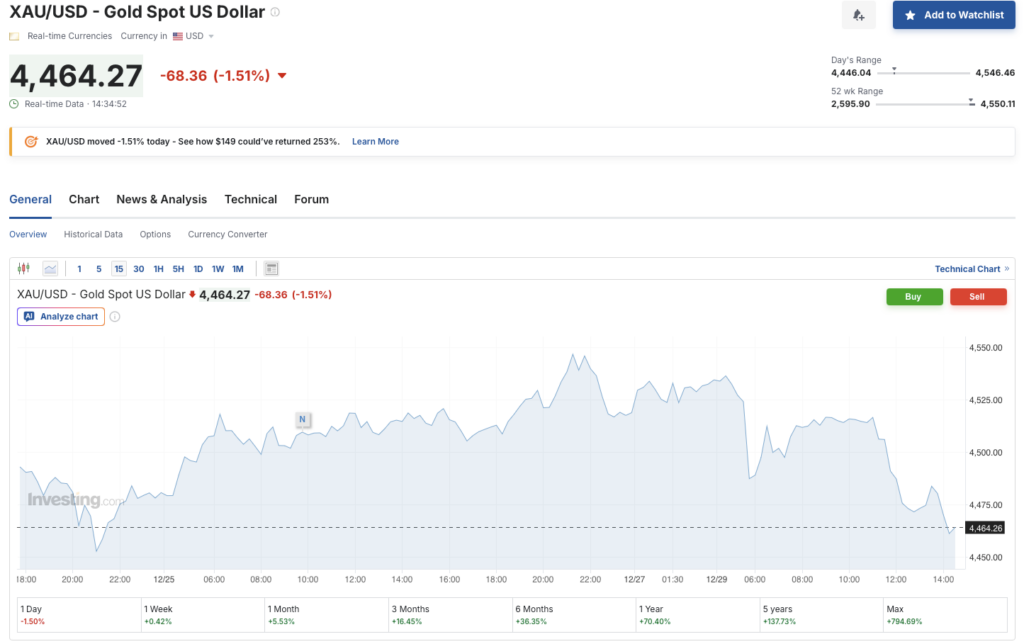

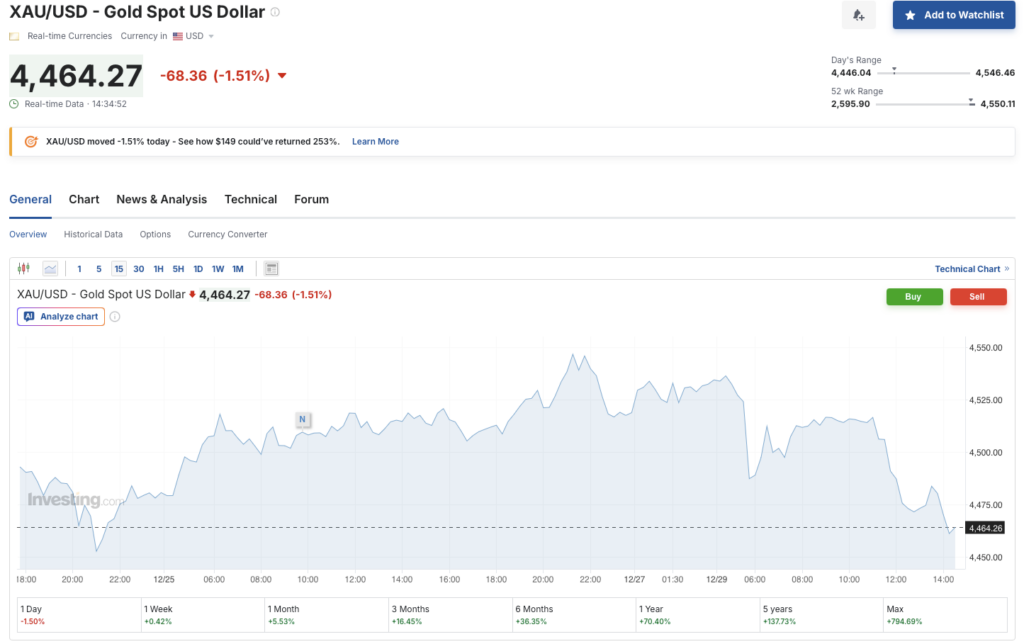

Spot gold costs noticed a 1.5% dip immediately, falling to $4464.27, whereas Bitcoin (BTC) registered a close to 2% achieve in the identical time-frame. Regardless of the dip, the yellow steel has hit a number of peaks over the previous few months. According to Investing.com, gold’s price has risen 5.5% over the last month and greater than 70% over the earlier yr. Let’s talk about if the newest turnaround is a sign for a crypto market rebound.

Gold Dips Whereas Bitcoin Rises: Is The Market Turning Round?

