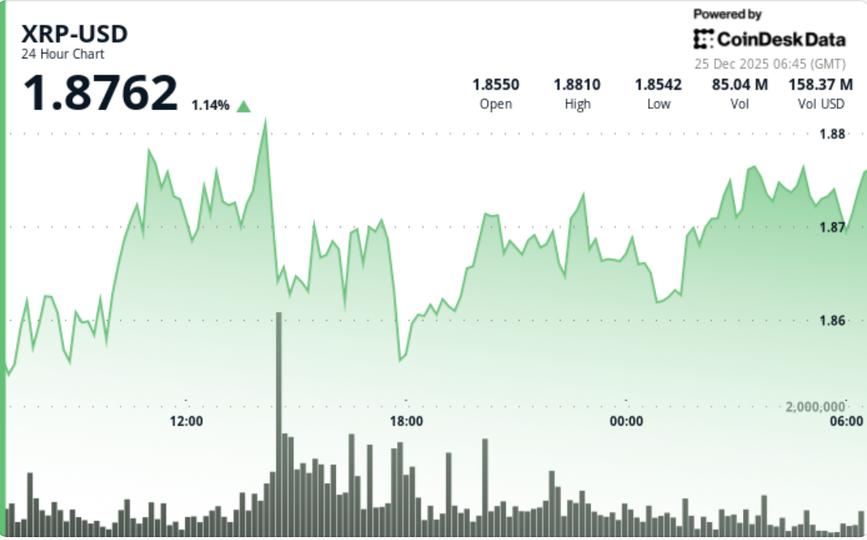

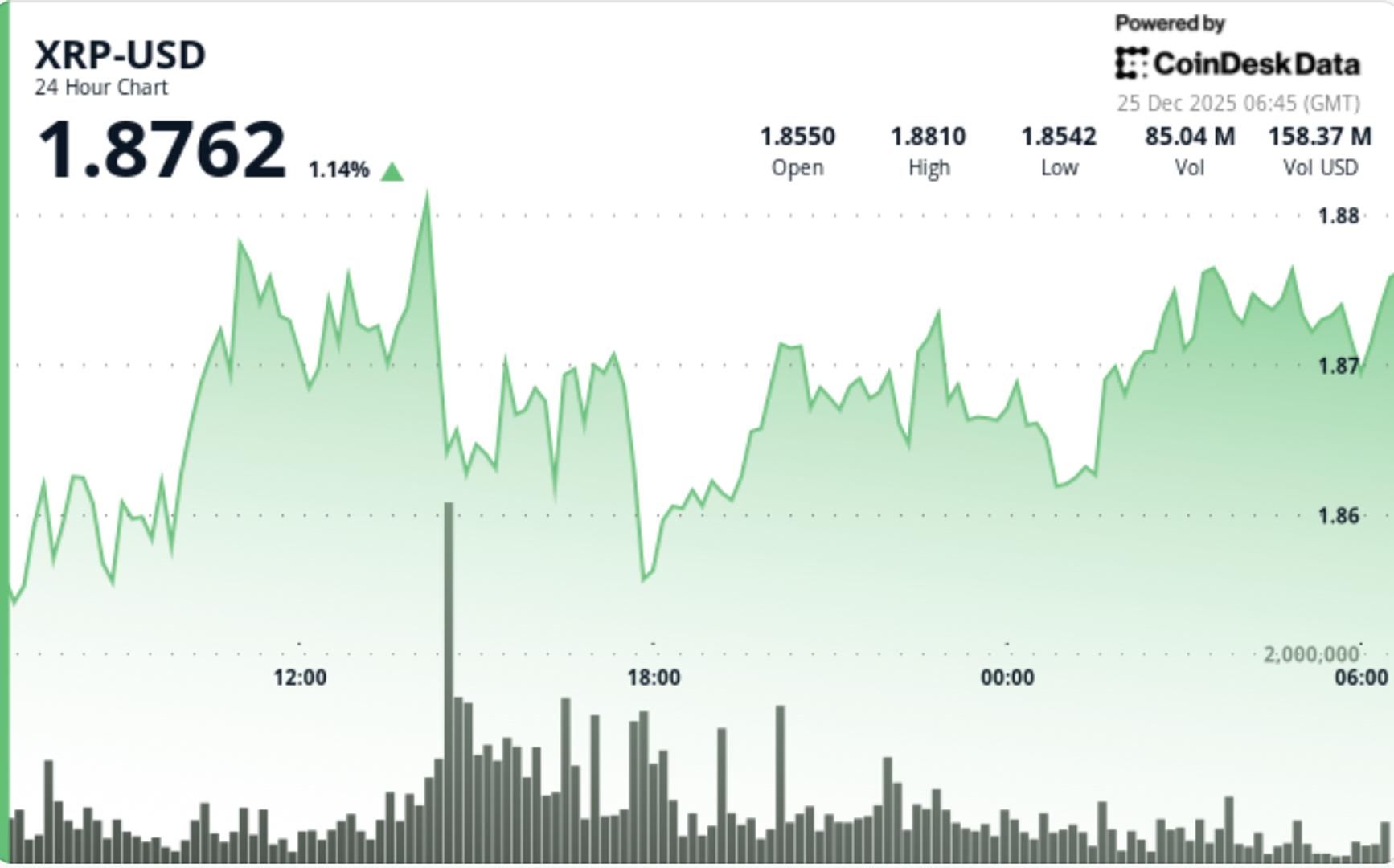

XRP slipped to $1.86 as merchants continued to promote into rallies, whilst spot ETF demand stayed regular and complete ETF-held property climbed to $1.25 billion — a spot that means the market remains to be digesting provide at key technical ranges.

Information background

Institutional urge for food for XRP publicity continued to construct by way of exchange-traded funds, with traders including $8.19 million in latest classes. That pushed complete ETF-held internet property to $1.25 billion, reinforcing the concept that skilled traders are constructing positions by way of regulated automobiles somewhat than chasing spot momentum.

The move development suits a broader sample in institutional crypto allocation: portfolio managers more and more favor structured merchandise that cut back custody and compliance friction, particularly when liquidity is deep and regulatory readability is enhancing. XRP’s depth throughout venues and the regular ETF bid has stored longer-term demand intact, whilst short-term value motion stays uneven.

Within the wider market, bitcoin’s tried rebound lacked follow-through throughout U.S. hours, leaving majors caught in a risk-off, range-bound tape the place flows matter however technical ranges nonetheless dictate the day-to-day commerce.

Technical evaluation

XRP fell from $1.88 to $1.86, staying pinned inside a $1.85–$1.91 channel as sellers repeatedly defended the $1.9060–$1.9100 resistance space. Quantity rose sharply through the session’s most lively window, with 75.3 million altering fingers — about 76% above common — through the rejection, underscoring that this isn’t a low-liquidity drift. It’s a market assembly actual presents overhead.

