According to a report by VanEck, Bitcoin’s (BTC) hash rate has dropped 4%, the sharpest dip since April 2024. Hash charge dips are a bullish sign, and will point out that BTC is nearing its backside. The agency additionally famous that digital asset treasuries (DAT) added 42,000 BTC, the biggest accumulation since July 2025. Furthermore, long-term holders will not be giving in to the promoting stress. All three developments might imply that Bitcoin (BTC) could also be gearing up for a worth reversal.

Is Bitcoin Coming into a Worth Reversal Part?

VanEck isn’t the one establishment with an optimistic outlook for Bitcoin (BTC). Grayscale and Bernstein additionally anticipate BTC to interrupt out in 2026. Each Grayscale and Bernstein declare that BTC could also be following a 5-year cycle, as an alternative of its common 4-year path. Which means Bitcoin (BTC) might climb to a brand new all-time excessive in 2026, 5 years after its 2021 peak. Bernstein anticipates BTC to hit $150,000 in 2026 and $200,000 in 2027.

Whereas VanEck, Grayscale, and Bernstein current bullish outlooks for Bitcoin (BTC), Barclays, however, is kind of pessimistic concerning the 2026 crypto market. Barclays anticipates the crypto sector to face further struggles subsequent 12 months. The monetary establishment cites low spot buying and selling volumes and low demand for its bearish outlook.

Additionally Learn: Bitcoin Attempts To Reclaim $90,000, Will It?

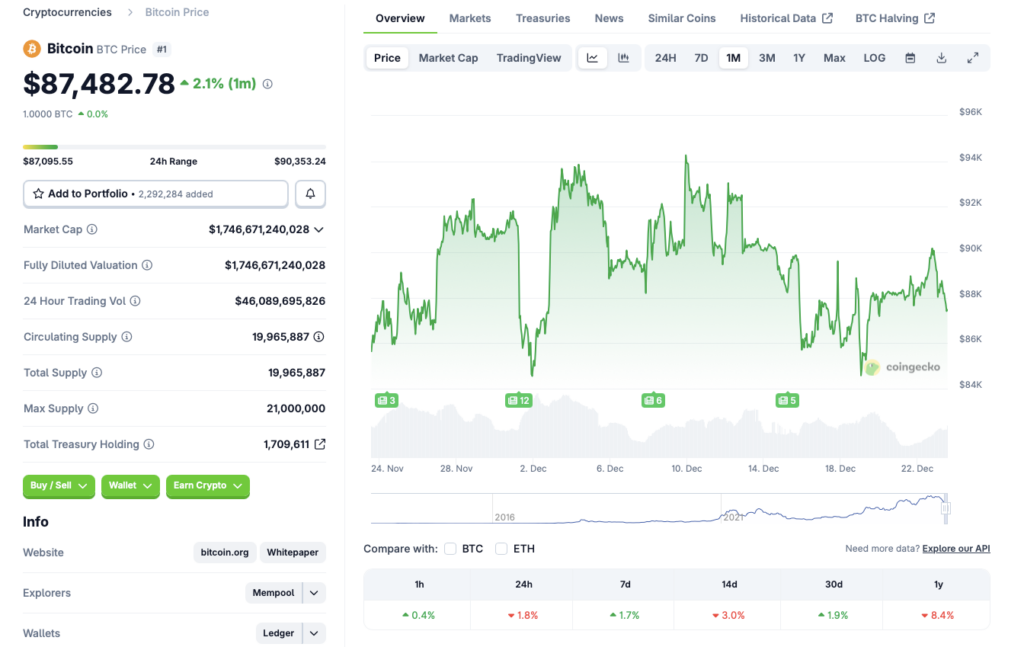

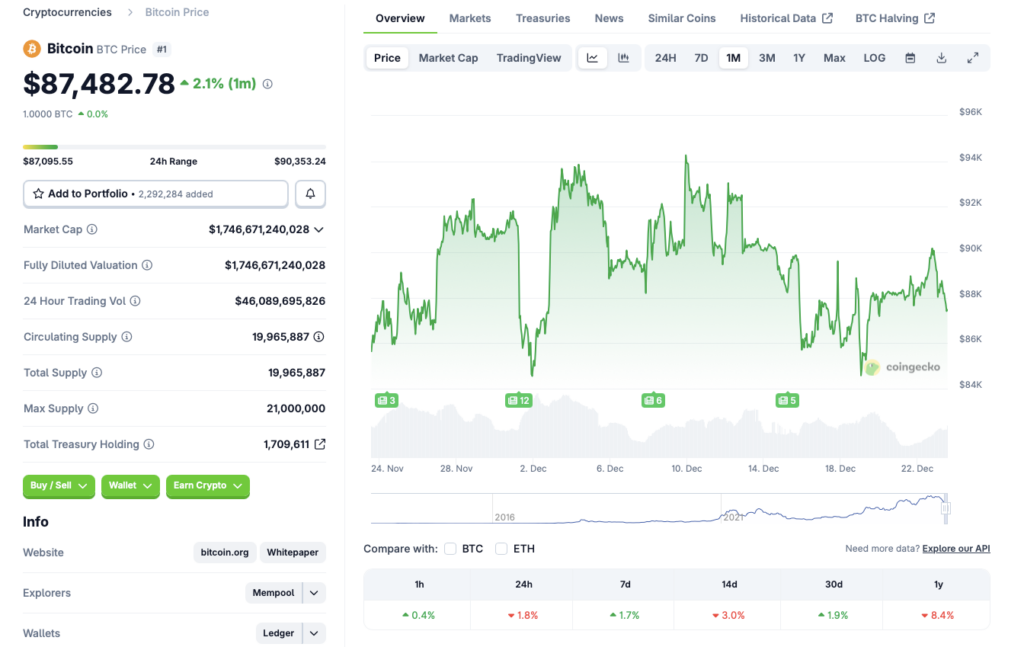

The crypto market has struggled to realize momentum over the previous couple of months, regardless of two rate of interest cuts since October. Bitcoin (BTC) is at present going through substantial resistance on the $90,000 stage. The present market state of affairs is attributed to macroeconomic uncertainties. Market contributors appear to be taking a risk-off method. The event is additional strengthened by rising gold and silver costs. Bitcoin (BTC) might proceed its lackluster path till financial situations enhance. According to CoinGecko’s BTC data, the unique crypto has seen a 1.7% rally within the weekly charts and a 1.9% rally over the earlier month. Nevertheless, BTC continues to be down by 1.8% within the every day charts, 3% within the 14-day charts, and eight.4% sicne December 2024.