For individuals who have been dwelling below a rock, let’s hope it was gold, as a result of the shiny metallic is up over 50% year-to-date (YTD) in contrast with 18% for the S&P 500 (with dividends). With this current outperformance by gold, some are beginning to query whether or not investing in shares nonetheless is smart.

For instance, I noticed a chart like this going viral which in contrast the expansion of $1 invested in gold versus the S&P 500 since January 2000:

As you’ll be able to see, gold has outperformed the S&P 500 (with dividends) by almost 2x since 2000. After seeing one thing like this it’s simple to query why you’d ever personal shares. If a glittering rock can outperform productive companies, what’s the purpose of proudly owning shares in any respect?

Whereas this comparability is technically correct, it’s additionally fairly deceptive. Not solely had been U.S. shares within the midst of their largest bubble ever (throughout the DotCom increase), however gold was nonetheless down over 50% from its highs within the late Seventies. By beginning within the yr 2000, you’re evaluating U.S. shares at their most costly to gold close to its most cost-effective. That is the Mike Tyson vs. Jake Paul comparability of investing. One was out of their prime and the opposite wasn’t.

I can equally stack the deck in opposition to gold by beginning the efficiency comparability in January 2012, as gold reached new all-time highs. Should you did so, you’d see that the S&P 500 outperformed gold by 2.7x since then:

So which is it? Is investing in gold a greater wager than shares? Or is the yellow ore sure to disappoint?

In truth, it’s a little bit of each. Over lengthy durations of time, U.S. shares are likely to outperform gold. You may see this within the chart under which reveals the expansion of $1 invested within the S&P 500 versus gold since 1990:

That’s a 4x distinction in return over the past 35 years.

Nevertheless, there are additionally durations the place gold completely crushes U.S. shares. The Seventies had been one such interval. Throughout this decade, gold was up 1,365% whereas U.S. shares solely ended up 76% (from Ben Carlson’s recent post on why he doesn’t personal any gold):

Are you able to think about not proudly owning gold when this occurred? It could’ve been one of the crucial FOMO-inducing moments in funding historical past.

This is among the the reason why gold stays in style as an asset class. Although it normally underperforms, it has uncommon moments the place it triumphs. And in these triumphs it may be fairly efficient in a diversified portfolio.

However what’s occurring with gold right now? It’s outperforming, but U.S. shares aren’t struggling. The funding surroundings is nothing just like the Seventies or 2000s, so what’s occurring? Warren Pies summarized the sentiment shift completely a number of months in the past:

The worry of shedding floor (i.e., buying energy) is changing the worry of shedding principal.

Buyers have plenty of anxiousness across the stability of the U.S. greenback with hovering debt ranges, an ongoing commerce battle, and the specter of continued inflation. These fears aren’t unfounded both. The U.S. deficit is tracking about the same as in 2024 and CPI has also increased from 2.3% in Might to 2.9% in August. With the doable lack of buying energy for the U.S. greenback, traders are piling into belongings which might be usually considered inflation hedges (e.g. gold, silver, and many others.).

And after I say “piling in,” I imply it. As the World Gold Council reported:

International bodily backed gold ETFs recorded their largest month-to-month influx in September, ensuing within the strongest quarter on report.

However demand isn’t simply coming from retail traders, it’s coming from central banks too. As a result of current shopping for exercise, overseas central banks now maintain extra gold than U.S. Treasuries for the primary time since 1996 (h/t Reuters):

Extra importantly, gold is now the second-largest world reserve asset after the U.S. greenback.

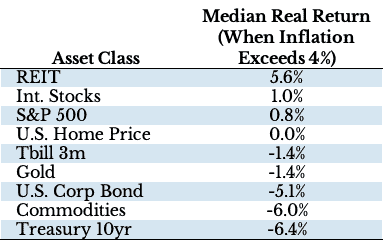

Right here’s the ironic half although—traders are shopping for into gold partially as an inflation hedge, however it’s by no means been a fantastic inflation hedge. Traditionally, each time inflation has been above 4%, one of the best belongings to personal had been REITs and equities, not gold. The desk under illustrates this by displaying the median actual return (when inflation exceeded 4%) by asset class from 1972-2021:

Gold had a -1.4% actual return throughout these inflationary durations. And through our most up-to-date bout of inflation in 2022, gold was flat as properly.

Sure, gold did go up 33% from January 2020 to August 2020, however it didn’t do a lot afterwards, as inflation skyrocketed. The chart under reveals this preliminary value enhance adopted by an extended whipsaw (throughout the precise inflationary interval):

Whereas traders are definitely forward-looking, do you suppose they anticipated all of the inflation from 2021-2022 and bid up gold’s value accordingly by August 2020? Name me skeptical.

Both method, gold is rising as a result of extra persons are shopping for than promoting. Whether or not they’re shopping for due to a weakening greenback, geopolitical uncertainty, doable future inflation, or some combine of those components is up for debate.

Is that this confluence of things pushing gold into bubble territory? I don’t know. However I do know that, traditionally, gold tends to maneuver in suits and begins. It goes on nice runs after which has many years with nothing to indicate for it. Not everybody can deal with these misplaced many years. I’m not even positive I can, and I’ve a small allocation (3%) myself.

I’ve an extended love-hate relationship with gold. I invested in it a few years in the past, however publicly abandoned it in 2017 after analyzing the information. These multi-decade drawdowns had been a no-go for me.

However, because it began to rise in 2024, I regarded on the information once more and realized that I used to be lacking the forest for the bushes. Sure, gold performs poorly as an particular person asset class, however its diversification advantages inside a portfolio are laborious to argue in opposition to. As the World Gold Council noted:

Our evaluation reveals that gold has persistently lowered the general volatility portfolios: on common, the Sharpe ratio will increase by 12% when 2.5% of the portfolio consists of gold, demonstrating a novel diversification impact unparalleled by every other asset.

StateStreet did an analysis from 2005-2025 which discovered that including a small gold allocation (from 2% to 10%) to a world multi-asset market portfolio elevated the return whereas lowering the volatility and most drawdown:

As a lot as I hate to confess it, just a little gold can go a great distance. So, I added a small (nearly trivial) place and moved on.

That call has labored out properly, largely because of dumb luck. It’s simple to carry onto one thing whereas it’s going up. However when gold inevitably declines and has an extended stretch of lackluster efficiency, then come speak to me. I gained’t be as cheerful, however I’ll attempt to maintain anyhow.

Till then, completely satisfied investing and thanks for studying.

Should you preferred this put up, think about signing up for my newsletter.

That is put up 474. Any code I’ve associated to this put up may be discovered right here with the identical numbering: https://github.com/nmaggiulli/of-dollars-and-data