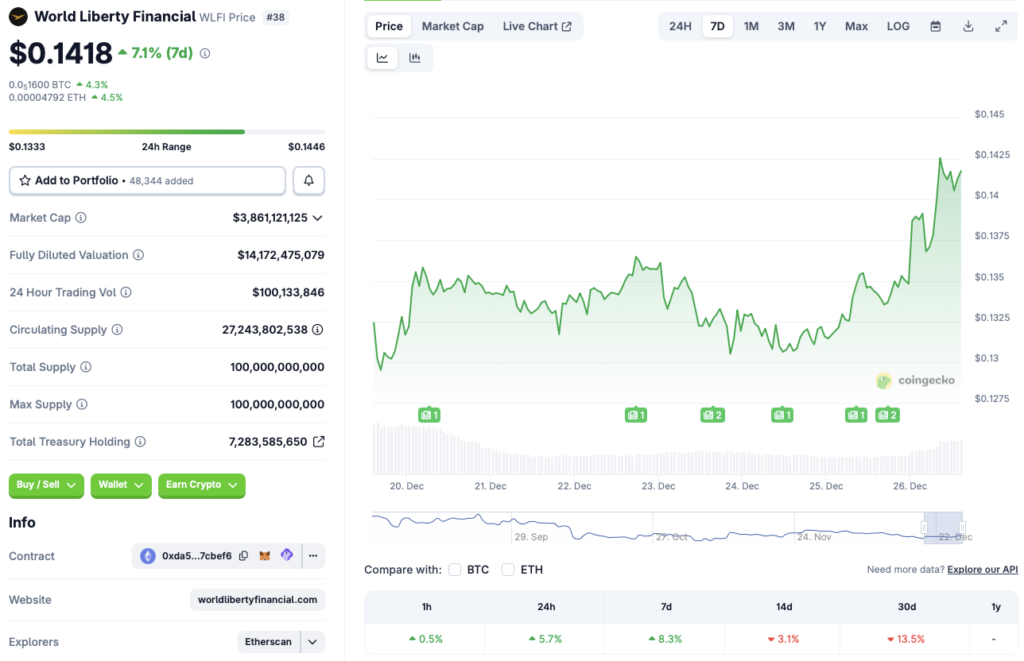

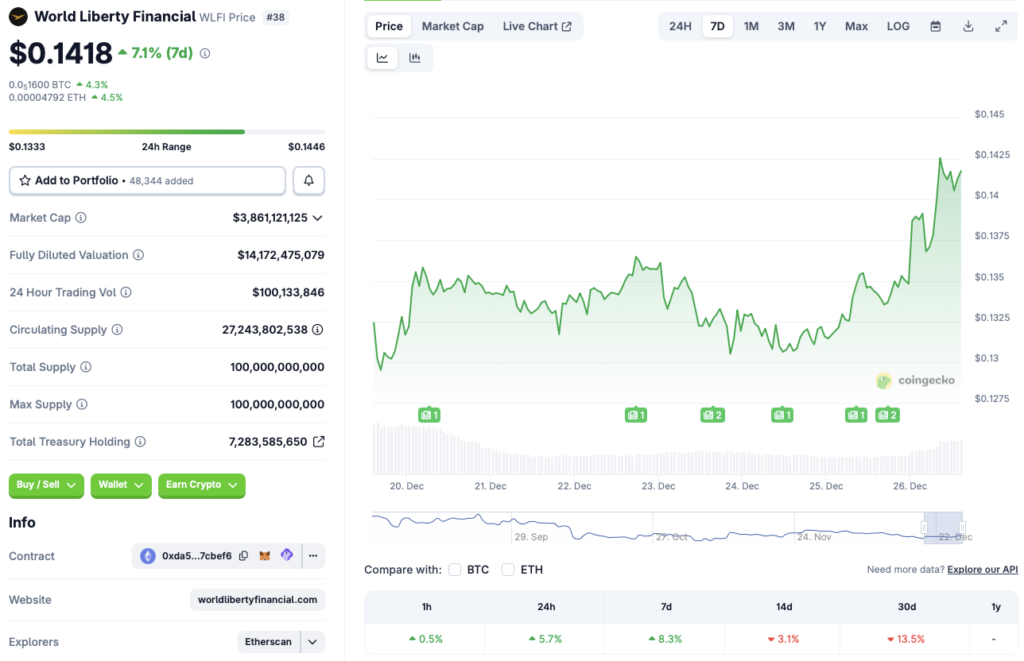

World Liberty Monetary (WLFI) is at present the best-performing cryptocurrency within the every day charts among the many high 100 initiatives by market cap. According to CoinGecko data, WLFI has rallied 5.7% within the final 24 hours and eight.3% over the earlier week. Nonetheless, the asset remains to be within the crimson zone within the different time frames, falling 3.1% within the 14-day charts and 13.5% over the earlier month. WLFI’s rally is shocking, on condition that the bigger crypto market is dealing with substantial challenges. Let’s focus on why World Liberty Monetary (WLFI) is rallying right this moment, and if the rally will proceed over the approaching weeks.

What’s Behind World Liberty Monetary’s Rally? Will It Maintain?

WLFI’s newest worth surge could possibly be because of the the venture’s USD1 stablecoin hitting the $3 billion market cap milestone. The stablecoin market has seen unbelievable progress over the previous few years. A number of initiatives have begun stablecoin initiatives, together with Ripple. USD1’s market cap hitting $3 billion might have led to a lift in investor sentiment. USD1’s large progress might have been additional amplified by Binance’s USD1 Enhance Program. In keeping with an announcement, this system is “designed to assist USD1 holders to maximise their rewards.”

Whereas World Liberty Monetary’s (WLFI) rally is commendable, it’s unclear if the rally can maintain itself. Provided that the bigger crypto market confronted a large correction and is present process a consolidation part proper now, WLFI’s rally might fizzle out over the approaching days. Bitcoin (BTC) is struggling to carry the $89,000 worth degree, and different belongings might observe its trajectory. WLFI may see a worth dip if buyers start to ebook earnings.

Additionally Learn: Trump Coin is Down 93% Since January: Is The Hype Over?

Moreover, market contributors are at present taking a risk-averse method. This argument is complimented by the truth that gold and silver are hitting new peaks ever so typically. Buyers may exit their WLFI positions, ebook earnings, and relocate their funds to secure havens.