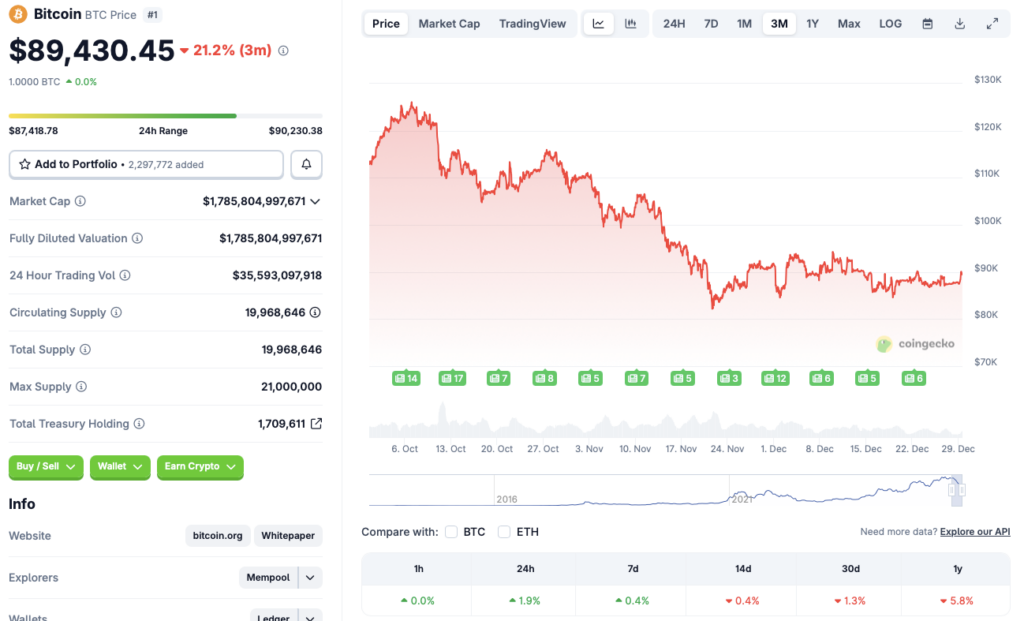

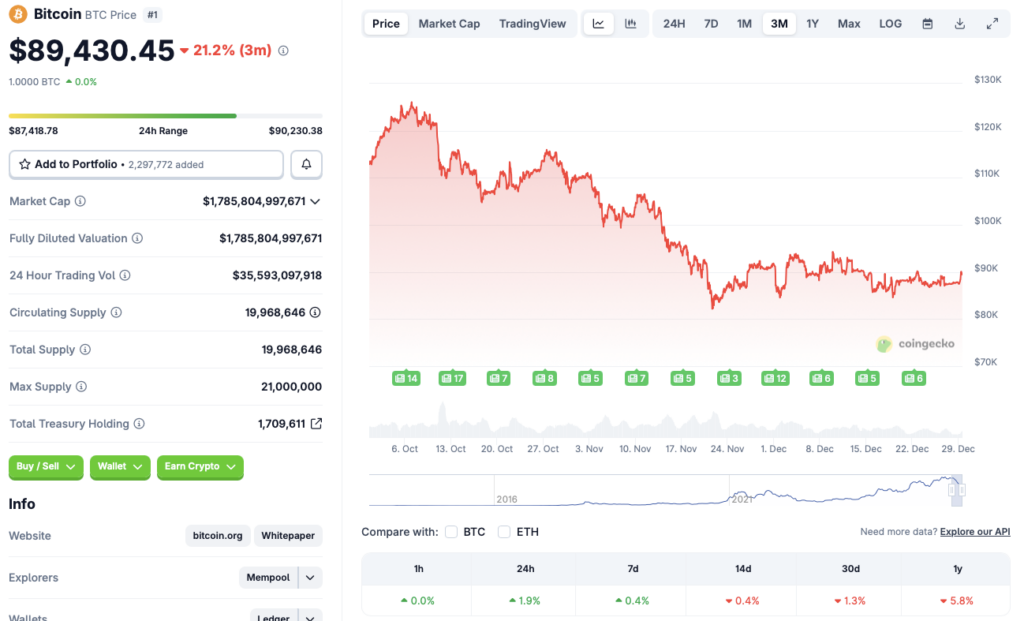

According to CoinGecko data, Bitcoin (BTC) has rallied 1.9% in the last 24 hours and 0.4% over the earlier week. Nevertheless, the unique crypto continues to be down by 0.4% within the 14-day charts, 1.3% during the last month, and 5.8% since December 2024. Bitcoin (BTC) is at present dealing with resistance on the $90,000 value stage. Breaching past $90,000 might take BTC again to $100,000, a value stage final traded at in mid-November 2025.

Bitcoin (BTC) confronted a steep value correction over the previous few months after traders started to take a risk-averse strategy. The event steps from macroeconomic uncertainties, resulting in diminishing possibilities of one other rate of interest minimize in early 2026. Buyers have possible moved their funds from dangerous property, comparable to Bitcoin (BTC) and different cryptocurrencies, to secure havens comparable to gold and silver. The development might proceed over the approaching months, till macroeconomic circumstances enhance.

Additionally Learn: Is Silver a Smart Buy Before 2026? Analyst Screams YES

The current dip in gold and rise in Bitcoin (BTC) may very well be a sign that the development could also be in for a change. Nevertheless, additionally it is doable that traders are testing the waters earlier than 2026 kicks off. BTC might see a value dip, or a value consolidation over the approaching days. Nevertheless, if gold continues to dip, we might even see a surge in crypto investments.