Value briefly pushed out of its $1.854–$1.858 consolidation pocket and examined $1.862 on a burst of exercise that spiked roughly 8–9x versus typical intraday move. However the transfer lacked persistence, and XRP rotated again towards $1.86 as provide returned.

The repeated protection of $1.90+ suggests sellers are nonetheless utilizing that zone to distribute into energy. On the similar time, bids close to $1.86–$1.87 have proven up persistently sufficient to maintain the market from unraveling — making a tightening coil the place the subsequent break is more likely to be decisive.

Value motion abstract

- XRP slid from $1.8783 to $1.8604, staying locked in a $1.85–$1.91 vary

- The strongest promoting response arrived close to $1.9061 resistance on above-average quantity

- Bulls held the $1.86 deal with on a number of retests, limiting draw back follow-through

- A brief-lived pop above the prior consolidation pocket failed to show right into a sustained transfer

What merchants ought to know

Two forces are competing, and that’s the story: ETF flows preserve leaning supportive within the background, however near-term merchants are nonetheless treating $1.90–$1.91 as a promote zone.

The degrees are clear:

- If $1.87 holds and XRP can reclaim $1.875–$1.88, the subsequent take a look at is the heavy provide cluster at $1.90–$1.91. An in depth above there would drive short-covering and pull value towards $1.95–$2.00.

- If $1.86 fails, the market probably slides into the subsequent demand pocket round $1.77–$1.80, the place prior patrons have traditionally defended and the place “concern” sentiment tends to peak.

For now, the tape reads like consolidation with distribution overhead — however with ETF flows appearing as a stabilizer that would make draw back strikes extra grinding than free-falling except bitcoin breaks down sharply once more.