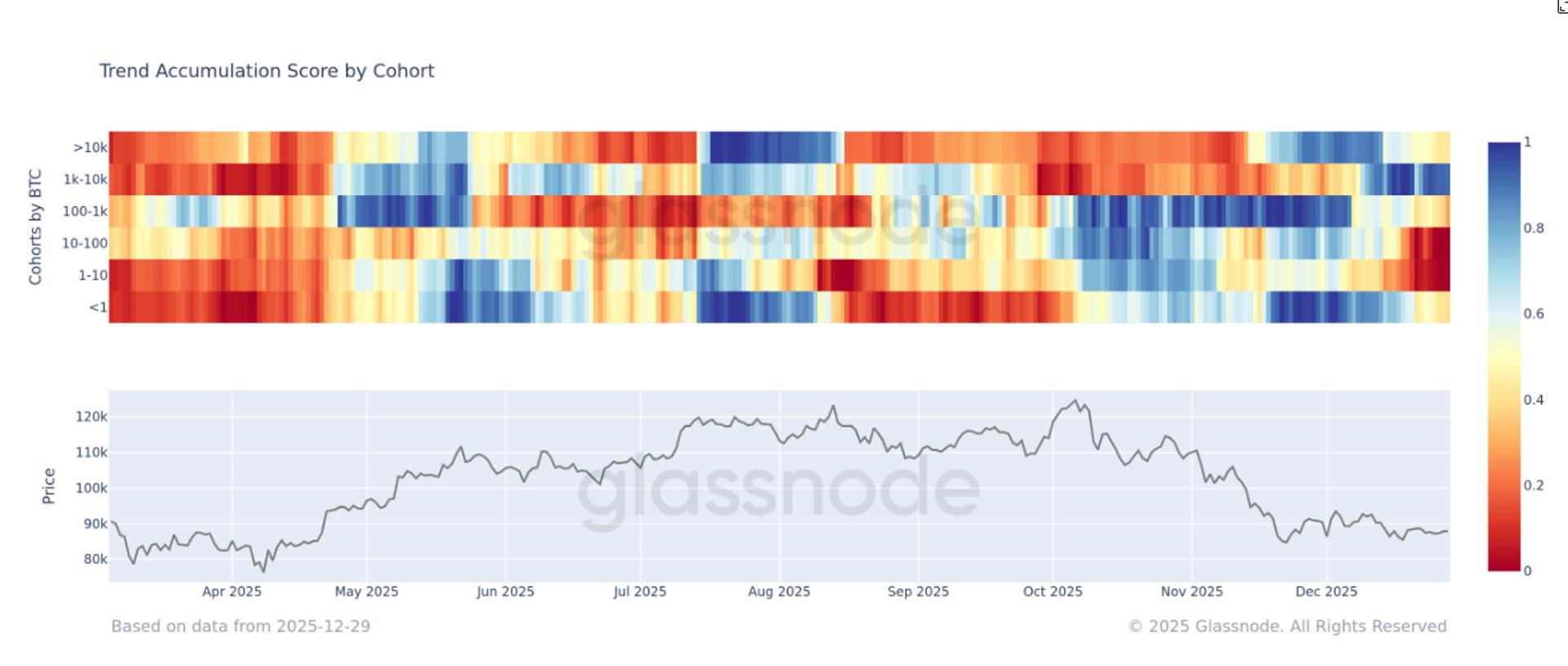

Bitcoin whales, or holders with a minimum of 1,000 BTC, have been the dominant consumers for the reason that worth of the most important cryptocurrency bottomed close to $80,000 on the finish of November, based on Glassnode data. They continue to be the strongest accumulators as bitcoin trades just below $90,000.

In keeping with Glassnode knowledge, the 1,000-10,000 BTC cohort is the one group exhibiting sustained accumulation, with an Accumulation Pattern Rating near 1.

The metric breaks down shopping for and promoting habits throughout pockets cohorts, measuring each the scale of entities and the web quantity of bitcoin they’ve acquired over the previous 15 days. A rating nearer to 1 signifies accumulation, whereas a rating nearer to 0 indicators distribution.

The information suggests that giant holders have been accumulating bitcoin within the $80,000 vary, a worth degree bitcoin has not traded in for an extended period in contrast with different worth buckets.

This habits contrasts sharply with smaller holders, all of whom present various levels of distribution.

Provided that the Crypto Fear and Greed Index has remained in “concern” or “excessive concern” for roughly the previous 30 days, this promoting strain from smaller entities possible displays capitulation.

In the meantime, the ten,000-plus BTC whale cohort was aggressively shopping for when bitcoin traded close to $80,000 in late November, although they’ve begun to sluggish over current weeks. Nonetheless, as a cohort they aren’t but promoting, which was the dominant habits the the BTC worth topped $100,000 round mid-year.